Behavioural economics, competition and remedy design (revisited)

https://www.oxera.com/wp-content/uploads/2018/07/Behavioural-economics.pdf.pdf

Over the past few years, policymakers have shown growing interest in the field of ‘behavioural economics’. In essence, ‘traditional economics’ makes a variety of assumptions about the preferences, cognitive ability and rationality of individuals. Behavioural economics incorporates psychological concepts to help explain observed behaviours that deviate from the predictions of these models.

Behavioural economics itself is not new—some of the ideas date back to the 1950s, and it became a field in its own right in the late 1970s with the work of psychologists Daniel Kahneman and Amos Tversky and the economist Richard Thaler.1 What is more recent is the attention it has received from the general public, helped by popular economics books such as Freakonomics and Nudge,2 and by Kahneman winning the Nobel Prize for Economics in 2002. Furthermore, policymakers are looking more closely at what behavioural economics means in determining whether markets are working in the interests of consumers. In October, the Oxera Economics Council looked at the state of the evidence base, and considered the following questions in particular.

- What does behavioural economics have to say about how consumers might be affected by biases in their behaviour?

- What does the presence of these consumer biases mean for competition policy?

- How does the presence of biases affect the design of remedies in markets in which there are identified competition problems?

Better information (or ‘transparency’) does not necessarily equate to ‘more information’.

In some instances the endowment effect and inertia are helpful. They can help to protect consumers against the instinct for immediate gratification.

A distinction perhaps needs to be made between firms making excess profits from exacerbating consumer biases and distributional issues of sophisticated consumers gaining and naive customers losing out. In some cases, however, both phenomena may occur.

Identifying naive and sophisticated consumers can be difficult in practice. Ideally, liberal paternalist interventions should be designed to make a positive difference, and to do little harm if they go wrong. Smart up-front provision of information (for example, to remedy ‘drip pricing’) may fall into this category.

Care is required in reducing the scope for ‘complex pricing’, since this may generate preconditions for tacit collusion in certain markets, by improving the monitoring of players by their rivals.

Consumer bodies generally wish to intervene, whereas competition bodies tend to be more hands-off. This can be a source of tension in applying policy across different EU member states.

‘Traditional’ versus ‘behavioural’ economics

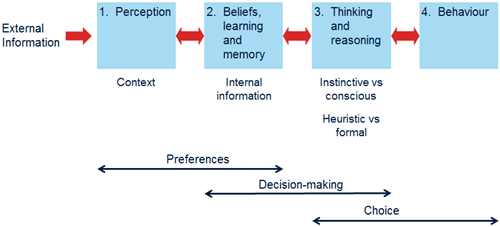

As a starting point, is it useful to consider some of the core psychological processes involved when consumers make ‘choices’ (see Figure 1). These include how consumers perceive information presented to them; their beliefs, learning and recall; how they think and reason based on the available information; and their subsequent behaviour.

Figure 1 Basic psychological processes involved in exercising ‘choice’

Source: Oxera.

The psychological processes outlined in the figure can also be matched to concepts more familiar to economists: preferences, decision-making and consumer choice. Traditional economics makes simplifying assumptions on all three. With regard to individuals’ preferences, it assumes that the way in which information is perceived, and an individual’s preferences, are not affected by the way in which external information is portrayed or ‘framed’. Context does not matter, and ‘irrelevant’ information will be ignored.4 Traditional economics further assumes that individuals use all available information when making decisions—the more information, the better—and that they have perfect recall of their past experiences. Consumers engage in fully rational and fully conscious reasoning, weighing up the best course of action. People are skilled at forecasting the future, and over time act in a way that maximises their lifetime utility.

