An era of negotiation: news publishers and online intermediaries

In September, the European Commission granted news publishers a new right that recognises their role in the creation of press content. But will this increase the remuneration they receive from online intermediaries and aggregators (such as social media companies and search engines) in negotiations over the publication of short news snippets on these sites? What can economics tell us about the dynamic surrounding these negotiations, and the likely success of the proposed regulations?

In the past, consumers would often obtain their news from a print newspaper or broadcasting channel, which provided curated content designed to appeal to a particular demographic, cultural group or political allegiance. The arrival of the Internet allowed many of these publications to move online, lowering their distribution costs and enabling them to provide new interactive features and reach wider audiences. Initially, users would navigate directly to the publication’s website, or access it via a web portal such as Yahoo or MSN. When they found an article of interest, they would click on the relevant link and the article would be shown, all within the publisher’s website.

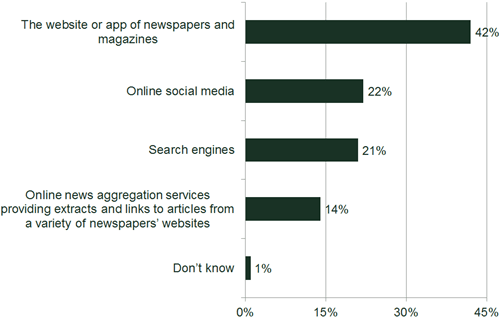

This is changing, however. Figure 1 shows how consumers’ first port of call is now often not a single news website, but a social media service such as Twitter or Facebook, a search engine such as Bing, or a news aggregator such as Google News. These are online intermediary platforms that offer external links to articles on news websites, usually without hosting the content themselves (Facebook Instant Articles is a notable exception). These links often include ‘snippets’ of the news article to indicate its content.

Figure 1 What services do consumers mainly use to read the news?

Source: European Commission (2016), ‘Internet users’ preferences for accessing content online’, Flash Eurobarometer 437, March.

The growing importance of online intermediaries has caused concern among some publishers, which claim that there is an imbalance of power regarding the use of snippets, such that a disproportionate amount of the value created by content is retained by intermediaries. This has led to a call for regulatory intervention.1 While this argument has been supported by some large publishers, it should be noted that not all publishers are in favour of intervention in these markets.2

Intermediaries argue that both publishers and consumers derive substantial benefit as a direct result of the presence of intermediaries, and that there is no market failure to warrant intervention.3

In response to this debate, the European Commission has proposed the modernisation of EU copyright laws so that they:

will give press publishers legal certainty and put them in a better negotiating position in their contractual relations with online services using and enabling access to their content.4

The Commission’s proposals mean that intermediaries will be required to negotiate with publishers for the right to publish snippets (whereas currently they do not need permission). This article focuses on what economics can tell us about negotiations between publishers and intermediaries, and the likely outcomes. If left to the market, would the most efficient outcome involve one side paying the other?

A win–win relationship?

One view of the relationship between publishers and online intermediaries is that it is win–win. Intermediaries better match consumers’ interests with the content produced by publishers, and this leads to increased impressions (website visits), which in turn can lead to advertising sales or other monetisation of content that would otherwise not have taken place. Consumers also benefit from the relationship, through better matching of content to their preferences and arguably easier access to content. Provided that publishers can monetise these visits, this should result in a financial gain for them. For their part, intermediaries may also monetise this traffic, for example through advertisements or by charging users for the service. Further details are given in the box.

Benefits of online intermediaries to consumers and publishers

With large amounts of content available on the Internet, it can be disproportionately costly for individual consumers to filter content and identify exactly what they are looking for.

Online intermediaries can perform an important role in matching content to user preferences. Increasingly, this is through machine-learning matching, with services such as Google search and Facebook using algorithms to identify and match consumer preferences (identified through browsing history or previous activity), with relevant content.

The popularity of intermediaries with consumers suggests that they provide value, through reduced search costs; greater plurality of content not available from a single supplier; better content identification; and the ability to interact with content (e.g. through sharing on social media).

Publishers can also potentially benefit by enjoying a greater reach and therefore audience. In particular for innovative or smaller publishers, intermediaries could generate opportunities for innovation through new business models for monetising content, and through lower barriers to entry (i.e. they could make it easier for a new publisher to attract consumers).

