Caught offside? The EU Foreign Subsidies Regulation and European football clubs

There have already been two well-publicised requests for the Commission to use its ex officio powers under the EU Foreign Subsidies Regulation (FSR), to investigate alleged distortive subsidies granted to two European professional football clubs by their Gulf states’ owners.

We set out the economic and financial questions that would need to be considered in order to determine whether financial measures in the football sector constitute subsidies and, if so, to assess the nature and extent of any distortive effects.

On 12 July 2023, the Foreign Subsidies Regulation became applicable across the EU. The European Commission can now launch ex officio investigations into undertakings active in the Single Market if it suspects that they have benefited from distortive foreign subsidies. For many observers, the date of 12 October 2023 bears even more relevance, as it will mark the start of compulsory notifications of large concentrations and public procurements.

However, while companies and practitioners geared up for the start of the FSR notification season, a number of stakeholders in the football world had decided that some pre-season (not so-)friendlies would be in order.

- As early as May this year, Belgian (then) second-division club Royal Excelsior Virton (RE Virton)1 wrote to the Commission to express concerns in relation to alleged foreign subsidies received by competing club SK Lommel. The club is ultimately owned by Sheikh Mansour, a member of the Abu Dhabi royal family and Vice President of the United Arab Emirates. As such, SK Lommel is a sister club of Manchester City FC.2

- More recently, the Spanish football association LALIGA similarly urged the Commission to take action against 11-time French Ligue 1 champions Paris Saint-Germain (‘PSG’),3 owned by Qatar Sports Investments (QSI)—itself owned by the Qatar Investment Authority (QIA), the sovereign wealth fund of Qatar.4

Although they originate from two clubs established in different countries and playing in different leagues, both ‘complaints’5 focus on fundamentally similar issues: both RE Virton and LALIGA allege that significant financial resources are made available at favourable terms by their competitors’ owners (which are ultimately claimed to be attributable to foreign states, thereby distorting competition by allowing these clubs to, for example, ‘sign top players and coaches well above [their] potential’ (as claimed by LALIGA),6 or even maintain themselves in the market by avoiding the loss of their licence (as claimed by RE Virton).7

When it comes to the Beautiful Game, the FSR interacts with and shares a number of similarities (but also, crucially, differences) with other rules, e.g. the (recently-updated) UEFA rules on Financial Fair Play (‘FFP’)8 and EU state aid rules.

If it were to be undertaken by the Commission, an assessment of alleged foreign subsidies under the FSR would entail a number of issues from an economics and finance perspective:

- How might the European Commission determine if the financial contributions received by certain football clubs amount to ‘subsidies’ and what challenges does such an assessment entail?

- How might it assess whether such subsidies are ‘distortive’?

Can the amounts at stake be qualified as ‘subsidies’?

1.1 Key concepts

Under the FSR, the notion of ‘subsidy’ is quite broad. The Regulation defines a foreign subsidy as a ‘financial contribution which is provided directly or indirectly by a third country, which confers a benefit and which is limited to one or more undertakings or industries’.9 From an economics perspective, there are two important takeaways:

- The notion of ‘financial contribution’ is broad and includes the transfers of funds as well as the foregoing of revenue or the provision of goods and services.10

- A financial contribution only constitutes a subsidy if it confers a ‘benefit’ to the recipient. For financial transactions (such as loans or equity injections) or commercial transactions (such as the provision or purchase of goods or services), this is the case if they are conducted on terms that are not in line with the market.

In the case of football clubs, subsidies provided directly or indirectly by third countries could take many forms, for example:

- loans at favourable interest rates (or even interest-free);

- inflated sponsorship and commercial deals with non-EU controlled entities that are above market value (including compensation and prizes for pre-season tours and tournaments);

- equity injections on terms that cannot under reasonable assumptions be expected to be sufficiently profitable;

- inflated player transfer and loan fees from other clubs (if their actions can be attributed to the non-EU countries).

Therefore, from an economics perspective the key question is whether the terms of these transactions are in line with the market, i.e. if they could have been entered into by rational, profit-seeking entities. If not, they would then confer a benefit, and potentially constitute a subsidy (subject to the other, legal criteria also being met).

This principle is well established in EU state aid rules, where it is known as the market economy operator principle (MEOP). Economic and financial tools can be deployed to determine whether the test is met, such as the use of comparative benchmarks or the analysis of expected profitability.11 This principle has been applied in the football context in past state aid investigations by the Commission, including an investigation into a guarantee from a public authority relating to Valencia Club de Fútbol. Oxera supported the club in its appeal in front of the EU General Court, which resulted in an annulment of the Commission’s decision.12

What is the link between the FSR and FFP rules?

