Four-ever? Competition remedies in the audit market

This article was nominated for the 2019 Antitrust Writing Awards.

In light of recent accounting scandals, there are widespread calls for the UK competition authority to re-examine the audit market. Yet spending a substantial amount of resources on a market investigation, and concluding once again that there is a competition problem, is of little value if a suitable remedy cannot be found. A break-up of the Big Four is perceived by many as a necessary and long-awaited intervention, but is it the right solution? And if not, what would be an alternative remedy?

The UK audit market has gone through some turmoil recently.1 This month the Financial Reporting Council (FRC), which regulates UK audit, announced a deterioration in audit quality across the ‘Big Four’ firms (KPMG, PwC, Deloitte and EY) compared with the previous year. Most notably, the FRC noted that 50% of KPMG’s FTSE 350 audits failed to reach the FRC’s standard for audit quality.2 At a global level, the International Forum of Independent Audit Regulators found significant problems in 40% of the 918 audits of listed public interest entities that it inspected last year.3

The recent audit failures uncovered by regulators are hardly trivial. In Miller Energy the US Securities and Exchange Commission found that KPMG had overvalued certain assets by more than 100 times.4 In BHS the FRC noted that PwC had signed off the accounts just days before the company was sold for £1.5 In the more recent case of Carillion, equity analysts appeared unaware of the warning signs that might have been flagged by a good audit.6

These market outcomes in audit services are unsatisfactory from a policy perspective. The Big Four’s joint market share in FTSE 350 audit has been close to 100% for many years, and the Big Four likewise dominate the audit of large companies across the world. It is this high market concentration that is frequently blamed for the poor outcomes,7 and regulators and competition authorities across the world have raised concerns about concentration ever since the collapse of Arthur Andersen in 2002. This year, two UK Parliamentary Committees have called for a new competition investigation by the Competition and Markets Authority (CMA) that ‘should explicitly include consideration of both breaking up the Big Four into more audit firms, and detaching audit arms from those providing other professional services’.8 The Chief Executive Officer of the FRC and the CEO of PwC have both expressed support for the idea of having the CMA study the audit market afresh.9

Previous remedies in the audit market

The audit market is effectively dominated at the top end by the Big Four, and despite turmoil in financial markets the audit market structure has remained largely unchanged since 2002.10 Concerns emanating from the high concentration include a lack of choice, a lack of innovation, higher audit fees, conflicts of interest, a lack of independence that weakens auditor professional scepticism, a systemic risk if one Big Four firm should fail, and, above all, poor-quality audit reducing the credibility and reliability of audited financial statements for the world’s largest companies.11

The previous investigation by the UK Competition Commission (CC), predecessor to the CMA, put forward a package of seven remedies, the most significant of which was a requirement that FTSE 350 companies put their audit out to tender at least every ten years (‘mandatory tendering’). Shortly thereafter, the EU introduced rules that obliged listed companies to switch their auditor (‘mandatory rotation’) every 20 years.12 At the conclusion of the previous market investigation the CC expressed confidence in its package of remedies, noting that they should ‘increase choice’ and provide a ‘substantially improved environment for competition’.13 The CC’s remedies package did not include any structural remedies.

The CC and EU remedies have not solved the problem of attracting more competition from outside the Big Four.14 Indeed, the leading non-Big Four firms, Grant Thornton and BDO, between them have fewer FTSE 350 clients than before the regulatory interventions. In 2013, just before the new measures to boost competition were enacted, Grant Thornton had six FTSE 350 audit clients. In 2016, this number was unchanged. But in 2018 the firm said that it would exit the market for large audits.15 In 2013 BDO had eight FTSE 350 clients, falling to five in 2016.16 The previous rule changes are therefore widely perceived to have failed to remedy concerns over market concentration. The Big Four accountancy firms still audit 97% of FTSE 350 companies, a similar rate to that found by Oxera17 in its 2006 market study for the FRC.18

What could structural remedies achieve?