Source: Oxera (2015), ‘Benefits of online platforms’, prepared for Google, October.

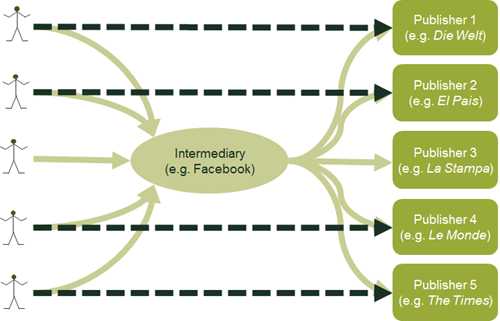

However, there is a perception by some publishers that the use of intermediaries is at the expense of ‘direct’ or ‘unmediated’ use of news publishers’ own websites or apps. The argument is that some of the traffic that publishers receive from intermediaries (and its associated revenue) is not genuinely incremental, but is ‘intercepted’ before reaching them and then ‘given back’. This is illustrated in Figure 2, where the dashed arrows denote ‘direct’ consumption, and the solid arrows denote intercepted and additional traffic.

Figure 2 Direct and mediated news consumption

The limited evidence available in the public domain suggests that incremental and intercepted traffic coexist. For example, results from a recent study examining the impact of the closure of Google News in Spain5 found a net decrease in online news consumption of around 16% (measured in terms of articles read) among former Google News users, which suggests that some traffic was genuinely incremental. However, the top five news websites viewed in Spain saw their usage increase after Google News’s closure (again, among former users of Google News), which suggests that Google News also partially substituted for direct, ‘unmediated’ consumption of the main news services and effected a degree of reapportionment of market shares away from the largest publishers in favour of niche/smaller publishers.

In addition, evidence reported in a study by Oliver & Ohlbaum and Oxera shows that BBC website visits via social media have 1.3 page views on average, compared with an average of 3.5 page views per visit across all visits.6 The same pattern was visible in (non-BBC) commercial website data. This might suggest that the growth of online news intermediation is offering consumers more choice and opening up a wider audience to publishers, but may also be changing the number of impressions that publishers’ websites see directly.

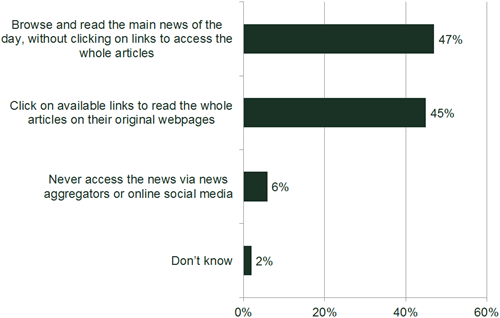

Figure 3 presents some evidence that, among European consumers who access the news online, nearly half browse the news without clicking through to a publisher’s website.

Figure 3 When consumers access news via news aggregators, social media or search engines, what do they most often do?

Source: European Commission (2016), ‘Internet users’ preferences for accessing content online’, Flash Eurobarometer 437, March.

Current regulatory regime

The role and responsibilities of online intermediaries regarding content distribution are part of the EU’s wider Internet intermediary liability regime. Such a regime should seek to balance the interests of content providers and intermediaries while increasing consumer benefit.

The EU’s regime defines where intermediaries are exempt from copyright liabilities—so-called ‘safe harbours’. European safe harbours were defined in 2000 when the Commission introduced legislation that protected intermediaries from copyright infringement liabilities in relation to information that they transmit as a mere conduit, cache or host without modifying it.7

There are economic benefits to safe harbours,8 but the current EU debate centres on whether intermediaries’ use of this legislation to offer snippets of external content is legitimate. In other words, do the current activities of intermediaries go beyond the original definitions of transmission, caching or hosting, and should they therefore be responsible for the copyright of information that is made available via their services?

Some publishers have argued for the introduction of ancillary copyright laws, whereby intermediaries pay for the use of snippets on their platform. Such regulations have been introduced in Germany and Spain.