Behavioural economics, on the other hand, relaxes a number of these assumptions. It builds on a cornerstone of psychology: that people can be seen as relying on two cognitive systems. System I processing is undertaken by the older parts of the human brain and involves instinctive processing, rather than conscious ‘thinking’. System II processing is undertaken by newer parts of the brain, facilitating conscious, rules-based processing.5 Taking on board these two systems, behavioural economics adopts more realistic assumptions on how people’s preferences are formed, and how they make decisions.

Regarding preferences, behavioural economics builds on the psychological notion that human beings perceive the world by placing things ‘in context’. This is driven heavily by System I. Similarly, consumers’ preferences are ‘reference-dependent’, since the way they process information depends on how it is ‘framed’. For example, information at the top of a list of search results on a price-comparison website may be given greater weight than that at the bottom. Consumers may focus on a headline price, while ignoring add-ons. Another important feature of reference dependence is that people dislike the risk of losing what they have more than they like the prospect of gaining that which they do not—the ‘endowment effect’. This can lead to a preference for the ‘default’ option and inertia—i.e. a strong preference for the status quo, or making their minds up and not changing their decision. As discussed below, firms can take advantage of the endowment effect in structuring the buying process.6

Behavioural economics also incorporates psychological concepts of how people actually make decisions. Conscious, fully rational deliberation (using System II) requires a considerable amount of information and computational power, and would be exhausting to apply to all day-to-day tasks. Helpfully, between Systems I and II lies a collection of shortcuts called ‘heuristics’, whereby decisions are made more instinctively based on a selection of the available information, recent experience, or a focus on the ‘headline’ aspects of a problem. Heuristics are helpful for making quick decisions, but can also lead to mistakes. They are again vulnerable to how information is framed. People may also be overconfident in their abilities, or selectively remember positive experiences while forgetting negative ones, leading to poor choices.

The above discussion suggests that emotion plays a major role in decision-making. In practice, this can complicate matters further by generating conflict between conscious deliberation of the future (System II) and our innate desire for immediate gratification (System I). This can lead to ‘time-inconsistent’ behaviour. For example, a consumer may be tempted to take out a loan that, in the longer term, they know they may be unable to afford.

1 Oxera (2013), ‘Behavioural Economics and its Impact on Competition Policy: A Practical Assessment with Illustrative Examples from Financial Services’, May. See also Oxera (2013), ‘Behavioural Economics and its Impact on Competition Policy: A practical assessment’, Agenda, June. 2 Financial Conduct Authority (2013), ‘Applying behavioural economics at the Financial Conduct Authority’, Occasional Paper No. 1, April. 3 Financial Conduct Authority (2014), ‘Credit card market study: Terms of reference’, November.

Consumers and competition

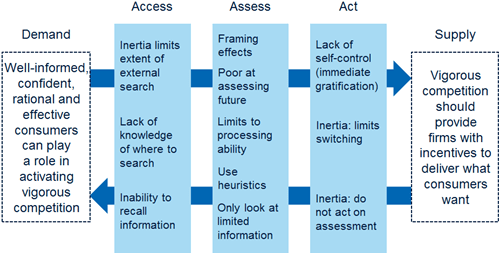

The OFT report seeks to cast some light on what behavioural economics and consumer biases mean for consumer protection and competition policy. The rationale identified is as follows.

Markets work well when there are efficient interactions on both the demand (consumer) side and the supply (firm) side. On the demand side, confident consumers activate competition by making well-informed and well-reasoned decisions which reward those firms which best satisfy their needs. On the supply side, vigorous competition provides firms with incentives to deliver what consumers want as efficiently and innovatively as possible. When both sides function well, a virtuous circle is created between consumers and competition. (OFT, 2010, p. 9)

The OFT report also notes that, while competition policy has traditionally focused on whether the supply side of markets works well, if consumers are not proactive, firms will have less incentive to provide consumers with what they want, and, through a vicious circle, competition will be weakened. However, while behavioural economics may change how the OFT undertakes its analysis or designs interventions, it does not necessarily imply a ‘fundamental shift’ in policy.