Vertical separation

There are different types of structural remedies. Vertical separation of the Big Four firms into audit and non-audit services would not increase the basic number of firms participating in the FTSE 350 audit market, but it would increase the effective choice for many companies that have non-audit relationships with Big Four audit firms. These relationships can preclude, whether legally or in terms of company perception,19 considering all four current audit firms as viable substitute auditors.20

Vertical separation would also be oriented towards audit quality, removing the conflicts of interest that can arise when the auditor also supplies valuable non-audit services. Yet the idea was not popular among investors at the time of the previous competition investigation. In 2012, an Oxera investor survey report found that ‘almost all investors surveyed do not want to see structural separation of the Big Four firms into audit and non-audit activities.’21

Horizontal separation

Horizontal separation of the Big Four firms would immediately improve choice in the sense of seeing more than four firms in the market, and also choice in terms of seeing several non-conflicted audit firms in every audit tender. Such a separation would therefore also, in general terms, improve competition. It could also serve audit quality by reducing the number of instances where a company involved in a complex transaction cannot realistically find an adviser that is not subject to some conflict of interest.

In the case of Carillion, PwC acted as the company’s pensions consultant (2002–17), then switched to advising the pension scheme trustees on Carillion’s restructuring proposals (from July 2017), and was finally appointed by the government to help manage the defunct Carillion after its collapse (from January 2018).22 It would appear that PwC was the only viable choice to advise on Carillion’s insolvency, because it was the only Big Four firm that did not have active contracts with Carillion at the time of Carillion’s demise.23 Expanding the market from a ‘Big Four’ to a ‘Large 6’ seems attractive in the face of such apparent conflicts, but realistically it would be a very difficult exercise if the aim is to create a ‘Large 6’ group of firms of similar size with similar international networks.

Would a break-up increase audit quality?

Audits are for the protection of investors against false accounting by a company’s management. The starting point is therefore that the true customer of audit, the investor, is not the procurer of audit services. This alone creates an environment in which market failures may be expected.

But why does audit quality fall short? Boeing and Airbus, Coca-Cola and Pepsi, and the Silicon Valley giants all operate in concentrated markets—but it seems highly unlikely that half of new aeroplanes, or soft drinks cans, possess substantial errors. Market concentration per se does not entail a poor-quality product: even a monopolist will have regard to product quality, knowing that if its product is faulty the financial consequences of fines and compensating consumers will typically be severe.

In equilibrium, a firm would only produce faulty items to the extent that it is rational to do so—i.e. if errors cannot be detected or if the financial consequences of errors are insubstantial. It seems to be widely accepted that audit quality is below the level demanded by investors, on whose behalf the audit is undertaken. The economics literature on audit has studied the link between greater market concentration and higher audit fees, but this does not help us very much in the present circumstances, where the primary concerns are not to do with high prices, or even exclusionary conduct, but with limited choice and sub-optimal quality. Where does the solution lie?

Penalties for poor-quality service

In public services markets (health, education) there is a high degree of regulatory supervision of quality—such as barring doctors who are found to be negligent, and awarding damages to patients harmed by negligence—even when the main providers are state-owned and have no incentive to chase profits at the expense of quality. In 2017, the UK National Health Service (NHS) estimated that the total liability for outstanding medical negligence cases could be as much as £56.1bn, and the £1.5bn annual NHS payout to settle claims is expected to double by 2023.24 In audit, the strength of regulatory supervision by the FRC is subject to an independent review following concerns that it lacks adequate powers to intervene in the market.25

However, the FRC has recently been levying higher fines for audit errors. It fined PwC £6.5m regarding failed UK retailer, BHS;26 £5.1m for its auditing of accountancy group, RSM Tenon (also, ironically, an auditor);27 and £5m in relation to the property company, Connaught.28 The other Big Four firms have also faced heavy fines, in both the UK and USA: £1.8m for EY’s auditing of Tech Data;29 £4.8m for KPMG’s work on Miller Energy;30 and £4m for Deloitte relating to the audit of Aero Inventory.31 The FRC is also fining audit partners whom it finds to be responsible for misconduct—for example, the lead partner for BHS has been fined £325k and banned from working as an auditor for 15 years.32 These FRC penalties are, however, minor relative to the £38m audit-related settlement reached by the UK’s largest pension scheme, USS, with PwC Brazil as part of a class action lawsuit against troubled oil giant, Petrobras.33 But note that the FRC has this month implemented an increase in fines to £10m or more for ‘seriously poor audit work by a Big 4 firm’, following an independent review in 2017 of FRC sanctions.34

Are audit fines providing optimal enforcement?