- In 2013 ancillary copyright was introduced in Germany, whereby publishers were given rights over the publication of snippets by intermediaries—in that intermediaries had to gain a licence from each publisher to publish them.9 In response, Google stopped using snippets in Germany, which caused a rapid decline in traffic to publishers’ websites—Axel Springer, a major European publisher, reported that traffic from Google’s search engine fell by 40% following this change.10 After a complaint, the German competition authority determined that Google did not have to provide snippets.11 As a result, many publishers issued free licences to intermediaries—resulting in a situation that was very similar to the previous status quo.

- In 2014, Spain introduced an ancillary copyright law that gave publishers a compulsory compensation right (which cannot be waived) for the use of snippets by intermediaries.12 The immediate effect was that Google shut down its Google News service in Spain, the effects of which are described above.13

Both measures were recognised by the Commission as being ineffective in attempting to increase publishers’ revenue from intermediaries—in part because they were not EU-wide.14

The European Commission’s proposed Directive on copyright

On 14 September 2016 the Commission published its proposals for new copyright legislation in the EU, including new rules regarding the publication of news snippets.15

The Commission highlighted two key motivations for making this change. First, it stated that the existing system provides incomplete protection of publishers’ contributions and investments at the EU level, and second, it recognised that there are differences in bargaining power between intermediaries and publishers. These two issues make it difficult for publishers to enforce their rights online, and generate legal uncertainty over the ability of publishers to claim compensation for uses under copyright exceptions. The consequences were identified as being the decline of publishers’ revenues, and therefore a reduced quality and variety in print media, which is to the detriment of consumers.16

The Commission has therefore proposed that:

- press publishers be granted a new ‘neighbouring right’, including both the ‘right of making available to the public’ and the ‘right of reproduction’ to the extent required for digital use. This new right includes snippets (but excludes hyperlinks);

- member states may introduce laws that allow publishers to claim compensation for the use of their rights.

The Commission expects the proposed measures to be more effective at raising publishers’ revenues than the ancillary copyright laws in Germany and Spain, because the proposed measures would be wider-ranging than the German law, and would give publishers more flexibility than the Spanish law (in that the outcome of negotiations would not necessarily be that intermediaries pay publishers).

The Commission expects that the proposed measures will increase publishers’ bargaining power relative to that of intermediaries:17

As for press publishers, the preferred option would increase their legal certainty, strengthen their bargaining position and have a positive impact on their ability to license content and enforce the rights on their press publications. The preferred option would also increase legal certainty for all publishers as regards the possibility for them to receive a share in the compensation for uses under an exception.

The proposals are supported by some (although not all) publishers, and are generally opposed by intermediaries.18

Bargaining dynamics

The Commission is aiming to change the bargaining dynamic between press publishers and online intermediaries. While it remains to be seen whether the proposed legislation will have the desired effect, economics can help to give an indication.

The current market structure involves many press publishers competing for consumers—and publishers’ revenue typically depends on consumers visiting their websites. These publishers reach consumers through large intermediary platforms that match consumers with published content. Some consumers do not use intermediaries to access news content, while others are unlikely to go directly to publishers’ websites. The status quo is that there is typically no payment between intermediaries and press publishers.

Intermediaries are substitutes to press publishers’ websites in terms of some content, and complements in terms of other content. For example, if a consumer is initially interested in the headlines (but not interested enough to go directly to a publisher), online intermediaries offer a way for publishers to share their content with them in a quick and accessible fashion. If a consumer did want to read a particular article or comment from a trusted source then they might visit a publisher’s website. In this case, the product offered by online intermediaries would be a complement to that offered by publishers.

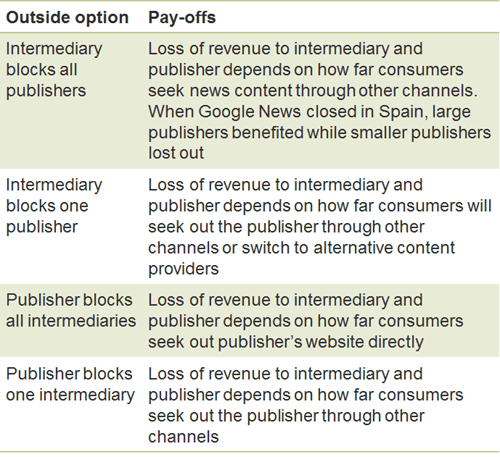

In a negotiation, the participants would have the following outside options.19

- An intermediary could choose not to show content from an individual publisher, or turn a service off, in a particular country. Consumers might or might not then access that content, depending on whether they are willing to switch to another intermediary or go directly to the publisher.