The OFT presents a three-part taxonomy of how consumers might be affected by some of the biases in preferences and decision-making discussed above, noting that, for consumers to make sound decisions, they need to:

- access information about the various offers available in the market;

- assess these offers in a well-reasoned way;

- act on this information and analysis by purchasing the product or service that offers the best value.

Figure 2 OFT taxonomy of interactions between consumer and competition policy

Figure 2 illustrates how consumer biases might hinder the virtuous circle of consumers (on the demand side) forcing firms to compete and act appropriately (on the supply side). In the figure, the ‘access’ stage relates to the information search that consumers undertake, whether seeking out (external) information or relying on (internal) recall. Many of the biases noted above that consumers face in perception and decision-making feature in the ‘assess’ stage: framing, limits on cognitive ability in assessing the future of calculating pay-offs when faced with different options, and reliance on heuristics in decision-making (which, arguably, includes using selective information). At the ‘act’ stage, the OFT notes two opposing effects: inertia (lack of inclination to make a decision), and lack of self-control (inability to resist making the wrong decision). The more these problems are present, the less able or inclined consumers will be to make the right choices, and the less firms will provide consumers with what they want.

So, what is the evidence that consumer biases are present, and what types of pricing frames might aggravate them? The OFT highlights a range of recent empirical literature that illustrates how, in real-world markets, consumer biases appear to be present.7 Certain forms of pricing cause problems for consumers in the assess stage, such as ‘partitioned pricing’ (for example, separate prices for a product and its delivery). If consumers are fully informed and fully rational, the OFT notes, it should not matter to them if a price is quoted as one price or is split into a base price and an add-on. However, evidence on partitioned pricing reviewed by Morwitz et al. provides real-life examples of Internet auctions where lower opening-bid reserve prices, coupled with higher shipping charges, attract more bidders—and higher revenues—than auctions with higher opening-bid prices and lower shipping charges.8 Framing effects (bidders focusing on the base price) and the use of heuristics (bidders not computing the two prices as the full cost of the product) mean that buyers do not fully process shipping charge information, and sellers can make more profit using partitioned pricing.

The OFT indeed highlights that firms may seek to exploit consumer biases in all three stages of its framework. To explore this further, the OFT commissioned experimental research on how various pricing frames can influence consumer behaviour.

The pricing frames investigated are drip pricing, ‘sales’, complex pricing, bait pricing, and time limited offers…The report found that all of these pricing practices have some adverse effect on consumer choice and that most of them do significantly impact on consumer welfare. It suggests that the root of the errors can be found in the existence of the behavioural biases, largely the endowment effect and cognitive errors. (OFT, 2010, p. 14, footnote 16)

Drip pricing (a form of partitioned pricing) is particularly interesting. Consumers face a headline price up front, and as they engage in the buying process, additional charges are ‘dripped through’ by the seller. Think about buying a holiday online. Having identified a promising deal, you spend some time entering your details on successive web pages. Towards the end of the process, you discover additional charges, but you still buy the holiday, even though you may not have done so had you known the full price up front. The experimental analysis identified drip pricing as a successful strategy—generating additional profits and reducing consumer welfare. The authors note that the endowment effect seems to be involved here—having engaged in the buying process, people’s point of reference shifts and they feel they already ‘own’ the product, so they are more inclined to pay not to lose it.

Traditional economists would note that, in competitive markets, ‘good’ firms should drive out the ‘bad’, so a firm that charges hidden add-on prices would soon lose custom to others. However, the OFT highlights that this may not be the case. Gabaix and Laibson show that, if the proportion of naive customers is high enough, all firms will choose to ‘shroud’ the add-on price information.9 Sophisticated consumers, who buy only the base product but not the add-on, receive a subsidy from naive customers who pay the add-on fees. Competition between firms fails to unwind this since an attempt by any one firm to educate naive consumers about the add-on market will, if close substitutes to the add-on exist, lead to a loss of profitable naive customers. Another finding, from Spiegler, is that more competition can, in certain circumstances, lead to more shrouding, making things worse, not better.10 However, the OFT acknowledges that the market may often correct itself—for example, where learning and reputation effects are strong, and where there is frequent purchasing.

