Squad goals: UEFA’s new financial regulations

Yesterday (7 April 2022), following a lengthy review, UEFA announced that it has approved new UEFA Club Licensing and Financial Sustainability Regulations, which will impose a new approach to financial regulation on football clubs competing in UEFA competitions.1

The headline announcement is a new squad cost rule, under which each club’s spending on squad costs (i.e. player wages, transfers and agents’ fees) will be capped at 70% of its revenue. The rule will be implemented gradually, with the threshold set at 90% in 2023/24, 80% in 2024/25, and 70% thereafter.2

So what might this mean for English clubs?

Most Premier League clubs will need to tackle their wage bills to comply with the rules

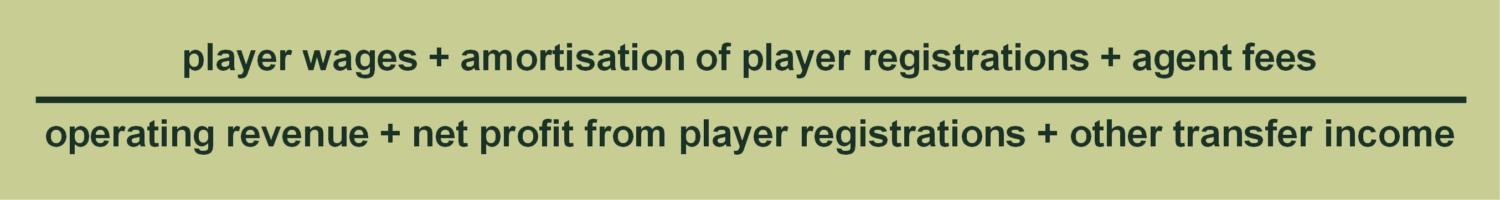

Under the cost control requirements, the squad cost ratio will be calculated as follows:3

The announcement is still fresh, with limited information currently available on how the regulations will be applied and enforced. Previous experience of cost controls in sports leagues and regulations in other sectors, such as banking and insurance, highlight the potential for definitional issues and regulatory gaming (e.g. commercial payments that do not reflect market conditions, off-book payments and differences in accounting practices).

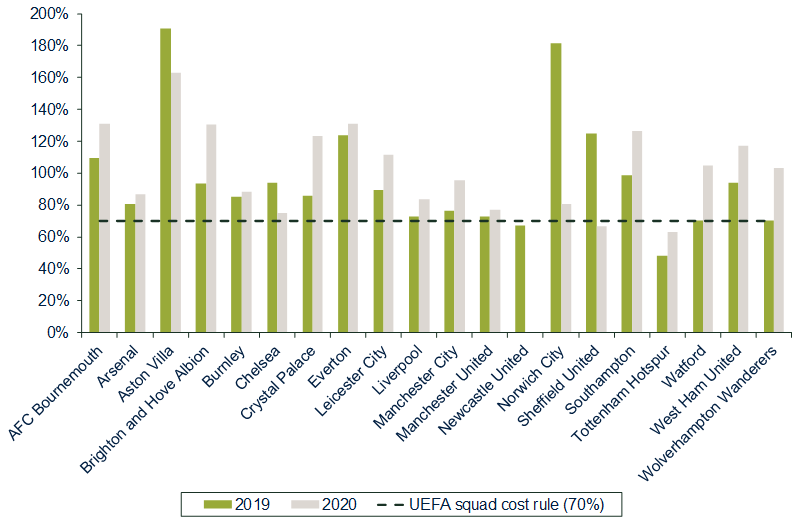

However, at first glance, it appears that the announcement could have serious implications for English clubs. The chart below considers this ratio for 20 clubs competing in the Premier League in the 2018/19 and 2019/20 seasons (excluding agents’ fees, information about which is less readily available).

Figure 1 EPL squad costs, 2018/19–19/20

Source: Oxera based on Deloitte (2021), ‘Riding the challenge: Annual Review of Football Finance 2021 – Databook’, July.

The chart shows that based on this definition of squad cost:

- the vast majority of Premier League clubs would have exceeded 70% in 2019 and 2020;

- some clubs would have significantly exceeded the 70% threshold (e.g. Aston Villa, Everton and Southampton);

- a number of clubs that frequently compete in UEFA competitions (including Arsenal, Chelsea, Liverpool, Manchester City, and Manchester United) would have been non-compliant in at least one of the years.