- A press publisher could refuse to make its content available to an intermediary or all intermediaries. Under the current regime, it is not clear whether a publisher would be able to do this—which is what the Commission’s proposals aim to address.

The participants would need to evaluate their outside option to calculate at what point an arrangement between the parties becomes unacceptable (i.e. at what point the participant is better off with the outside option). For both parties to benefit from an agreement between publishers and intermediaries, the value created by the agreement needs to be shared between them. If one side does not receive enough of the value, it will choose the outside option. Therefore, how the value is shared depends on these outside options.

Table 1 describes the nature of the outside options. Note that not all intermediaries would be affected in the same way—as they may have different pay-offs from outside options depending on the habits and preferences of their consumers. This caveat also applies to publishers.

Table 1 Outside options

There are three broad categories of possible outcome.

- No payment (status quo). Neither side has an incentive to deviate from the equilibrium, as the outside options have worse pay-offs than the status quo.

- Intermediaries pay publishers. Here the publishers have an incentive to use their outside options and deviate from the equilibrium. Therefore the intermediaries would end up paying the publishers.

- Publishers pay intermediaries. Here the intermediaries have an incentive to use their outside options and deviate from the equilibrium. Thus the publishers would end up paying the intermediaries.

An additional consideration for intermediaries is that payment by publishers might not constitute a good outcome—the promotion of articles through payment could undermine consumer trust in the intermediary, and therefore long-term revenues. One example of where an intermediary attempted to increase consumer trust was when Facebook replaced its ‘Trending Topics’ curators with an algorithm in order to tackle perceived bias in the choice of news stories that were highlighted to users.20

Policy and regulatory implications

The Commission’s proposals are aimed at increasing the bargaining power of news publishers, and therefore moving the bargaining outcome in their favour. The proposals remove the uncertainty about the ability of publishers to follow through on an outside option—i.e. publishers would now be able to refuse to license their rights to a platform. However, they would not change the pay-offs to intermediaries or publishers under the outside options. The proposals’ impact will therefore depend on the extent to which the legal uncertainty over the publishers’ outside options was influencing decision-making.

One development that could have a significant impact on market outcomes is the collective selling of rights by press publishers. This could mirror discussions that press publishers in the UK have reportedly begun on the creation of a single advertising sales operation to halt the decline of print advertising revenues.21 Such a move would make it more difficult for online intermediaries to block individual publishers, thereby strengthening the position of the publishers in any negotiation.

While collective selling might appeal to publishers, it raises important challenges in relation to competition law, which is designed to protect consumers from anticompetitive practices. There are prominent examples of lawful collective selling practices, such as the sale of rights to live televised matches undertaken by the Premier League on behalf of all English football clubs, and the use of collecting societies that charge copyright fees on behalf of authors and musicians.

In order to be considered compatible with competition law, collective bargaining would need to be set up in such a way that the benefits to consumers of selling on a collective basis outweigh any loss of competition benefits or consumer benefits from access to online intermediaries. In the case of the Premier League, the Commission accepted legally binding commitments that resulted in more rights being made available, as well as partitioning the rights into packages, which allowed the distribution of rights between two or more broadcasters.22

Concluding thoughts

The Commission has proposed new legislation that attempts to alter the bargaining dynamics between online publishers and intermediaries, but it is not clear that these rules will necessarily change market outcomes.

Policymakers will need to proceed with caution, to reduce the risk of unintended consequences in a market where dynamics are continuously changing. Google News’s exit from the Spanish market after it was legally obliged to pay publishers for content serves as a cautionary tale. Understanding the bargaining dynamics and the relative strengths of each party in the negotiation will be critical in the design of effective policies.

1 For example, see Axel Springer (2016), ‘An open letter to Eric Schmidt from Mathias Döpfner’, May. Mathias Döpfner is the CEO of Axel Springer, a major European publisher, and President of the Federation of German Newspaper Publishers. Eric Schmidt is the Executive Chairman of Alphabet Inc, of which Google is a subsidiary.

2 For example, see the Initiative Against An Ancillary Copyright for Press Publishers (IGEL), which lists some publishers as supporters.