As explained above, the notion of a foreign subsidy is broad and, as such, extends to areas that are not directly covered or accounted for in the latest version of FFP rules. Although, UEFA’s FFP rules only apply to clubs competing in UEFA’s club competitions (i.e. UEFA Champions League, UEFA Europa League and UEFA Europa Conference League),1 certain European leagues (for example LALIGA)2 have their own versions of financial sustainability rules which apply to domestic clubs. FFP rules aim to prevent clubs from ‘living above their means’, for example by having excessively high player wages relative to the revenues generated by the club. However, they do not require an assessment of whether financing sources, revenue streams and cost items are perceived on advantageous terms. In other words, the FSR would for example allow the European Commission to scrutinise the lucrative sponsorship deals of a European football club, which allow it to meet the criteria of the FFP rules, if these deals can be directly or indirectly attributed to a foreign state. The Commission could then investigate whether such deals are in line with market terms or whether they constitute subsidies that provide it with an unfair advantage over its competitors. In contrast, FFP rules remain silent on the terms of such sponsorship deals. These considerations appear particularly relevant in a context of a high number of foreign-owned clubs. As at the end of 2022, 92 European clubs were owned by foreign investors—although not all of them would necessarily be attributable to foreign states.3

Sources: 1 UEFA, ‘Financial Sustainability’, available at: https://www.uefa.com/insideuefa/protecting-the-game/financial-sustainability/ (last accessed 2 October 2023). 2 The LALIGA Newsletter (2020), ‘How LaLiga economic controls go beyond Financial Fair Play’, 2 March. 3 UEFA (2023), ‘The European Club Footballing Landscape – 14th Club Licensing Benchmarking Report’, p. 202.

In what follows, we illustrate how to apply the MEOP test in practice, using the example of an equity injection in a football club by an existing foreign state owner. Although the MEOP can be applied to the various types of transactions described above,13 this example appears particularly relevant, as equity injections were mentioned by both RE Virton and LALIGA as an alleged conduit for foreign subsidies.14

1.2 How to assess if a direct equity injection into a club confers a ‘benefit’ in practice?

Whether an equity injection into a club is in line with market terms can be assessed by estimating the expected return on the transaction, and comparing it with a benchmark level of return that would be required by a private investor given the level of risk of the activity.

Importantly, this profitability analysis should be conducted from an ex ante (i.e. forward looking) perspective, using forecasts that are based on the best possible information available at the time of granting the equity injection.15 It should also be undertaken based on the expected cash flows, in order to calculate the net present value (NPV) of future cash flows or, equivalently, the expected internal rate of return (IRR).

For an equity injection, this requires identifying and forecasting the relevant revenue and cost items that will determine the profits expected to be generated by the club. These profits could result in dividends expected to be paid to the equity investor over time, and/or lead to an expected appreciation in the value of the equity stake.

In the case of football clubs, revenues can be distinguished between four main sources. The relative importance of these revenue sources will differ between leagues and between clubs depending on their on-the-pitch performance and their off-the-pitch business strategy.16

- Matchday income: revenue generated from season ticket holders as well as individual match tickets. This also includes the sale of food, drinks and merchandise on the club’s premises and shops (including online).

- Broadcasting income relating to domestic competitions: revenues earned from broadcasting contracts related to domestic competitions (e.g. domestic league and domestic cup competitions). The precise amounts will depend on the performance of the club in the various competitions.

- UEFA prize money: income that is tied to the performance of the club in the European competitions. This is only relevant in cases where a club performs sufficiently well in its domestic league and is able to qualify for UEFA’s competitions.

- Sponsorship and commercial revenue: income generated from deals signed with sponsors and commercial partners. This includes sponsorship contracts with kit manufacturers, highly visible and recognisable ‘front-of-shirt’ sponsorship deals, as well as other types of commercial and sponsorship contracts.17

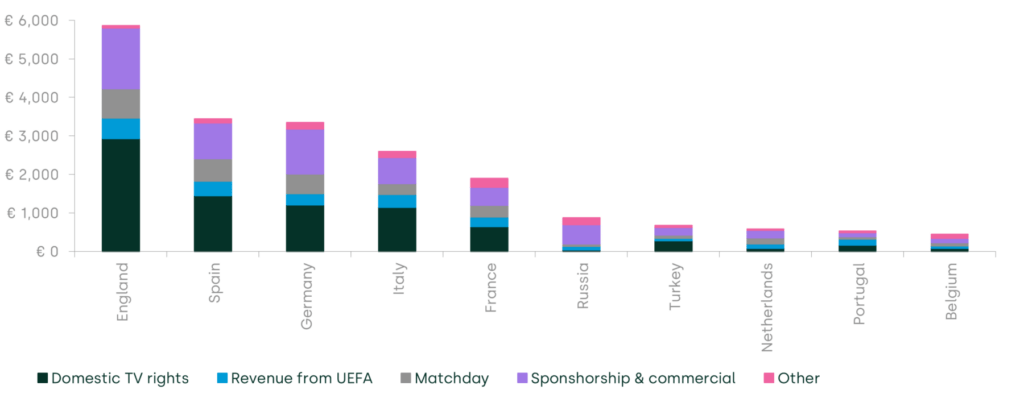

Figure 1 below presents a breakdown of these revenue sources across the top ten European leagues in the 2018/19 season.

