The economics of peer-to-peer lending

Lending to consumers and businesses through peer-to-peer (P2P) lending platforms has grown considerably in recent years, and this innovative form of finance has become an established element of the financial sector in the UK. But for the industry to continue to grow, and for it to reach a ‘mass market’ of investors, the economics need to be well understood. So what does P2P lending offer to borrowers and investors, and what are the risks?

This article is based on Oxera (2016), ‘The economics of peer-to-peer lending’, prepared for the Peer-to-Peer Finance Association, September.

At a basic level, P2P lending platforms provide a marketplace where investors who wish to lend funds can find borrowers looking for credit (typically in the form of two- to five-year loans, which are then set up through P2P Agreements).1 These marketplaces are made possible by online technologies, which provide investors with high-quality direct lending opportunities that would otherwise not be possible. The platforms conduct credit assessments and administer the loans on behalf of the investors. Platforms may also provide additional value-adding services to their users—the investors and borrowers—to ensure that the loan or investment characteristics best meet their needs.

As with other types of P2P platform,2 P2P lending platforms are two-sided markets that meet the needs of two distinct user groups (in this case, borrowers and investors) that provide each other with network benefits.

From the borrower’s perspective, P2P lending offers a competing source of finance to banks (and other possible lenders). In these competitive markets, P2P lenders can typically be expected to be ‘price-takers’, in that they lend at the going rate. Platforms do offer borrowers some additional services, including early repayment options and speed of funding, but such innovations are often a feature of new businesses without legacy systems, rather than something that is fundamental to P2P lending.3 This new form of financial intermediation offers additional choice to borrowers, but is not fundamentally different from the borrower’s point of view.

The investor side, on the other hand, is more distinct and novel. P2P lending platforms offer retail and institutional investors the opportunity to fund loans directly. Investors essentially own a part of the cash flows of a lending business, which is tied to specific loans through the P2P Agreement. For investors, this represents a novel asset class. The closest comparison might be the ownership of a portfolio of corporate bonds, except that P2P platforms facilitate loans mainly to individuals and SMEs.

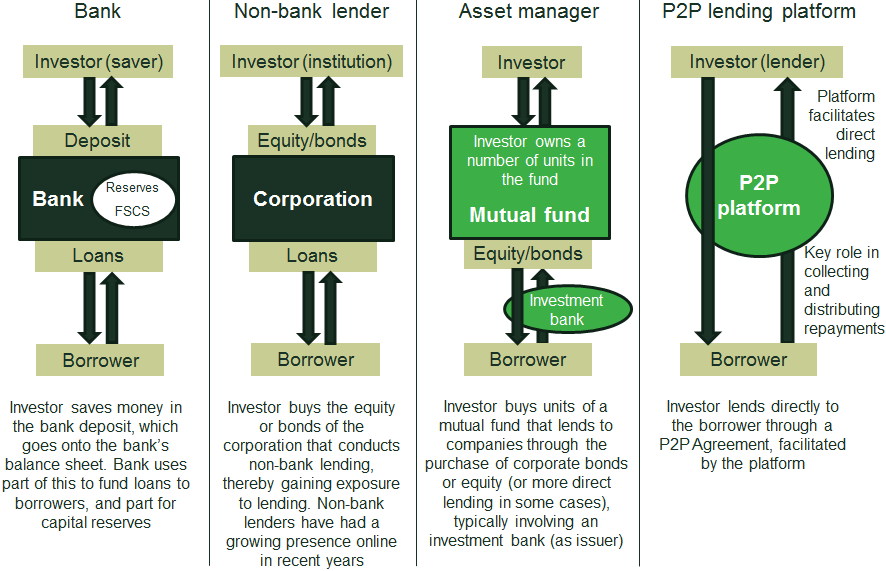

P2P lending therefore creates a new and additional business model for funding loans to consumers and businesses, compared to investing in banks or indirectly through other lenders or asset managers, with corresponding implications for regulation (see Figure 1).

