Shrinkflation! A bite missing?

‘Shrinkflation’ is the media’s buzzword for what happens when a firm makes its product smaller as an alternative to increasing its price. Not only has Toblerone shrunk, but Mars bars have recently reduced from 62.5g to 51g,1 and even Carlsberg beer bottles in Russia have got smaller.2

Shrinkflation is a way for firms to pass on cost increases in a way that is less visible or more acceptable to consumers than a price rise. Indeed, some consumer protection agencies are paying close attention to shrinkflation, such as the Israel Consumer Protection and Fair Trade Authority, which mandates that shrinkflation is clearly signposted.3 Shrinkflation has also led to class action lawsuits in the USA.

In 2015 a class action was brought against food manufacturer, McCormick, over the changing size of black pepper products. The amount of pepper fell by 25% while the container stayed the same size. While the new weight was written on the container, the class action claimed that the same containers had been used for decades and that consumers had come to expect a certain amount of pepper in each one.4

This article investigates why shrinkflation can be effective for firms and when it might backfire. It also examines the implications for official statistics and damages cases.

When do firms pass on input cost changes?

The extent to which a change in the cost of an input will affect consumer prices depends on several factors.5 Economics can provide useful insights into how much of a cost shock will be passed on. Typically, a greater proportion of an input cost change will be passed on if:

- the cost change affects the marginal cost of producing the output;

- the cost change is experienced by the whole market (rather than by some firms only);

- the market is competitive.6

The pass-on of higher input costs to consumers is often understood and measured in terms of end-user prices. However, higher input costs can also be passed on to consumers through a reduction in the size of the products (while keeping the same headline price).

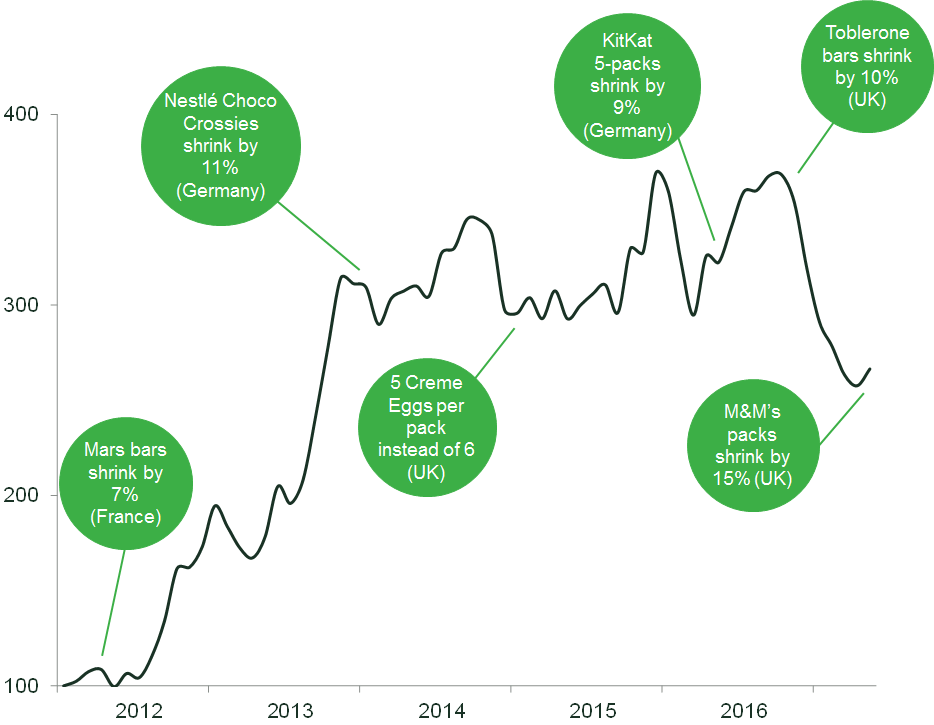

Shrinking product size could be a more effective way of passing on costs than raising the price, as discussed below. Indeed, in recent years, chocolate manufacturers in Europe have faced higher prices for cocoa butter, and this has been associated with incidences of shrinkflation, as shown in Figure 1.7