Figure 1 Total revenues for clubs participating in the top ten European leagues, 2018/19 season (m)

Source: UEFA (2022), ‘The European Club Footballing Landscape – 13th Club Licensing Benchmarking Report’, p. 154.

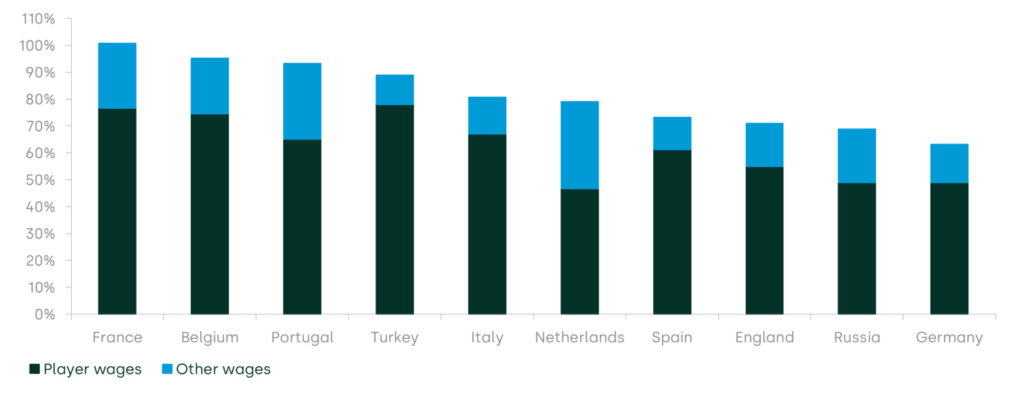

In terms of operating costs, the most significant cost item is the remuneration of players. Among Europe’s top ten domestic leagues, clubs’ ratio of its wage bill to revenues typically ranges from 60% to 100%,18 as illustrated in Figure 2 below.

Figure 2 Ratio of total wages to revenue for the top ten European leagues, 2020/21 season

Source: UEFA (2023), ‘The European Club Footballing Landscape – 14th Club Licensing Benchmarking Report’, pp. 184–185, 190.

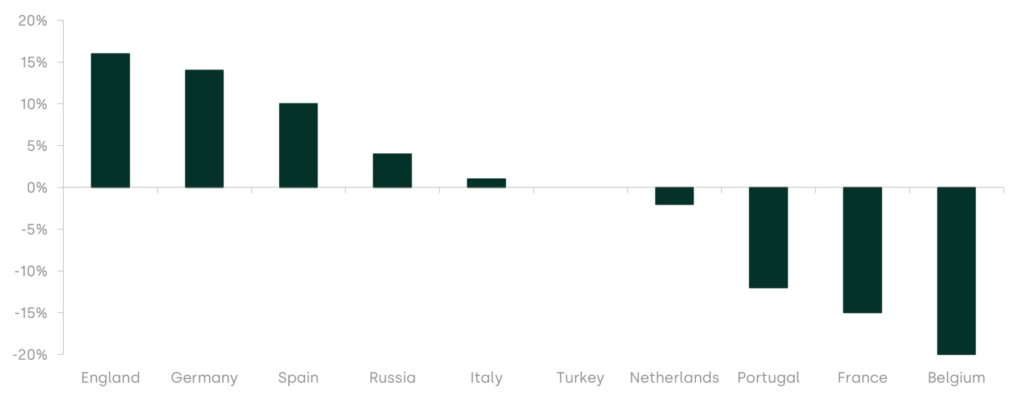

Other cost items include the travel expenses for the team when playing away matches (i.e. hotels, flight or train tickets, insurance), the costs of the coaching staff, or the utilities associated with the stadium, among others.19 When this is considered alongside the wage bill, the operating costs of football clubs tend to exceed revenues. Across five of Europe’s top ten domestic leagues, on average clubs are not generating profits on an operational basis, as Figure 3 below demonstrates.

Figure 3 Aggregate operating margins across all the clubs in the top ten European leagues in the 2018/19 season

Source: UEFA, ‘The European Club Footballing Landscape – 14th Club Licensing Benchmarking Report’, p. 154.