Figure 1 Value chains for four main forms of investor exposure to lending

The risks and liquidity constraints inherent in direct lending potentially offer the investor considerable advantages in terms of returns. ‘Maturity transformation’4 and deposit guarantees are costly for banks (and, indeed, for wider society, when taxpayers are called on to bail out banks), in terms of capital reserves and payments to the Financial Services Compensation Scheme (FSCS, which provides a guarantee for individuals’ deposits of up to £75,000 per bank); see the box below. P2P investors should therefore earn a higher return, on average, than they would from products such as bank saving accounts, in return for accepting investment risk.

Why is there prudential regulation of banks?

Banks play a vital role in the economy, by providing current accounts to individuals and businesses that rely on these accounts to fund day-to-day transactions. Consequently, a loss of confidence in banks, and hence the value of deposits, can have an immediate and severe effect on confidence in the economy, as has been well documented from past financial crises. However, the availability of these funds is potentially put at risk as banks lend them to other individuals and businesses, often on the basis of long-term loans (i.e. by engaging in maturity transformation). Banks typically cannot quickly reclaim the funds they have lent out if deposit-holders start to withdraw funds faster than expected.

Banks are therefore subject to strict prudential regulation to ensure that deposit-holders have confidence that banks can provide funds on demand. Deposits are essentially guaranteed for most consumers, so banks are less likely to fail (as customers are less likely to withdraw funds if they are concerned about the stability of the bank).

In contrast, individuals may hold significant funds in long-term savings vehicles such as pensions and investment funds (and P2P lending investments), but even major fluctuations in the value of these funds (such as with sharp declines in share prices) have much less impact on confidence in the economy, certainly in the short term. This is because consumers do not rely on these long-term investments for their immediate spending needs, as they do with bank accounts. There are also typically far fewer interconnections between longer-term savings vehicles (than between banks), as the organisations involved are not invested in one another to the same extent that banks are. Strict prudential regulation is therefore not required for these longer-term savings vehicles.

Source: Oxera.

Investor understanding of the nature of risk is therefore important to P2P platforms, due to the implications of potential misunderstanding, not just for investors, but also for the reputation of the platform itself and its ability to attract business. In a study for the Peer-to-Peer Finance Association, Oxera examined the risks and liquidity constraints inherent in direct lending, and investor understanding of those risks.

What are the risk–return trade-offs for investors?

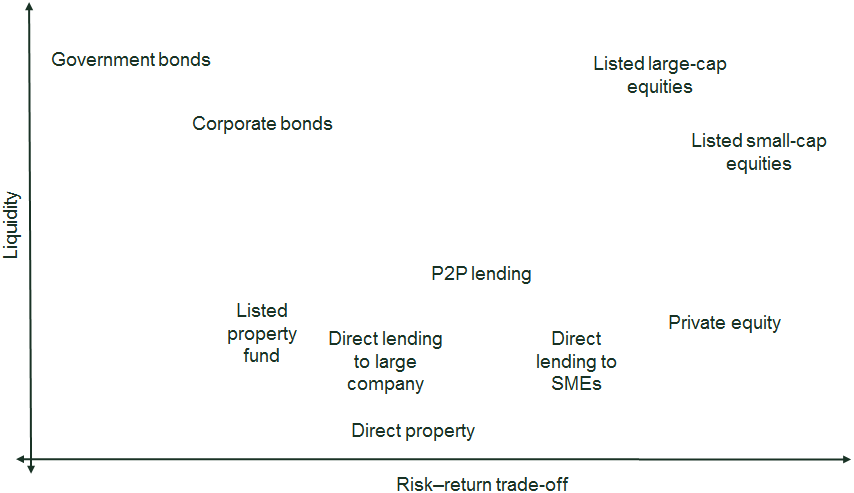

The levels of investment risk and potential return vary across P2P lending opportunities, with some platforms facilitating secured loans, such as buy-to-let mortgages, and others facilitating unsecured lending to individuals and businesses.

From the investor perspective, the risk level is also affected by additional services that may be provided by the platforms. For example, some platforms run buffer funds that can be expected to cover credit losses in ‘normal’ times, which helps to smooth returns with the more extreme ‘tail risk’ remaining for the investor—such as the risk of the buffer fund being depleted during a recession with high credit default.