From an economics perspective, if the deterrence effect of penalties is sufficiently severe, firms that might otherwise chase market share by cutting prices and their costs for a given audit will be deterred from cutting quality. In other words, when deterrence is weak, there is an opportunity for rent-seeking by firms that cut quality on unobservable dimensions. Although it might be argued that the cost to an accountant’s reputation is great enough to give the right incentives, this point seems difficult to sustain in light of the continued flourishing of firms that have had quite major hits to their professional reputations.

How large would audit fines need to be in order to deter bad audit? This article cannot provide the answer, but it may be instructive to look at a comparison between audit fines and cartel fines (in the EU). The latter are set based on the European Commission’s criteria. As the Commission explains:35

The Commission’s policy with regards to competition law infringements is one of prevention […] [fines] are ultimately aimed at prevention, and must hence fulfil two objectives: to punish and to deter. Breaking the competition rules is profitable if it goes unpunished – that is why companies do it

European Commission cartel fines are set based on the gravity and the duration of a competition infringement, and are capped at a maximum of 10% of a company’s total turnover. The 10% turnover ceiling for fines is engaged only when a cartel fine based on the usual criteria would otherwise be set at more than 10% of turnover.

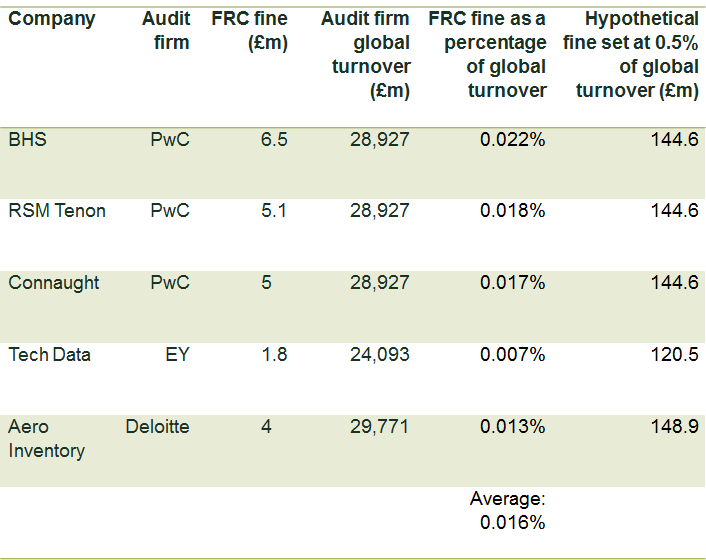

Cartel fines are large compared with audit fines, as Tables 1 and 2 illustrate. Looking at FRC audit fines in the cases mentioned above, the average fine is 0.016% of a Big Four firm’s annual global turnover, as shown in Table 1. The final column of Table 1 indicates that increasing this percentage to 0.5% would lead to fines of a much greater order of magnitude. This is purely illustrative; it is not a recommendation as to the optimal size of audit fines.

Table 1 Recent FRC audit fines as a percentage of an audit firm’s global turnover