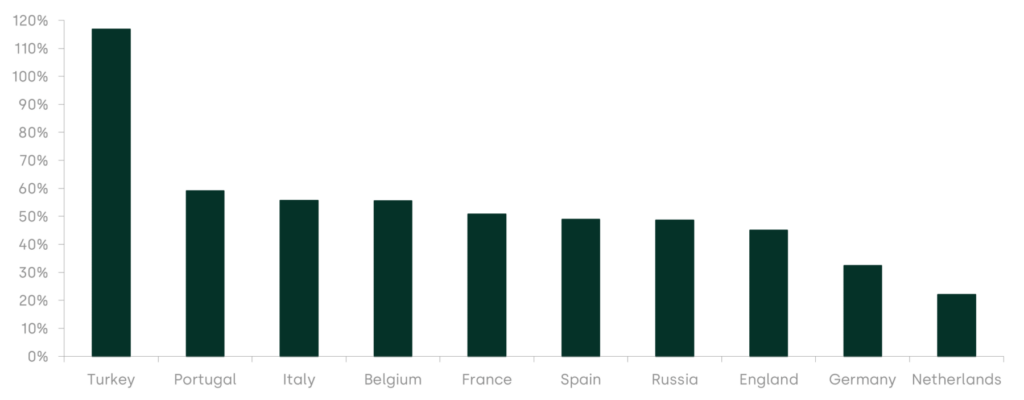

When considering the returns from the perspective of an equity investor, it is important to go beyond the operating costs and to also take into account interest expenses paid on the club’s outstanding debt. As football clubs throughout Europe are generally significantly indebted (see Figure 4 below), interest expenses represent a significant cost in clubs’ accounts.20 The COVID-19 pandemic, which contributed towards a €7bn decrease in revenues in the top European leagues, led to a further increase in indebtedness.21

Figure 4 Average ratio of gross total debt to total assets for clubs in the top ten European leagues in the 2020/21 season

Source: UEFA (2023), ‘The European Club Footballing Landscape – 14th Club Licensing Benchmarking Report’, pp. 184–185, 190.

The final aspect that an equity investor in a football club has to consider is the revenue and the costs associated with the purchases and sales of players.22 For smaller clubs that are not among the elite of wealthy European clubs, the revenue generated from player sales (in particular those of academy players) can help cover shortfalls in other revenue sources. Conversely, for the top clubs in Europe which consistently aspire to win the continent’s top competitions, securing the best talent can require considerable sums. As Figure 5 below shows, for the majority of the top European leagues, player transfers are on average a net cost for clubs, with only the smaller leagues such as the Portuguese, Belgian and Dutch leagues being on average net sellers of players.

Figure 5 Average net transfer profit/loss as a percentage for revenue for clubs in the top ten European leagues in the 2020/21 season

Source: UEFA (2023), ‘The European Club Footballing Landscape – 14th Club Licensing Benchmarking Report’, p. 147.

To conduct the MEOP test, these revenue and cost items need to be forecast over a reasonable time horizon—e.g. the next five seasons or possibly longer—in order to estimate the cash flows to the equity investor. It is then possible to calculate any expected ongoing dividend payments, as well as the expected appreciation in the value of the club, which could be materialised through a future sale to another investor.

Based on the expected future cash flows, it is possible to estimate the expected IRR of the equity investment.23 In order to assess whether the equity injection is in line with market terms, the IRR needs to be compared with the required return on equity that a private investor would demand from a project with a similar risk profile, i.e. the ‘cost of equity’. The club’s cost of equity will depend both on financial market conditions (e.g. interest rates on government bonds), on the risks associated with the club’s activities, and on its capital structure (e.g. high indebtedness).24 An IRR that is higher than the cost of equity implies that the project is expected to generate sufficient value for an investor and therefore complies with the MEOP. This means that no ‘benefit’ is likely to be derived.

1.3 Specific issues to consider in the football sector

The MEOP is a well-established framework and the financial methods and tools used to calculate the expected profitability of an equity injection are regularly applied by businesses and economists. However, in all industries and sectors, forecasting expected revenues and costs is subject to a number of uncertainties. More specifically, the football industry presents a number of specific features that make the robust calculation of expected profitability a challenging exercise. As any football aficionado will recognise, it is particularly difficult to forecast how a club will perform in any particular season, given the large number of variables that may affect performance.

Yet, all four revenue sources outlined above, as well as the income generated from player transfers, are inextricably linked with club performance.

- A good season where the club is performing well would, for example, lead to larger home crowds, resulting in higher matchday income.

- Similarly, in all major European leagues, finishing higher up in the league table would result in a greater share of broadcasting rights, or lead to qualification for a better division, where these rights may be higher.

- In the case of prize money, a strong season may lead to qualification for European competitions such as the UEFA Champions League the following season, where the prize money for simply competing in the group stage in the 2023/24 season is €15.64m per team, and the bonus per win in the group stage is €2.8m.25

- A consistent run of strong seasons is likely to see the commercial value of the club, in the eyes of potential commercial partners, also increase considerably.

- The club’s assets (and in particular its players) are also likely to appreciate in value if the club’s performance improves over time.

This reinforcing feedback loop can be observed in the UEFA Champions League, where clubs from the largest European domestic leagues now almost always lift the coveted trophy. The last time that a club from outside the four biggest European leagues (i.e. England, Spain, Germany and Italy) won the Champions League was FC Porto in the 2003/04 season. Throughout this period, all finalists, with the exception of PSG in 2019/20, also originated in the top four leagues. In contrast, during the 1980s and 1990s, clubs from France, Portugal, Romania, the Netherlands and Yugoslavia all won the competition.26

Although it could be argued that performance, while variable, can be predicted in broad terms (e.g. that a small number of clubs in each major European domestic league can be expected to finish in the top spots), even the difference between a first place and second place finish can have significant revenue implications, particularly in the smaller leagues where fewer clubs can qualify for UEFA’s competitions.27

In addition to the significant impact of small variations in performance, football leagues are also prone to surprises—who could have anticipated the meteoric rise of newly promoted clubs like Belgium’s Royale Union Saint-Gilloise (RUSG), or Leicester City in the 2015/16 Premier League season? It is also impossible to forecast the likelihood of injuries to a key group of star players which may contribute towards the club falling towards the bottom half of the table, or how a star player bought for a significant fee will integrate into a new team.28 Although it is not possible to account for every possible scenario, including a priori unlikely ones, it is clear that an analysis of expected profitability in the context of football clubs should carefully consider different scenarios in terms of performance, and their implications for the rationality of certain financial decisions.