Importantly, the liquidity of P2P lending investments is restricted by its direct lending approach, although secondary markets provided by platforms can make investments more liquid in ‘normal’ times, when there are other investors willing to take on the loans (although often with charges and other costs).

Figure 2 illustrates the relative liquidity, and risk–return trade-offs, for different investment asset classes (although note that P2P lending varies across platforms).

Figure 2 Relative liquidity, and risk–return trade-offs, for selected investments (diversified portfolios only)

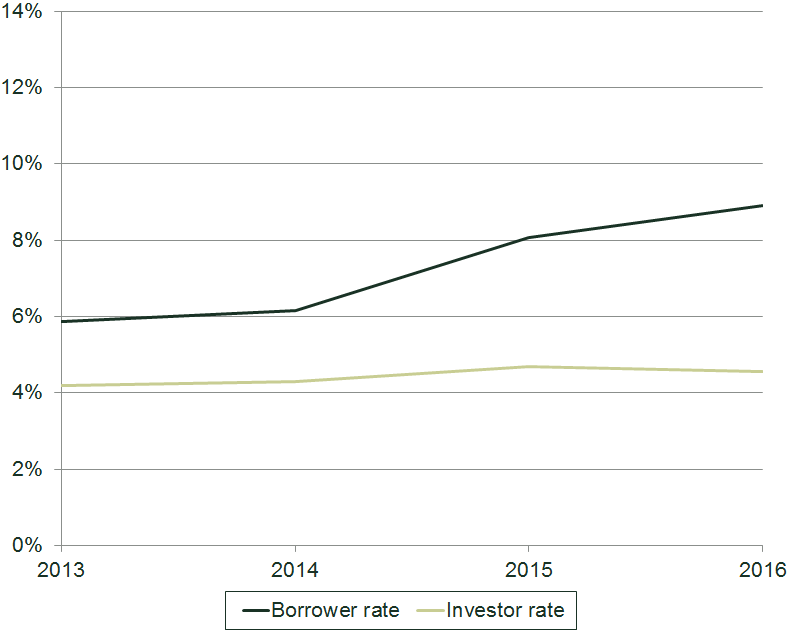

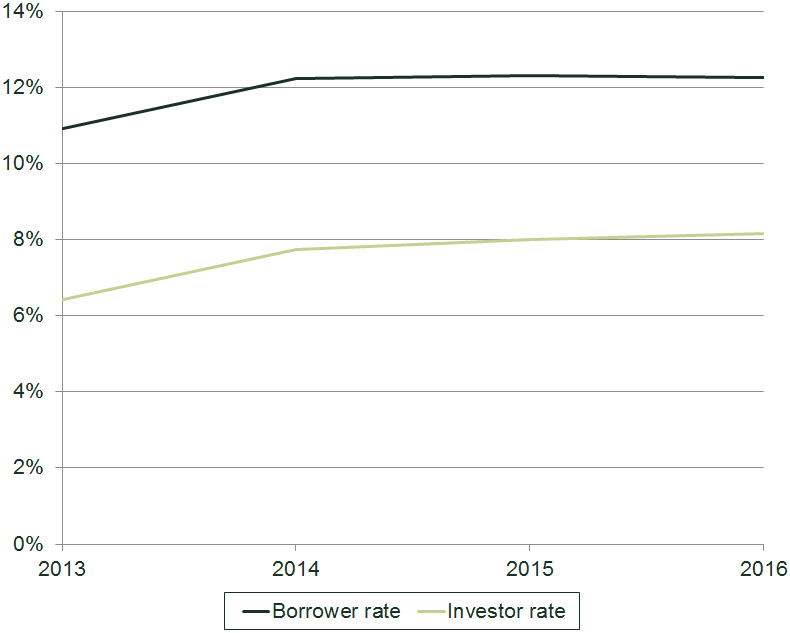

The actual performance of P2P lending as an asset class can be considered in terms of what it has delivered to investors in returns, net of all fees and default costs. This can then be compared to the rates charged to borrowers, which can be referred to as the ‘spread’, to help to understand its efficiency (see Figure 3, which looks at the rates that apply to consumer and business lending).