Figure 1 Evolution of the price of cocoa butter since 2011

Source: Oxera calculations, based on Thompson Reuters Datastream. See also Wood, Z. (2017), ‘Austerity bites? Less chocolate for your money as packets shrink’, The Guardian, 26 March. Crone, J. (2015), ‘Shell-shocked chocolate lovers launch protest campaign after Cadbury downsize on Creme Eggs box but keep price the same’, Daily Mail, 11 January. Lentschner, K. (2012), ‘Le marché français des barres chocolatées en pleine forme’, Le Figaro, 20 April. Verbraucherzentrale Hamburg (2017), ‘Anbieter sparen – Verbraucher zahlen: Kleinere Menge zum gleichen Preis oder andere versteckte Preiserhöhungen bei Produkten mit zum Teil veränderter Rezeptur!’, April. Verbraucherzentrale Hamburg (2014), ‘Anbieter sparen – Verbraucher zahlen: Kleinere Menge zum gleichen Preis!’, 4 July.

Why did firms choose to reduce pack sizes in response to the change in the price of cocoa butter, rather than increase prices? The key is in how consumers perceive information, make decisions, and ultimately behave.

Why is reducing size more attractive to sellers than raising price?

Economists tend to start from the assumption that if consumers are fully rational and pay careful attention to product size, shrinkflation is equivalent to raising prices. Thus the shrinking product size and changing unit price (e.g. price per gram) will be observed, and this will be taken into account in consumers’ purchasing decisions.

However, even a fully rational consumer may be less sensitive to product size than the model assumes (if their utility from consuming the product is fixed, regardless of size). For example, if the first couple of bites of a chocolate bar are the most satisfying, the next few are moderately satisfying, and the last ones are just about OK, the consumer might prefer a smaller bar to an increase in price.

In the real world consumers pay less attention to reductions in quantity than economists often assume. Numerous studies have found that consumers are far less sensitive to quantity reductions than they are to price increases.8 That is, they have a lower size elasticity of demand than price elasticity of demand. For example, US consumers were found to be four times more sensitive to the price of ice cream than the size of the container it came in.9

In practice, many people do not consider unit prices at all,10 especially if they have limited time.11 Behavioural economics sheds light on why this might be the case:

- people have limited cognitive power and may use it only where necessary; instead, they tend to adopt simple rules of thumb.12 This can lead to them focusing on the headline rather than the unit price;

- people often display representativeness bias, whereby they focus on one salient dimension (e.g. price) that they consider to be representative of the whole product, and ignore others (e.g. size and quality), and therefore might pay little attention to these other aspects.13

Sensitivity to headline prices but not unit prices is analogous to the well-observed case of sticky nominal wages, where workers are found to be much more sensitive to reductions in nominal wages than they are to reductions in real wages.14 Similarly, a rise in the headline price is more likely to be salient in a low-inflation environment. If price increases are conspicuous then firms are more likely to adopt the shrinkflation strategy. Thus, a low-inflation environment in retail markets can be reinforcing.

The box below gives an example of how a profit-maximising firm might decide whether to raise prices or ‘shrinkflate’, given that consumers are (for the reasons described above) more sensitive to price increases than to reductions in product size. However, as discussed below, a strategy of shrinkflation is not without risks for the firm.

A worked example

Consider a firm that sells 100 chocolate bars weighing 50g for €1 each. The firm has a constant marginal cost of €0.90 per bar, leading to a marginal profit of €0.10 per bar. The firm faces a price elasticity demand of -1 and a size elasticity of demand of -0.5.