Moreover, it is notable that many Premier League clubs currently spend more than 70% of revenue on player wages alone. Indeed, 14 Premier League clubs reported wage-to-revenue ratios at or in excess of 70% in 2019/20, up from eight in 2018/19.4

Consequently, these clubs would need to run net transfer surpluses to offset their wages in order to fall within UEFA’s requirements. This would require a significant change in transfer policies relative to what has been observed in recent years. Of the 20 clubs shown in Figure 1, only Norwich City recorded a net transfer surplus over the five-year period from 2015/16 to 2019/20.

The rules could alter levels of domestic competitiveness

The new regulations are intended to drive stronger football club finances, but it is also relevant to consider what impact they might have on competitiveness.

In this context, it is important to note that the rules will only apply to clubs that quality for UEFA competitions; therefore, Premier League clubs that do not expect to finish in European qualification places would not be bound by them. This could conceivably work to the advantage of ‘smaller’ clubs in the sense that clubs outside of the European places would not be subject to the same squad cost rules as those that do qualify.

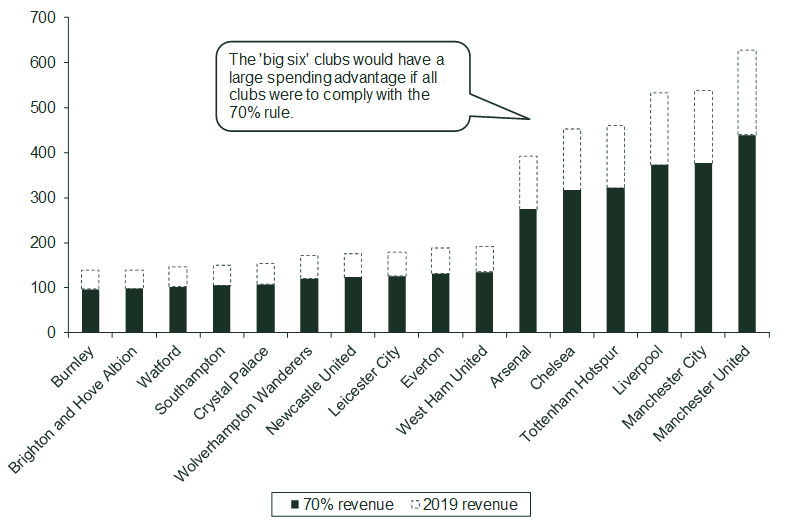

However, Figure 2 shows that if all clubs were to seek to comply with the rules, there would be a stark difference in squad spending power across the Premier League clubs. Based on 2019 revenue, the club with the highest squad cost allowance (Manchester United, c. £440m) would be able to spend around 4.5x the amount of the club with the lowest allowance (Burnley, c. £97m).

Figure 2 Illustrative squad cost allowances based on 2019 revenue

Initial perspectives

Based on the limited information available at this stage, the new squad cost rule could have considerable repercussions for Premier League clubs. The impact on competitiveness will depend on how clubs react to the new regime, but there appears to be a genuine risk that UEFA’s new rules might dampen UK domestic competition.

The rules go well beyond the existing UEFA rules and the Profit and Sustainability rules that have applied to Premier League clubs to date. It also raises a question of how these rules would interact with the proposals, set out by the Fan-Led Review of Football Governance, to establish an independent regulator focused on the financial sustainability of English clubs.5

1 UEFA (2022), ‘UEFA Executive Committee approves new financial sustainability regulations’, 7 April. UEFA club competitions include the Champions League, the Europa League, and the Europa Conference League.

2 UEFA (2022), ‘Explainer: UEFA’s new Financial Sustainability regulations’, 7 April.

3 UEFA (2022), ‘UEFA Club Licensing and Financial Sustainability Regulations, Edition 2022’, April.

4 Deloitte (2021), ‘Riding the challenge: Annual Review of Football Finance 2021’, July, p. 35.

5 See Oxera (2021), ‘Tactical innovation or own goal? The proposals for an independent football regulator’, Agenda, December.

Related

The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say? (Part 2 of 2)

On Thursday 23 October in Brussels, Oxera hosted a roundtable discussion entitled ‘The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say?’. In the second of a two-part series, we share insights from this productive debate. The discussion took place in the context of an… Read More

The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say? (Part 1 of 2)

On Thursday 23 October in Brussels, Oxera hosted a roundtable discussion entitled ‘The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say?’. In the first of a two-part series, we share insights from this productive debate. The discussion took place in the context of an… Read More