1 See Oxera (2012), ‘Behavioural problem, behavioural solution: the case of extended warranties’, Agenda, October. 2 See Oxera (2014), ‘Adding up the add-ons: the FCA’s first market investigation’, Agenda, May. 3 See Oxera (2014), ‘Adding up the add-ons: the FCA’s first market investigation’, Agenda, May.

Designing remedies

An important future role for behavioural economics may be in designing remedies to tackle perceived problems in markets. Historically, remedies have focused on tackling supply-side issues. For example, in cases under Articles 101 and 102, remedies have typically focused on punishing firms for their past behaviour, including through fines for infringement of competition law. However, the OFT highlights that ‘there is little reason why [remedies] should not be based on the demand side, if consumer behaviour were found to be an important driver of problems in the market’.11 Moreover, the OFT notes that behavioural economics and demand-side remedies may play an even greater role in examining whether markets work well—for example, in the UK the OFT can undertake ‘market studies’, and can also make references to the Competition Commission (CC) to conduct ‘market investigations’ where problems are identified in the functioning of a market.

In whatever context demand-side remedies are proposed, the OFT recommends that interventions should ideally be in the ‘liberal paternalist’ vein, for a variety of reasons.

First, on a principled level, we want solutions that solve the problem, but we do not want to remove consumer choice…Second, there is no guarantee that authorities will necessarily improve the market or not create unforeseen consequences elsewhere. Asymmetries in information are inherent in intervention. Firms may have incentives to manipulate the information they provide to authorities in order to gain more favourable outcomes. More simply, it may be that authorities simply do not have the level of expertise required to make delicate interventions. In such situations an authority would be wise to be conscious of its own limitations. (OFT, 2010, p. 35)

Behavioural economics therefore means smarter intervention rather than necessarily more intervention. The liberal paternalist approach, as popularised in the book Nudge, involves remedies that partly work with consumers’ flawed preferences and decision-making abilities, rather than necessarily correcting them. On the one hand, such remedies may encourage consumers to make a ‘forced choice’, rather than letting them remain inert or simply opt for ‘the default’. On the other hand—and again consistent with the liberal paternalist approach—where there is a clearly superior outcome for consumers, the policy might be to set the superior outcome as default, without restricting consumers’ ability to choose an alternative.

Even where behavioural biases have featured as part of a competition investigation, however, the remedies proposed by competition authorities have not always been consistent with the competition problems identified. For example, Microsoft was considered by the European Commission to have leveraged its dominance in the operating system market into the emerging competitive market for media players by bundling Windows Media Player free of charge with its operating system.12 Part of the remedy adopted was that Microsoft should make available versions of Windows with and without Media Player installed. However, very few copies of the version without Media Player were sold.13 This is perhaps not surprising, since for the same overall price consumers would be most likely to choose the version with Media Player pre-installed. In a similar case, in which the European Commission investigated the bundling of the Microsoft Internet Explorer web browser with Windows, a different remedy was agreed.14 Users of Windows-based personal computers with Internet Explorer set as their default browser, who also subscribed to operating system updates, would be taken to a screen providing, at random, Internet Explorer and a number of competing browsers. The remedy, in effect, removed the impact of the default option, forcing consumers to make an active choice of their preferred browser.