Figure 3a Consumer lending: estimated average borrower rate of interest and investor rate of net return, selected UK P2P platforms, 2013–16

Source: Oxera estimates, based on information provided by the Peer-to-Peer Finance Association members.

Figure 3b Business lending: estimated average borrower rate of interest and investor rate of net return, selected UK P2P platforms, 2013–16

Source: Oxera estimates, based on information provided by the Peer-to-Peer Finance Association members.

This comparison is inherently limited by the short history of most P2P platforms (many began operations in 2010–14), but does point towards average returns to investors (net of fees and default losses) of around 4–8%, with a spread to borrowing rates of around 4%. These spreads are in line with the spread between the cost of funds for banks (the interbank lending rate) and the rate at which banks lend to SMEs.5 The costs involved in P2P platforms (loan origination fees and ongoing fees) are broadly comparable to those involved in investing in corporate bonds through asset managers, even though P2P loans are typically much smaller in size than corporate bonds. This indicates the efficiency of P2P lending as a form of financial intermediation.

Effective management of credit risk?

Effective management of credit risk—the risk of the borrower defaulting on the loan—is a key requirement for most P2P investors, as they are typically unable to effectively assess the risk themselves due to lack of time and skill.

Even though P2P platforms do not typically invest in loans directly, they do have incentives to manage credit risk effectively due to its impact on both direct revenue and the platform’s reputation. Platforms are directly affected by borrower defaults, as they result in the loss of ongoing servicing fees, which, at a rate of around 0.7% to 1% per year, make up a significant proportion of income.6 In addition, the ability of P2P platforms to attract investors depends on them delivering strong net returns while managing credit risk effectively.

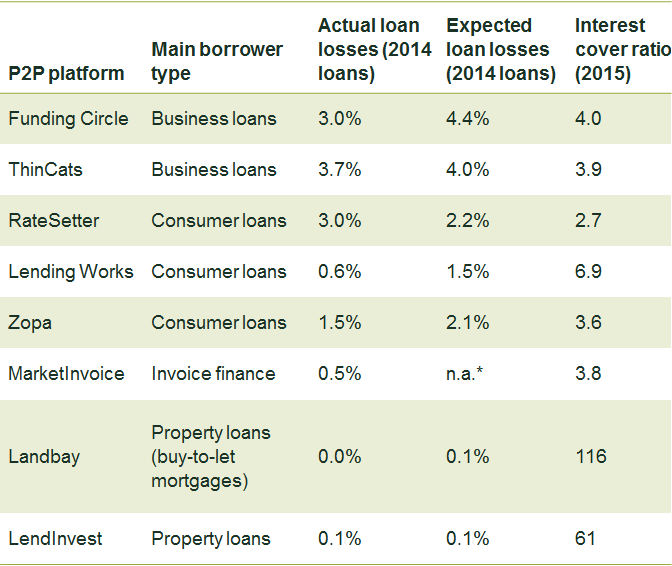

The platforms considered in the Oxera study have developed credit risk models that are broadly similar to those of traditional lenders, using data from credit reference agencies and other sources.7 Most of the platforms report approval rates (for both business and consumer loans) of only around 10–25%, with the majority of applications failing the credit assessment. The platforms that facilitate lending to SMEs generally offer loans only to companies with at least a couple of years of trading experience and a (positive) credit history; the default rates seen are therefore broadly in line with those at banks offering similar loans.8 In addition, in nearly all cases the actual default rates on loans issued via platforms have been in line with, or lower than, the expected loan losses (as stated by the platforms at the time when loans were issued)—see Table 1 below.

