Most-favoured-nation clauses: how to assess their competitive effects?

Most-favoured-nation clauses (MFNs) remain a hot topic in competition policy. The direction of travel has generally been one-way, with the UK and European vertical block exemption regimes designating wide MFNs as hardcore or excluded restrictions, and both wide and narrow MFNs being prohibited for designated gatekeepers under the EU’s Digital Markets Act (DMA). However, the 2022 judgment in BGL v. CMA reopens the debate: how should the competitive effects of these clauses be assessed?

MFNs (also known as price parity clauses) are contractual arrangements agreed between firms at different levels of the value chain. They stipulate that the seller will offer its good or service to the counterparty on terms that are as good as the best terms offered to third parties.1

In the context of online platforms such as price comparison websites (PCWs), which typically operate on an agency model—i.e. the supplier, not the platform, sets the retail price paid by the customer—MFNs protect the platform from the supplier ‘free-riding’ on the platform’s investment and undercutting it through other channels (e.g. by offering cheaper prices on its own website).2 PCWs typically obtain their revenues from commission fees charged to suppliers for each consumer who clicks through from the PCW to the supplier’s website and goes on to purchase.

A distinction is commonly drawn between ‘narrow MFNs’, which restrict the supplier’s pricing through its own sales channels, and ‘wide MFNs’, which apply to all other sales channels, including those of other PCWs. In the case of online platforms, MFNs often refer to other online sales channels only (i.e. they do not restrict the terms offered via offline sales).

Following a market study into digital comparison tools in September 2017, the UK Competition and Markets Authority (CMA) opened a competition investigation into the wide MFNs that Comparethemarket had agreed with several home insurance providers.3 The investigation concluded in November 2020, with a Decision against Comparethemarket (and its parent group, BGL) that its use of wide MFNs in home insurance—over the period December 2015 to December 2017—had infringed competition law ‘by effect’.4 The CMA imposed a penalty of £17.9m, which was ultimately overturned by the judgment from the Competition Appeal Tribunal on 8 August 2022.5

As of today, there are four main PCWs for insurance products in the UK: Comparethemarket, Confused.com, Go.Compare and MoneySuperMarket. Comparethemarket was the most popular PCW for home insurance products during the relevant period, accounting for over 50% of sales through this channel.6 Comparethemarket was the only PCW to have wide MFNs in place with insurers, although not all insurers accepted them. When considering policies sold through PCWs only, wide MFNs covered 40% of sales.7 Narrow MFNs, meanwhile, were commonplace, and were adopted by all PCWs and accepted by almost all insurers. Therefore, the CMA’s counterfactual for its competitive assessment was against a benchmark of narrow MFNs. Oxera acted as economic adviser to Comparethemarket (and BGL) during the CMA’s investigation, and Comparethemarket’s subsequent appeal of the CMA’s Decision before the CAT.

The by-object vs by-effect debate

Regulatory scrutiny over the past decade of the use of MFNs by digital platforms has prompted increased academic research into the nature of these clauses. From a theoretical perspective, it is well recognised that MFNs can have both anticompetitive and procompetitive effects, and that the impact of MFNs depends on several factors. In this respect, MFNs are no different to other vertical restraints such as selective distribution agreements. While a number of the academic studies have concluded that MFNs (particularly wide MFNs) are likely to be harmful in their net effect,8 some find that MFNs could be beneficial for consumers overall.9

The economics literature on the competitive effects of platform MFNs is primarily theoretical, and there are fewer empirical studies on the issue. With respect to wide MFNs, the literature outlines three main theories of harm associated with such clauses.

- First, wide MFNs can soften wholesale commission competition among platforms, leading to higher commissions than would otherwise have prevailed. In other words, a platform with a wide MFN in place may have a reduced incentive to compete by reducing its commissions in return for lower retail prices, as its wide MFN guarantees it the lowest retail prices in the market.

- Second, wide MFNs can discourage retail price competition among providers—that is, wide MFNs make it more expensive for insurers to discount on other platforms, as doing so means that they have to offer this discount across the board.

- Third, wide MFNs can create an artificial barrier to entry or expansion by rival platforms that would otherwise have adopted a discount business model, and thereby competed down retail prices.

Given that the economics literature sets out several intuitive mechanisms through which wide MFNs can have negative competitive effects, one might ask: are wide MFNs therefore always bad? Should they be seen as anticompetitive ‘by object’?

One of the most important messages that emerges from the BGL v. CMA case is that the answer to these questions is ‘no’—the effects of MFNs are ambiguous, they depend on the market context, and it would be inappropriate to treat them as ‘by object’ infringements. In this respect, the judgment is in contrast to recent regulatory developments that have designated wide MFNs as hardcore, or excluded restrictions in the UK and the EU. Below, we highlight the main points considered by the CAT that led to this conclusion.