Forecasting a club’s costs over multiple years, in particular its wage bill and the fees paid for key transfers, can also be a difficult exercise. Although clubs directly control how much they decide to spend on players, decisions on player purchases are also driven by strategic and competitive considerations. For example, an investor’s financial strategy may hinge on improvements in the club’s on-field performance, which is likely to require purchasing more expensive players. Furthermore, for a given number of transfer targets, the fees and wages that the club will have to pay are at least partly driven by external factors such as competition with other clubs for the same pool of talents. For example, the summer 2023 transfer window showed that the top European clubs may have to compete with Saudi football clubs for player talent in the future. These clubs spent a combined amount of $875m on transfer fees alone,29 with reported annual wages of over $100m for Neymar30 and $200m for Cristiano Ronaldo.31

In addition, an important question is also the level of required return against which the expected return of the investment will be benchmarked. The comparison of IRRs to measures of the cost of equity is a widespread tool used by many businesses, but the estimation of a benchmark rate that would be considered reasonable by a private profit-seeking investor in the context of football comes with additional questions. There is a wide range of reasons for (private) investors to get involved in football clubs, not all being related to the pursuit of profitability. Nevertheless, the growing importance of private sector investment funds in European football can provide helpful references and benchmarks for expected returns.

Finally, in certain cases, another aspect to consider when assessing expected profitability is the growing prevalence of multi-club ownership structures.32 Smaller clubs that are part of a large group, even though they may be unprofitable, may serve the strategic and financial interests of the larger clubs in the group, helping to launch and train younger talents which otherwise would not be able to break into the first squad at top clubs. An MEOP assessment at the group level, rather than at the level of one individual club, could therefore yield different conclusions.33

1.4 Conclusion on the existence of a subsidy

In the field of state aid, the MEOP has been applied to various types of transactions in various industries, including in football. While the discussions above illustrate the challenges of conducting such an assessment in the football industry, there are different ways in which these can be addressed.

For example, it is important to carefully consider the following aspects:

- the evidence that would underpin a ‘reasonable’ set of expectations at the time of the investment;

- the consistency between expectations on the revenues and cost side of the business;

- the sensitivity of the conclusions to different scenarios in terms of performance—e.g. do the results rely on an assumption of five titles in a row?

In situations where there is more uncertainty regarding the future prospects of a club, it is worth assessing whether the specific transaction complies with the MEOP under a range of different scenarios—e.g. in terms of standing in the league table at the end of the season. This type of scenario analysis should account for greater uncertainty around the cost and revenue items that are more volatile and for which clubs tend to have less control and influence.

Whether a transaction would be deemed ‘sufficiently profitable’ or ‘economically rational’ in the eyes of a hypothetical profit-seeking private investor also depends on what is considered a reasonable return in an industry where motivations to invest in a club, even for private owners, may vary.

From an economics perspective, the first step of an assessment of foreign financial contributions under the FSR, i.e. determining whether we are indeed talking about subsidies, is therefore not a simple task.

If we are talking about subsidies, are they distortive?

If a measure is found not to constitute a foreign subsidy (e.g. if it can be demonstrated to be in line with market terms), then the questions of any competitive distortions created by that measure would not even arise—i.e. a measure can only be deemed a ‘distortive subsidy’ if it constitutes a subsidy in the first place.

However, if it could be demonstrated that a certain measure constitutes a foreign subsidy, the Commission would then assess the distortions created. Under the FSR, a ‘distortion’ is deemed to exist ‘where a foreign subsidy is liable to improve the competitive position of an undertaking in the internal market, and where, in doing so, [it] actually or potentially affects competition in the internal market’.34

Under the FSR, the Commission’s assessment of distortive effects will consider a number of ‘indicators’, such as the amount, nature, purpose, the conditions and the use of the subsidy, as well as the size of the beneficiary and the level and evolution of its activity on the internal market.35 Certain categories of subsidies would also be deemed ‘most likely to distort the internal market’, such as those granted to an ailing undertaking.36

Having considered other indicators, a first step would be to articulate possible ‘theories of harm’ to be assessed in relation to the use of the subsidy, i.e. the mechanisms through which the competitive position of the beneficiary might be improved. In general, in the context of the FSR, and given the various types and origins of subsidies that may be granted, it may not always be obvious how a clear and testable theory of harm can be articulated and demonstrated based on robust evidence and analysis.37 For example, it may be challenging in some cases to articulate the impact on an acquisition of a collection of subsidies of different types and amounts provided to different entities that form part of the acquirer’s group.