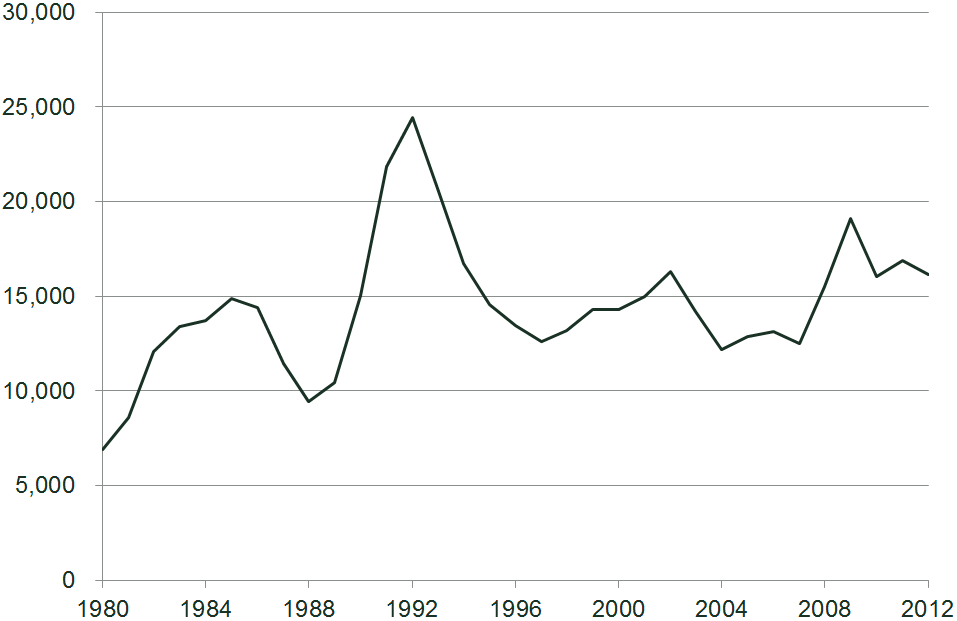

The current low interest rate environment arguably makes current UK credit conditions quite benign, so it is also useful to consider how default rates might differ in a recessionary environment. Most P2P platforms are relatively young and do not have direct experience of past recessions, and so it is necessary to consider how current loan books would be likely to perform if default rates were similar to those observed in the past.

In past recessions, increases in default rates were typically around 50–150% above pre-recession levels, for broad categories of consumer and business loans (for historical data on recent recessions showing business insolvencies, and therefore defaults on loans, see Figure 4).9 Based on the information available on the platforms, it would seem likely that increases in default rates of this magnitude would be insufficient to reduce net returns to investors to below zero, as the ‘interest cover ratios’ (the ratios of net returns to loan losses)10 are above 2.5x, and much higher in some cases (see Table 1).

Figure 4 Number of corporate insolvencies per year, 1980–2012

Table 1 Actual total loan losses so far (and expected loan losses), as a percentage of value by platform for loans that originated in 2014

Source: Platform loan books and websites.

How liquid are P2P investments?

Most P2P platforms facilitate loans with durations of around two to five years. Investors therefore value mechanisms that platforms put in place to allow investors to sell their remaining loans to other investors (if there is someone willing to take them on), to enable them to access their funds before the loans are repaid. Most platforms therefore provide secondary markets where investors can sell on their remaining loans.

The purpose of these secondary markets is not to guarantee liquidity transformation—the underlying asset remains the key determinant of the liquidity of the investment, and the ability to sell the remaining loans is not guaranteed. Most platforms charge for the use of the secondary market, and investors may also face additional costs or losses when they sell their remaining loans if interest rates have moved against them.11 These charges for using the secondary market and variations in loan value are broadly comparable to what a bond investor would expect if selling bonds before redemption.

The use of secondary markets is actually rather limited, with annual secondary market transactions no more than one-quarter of the size of the loan book, and much lower on some of the platforms. This level of transactions is arguably lower than (and at least broadly comparable to) the average rate of transactions in retail equity investment funds,12 which suggests that investors are using P2P investments in a similar way to other long-term investment options.

What about platform risk?

In addition to the risk characteristics of the underlying asset, there is risk associated with the platform itself. In the case of a retail investment into an equity fund, for example, there will typically be an investment platform (often in conjunction with a financial adviser) and an asset manager involved. In the case of P2P lending, the P2P platform is the sole intermediary. P2P platforms operate under broadly similar regulation to equity fund intermediaries with regard to client money, resolution plans and complaints handling, for example. Although P2P platforms are not directly covered by the FSCS, it should be noted that the requirement to hold client money in an FSCS-regulated deposit account does mean that client money can be expected to be covered by the FSCS, as it is with investments in equity funds. Only in cases where the platform has failed to put client money into the appropriate segregated account, and there are insufficient funds available to compensate investors,13 is there additional risk for the investor.

