A fair share? The economics of the sharing economy

Although relatively new, the sharing economy is growing rapidly. There are many definitions of the sector, which make it hard to estimate its scale—in 2013 the value of the global consumer peer-to-peer rented goods market was estimated by Rachel Botsman, the author of a book on the sharing economy, at $26bn.1 Nesta, an innovation charity, has estimated that 25% of UK adults used Internet technologies to share assets and resources in 2013.2

Not surprisingly, there is significant interest in the sharing economy from governments, authorities and businesses. Ongoing debates range from how sharing platforms are affecting existing markets to issues such as quality standards and health and safety, and ultimately whether these platforms should be regulated.3 Advocates of the sharing economy have criticised the conflicting or piecemeal approaches that have been taken in Europe—for example, laws have been introduced in some cities to support specific platforms while elsewhere authorities have sought to ban them. Sharing platforms also feature prominently in the European Commission’s recently launched consultation on online platforms, which seeks views on their impact on consumers, businesses and the economy more widely.4

What is the sharing economy?

There is no consensus on the activities that can be undertaken on sharing platforms. Some consider the sharing economy to consist of a broad array of services. This article uses a narrower definition: sharing platforms are taken to be online platforms that co-ordinate a group of individuals (or ‘peers’) to enable the sharing of an asset or resource (including physical assets or skills). They are platforms on which peers are able to share, rent, swap or donate goods and services. Assets and services being shared might include transportation (e.g. on Uber), labour services (e.g. on TaskRabbit), accommodation (e.g. on Airbnb), or open data (e.g. on London DataStore). Innovations have also occurred in the financial sector with the growth of platforms for crowd-funding and peer-to-peer lending.

Today, the sharing economy is reported to include 17 companies with an annual turnover of more than $1bn, including Uber, Lyft, Airbnb, Freelancer and Funding Circle.5 London itself is reported to have an estimated 72 sharing economy start-ups, the largest number after San Francisco and New York.6

While the business model spans a number of sectors, sharing platforms have four main characteristics in common.

- A sharing platform facilitates an exchange. The platform enables matches between two fragmented sides of a market which might not otherwise have taken place or would have taken place via an intermediary at higher cost. For example, Airbnb allows transactions between individuals with spare rooms and others looking for a place to stay, which could not occur without the website unless the individuals already knew each other. These transactions can now be directly between consumers rather than between businesses and consumers.

- It has a many-to-many structure. A key feature of the platform is that the likelihood of a match increases as the number of peers increases, and hence both sides benefit from the transaction. For example, individuals are more likely to find a parking spot on JustPark if many people in the same area rent out their driveways.

- The matches are generally instantaneous. While not all the transactions can be called ‘spot’ transactions, many of the platforms seek to supply services ‘on demand’. For example, TaskRabbit allows individuals looking for cleaning services to locate others who are supplying these services in an instant, without the need for a long-term contract.

- Transactions require trust between peers, primarily because of the fragmented nature of the two sides but also because of the personal nature of many of the transactions. Sharing platforms have found innovative mechanisms, such as review and reputation systems, to encourage peers to share or rent goods and services. For example, in order for peer-to-peer transactions to occur in the financial sector, lenders need to trust that their investments are protected from fraud.

What are the benefits of the sharing economy?

The scale of use of these sharing platforms demonstrates that users perceive there to be substantial benefits from participation.

At a high level, sharing platforms can allow better resource allocation and utilisation, improving productivity and efficiency in the economy. Specifically, they can deliver benefits to both the buyer and the seller of the asset/service in question, as well as the broader market.

- At an individual level, the new technology reduces consumers’ economic costs of finding assets or services. There are lower effort costs to finding a ride home if it is possible to do so in a few clicks on the Uber app.

- The sharing economy can also lower barriers to entry for sellers who can maximise utilisation of their existing assets and earn additional income. For example, anyone with spare time is now able to go online and offer this to others on the Echo website.