The firm now faces a €0.10 increase in marginal costs due to rising cocoa butter prices (leading to a marginal cost of €1 per bar). The firm wishes to pass on the cost rise in full, and has two options:

- to increase the price by 10% (€0.10). The marginal profit of each bar is €0.10, but the firm would then sell only 90 bars (10% x -1 = -10%), making a total profit of €9;

- to reduce the size of each bar by 10% (5g). The marginal cost is €0.90 per bar and the marginal profit is €0.10 per bar. The firm would then sell 95 bars (10% x -0.5 = -5%), making a total profit of €9.50.

Therefore, this firm would find it optimal to shrinkflate rather than to raise prices.

Note: Price elasticity of demand is the responsiveness of demand to changes in product price. Formally, it is the percentage change in quantity of the product sold divided by the percentage change in price. A size elasticity of demand is the responsiveness of demand to changes in product size. It is the percentage change in quantity of the product sold divided by the percentage change in product size.

Source: Oxera.

When might shrinkflation backfire?

Shrinkflation may not always be effective, and may even be counterproductive in some cases. Economic research in this area has shown that:

- fairness is important to consumers and they could react strongly to a perceived ‘unfair’ pricing strategy;15

- if consumers notice a smaller product only after they have bought it, they are more likely to switch away from that product in future because they feel deceived.[16] This is illustrated by the McCormick black pepper lawsuits, described above.

Firms therefore need to be careful when shrinkflating, although they might be able to avoid these pitfalls by ensuring that the product size does not shrink by too much, too frequently, or in a way that appears to be too ‘unfair’. The public outcry at the ‘shrinkflated’ Toblerone bar might have been avoided if the weight had been reduced by less or if the perceived size of the packaging had also changed.

Survey data also shows that people do care about shrinkflation and unit prices.17 However, while they may respond in a survey that they care about shrinkflation, the real-world evidence (cited above) suggests that they have less sensitivity to package size than to price when they are actually deciding what to buy when shopping.

Shrinkflation in the courtroom

Estimating pass-on to consumers is important for quantifying damages lawsuits. Pass-on through the value chain to consumers is often done through measuring price changes, but the examples above suggest that other mechanisms exist.

To continue the chocolate example, the Canadian Competition Bureau investigated price-fixing in the retail chocolate market in 2007. This assessment required the amount of harm to be established.18

If the cost of chocolate were artificially raised by such price-fixing, economists would estimate the extent to which consumers suffered higher prices. The typical analysis would compare the price of chocolate during an infringement with the prices before and after that infringement. However, size effects should also be considered, as the amount of chocolate purchased might also have decreased.

In a shrinkflation scenario, consumers may have spent the same amount on chocolate and bought the same number of chocolate bars during the cartel period, but the size of the chocolate bars would have been less. In this case, the damage to consumers would need to take account of the fact that they obtained less chocolate for the same money.

However, incorporating analysis of size effects into damages estimates may require additional evidence to prove causation between the illegal act and the size change.

Shrinkflation and inflation statistics

Shrinkflation may not be noticeable to all consumers, but it should be captured in official statistics. Inflation statistics are designed to measure how the price of a representative basket of goods changes over time.1

What happens if the basket is shrinking? Such analysis should take shrinkflation into account, but it is not obvious that it always does. In the short term, the reducing size of the goods may not be picked up in the measurement of inflation if the weight of the basket is not adjusted to account for the changing product sizes.

However, in Germany, for example, the Statistisches Bundesamt makes periodic adjustments to the weighting of goods in the basket.2 Indeed, it states that it takes into account adjustments to the size of packages so that ‘hidden price increases are captured’.3

Taking account of shrinkflation in the inflation statistics requires the weighting of the shrinkflated goods to be increased (as consumers buy more of the product to obtain the same quantity).

Note: 1 For example, see Office for National Statistics (2017), ‘Quality and Methodology Information (QMI): Consumer Price Inflation (includes all 3 indices – CPIH, CPI and RPI)’, 21 March. 2 DESTATIS (2017), ‘Verbraucherpreisindex (VPI)’. 3 DESTATIS (2017), ‘Qualitätsbereinigung in der amtlichen Preisstatistik’; Oxera translation.