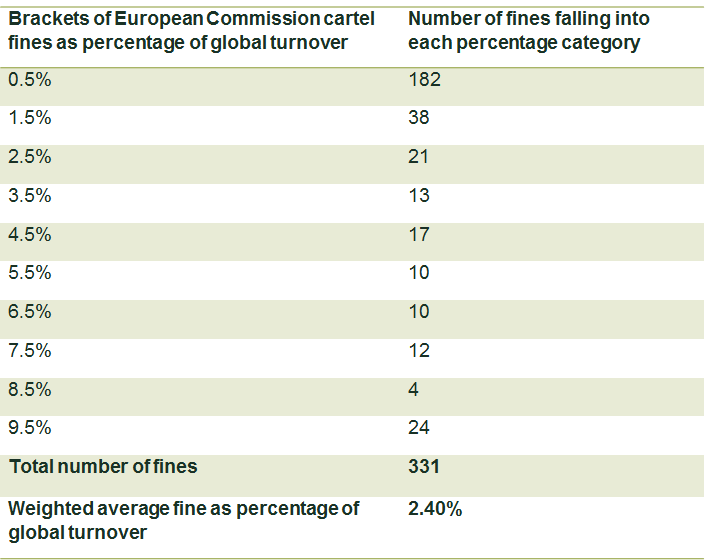

How do cartel fines compare? Weighted by the number of fines falling into each percentage bracket of turnover, the average European Commission cartel fine is 2.40% of turnover. This means that cartel fines expressed as a percentage of global turnover are about 150 times larger (2.40% divided by 0.016%) than FRC audit fines measured in the same way. Table 2 shows the calculation of the weighted average European Commission cartel fine.36

Table 2 European Commission weighted average cartel fines as a percentage of a company’s global turnover

Source: European Commission cartel statistics, last updated 21 March 2018.

It might be argued that increased deterrence for poor audit would come at the cost of competition, such as financial penalties leading to market exit and a ‘Big Three’, or hiking the barriers to entry for non-Big Four audit firms. Likewise, the Commission does not wish to fine a cartel with penalties that are so high that the consequence would be a reduction in the number of market competitors (or else the competition remedy would be self-defeating). Hence the scaling of cartel fines to turnover, and the ‘inability to pay’ test, whereby the Commission can reduce the scale of fines where it is shown that they pose a serious threat to the economic viability of the undertaking concerned. Scaling audit fines to audit firm turnover makes it unlikely that such penalties would deter entry or cause the market exit of one of the Big Four. The cartel fines policy therefore has useful principles, albeit it does not indicate the right order of magnitude for audit fines.

Fines set as a percentage of turnover would of course decline if measured against a smaller metric for revenue. As a hypothetical exercise, taking Big Four audit-only revenues as the denominator, the FRC fines mentioned previously would be on average 0.039% of the firms’ global audit-only revenues. In this scenario cartel fines at 2.40% of global turnover would be about 60 times greater than the FRC recent audit fines (2.40% divided by 0.039%), and a hypothetical fine of 0.5% of audit fines would amount to between £45m and £60m. The latter figures are much closer to the penalties proposed in last year’s independent review of FRC sanctions—i.e. ‘£10 million or more (before any discount)’. Note also that the independent review recommended that ‘the figure could be well above [£10m] if dishonesty or conscious wrongdoing were involved.’37

Evidence on the deterrence effect of cartel fines can be found in the economics literature. Professor Stephen Davies at the ESRC Centre for Competition Policy estimates that cartel deterrence is highly effective:38

On the most conservative of our estimates, more than half of all potential cartel harm never occurs, because it is deterred. This is very much a lower bound, and the proportion could be as high as 90%.

Similar research would be required to understand the effects of a different penalty regime for poor audit.

Break-up or shake-up?

There is little doubt that a new CMA investigation would consider a break-up remedy. However, no matter what the divestments and structural changes, the inherent tension within the industry’s ‘client pays’ business model is likely to remain—that is, an auditor’s basic conflict between serving the paying client and serving the greater good.

If it were to address that conflict, the CMA would need to look into penalties and deterrence, as well as studying the effects of a break-up remedy. It is not realistic to expect the CMA to be able to fix every major issue in the market by achieving the goal of reduced concentration in FTSE 350 audit.

The quality of audit might be improved with a more disaggregated market, but this link is not certain. Moreover, it is possible that greater deterrence for bad audit would lead to an organic change in market structure: the Big Four have expertise in advising clients as to when a substantial divestment or restructuring might increase shareholder value. It seems possible that, in a world of greater deterrence, the accounting firms might look inwards using this expertise and shake up the market structure themselves.