Inter-brand competition can neutralise the adverse effects of MFNs

As noted above, the existing literature on MFNs is mostly theoretical, and sets out stylised models of market dynamics. These are based on a number of strong assumptions about how the market and MFNs operate. Notably, the economics literature commonly assumes that all platforms agree wide MFNs with all suppliers being listed (i.e. that there is full coverage of the wide MFNs), and that the wide MFNs are effective (i.e. that they constrain providers’ pricing, resulting in uniform pricing).10 In the BGL v. CMA case, however, these two assumptions did not hold true.

In particular, the first observation made by the CAT was that wide MFNs inhibit only intra-brand competition—i.e. the ability to price the same product (e.g. the home insurance offered by a home insurance provider) differentially across different PCWs—and do not inhibit inter-brand competition—i.e. the ability of different products (e.g. home insurance offered by multiple home insurance providers) to compete against each other.11

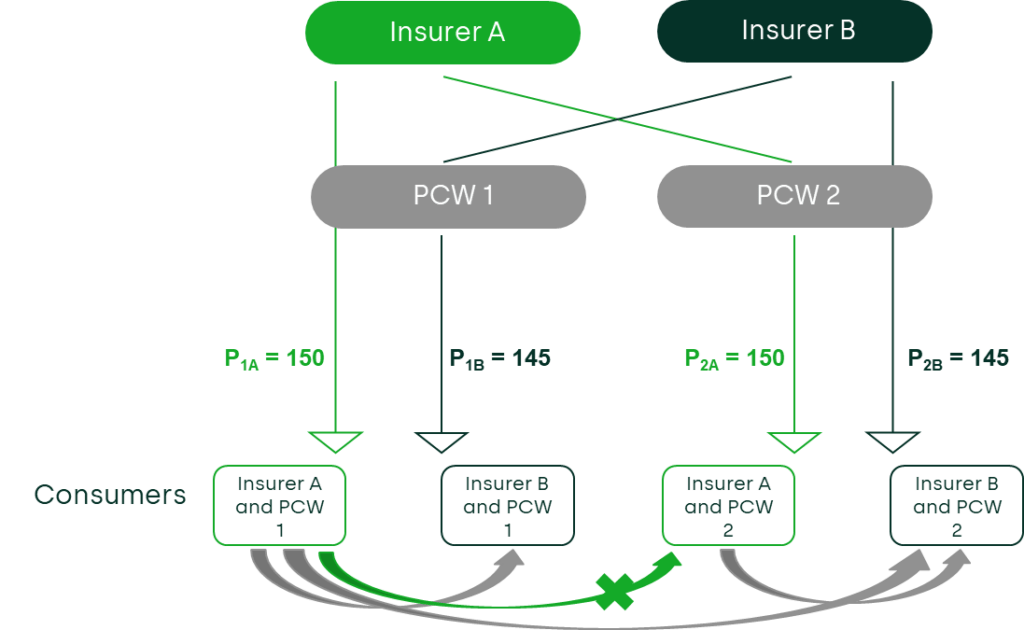

This is illustrated in Figure 1 below, which depicts two insurers (Insurer A and Insurer B) listing on two PCWs (PCW 1 and PCW 2). Insurer A has a wide MFN with PCW 1, while Insurer B does not have a wide MFN in its agreements with either PCW (i.e. there is ‘partial’ coverage of the wide MFNs). The competition that is restricted by the wide MFN is indicated by the green arrow at the bottom of the figure—i.e. intra-brand competition for Insurer A across PCWs. However, suppose that PCW 2 offers a competitive commission to Insurer B in order to incentivise it to offer a competitive retail price. Insurer B sets a price of £145 across both platforms. This competitive price would encourage consumers who single-home on PCWs to switch from Insurer A to Insurer B (on the respective PCW on which they single-home), and encourage consumers who multi-home across PCWs to switch from Insurer A’s offering on PCW 1 to Insurer B’s offering on PCW 2.12 This customer diversion, due to inter-brand competition, is marked by the grey arrows. In this way, inter-brand competition can place pressure on Insurer A and PCW 1 to price more competitively, despite a wide MFN being in place.

Figure 1 Inter-brand competition may neutralise adverse effects of wide MFNs

Source: Oxera.

In relation to competition on retail prices, the CAT found that (i) this was ‘a highly price elastic market’, thereby intensifying inter-brand competition between insurers; (ii) there would be ‘significant competition’ across home insurance products offered only through PCWs; (iii) the CMA’s decision materially understated the nature of this competition by excluding a number of channels (such as insurers’ direct channels) from the relevant market.13

At the heart of all of these observations is the view that inter-brand competition could serve to neutralise adverse effects, implying that the anticompetitive effects predicted in the economics literature may not hold. Some academic researchers go further than this (in particular, Johansen and Vergé (2017), a paper that was hotly discussed at trial14) and show that, when inter-brand competition is fierce, wide MFNs can actually benefit consumers, resulting in lower retail prices and commissions.15 In the CAT’s view, this was a key argument as to why the ‘object box’ was not appropriate in this case.