Conclusions: risk and return from the investors’ perspective

In terms of the trade-off between risk and return offered by investments on the platforms considered above, P2P lending appears to offer real innovation in providing a new option for investment, with risk characteristics that are broadly comparable to those of other retail investment asset classes, and in particular corporate bonds. Providing the 100% capital guarantee required of bank deposits has become increasingly costly, particularly in a low interest environment, and there is investor demand for risk-taking investment options. The characteristics of P2P lending do not appear to be inherently more risky, complicated or illiquid than those of bonds and equities that investors already have access to. In particular:

- the risk profile of P2P loan portfolios appears to be comparable to those of other lenders (including banks), which suggests that the inherent cash-flow risk is no different from that of investing in the equities and bonds of such a lender;

- as long as there is a good spread of loans across sectors and regions, diversified portfolios of loans typically correlate with one another only through macroeconomic conditions;

- platforms manage interest rates to ensure that direct lending is appropriately priced to reflect risk.

The phenomenon of P2P lending remains relatively new, and more will be learned about how such investments perform over time as the sector matures and experiences more significant variations in credit conditions, such as higher interest rates. It appears to be an exciting new development in the future financing of business and consumer needs.

1 P2P Agreements are defined in the UK Financial Conduct Authority’s FCA Handbook.

2 For example, eBay (matching sellers with buyers), Uber (matching drivers with passengers), and Airbnb (matching those with spare rooms with those wanting a room).

3 Non-bank lenders and new entrant banks may offer similar innovative services.

4 Where banks guarantee that deposits are available (typically instantly), while using the funds to make long-term loans (e.g. mortgages).

5 See Oxera (2016), ‘The economics of peer-to-peer lending’, prepared for the Peer-to-Peer Finance Association, September, section 3.

6 See Oxera (2016), ‘The economics of peer-to-peer lending’, prepared for the Peer-to-Peer Finance Association, September, section 4.

7 Such as Call Credit, Experian, Equifax, Cifas, Graydon, and loan-specific information provided by the borrower.

8 See Oxera (2016), ‘The economics of peer-to-peer lending’, prepared for the Peer-to-Peer Finance Association, September, Figure 4.2.

9 Past financial crises have produced some increases in default that were greater than this, such as with subprime mortgages in the USA in 2007–08. Where there is collateral, in ‘normal’ times losses for the lender can be close to zero, but in severe recessions they can rise sharply.

10 In this context, interest cover ratios indicate the increase in the default rate that would be required to reduce net returns to investors to zero. For example, an interest cover ratio of 2 indicates that the current default rate would need to double in order to reduce net returns to zero. This ratio therefore indicates the extent to which loan performance would need to worsen before investors suffered losses.

11 Different mechanisms are used by different platforms, with different fee structures.

12 On average, retail investors hold equity investment funds for 4.4 years. Investment Association (2015), ‘Asset management in the UK 2014-2015’, September.

13 In a platform failure situation, it is understood that client money would have seniority over other creditors, with the exception of the insolvency practitioners managing the case. This is discussed in Financial Conduct Authority (2014), ‘PS14/4: The FCA’s regulatory approach to crowdfunding over the internet, and the promotion of non-readily realisable securities by other media. Feedback to CP13/13 and final rules’, March. See ‘Client Money Rules’ section from para. 3.13 onwards.

Download

Related

The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say? (Part 2 of 2)

On Thursday 23 October in Brussels, Oxera hosted a roundtable discussion entitled ‘The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say?’. In the second of a two-part series, we share insights from this productive debate. The discussion took place in the context of an… Read More

The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say? (Part 1 of 2)

On Thursday 23 October in Brussels, Oxera hosted a roundtable discussion entitled ‘The new electronic communications and digital infrastructure regulatory framework: what does the economic evidence say?’. In the first of a two-part series, we share insights from this productive debate. The discussion took place in the context of an… Read More