- Market mechanisms encourage supply to be more elastic through price mechanisms, leading to higher levels of (and more accurate) matching. Consumers can benefit from this increased competition between suppliers in the form of lower prices, better quality and/or more choice, particularly if existing firms improve their offerings in order to compete. For example, where holiday accommodation options in a particular area may have previously been limited to a small number of hotels or bed and breakfast rooms, tourists can now choose to stay at a plethora of locations.

There are also potential social gains from peers’ participation in the sharing economy. For example, there may be greater sustainability of resources as a result of more efficient allocation and lower environmental damage from reduced production. Ride-sharing, for example, may lead to fewer vehicles on the road, and therefore fewer emissions. There might also be sector-specific benefits. For example, sharing platforms in the financial sector provide sources of business revenue that might otherwise not be available. The box below describes some quantifications of these benefits.

What does the empirical analysis show?

Some studies have estimated the effects of sharing platforms in specific sectors as follows.

- Ride-sharing: an assessment of the impacts of Uber in Stockholm concluded that consumers benefit from lower fares, less traffic and less congestion.1

- Holiday accommodation: over one year in Paris (June 2012–June 2013), Airbnb estimated that 10,000 hosts welcomed over 223,000 guests, generating €185m of economic activity and supporting 1,100 jobs.2

- Financial services: a report on Funding Circle in the UK found that lenders tend to build portfolios of companies by lending to at least 100 companies. For businesses borrowing money, 32% of respondents to a survey said that, without Funding Circle, it is likely or very likely that they would not have received external finance.3

Note: 1 Copenhagen Economics (2015), ‘Economic benefits of peer-to-peer transport services’, 25 August. 2 Airbnb, ‘The Economic Impacts of Home Sharing in cities around the world’. 3 Nesta (2013), ‘Banking on each other. Peer-to-peer lending to business: evidence from Funding Circle’, April.

However, governments, authorities and businesses have raised concerns about the impacts of some of these new business models.

So what’s the problem?

While the benefits of these new business models are widely recognised, they come with potential challenges. Concerns have been raised across many countries—in Europe and elsewhere—relating to compliance with quality standards, insurance obligations, licensing, taxation, employee protection, and health and safety legislation. For example, there have been complaints that regulations relating to fire safety and food hygiene are not being applied to accommodation rented through Airbnb,7 and that vehicle insurance obligations are being circumvented by taxis offered through Uber.8

A common question in these debates among governments and other authorities is whether these new business models should be regulated in some way, in order to ensure that the risks are minimised and they continue to deliver benefits to consumers and the economy. In particular, should they face the same entry and quality regulation that is faced by incumbent suppliers?

This discussion is no different from those surrounding the merits, or otherwise, of regulation in other contexts; regulatory intervention has to be justified on the basis that it addresses a market failure and leads to better outcomes than the market would provide on its own.

For example, if individuals do not know the quality of the assets or services they are exchanging in a transaction, uncertainty on both sides might lead to the transaction not occurring. Here, the market failure is an asymmetry of information between the buyer and the seller. Traditionally, regulations (such as health and safety legislation and minimum quality standards) have been put in place to address this information asymmetry. Specific examples include having mandatory fire doors in hotels, and taxi licences requiring drivers to know how to navigate from one place to another.

The temptation is to apply the same regulation that applies to incumbent suppliers to the sharing economy in order to ensure a ‘level playing field’. However, this assumes that the market failure still exists.

In many of the industries where sharing-based business models have flourished, it is possible that the new technology itself is providing a better market-led solution to the original market failure than regulation can. Feedback and review mechanisms act as an indicator of the quality of a service, and incentivise good behaviour by the purchaser and the supplier. While such mechanisms can and do operate outside the sharing economy (e.g. on TripAdvisor), the smartphone apps and online platforms that sharing economy businesses use make giving feedback easier than in some traditional industries.

Equally, in some cases regulation that is present for historical reasons may no longer be necessary, even for existing firms, if the market failure no longer exists.