The UK market investigations regime has dealt with several markets that seem prime candidates for consumer bias issues, such as extended warranties on electrical goods, personal current accounts, store cards, home credit, and payment protection insurance (PPI).15 The OFT notes that, in banking:

rather than centring on directly reducing market power, recent OFT work in Personal Current Accounts in banking has highlighted clarity, transparency, and consumer empowerment as keys to making the market function effectively. This, in turn, may mean that banks in the UK will need to change what information they provide and how they provide it. (OFT, 2010, p. 36)

The OFT cautions, however, that the theory of behavioural economics needs to be supported with empirical evidence. This arose in the PPI investigation by the CC.16 Consumers may face behavioural biases at the point of sale in purchasing a primary product (e.g. a loan) and in choosing whether to buy an add-on product when it is offered (e.g. PPI).17 However, when intervening in such markets, it is important to have evidence of the nature and extent of biases present and of the effects on consumers of any remedies put forward. The CC considered that providers of the product in effect had point-of-sale monopolies in PPI, leading to high prices. Part of the package of remedies proposed by the CC was to prohibit credit providers from selling PPI as an add-on at the point of sale of the primary product, and for up to seven days afterwards. However, the Competition Appeal Tribunal rejected this remedy since the CC had provided insufficient evidence of how consumers would respond to it, whether it would benefit them, and how this would weigh against the loss of convenience to consumers.18 The CC subsequently undertook consumer surveys and a number of experiments to obtain further evidence, before confirming the point-of-sale prohibition.19

The PPI case demonstrates that when designing demand-side remedies it is important to obtain empirical evidence of their likely effects on consumers—it is not enough to assert that biases exist, and that a specific remedy will correct them. In practice, such evidence might be obtained from the empirical literature, the experimental literature, by undertaking experimental analysis, or by undertaking other forms of ‘road testing’ of remedies. There is a greater role for all four going forward.

1 Kahneman, D. and Tversky, A. (1979), ‘Prospect Theory: An Analysis of Decision under Risk’, Econometrica, 47:2, pp. 263–91, March. Thaler, R. (1980), ‘Toward a Positive Theory of Consumer Choice’, Journal of Economic Behavior & Organization, Elsevier, 1:1, pp. 39–60, March.

2 Levitt, S. and Dubner, S. (2005), Freakonomics: A Rogue Economist Explores the Hidden Side of Everything, William Morrow & Co. Thaler, R. and Sunstein, C. (2008), Nudge: Improving Decisions About Health, Wealth, and Happiness, Yale University Press.

3 OFT (2010), ‘What does Behavioural Economics mean for Competition Policy?’, March.

4 In traditional economics, individuals also seek to maximise their own level of absolute utility. In this sense, preferences are also independent of what ‘comparison others’ have (for example, people do not care about fairness), and people do not habituate over time to steady-state consumption (e.g. having purchased a small car, the satisfaction I get from it next year will be the same as the satisfaction I get from it this year). Psychology illustrates, however, that people do care about how their own pay-offs compare against those of others (e.g. the fairness of pay-offs and the relative status that they bring). Furthermore, psychology illustrates that, in perceiving information, individuals habituate to steady-state stimuli (e.g. a security guard may find it difficult to concentrate on CCTV camera footage when little is happening over a period of time). Analogously, in preference terms, people care not just about steady-state pay-offs, but also about how these vary over time (e.g. happiness is derived from upgrading from a small to a larger car, until I habituate to using the larger car).

5 For a more detailed explanation, see Gilbert, D. (2006), Stumbling on Happiness, Knopf; and Thaler, R. and Sunstein, C. (2008), Nudge: Improving Decisions About Health, Wealth, and Happiness, Yale University Press.

6 Consumer preferences may be constructed during the buying process, rather than given, and may also be susceptible to external influence. A consumer who has spent time booking a holiday on a website may feel midway through the process that they already ‘own’ a holiday. Prior to completing a purchase, when faced with add-on fees, they may be willing to pay these in order to avoid the risk of ‘losing’ their dream break (and wasting the time taken to reach that point in their purchase—i.e. the ‘sunk-cost fallacy’).