Source: Oxera.

Concluding thoughts

The world has woken up to shrinkflation. Chocolate bars are getting smaller.

Behavioural economics shines a light on why shrinkflation is effective. Importantly, it also shows how shrinkflation might backfire.

Legal cases that consider the pass-on of input costs to end-consumers will need to consider not only how cost shocks are passed on to prices, but also how they manifest themselves in reduced consumption through shrinkflation.

1 SpringTide (2014), ‘The real reason your chocolate bar is shrinking’, blog post, 21 May.

2 The Moscow Times (2014), ‘Carlsberg Makes Bottles Smaller to Avoid Hiking Prices’, 22 August.

3 See OECD (2017), ‘Behavioural Insights and Public Policy: Lessons from Around the World’, OECD Publishing, Paris.

4 Class Actions Reporter (2016), ‘McCormick Black Pepper Class Action Lawsuit’.

5 See Oxera and a multi-jurisdictional team of lawyers led by Dr Assimakis Komninos (2009), ‘Quantifying antitrust damages Towards non-binding guidance for courts’, study prepared for the European Commission, December.

6 Oxera (2014), ‘Passing game: the ongoing debate about pass on in damages actions’, Agenda, January.

7 The rising cost of cocoa butter has been amplified by changes in exchange rates.

8 See Gourville, J.T. and Koehler, J.J. (2004), ‘Downsizing Price Increases: A Greater Sensitivity to Price than Quantity in Consumer Markets’, HBS Marketing Research Paper No. 04-01, January; and Levy, D. and Snir, A. (2013), ‘Shrinking Goods’, Emory Law and Economics Research Paper, 22 January.

9 Çakir, M. and Balagtas, J.V. (2013), ‘Estimating Consumer Response to Package Downsizing: an Application to Chicago Ice Cream Market’, Journal of Retailing, 90:1, January.

10 Mitchell, V.-W., Lennard, D. and McGoldrick, P. (2003), ‘Consumer Awareness, Understanding and Usage of Unit Pricing’, British Journal of Management, 14:2, 11 June.

11 Binkley, J.K. and Bejnarowicz, J. (2003), ‘Consumer price awareness in food shopping: the case of quantity surcharges’, Journal of Retailing, 79:1.

12 Kahneman, D. (2003), ‘Maps of Bounded Rationality: Psychology for Behavioral Economics’, The American Economic Review, 93:5, December.

13 Tversky, A. and Kahneman, D. (1974), ‘Judgement under Uncertainty: Heuristics and Biases’, Science, New Series, 185:4187, September.

14 For example, see Kahn, S. (1997), ‘Evidence of Nominal Wage Stickiness from Microdata’, The American Economics Review, 87:5, December.

15 Kahneman, D., Knetsch, J.L. and Thaler, R.H. (1986), ‘Fairness as a Constraint on Profit Seeking: Entitlements in the Market’, The American Economic Review, 76:4, September.

16 Wilkins, S., Beckenuyte, C. and Butt, M.M. (2016), ‘Consumers’ behavioural intentions after experiencing deception or cognitive dissonance caused by deceptive packaging, package downsizing or slack filling’, European Journal of Marketing, 50:1/2, pp. 213–35.

17 Flood, R. (2017), ‘Cutting chocolate bar sizes will lose companies money, YouGov study finds’, Independent, 11 March.

18 For example, Competition Bureau (2015), ‘Final price-fixing charges stayed in chocolate case’, press release, 18 November.

Download

Related

Economics of the Data Act: part 1

As electronic sensors, processing power and storage have become cheaper, a growing number of connected IoT (internet of things) devices are collecting and processing data in our homes and businesses. The purpose of the EU’s Data Act is to define the rights to access and use data generated by… Read More

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More