The role of quantitative evidence

In the BGL v. CMA case, the parties adopted the standard economic framework of analysing effects as a function of three factors: (i) the market share of the parties concerned in the relevant market; (ii) the market coverage of the agreements in question; (iii) any evidence on the actual or likely effects on competition.

While it was common ground that this was the relevant framework for the analysis, a major point of difference related to the type of evidence that was required in order to fully assess these factors. While the CMA relied largely on qualitative and documentary evidence, Comparethemarket relied on both qualitative and quantitative evidence, including substantial quantitative evidence adduced by way of economic expert opinion.16

Comparethemarket did not have wide MFNs with all insurers and, on 30 November 2017, its wide MFNs were formally disapplied. As a result, there was an opportunity to explore whether the disapplication resulted in any change in insurer behaviour or the market more generally—i.e. one could analyse the effect of the disapplication by comparing the situations before and after disapplication, using insurers without wide MFNs as a control group (this is commonly referred to as ‘difference-in-differences’ analysis).

The CAT was very much alive to this fact, describing the situation as presenting the ‘makings of a natural experiment’, one which, ‘at least prima facie lends itself to econometric analysis’.17 The analysis carried out by Comparethemarket’s advisers found no evidence of a statistically significant effect of Comparethemarket’s wide MFNs on retail prices and PCW commissions across a large number of models and sensitivity tests. This suggested that there was no evidence to conclude that the existence of the wide MFNs had any adverse effect on key competitive outcomes. However, based on the documentary evidence, the CMA had instead concluded that Comparethemarket’s wide MFNs softened price competition appreciably by inhibiting PCWs’ and insurers’ competition on price.18

The Tribunal had to reconcile this stark difference in the approaches and conclusions, and determine the weight to be attached to different sources of evidence. It ultimately considered that the econometric analysis was part of the evidence to be taken into account, and that it was broadly consistent with the CAT’s views both as to the theoretical operation of the market and the value of the qualitative evidence.19

It is worth noting that a similar econometric approach had been used in ex post assessments in other sectors, most notably the hotel sector following the prohibition of MFNs in certain European countries. One was carried out by a group of national competition authorities, and the European Commission, to examine the effect of the ban on wide MFNs (the ECN study).20 Another analysis was undertaken as part of the support study prepared for the evaluation of the European Commission’s Vertical Block Exemption Regulation (this study includes an assessment of the impact of a ban on narrow MFNs in certain European countries).21 In the context of the digital comparison tools market study, the CMA itself relied on econometrics to assess the impact of the removal of wide MFNs in private motor insurance.22

This is not to say that the qualitative or documentary evidence does not have value. In the BGL v. CMA case, the qualitative evidence provided useful insights into how the UK home insurance market worked and how companies behaved, and allowed the subsequent economic analysis to be rooted in market facts. But it was usefully complemented by quantitative evidence from market data, particularly given the substantial data that had been gathered on the PCW market.

Context is key

Previous competition assessments of MFNs have commonly been resolved through undertakings and commitments and, as such, economic evidence determining actual competitive effects in the context of antitrust investigations is limited.

The BGL v. CMA case has provided an opportunity to strengthen the evidence base. A central finding from the case is that it was correct to assess the impact of wide MFNs on a by-effect and not a by-object basis, and that it can be challenging to determine the nature of competitive effects based on factual evidence only.

The actual or likely effects of MFN clauses ultimately depend on the specific context of a case. A one-size-fits-all approach may not be appropriate to evaluate the risks and benefits of these clauses and assess the net effect on consumers. Quantitative analysis, and specifically econometrics, can provide a robust and systematic way to test for any competitive effects—and the CAT has shown a willingness to engage with such evidence.

1 For an overview on how MFNs operate under different business models, see Oxera (2014), ‘Most-favoured-nation clauses: falling out of favour?’, Agenda, November.

2 In order to operate, platforms have to invest and innovate with the objective of increasing the volume of visits and transactions conducted through their websites. Where a platform is an intermediary whose function is to enable buyers and sellers to find the most appropriate match (e.g. a PCW), once a match has been found the parties can seek to circumvent the platform fee, by attracting consumers to purchase the product from them directly (e.g. by offering a slightly lower price on their own websites). In doing so, the intermediary free-rides on the investment undertaken by the platform to attract consumers and facilitate search and matching.