7 An example of one such study is Della Vigna et al. (2006), which presents the results of a fairly extensive review of the empirical literature on the existence (or otherwise) of biases in different markets. A paper by Armstrong et al., prepared for the OFT, also reviews the theory and evidence on how biases might affect consumers. Perhaps the most familiar empirical example is consumers signing up for gym membership and then not using it. This might be explained by overconfidence, hyperbolic discounting of future pay-offs (which results in time-inconsistent behaviour where an individual makes choices today that their ‘future self’ would prefer not to make), and/or non-cancellation driven by inertia and/or complicated cancellation policies. See Della Vigna, S. and Malmendier, U. (2006), ‘Paying Not to Go to the Gym’, American Economic Review, 96:3, pp. 694–719; and Armstrong, M. (2008), ‘Interactions Between Competition and Consumer Policy: A report prepared for the OFT’, OFT991, April.

8 This review of the latest evidence may be found in Morwitz, V., Greenleaf, E., Shalev, E. and Johnson, E.J. (2009), ‘The Price Does Not Include Additional Taxes, Fees, and Surcharges: A Review of Research on Partitioned Pricing’, 26 February. The OFT (2010) report refers to the seminal study by Morwitz, V.G., Greenleaf, E.A. and Johnson, E.J. (1998), ‘Divide and Prosper: Consumers’ Reactions to Partitioned Prices’, Journal of Marketing Research, 35, pp. 453–63.

9 Gabaix, X. and Laibson, D. (2006), ‘Shrouded Attributes, Consumer Myopia, and Information Suppression in Competitive Markets’, Quarterly Journal of Economics, May, 121:2, pp. 505–40.

10 Spiegler, R. (2006), ‘Competition over Agents with Boundedly Rational Expectations’, Theoretical Economics, 1, pp. 207–31.

11 OFT (2010), p. 35. Such an approach has been discussed in terms of enforcement to deal with exploitative abuses. See Fletcher, A. and Jardine, A. (2007), ‘Towards an Appropriate Policy for Excessive Pricing’, 12th Annual Competition Law and Policy Workshop, June.

12 The OFT highlights that, if consumers are fully rational, bundling of Media Player free of charge with an operating system should make little difference—consumers can quickly download an alternative media player free of charge from the Internet. However, behavioural economics shows that the inclusion of a media player by default can make a difference to subsequent customer search behaviour (due to the endowment effect, default bias and customer inertia), which makes foreclosure through this bundling strategy more likely. See OFT (2010).

13 See, for example, Ahlborn, C. and Evans, S. (2009), ‘The Microsoft Judgment and its Implications for Competition Policy towards Dominant Firms in Europe’, Antitrust Law Journal, 75:3, p. 24.

14 European Commission (2009), ‘Summary of Commission Decision of 16 December 2009 Relating to a Proceeding under Article 102 of the Treaty on the Functioning of the European Union and Article 54 of the EEA Agreement (Case COMP/39.530—Microsoft (Tying), notified under document C(2009) 10033))’, Official Journal of the European Union, C 36/7, 13 February 2010.

15 See Oxera (2008), ‘Market Investigations: A Commentary on the First Five Years’, Agenda, September.

16 Competition Commission (2009), ‘Market Investigation into Payment Protection Insurance’, 29 January.

17 PPI offers protection to consumers who take out a loan against events that may prevent them from keeping up with their repayments, such as unemployment and illness. When sold the add-on product at the point of sale (e.g. the bank branch where the consumer purchases the primary credit product), consumers may lack the cognitive capacity to assess the level of the premium and whether the add-on PPI suits their needs. They may instinctively opt to include the product in their overall purchase by default. They may also be overoptimistic about their inclination to cancel the add-on PPI at a later date, even when offered a cooling-off period.

18 Barclays Bank Plc v Competition Commission, [2009] CAT 27, Judgment of 16 October 2009.

19 See Competition Commission (2010), ‘PPI—CC Confirms Point-of-sale Prohibition’, press release, 14 October.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More