Both LALIGA and RE Virton—when announcing that they had requested that the Commission start an investigation into PSG and SK Lommel, respectively—set out an outline of the way in which, in their view, the alleged subsidies adversely affected the sector. In the case of LALIGA, the mechanisms include the possibility for PSG to sign players and coaches above their potential, thereby ‘boost[ing] their sporting performance’ and ‘affecting the ability of rival clubs to recruit’.38 In the case of RE Virton, the measures in favour of SK Lommel allegedly enabled the Flemish club to retain its licence, avoiding relegation and allowing it to remain in the country’s second division.39

At first glance, these ‘theories of harm’ appear relatively straightforward, setting out stark effects, and may find strong intuitive appeal. In addition, the large amounts at stake may by themselves be considered an ‘indicator’ of distortions, as explained above.

More generally, one could also imagine a ‘generalisation’ of the alleged effects of subsidies, based on an alleged causal link between the financial resources available to a club and its performance on the field and in the league tables and standings. A difference of only a couple of points can have far-reaching consequences in terms of access to international competitions (and in particular the UEFA Champions League) and the prize money that comes with them.

However, for the existence of distortive effects to be established, it would seem necessary to be able to articulate the theories of harm in a clear conceptual framework, and to demonstrate these effects on the basis of robust evidence.

In particular, an analysis of potential distortions should arguably take into account a conceptually sound definition of the relevant markets. In the case of football, it is important to define the product market(s) being considered. For example, in its state aid decisions relating to alleged aid to Dutch football clubs, the Commission mentioned the market for participating in football competitions, as well as ‘the transfer market for professional players, publicity, sponsorship, and media coverage’.40 In addition, the geographical market(s) also need to be considered, which could depend on the size of the club, its fanbase, and its commercial partners, among other factors. In state aid decisions, the Commission noted that these markets had ‘an international dimension’, and that most of them covered ‘several member states’.41

In addition, the existence of distortions should be assessed by comparison to a ‘counterfactual’ scenario: what would have happened in the absence of a subsidy? Can a causal link be established between the subsidy itself and the distortions, or could the subsidy in question be demonstrated to have been used for non-distortive purposes?

Call a foul or let the game play on?

Within the EU, state aid rules impose limits on the way in which member states can support football clubs. In the past, the Commission has started state aid investigations of a number of Dutch and Spanish football clubs.42 The issue of support from EU member states to football clubs is an ongoing one, and can take multiple forms in addition to tax or financing measures. For example, the decision of regional authorities in the Canary Islands to support local professional clubs through sponsorship deals43 was deemed by certain industry observers to entail prices ‘significantly above market logic’.44

Given that Spanish (and Dutch) clubs have been the subject of EU state aid investigations in the past, it was perhaps to be expected that they would be among the first to see an opportunity in the FSR. After all, the new regulation’s aim is to fill a regulatory gap left by (among others) state aid rules, and the principles it imposes on foreign subsidies find close parallels with those imposed by state aid rules on support from EU member states.45

If the Commission were to pick up these cases and investigate into the measures received by certain football clubs, economic and financial questions would prove key (alongside legal issues) to determine:

- whether these measures in fact constituted subsidies or can be deemed to have followed economic rationality;

- if they are foreign subsidies, whether and how they affected the internal market in a potentially distortive manner.

With the compulsory notification obligations for large concentrations and public procurements becoming applicable on 12 October 202346 and concerns surrounding resource constraints faced by the Commission,47 it remains to be seen whether the Commission will investigate these cases. Indeed, the Commission recently indicated that its initial enforcement priorities would focus on notifications as opposed to ex officio investigations.48 Furthermore, there is no formal complaint mechanism under the FSR, and limited procedural status for third parties.49 As such, the Commission is under no obligation to opine on these matters.50

However, another option in the Commission’s FSR toolbox could be to open a so-called ‘market investigation’ in the football sector, under Article 36 of the FSR. This would require a ‘reasonable suspicion’, substantiated by ‘information available to the Commission’, that ‘foreign subsidies’ in the sector ‘may distort the internal market’.51 The findings from such an investigation could then be used by the Commission in the context of individual procedures.52 It could therefore be seen, if it were opened, as a first step towards individual investigations. Could information submitted to the Commission by LALIGA and RE Virton prove sufficient to substantiate such a suspicion—and if not, could more ‘complaints’ result in that bar being met?

1 RE Virton was relegated at the end of the 2022/23 season to the Belgian National Division 1, the third tier division of Belgian football.