Possibly the Big Four firms are already thinking along these lines. According to a letter from the two MPs who led the parliamentary review on Carillion, voluntary break-up scenarios are now under active consideration:

Since our report was published, Bill Michael, Chairman KPMG UK, said his firm had been thinking about break-up scenarios ‘for some time’ as the current business model of the Big Four is ‘unsustainable’. Mr Michael is quoted as saying:

‘The profession, like it or not, is an oligopoly. You can’t be all things to all men and women forever. We have to reduce the level of conflicts and demonstrate why they are manageable and why the public and all stakeholders should trust us.’

Other Big four firms have reportedly begun making preparations for a break-up.39

Finally, the example of cartel fines shows that they are of a different scale to audit fines, raising the question as to whether fines should be reconsidered in the audit market. Penalties for anticompetitive conduct are used for prevention, not retribution. An audit firm with consistent high quality would have a minimal incidence of fines, which would place the high-quality firm at a competitive advantage to an audit firm with lower quality.40 If audit quality became high across the market, no firm would be faced with very substantial financial penalties, and investor perceptions as to the value of statutory audit might be restored. In summary: prevention is better than cure.

1 Oxera has been involved in several studies of audit markets:

In 2006 Oxera produced a report on competition and choice, commissioned by the UK Department for Trade and Industry and the Financial Reporting Council: Oxera (2006), ‘Competition and choice in the UK audit market’, report prepared for the DTI and the FRC, April.

In 2007 Oxera produced a report on ownership rules for audit firms and market concentration, commissioned by the European Commission: Oxera (2007), ‘Ownership rules of audit firms and their consequences for audit market concentration’, report prepared for DG Internal Market and Services, October.

In the 2011–13 UK Competition Commission market investigation Oxera worked for both BDO and Grant Thornton, but also made submissions to the Competition Commission on its own behalf. The Competition Commission’s final report was published in October 2013. See Competition Commission (2013), ‘Statutory audit services for large companies market investigation: a report on the provision of statutory audit services to large companies in the UK’, 15 October.

2 Financial Reporting Council (2018), ‘KPMG LLP, KPMG Audit plc, Audit Quality Inspection’, June, p. 4.

3 Marriage, M. (2018), ‘Accounting watchdogs find “serious problems” at 40% of audits’, Financial Times, 11 March.

4 Murphy, H. (2017), ‘KPMG slapped with $6.2m fine over oil company audit errors’, Financial Times, 15 August.

5 BBC (2018), ‘PwC partner banned over BHS audit’, 13 June.

6 Vincent, M. (2018), ‘Carillion’s sins of omission on pay and debt were a warning sign’, Financial Times, 16 January.

7 Marriage, M. (2018), ‘Probe urged into break-up of Big Four accountants’, Financial Times, 16 March.

8 House of Commons Business, Energy and Industrial Strategy and Work and Pensions Committees (2018), ‘Carillion’, 16 May, p. 6.

9 Pickard, J. (2018), ‘UK competition watchdog chair signals accountants probe’, Financial Times, 24 April. Ellis, K. (2018), ‘A Big Four upheaval could endanger audit quality’, Financial Times, 21 May.

10 For market shares between 2002 and 2006, see Oxera (2006), ‘Competition and choice in the UK audit market’, report prepared for the DTI and the FRC, April. For later market shares, see the Financial Director audit fees surveys—links are available for each year from 2009 to 2016 on the ICAEW website, last accessed 25 June 2018.

11 European Commission (2016), ‘Reform of the EU Statutory Audit Market – Frequently Asked Questions (updated version)’, Fact Sheet, 17 June.

12 European Commission (2014), ‘Regulation (EU) No 537/2014 on specific requirements regarding statutory audit of public-interest entities and repealing Commission Decision 2005/909/EC’, L 158/97, Official Journal of the European Union, 16 April, Article 17.

13 Competition Commission (2013), ‘Statutory audit services market investigation: Summary of provisional decision on remedies’, 22 July, p. 5, para. 13; and p. 6, para. 16.

14 Competition and Markets Authority (2014), ‘CMA finalises audit changes’, press release, 26 September. European Commission (undated), ‘Auditing of companies’ financial statements’.