3 For example, Computer & Communications Industry Association (CCIA), whose members include Facebook, Google, Microsoft and Yahoo. Computer & Communications Industry Association (2016), ‘The ancillary copyright for news publishers: why it’s unjustified and harmful’, May.

4 European Commission (2016), ‘Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions: Promoting a fair, efficient and competitive European copyright-based economy in the Digital Single Market’, COM(2016) 592 final, 14 September.

5 See Athey, S., Mobius, M. and Pal, J. (2014), ‘The Impact of News Aggregators on Internet News Consumption’, in Athey, S. (2014), ‘The Internet and the News Media’, presentation given at the 2014 Lear Conference, Rome.

6 Oliver & Ohlbaum and Oxera (2016), ‘BBC television, radio and online services: An assessment of market impact and distinctiveness’, prepared for The Department for Culture, Media and Sport, February. The study also reported that, on average, search-mediated visits to the BBC news website consisted of 3.6 page views. However, a large component of search referrals is likely to reflect users entering simply ‘BBC’ or ‘BBC news’ into search engines, which is effectively equivalent to unmediated consumption.

7 European Commission (2000), ‘Directive 2000/31/EC of the European Parliament and of the Council of 8 June 2000 on certain legal aspects of information society services, in particular electronic commerce, in the Internal Market (Directive on electronic commerce)’, Official Journal, L 178, 17 July.

8 Oxera (2015), ‘The economic impact of safe harbours on Internet intermediary start-ups’, prepared for Google, February.

9 Bundesministerium der Justiz und für Verbraucherschutz, ‘Copyright Act of 9 September 1965 (Federal Law Gazette Part I, p. 1273), as last amended by Article 8 of the Act of 1 October 2013 (Federal Law Gazette Part I, p. 3714)’, Articles 87f–87h, available in English here. There was some uncertainty over the extent to which the law covered snippets, as it excluded ‘smallest text snippets’, a term that was not defined.

10 Axel Springer (2014), ‘Axel Springer concludes its data documentation: Major losses resulting from downgraded search notices on Google’, press release, 5 November.

11 Bundeskartellamt (2014), ‘Complaint by VG Media not sufficient to institute formal abuse of dominance proceedings against Google’, 22 August.

12 Spanish government, ‘Ley 21/2014, de 4 de noviembre, por la que se modifica el texto refundido de la Ley de Propiedad Intelectual, aprobado por Real Decreto Legislativo 1/1996, de 12 de abril, y la Ley 1/2000, de 7 de enero, de Enjuiciamiento Civil’, Boletín Oficial del Estado, 268, 5 November.

13 Google (2014), ‘An update on Google News in Spain’, Google Europe Blog, 11 December.

14 European Commission (2016), ‘Commission Staff Working Document: Impact Assessment on the modernisation of EU copyright rules’, SWD(2016) 301 final, 14 September.

15 European Commission (2016), ‘Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions: Promoting a fair, efficient and competitive European copyright-based economy in the Digital Single Market’, COM(2016) 592 final, 14 September.

16 European Commission (2016), ‘Commission Staff Working Document: Impact Assessment on the modernisation of EU copyright rules’, SWD(2016) 301 final, 14 September.

17 European Commission (2016), ‘Commission Staff Working Document: Executive Summary of the Impact Assessment on the modernisation of EU copyright rules’, SWD(2016) 302 final, 14 September.

18 For example, see European Publishers Council (2016), ‘Myths and Facts about today’s EU Copyright Proposal, 14 September; Financial Times (2016), ‘Brussels takes a backward step on digital copyright: New rules should strengthen the system rather then weaken it’, 19 September; and Google (2016), ‘European copyright: there’s a better way’, Google Europe Blog, 14 September.

19 An outside option is an alternative to finding a negotiated agreement—that is, a participant decides to follow an option outside of the negotiation.

20 Facebook (2016), ‘Search FYI: An Update to Trending’, 26 August.

21 Bond, D. (2016), ‘UK newspapers consider ad sales venture: Rivals working together to find ways of countering declining print revenues’, Financial Times, 19 June.

22 European Commission (2006), ‘Competition: Commission makes commitments from FA Premier League legally binding’, press release IP/06/356, 22 March.

Download

Related

Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by… Read More

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More