Should sharing economy platforms be regulated?

There are two common arguments in the public debate for why parts of the sharing economy should be regulated.

The level playing field argument

The first is that sharing economy firms do not compete with existing firms on a level playing field. Many of these platforms use sophisticated search algorithms to facilitate the matching of demand with supply of existing assets and labour much more efficiently than going via a traditional intermediary. Lower overheads and costs reduce entry barriers for suppliers, which leads to more competitive and responsive markets. This increased competition may have a negative impact on existing firms, which may even be competed out of the market altogether.

Incumbent firms argue that differences in regulation and legal obligations give sharing platforms an unfair competitive advantage. Proponents of the sharing economy argue that imposing regulations on these new business models would reduce consumer benefits. They argue that preserving barriers to entry shields existing firms from healthy competition and innovation.

New sharing platforms do not necessarily displace existing firms. Shared products or services may not be directly substitutable with existing products and services, or the supply of sharing goods and services may not be large enough to fulfil all demand. In the financial sector, for example, peer-to-peer lenders have lent over £1.7bn to small and medium-sized businesses in the UK, but this makes up only 2.4% of all bank lending.9 To some extent, economic activity generated on sharing platforms is supplementary to existing economic activity.

The quality argument

The second argument is that, without regulation, lower-quality transactions are likely to occur. Asymmetric information means that peers cannot perfectly observe or assess how other users are likely to behave, or the quality of the transaction being undertaken or the asset/service being shared. It can be especially costly or difficult to acquire information about quality or potential risks in the sharing economy where peers are unknown to each other and the service is a personal one.

Sharing platforms use features such as review and reputation systems to reduce this asymmetric information. The low-cost nature of these online mechanisms enables a large-scale word-of-mouth network among individuals who do not know each other. These feedback systems allow peers to enter into transactions that might otherwise not happen. The economic mechanism is twofold:

- they provide information to facilitate better matching between sharers, particularly where there are different preferences or characteristics of assets or services. Review systems also generally bundle prices and information on the quality or characteristics of the product or service so that consumers can make well-informed decisions;

- they reduce information asymmetry that arises where peers on the two sides of the transaction are anonymous or their ‘type’ is unknown. As a result:

- buyers and sellers can accurately distinguish between ‘good’ and ‘bad’ transaction partners;

- buyers and sellers are incentivised to be ‘good’;10

- ‘bad’ sellers and buyers are deterred from participating in the market.

Accurate user reviews are important for these mechanisms to work. Inaccurate reviews reduce market efficiency if they cause buyers to undertake transactions that are sub-optimal. There is evidence that reviews are generally positively biased.11 There are several possible reasons for this. For example:

- there may be selection bias: those who have better experiences leave reviews, whereas those who have worse experiences do not;

- buyers and sellers may form social relationships with one another, which leads them to submit positive reviews;

- reciprocal behaviour may bias results if someone leaves a good review because the other user in the transaction has already left one.

Another reason for inaccurate reviews could be that users may not know, or have the opportunity to gain information about, certain characteristics of the transaction, product or service. As such, the reviews do not present the right information on quality. There might also be sector-specific quality issues, as discussed in the box below.

Risks in the financial sector

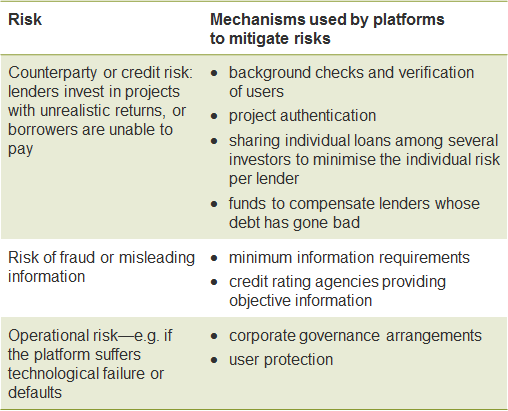

In the financial sector, quality depends on the risks involved in transactions. Traditionally, intermediaries such as banks and insurance agents have facilitated these transactions; however, in the sharing economy, intermediaries have been replaced by platforms that use technology to make information available to all, which was previously available only to banks. Although verification is undertaken by the platform to check participants’ creditworthiness, decisions are ultimately made by the peers themselves. Platforms have introduced a number of mechanisms to mitigate these risks.