15 Marriage, M. (2018), ‘Grant Thornton exits audit market for big UK companies’, Financial Times, 29 March.

16 Financial Director (2013), ‘Audit fees survey 2013’, p. 5. Financial Director (2016), ‘Audit fees survey 2016’, p. 1.

17 Oxera (2006), ‘Competition and choice in the UK audit market’, report prepared for the DTI and the FRC, April.

18 Ellis, K. (2018), ‘A Big Four upheaval could endanger audit quality’, Financial Times, 21 May.

19 For a discussion on concentration and the extent of choice, see Oxera (2006), ‘Competition and choice in the UK audit market’, report prepared for the DTI and the FRC, April, section 5.3, pp. 80–85.

20 Oxera (2012), ‘Investor views on market outcomes and potential remedies in the audit market’, report prepared for the Competition Commission on behalf of BDO and Grant Thornton, p. 10.

21 Oxera (2012), ‘Investor views on market outcomes and potential remedies in the audit market’, report prepared for the Competition Commission on behalf of BDO and Grant Thornton, p. ii.

22 Cole, M. (2018), ‘Carillion inquiry’, letter from the PwC General Counsel, Margaret Cole, to Rt Hon Frank Field MP and Rachel Reeves MP, 2 February. See also Field, F. and Reeves, R. (2018), ‘Carillion – conflicts of interest’, letter from the Chairs to Margaret Cole, General Counsel at PwC, 6 June.

23 Peter Kyle, Member of the Business, Energy and Industrial Strategy Committee, speaking at the pre-appointment hearing with the Government’s preferred candidate for Chair of the Competition and Markets Authority, HC 985, 24 April 2018. See Transcript of oral evidence, Question 34, p. 19.

24 Bowcott, O. (2017), ‘Cost of NHS negligence claims likely to double by 2023, says study’, The Guardian, 23 June.

25 Irvine, J. (2018), ‘Two leading FCAs join Kingman FRC review panel’, Economia, 18 May. Marriage, M. (2018), ‘UK accountancy watchdog’s competence faces government probe’, Financial Times, 21 March.

26 Marriage, M. and Samson, A. (2018), ‘PwC hit with record UK fine of £6.5m over BHS audit’, Financial Times, 13 June.

27 Murphy, H. (2017), ‘PwC fined £5m for “misconduct” in RSM Tenon audit’, Financial Times, 16 August.

28 Murray-Brown, J. (2017), ‘Watchdog slaps PwC with record fine for Connaught audit “misconduct”’, Financial Times, 11 May.

29 Rovnick, N. (2017), ‘UK regulator fines EY £1.8m for audit misconduct’, Financial Times, 16 October.

30 Murphy, H. (2017), ‘KPMG slapped with $6.2m fine over oil company audit errors’, Financial Times, 15 August.

31 Murray-Brown, J. (2016), ‘Deloitte hit with record £4m fine for audit of aerospace client’, Financial Times, 10 November.

32 Marriage, M. and Samson, A. (2018), ‘PwC hit with record UK fine of £6.5m over BHS audit’, Financial Times, 13 June.

33 Reeve, N. (2018), ‘USS settles lawsuit against Petrobras auditor for $50m’, IPE, 5 February.

34 Financial Reporting Council (2018), ‘FRC implements sanctions review recommendations’, 9 April.

35 European Commission (2011), ‘Fines for breaking EU Competition Law’, Fact sheet, November.

36 The European Commission statistics provide the percentages of fines imposed on undertakings per cartel infringement. Certain cases may comprise several infringements for which multiple counting of undertakings is considered.

37 Financial Reporting Council (2017), ‘Independent review of the Financial Reporting Council’s Enforcement Procedures Sanctions’, Review Panel Report, October, p. 34, para 5.31. A £10m fine would be 0.09% of audit revenues measured on the same basis.

38 Davies, S. (2017), ‘The deterrence value of competition policy can and should be measured’, posted on the Competition Policy Blog at the Centre for Competition Policy, University of East Anglia, 17 August.

39 Field, F. and Reeves, R. (2018), ‘The Big Four’, letter from the Chairs to Rt Hon. Andrew Tyrie, Chairman, CMA, 22 May.

40 This ought to reduce the harm of externalities caused by rent-seeking firms that cut quality on unobservable dimensions.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More