2 Royal Excelsior Virton (2023), ‘Subventions étrangères à certains clubs’, Press Release, 4 May.

3 LALIGA (2023), ‘LALIGA files complaint against PSG with European Commission’, Nota de Prensa, 12 August.

4 Kuper, S. (2020), ‘Simon Kuper on the rise of PSG’, Financial Times, 21 August.

5 Under the FSR, there is no formal complaint mechanism, nor are third parties recognised as official complainants. As such, in both cases the use of the term ‘complaint’ more accurately refers to the transmission of information to the Commission, with the aim that the Commission would decide to initiate an ex officio investigation into the clubs. For a discussion of the role of third parties in the context of the FSR, see: Hornkohl, L. (2023), ‘The role of third parties in the enforcement of the Foreign Subsidies Regulation: complaints, participation, judicial review and private enforcement’, Competition Law & Policy Debate, 8:1, 25 August, pp. 30–43.

6 LALIGA (2023), op. cit.

7 Royal Excelsior Virton (2023), op. cit.

8 UEFA (2023), ‘UEFA Club Licensing and Financial Sustainability Regulations (Edition 2023)’.

9 Foreign Subsidies Regulation, recital 11 and Article 3.1.

10 Foreign Subsidies Regulation, Article 3.2.

11 This is also explicitly recognised in the FSR, see in particular recital 13.

12 The General Court’s judgment was upheld by the European Court of Justice. See:

EU Court of Justice, Valencia Club de Fútbol, Case No. C‑211/20 P, Judgement, 10 November 2022.

13 For example, the MEOP framework can also be applied to the case of a loan. In that case, the exercise would focus on assessing whether the interest rate on the loan is in line with what a commercial lender (e.g. a private bank) would offer the club given its credit risk profile and the features of the transaction (e.g. seniority of the loan, existence of any collateral, repayment terms, maturity of the loan, etc.). This would involve assessing the riskiness of the football club given its current finances and its credit history.

14 Royal Excelsior Virton (2023), op. cit. and LALIGA (2023), op. cit.

15 In particular, when the assessment is carried out some time (e.g. a number of years) after the transaction took place, actual, ex post developments are not directly relevant to determining whether the injection was expected to be sufficiently profitable at the time it took place. For example, it could be that a certain transaction could reasonably be expected to be sufficiently profitable at the time it was concluded, but would actually turn out to be loss-making due to unforeseeable developments outside of the parties’ control.

16 Sales of players are also a source of income for clubs. However, as sales of players are harder to predict and tend to be quite volatile from one season to another, they are not considered as part of club’s (ordinary) operating profitability. We describe the impact of sales of players and purchases of plays later in the article.

17 These include, for example, stadium naming rights or revenues from advertising on stadium signage.

18 For the clubs competing in the EFL Championship (the second division of English football) this is routinely above 100%. See Maguire, K. and Philippou, C. (2023), ‘Research Report: Still ill? Assessing the financial sustainability of football (2023)’, 7 September, Figure 3.

19 Maguire, K. (2023), The Price of Football: Understanding Football Club Finance, Second Edition, Chapter 9.

20 UEFA (2023), ‘The European Club Footballing Landscape – 14th Club Licensing Benchmarking Report’, p. 80.

21 Ibid., p. 135.

22 From the perspective of an equity investor, the cash flows associated with the transfer (i.e. purchase and/or sale) of players are the important metric to consider. However, in a club’s accounts, player transfer fees are amortised over the duration of a player’s contract, and only the annual amount of amortisation is considered as a cost in the club’s income statement. This is akin to how companies account for investments (i.e. capital expenditure) on their income statements through depreciation charges.

23 The IRR is the discount rate which makes a project’s sum of discounted future cash flows equal to zero. In other words, the sum of future (positive) cash flows discounted at the IRR would equal the value of the initial equity injection.

24 The cost of equity is usually estimated using the Capital Asset Pricing Model (‘CAPM’), which provides a measure of the return that a perfectly-diversified equity investor would require for holding an asset with a particular risk profile. It requires an estimate of the risk-free rate and the expected return of the equity market of the country where the football club operates, as well as an estimate of the sensitivity of the football club’s cash flows to the performance of the stock market.

25 UEFA (2023), ‘Circular No. 35/2023, ‘Distribution to clubs from the 2023/24 UEFA Champions League, UEFA Europa League and UEFA Europa Conference League and the 2023 UEFA Super Cup. Payments for the qualifying phases. Solidarity payments for non-participating clubs’, 7 July.

26 Steaua Bucharest won in 1985/86, FC Porto in 1986/87, PSV Eindhoven in 1987/88, Red Star Belgrade in 1990/91, Marseille in 1992/93, and Ajax in 1994/95.

27 For example, in its first season back in the Belgian top division after 48 years in the lower tiers, Royal Union Saint-Gilloise finished second in the 2021/22 season, just four points shy of three-time champions, Club Brugge. Instead of receiving €15.64m as prize money for qualifying directly for the 2022/23 UEFA Champions League group stage, RUSG instead received €3.63m for playing in the 2022/23 UEFA Europa League group stage. See UEFA (2022), ‘Circular No. 47/2022 – Distribution to clubs from the 2022/23 UEFA Champions League, UEFA Europa League and UEFA Europa Conference League and the 2022 UEFA Super Cup. Payments for the qualifying phases. Solidarity payments for non-participating clubs’, 4 July.