Risks in the financial sector, and mechanisms used by peer-to-peer platforms to mitigate them

Source: European Commission Business Innovation Observatory (2013), ‘The Sharing Economy: Accessibility Based Business Models for Peer-to-Peer Markets’, case study 12, September; Oxera analysis of platform design.

If feedback mechanisms work well and consumers are well informed then regulation may not always be required. This is because:

- market-based solutions can potentially solve the asymmetric information problem;

- profit-seeking behaviour can result in outcomes that are beneficial to consumers because it is within platforms’ own long-term interests to sustain high-quality transactions;

- in markets that feature repeat transactions, platforms are incentivised to ensure that quality is upheld.

If feedback mechanisms are not effective, or sharing platforms create new risks in certain markets, there might be a need for quality regulation or for self-regulation via the platform itself.

Conclusion

Technological advances mean that online platforms can compete in markets that traditionally required intermediaries in order to allow better and more efficient matching. This can lead to better utilisation of society’s resources and an increase in the flexibility of markets to meet consumer demand.

Whether these firms should be regulated in the same way as traditional firms depends on the degree to which the new technology solves existing market failures, and whether the market failure that led to regulation of traditional firms also affects the new entrants. If technology can prove that it has solved the market failure then we can all enjoy the benefit of more personal, cheaper and flexible services.

The Oxera Economics Council is a group of prominent European thinkers and academics, specialising in microeconomics and industrial organisation, that meets with Oxera twice a year to discuss pressing economic issues facing policymakers. This article does not necessarily reflect the views of the Oxera Economics Council or its members.

1 See The Economist (2013), ‘The Rise of the Sharing Economy’, 9 March. See also Twitter conversation, 4 September 2013.

2 Nesta (2014), ‘Making Sense of the UK Collaborative Economy’, September.

3 For example, see Cannon, S. and Summers, L.H. (2014), ‘How Uber and the Sharing Economy Can Win Over Regulators’, Harvard Business Review, 13 October.

4 European Commission (2015), ‘Regulatory environment for platforms, online intermediaries, data and cloud computing and the collaborative economy’.

5 See Owyang, J. (2015), ‘The Collaborative Sharing Economy has created 17 Billion-Dollar Companies (and 10 unicorns)’, blog post, 4 June.

6 See Davidson, L. (2015), ‘Mapped: how the sharing economy is sweeping the world’, The Telegraph, 23 September.

7 Bed & Breakfast Association (2014), ‘Spare room “sharing” websites: a ticking time bomb?’, blog post, 30 January.

8 Booth, R. (2015), ‘Uber whistleblower exposes breach in driver-approval process’, The Guardian, 12 June.

9 KPMG (2015), ‘The changing world of money’.

10 ‘Good’ seller behaviour is incentivised by the perception that the review system functions well. If sellers expect to be given a bad rating if their offering is of a low quality, this will encourage them either to ensure that their offering is ‘good’, or not participate if they know that the offering is not good.

11 Nosko, C. and Tadelis, S. (2015), ‘The Limits of Reputation in Platform Markets: An Empirical Analysis and Field Experiment’, NBER Working Paper No. 20830. Resnick, P. and Zeckhauser, R. (2001), ‘Trust among strangers in Internet transactions: empirical analysis of eBay’s reputation system’, Advances in Applied Microeconomics, 11, pp. 127–57. Fradkin, A., Grewal, E., Holtz, D. and Pearson, M. (2015), ‘Bias and reciprocity in online reviews: evidence from field experiments on Airbnb’, The Sixteenth ACM Conference on Economics and Computation.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More