3 Around 60 home insurance providers used PCWs as an indirect means of selling home insurance products. Of these, around 45 subscribed to Comparethemarket’s services, and of these 45, 32 had a wide MFN in their agreement with Comparethemarket. Source: BGL (Holdings) Limited, BGL Group Limited, BISL Limited and Compare The Market Limited v. The Competition and Markets Authority 1380/1/12/21, 8 August 2022, henceforth ‘BGL v CMA’.

4 Competition and Markets Authority, Price comparison website: use of most favoured nation clauses, Case 50505, 19 November 2020.

5 Competition and Markets Authority, Price comparison website: use of most favoured nation clauses, Case 50505, 19 November 2020; and BGL v CMA.

6 Competition and Markets Authority, Price comparison website: use of most favoured nation clauses, Case 50505, 19 November 2020, para. 1.21.

7 Under a broader market definition—which included the direct channel in addition to PCWs—the percentage of policies covered by wide MFNs was well below 40%. Note that the judgment also contains important observations on how market definition should be approached in the context of ‘two-sided’ markets, i.e. markets where an intermediary (such as a PCW) serves two different groups of customers, which in this case were insurers on one side and consumers on the other.

8 See, for example, Boik, A. and Courts, K.S. (2016), ‘The Effects of Platform Most-Favored-Nation Clauses on Competition and Entry’, Journal of Law and Economics, 59:1; and Johnson, J.P. (2017), ‘The Agency Model and MFN Clauses’, Review of Economic Studies, 84:3.

9 For example, Johnson (2014) finds in a theoretical model that MFN clauses increase prices when used with an agency model (and not with a wholesale model), although even with an agency model they may facilitate greater choice without higher prices under certain contractual settings (e.g. if retailers face market-entry costs and when parties use profit-sharing rather than revenue-sharing). See Johnson, J.P. (2014), ‘The agency model and MFN Clauses’, Review of Economic Studies, 84:3, pp. 1151–1185. Some other theoretical models show procompetitive effects, for example when suppliers have higher bargaining power—see Larrieu, T. (2019), ‘Most Favoured Nation Clauses on the Online Booking Market’, Working Paper.

10 For example, the theoretical models employed in Boik and Courts (2016) and Johnson (2017) consider only a situation of full coverage. Boik, A. and Courts, K.S. (2016), ‘The Effects of Platform Most-Favored-Nation Clauses on Competition and Entry’, Journal of Law and Economics, 59:1; Johnson, J.P. (2017), ‘The Agency Model and MFN Clauses’, Review of Economic Studies, 84:3, pp. 1151–1185.

11 BGL v. CMA, para. 209(4)(ii).

12 A single-homing consumer uses only one PCW to compare products, whereas a multi-homing consumer uses multiple PCWs.

13 BGL v. CMA, paras 262(7) and 262(8).

14 BGL v. CMA, para. 201.

15 Johansen, B.O. and Vergé, T. (2017), ‘Platform Price Parity Clauses with Direct Sales’, University of Bergen Working Paper No. 1/17. Johansen and Vergé (2017) find that consumers benefit from the introduction of a wide MFN provided that providers compete fiercely and can delist from platforms charging excessively high commissions.

16 BGL v. CMA, paras 63–64.

17 BGL v. CMA, para. 238(1).

18 BGL v. CMA, para. 233.

19 Specifically, the CAT noted as follows: ‘Finally, there is the fact that the quantitative evidence adduced by Compare The Market is entitled to some weight and is broadly consistent with our views both as to the theoretical operation of the market and the value of the qualitative evidence. In short, we find it altogether unsurprising that the econometric evidence tells as it does; and we consider the CMA’s contention that there can be anti-competitive effects that are not discernible to be unarguable where both the theoretical and the qualitative underpinnings are as weak as they are.’ BGL v. CMA, para. 262(9).

20 European Commission and the Belgian, Czech, French, German, Hungarian, Irish, Italian, Dutch, Swedish and UK national competition authorities (2017), ‘Report on the monitoring exercise carried out in the online hotel booking sector by the EU competition authorities in 2016’, April.

21 European Commission (2020), ‘Support studies for the evaluation of the VBER’, Final Report, May.

22 Competition and Markets Authority (2017), ‘Digital comparison tools market study’, Final report, Paper E: Competitive landscape and effectiveness of competition, Appendix 2.

Related

What is venture capital, how does it work, and what are the risks?

In the third and final episode demystifying private equity, we explore the world of venture capital. While venture capital has delivered exceptional returns for some investors and founders, it’s also very high risk. So, is vibrant venture capital essential for economies seeking to boost innovation and drive productive growth? In… Read More

Measuring and inferring anticompetitive effects from an exchange of information

In four rulings1 dated 3 November 2025, the Spanish National Court overturned the Decision of the Comisión Nacional de los Mercados y la Competencia (CNMC) in case S/DC/67/17 Tabacos2 (‘the Decision’). These four rulings are significant because they close one of the first cases that the… Read More