28 A recent example is the slow decline of a player such as Eden Hazard, who was purchased by Real Madrid for the price of €115m in July 2019 and left the club four years later with an estimated market value of €5m. According to data from Transfermarkt.

29 Miller, H. (2023), ‘Saudi Arabia Leapfrogs Football Powerhouses With $875 Million Splurge’, Bloomberg, 8 September.

30 Al Jazeera (2023), ‘Brazil’s Neymar signs for Saudi football club Al Hilal’, 15 August.

31 Rai, G. et al. (2023), ‘Cristiano Ronaldo’s life in Saudi: Private shopping, luxury hotels, Messi taunts’, The Athletic, 30 January.

32 According to UEFA, in 2022 there were 82 top-division clubs in Europe with a cross-investment relationship with one or more other club. UEFA (2023), ‘The European Club Footballing Landscape – 14th Club Licensing Benchmarking Report’, p. 206.

33 Similarly, if football clubs are part of a larger corporate group that includes companies active in other sectors, it is worth considering whether there are any effects on the profits of these related entities that should be considered in the MEOP assessment.

34 Foreign Subsidies Regulation, Article 4(1).

35 Ibid.

36 Foreign Subsidies Regulation, Article 5.1(a). It would therefore be particularly important to determine whether a club, prior to receiving the subsidy, would have satisfied the criteria to be considered in financial difficulty (e.g. whether certain thresholds were met in terms of leverage and interest coverage ratios, or if more than half of the club’s share capital had disappeared as a result of accumulated losses). The precise criteria are set out in the Implementing Regulation, and are similar to the notion of ‘undertaking in difficulty’ in the context of state aid rules.

37 For a discussion, see for example Lowe, P. and Yarak, S. (2023), ‘Closing the regulatory gap – answers (and new questions) from the Foreign Subsidies Regulation’, Competition Law & Policy Debate, 8:1, 25 August, pp.22–29. In particular, see section 5.

38 LALIGA (2023), op. cit..

39 Royal Excelsior Virton (2023), op. cit..

40 European Commission (2016), ‘Commission Decision of 4.7.2016 on the Measure SA.41613 – 2015/C (ex SA.33584 – 2013/C (ex 2011/NN)) implemented by the Netherlands with regard to the professional football club PSV in Eindhoven’, 4 July, para. 37.

41 Ibid.

42 In Spain, the Commission launched investigations into corporate taxation at Real Madrid, FC Barcelona, Athletic Club Bilbao and Atletico Osasuna (SA-29769); land transfers from the city of Madrid to Real Madrid (SA-33754); and loan guarantees provided by a state-owned financial institution to Valencia CF, Hercules and Elche (SA-36387). In regards to the corporate taxation investigations, the European Court of Justice upheld the Commission’s decision upon appeal of the parties. In regards to the loan guarantees to Valencia CF and others, the Commission’s decision was overruled by the European Court of Justice. In parallel to the proceedings regarding the Spanish clubs, the Commission cleared measures in favour of five Dutch professional football clubs following in-depth investigations (FC Den Bosch (SA.41614), MVV Maastricht (SA.41612), NEC Nijmegen (SA.41617), Willem II (SA.40168) and PSV Eindhoven (SA.41613)).

43 García, C. (2023), ‘Canarias inyecta 20 millones vía patrocinio a los clubes de LaLiga, Liga F y ACB hasta 2025’, 2Playbook, 15 June.

44 See the comments on X (formerly Twitter) of Marc Menchén Alba, founder of the Spanish sports platform and media, 2playbook.

45 The FSR is concerned with ‘subsidies’, i.e. measures that are attributable to a foreign state, but does not provide any basis to analyse financial support provided by wealthy individuals or corporate groups, whose actions may not be attributed to a foreign state.

46 Foreign Subsidies Regulation, Article 54(4).

47 See: McNelis, N. and Croft, L. (2023), ‘New foreign-subsidy powers see EU start search for external help’, MLex, 11 July, and Folkman, V. (2023), ‘EU strapped for staff to combat Chinese subsidies’, Politico, 5 October.

48 Gil, T. (2023), ‘Football complaints over foreign subsidies aren’t top priority, EU official Pesaresi says’, MLex, 13 September.

49 For a discussion, see Hornkohl, L. (2023), ‘The Role of Third Parties in the Enforcement of the Foreign Subsidies Regulation: Complaints, Participation, Judicial Review, and Private Enforcement’, Competition Law & Policy Debate, 8:1, 25 August, pp.30–43.

50 We note that RE Virton claimed to have secured a meeting with the Commission’s Foreign Subsidies Task force in September 2023. If confirmed, this would indicate interest from the Commission, but would not necessarily mean that it intends to open an investigation. See Verhelst, K. (2023), ‘Belgian football club told relegation battle over foreign subsidies can’t be heard in Brussels court’, MLex, 14 August.

51 Foreign Subsidies Regulation, Article 36(1).

52 Foreign Subsidies Regulation, Article 36(3).

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More