Valuing banks’ non-performing loans after COVID-19

Due to the COVID-19 crisis, the European Central Bank (ECB) projects a sharp rise in non-performing loans (NPLs). In late 2020, the European Commission published an action plan for tackling NPLs, highlighting a potential need for banks to move NPLs off their balance sheets and into asset management companies (AMCs). Any transfer of NPLs to state-owned AMCs is likely to raise state aid issues—what are the key economic and financial questions that need to be considered here?

The COVID-19 crisis has led to a sharp economic downturn in the EU and worldwide.1 To mitigate the impact on households and businesses, regulators have introduced a number of measures to support banks’ ability to continue lending and to absorb losses.2

Since the start of the pandemic, €900bn of EU loans have received support through the introduction of flexibility on loan repayments.3 In particular, banks in France, Italy and Spain have granted significant flexibility to borrowers, making these jurisdictions potentially vulnerable when the support measures unwind.4 As a result, the European Central Bank is currently projecting a sharp increase in NPLs across Europe.5

The European Commission’s action plan for tackling NPLs6 highlights the need for banks to move NPLs off their balance sheets to national AMCs.7 Financial due diligence and the valuation of NPL transactions will play a key role in this process. This is particularly important in the state aid context if NPL portfolios are transferred to state-owned AMCs.

This article discusses why NPLs might need to be transferred from banks’ balance sheets, and the key state aid considerations, from an economics perspective. It then discusses how NPLs can be transferred in a manner that is in line with state aid rules, either on market (i.e. no-aid) terms, or as compatible aid. The article concludes by considering the implications of the unwinding of the unprecedented government support measures that have been introduced since the onset of the pandemic.

Why should NPLs be transferred off banks’ balance sheets?

NPLs are loans where the borrower has defaulted, the loan is foreclosed, and the collateral has either been seized or is in the process of being seized, following the failure of a distressed restructuring.8

Banks’ ability to lend to households and businesses can be significantly affected by the quality of their asset portfolios. Banks with high levels of NPLs on their balance sheets may need to divert resources away from profitable services to managing loans that provide no, or very limited, return. It may therefore be efficient for banks to transfer NPLs off their balance sheets. This could be via a direct sale, or as a securitisation structure. A number of private investors purchase NPL portfolios directly from European banks, and recent buyers in Europe include CPPIB, doValue, Bain Capital, LCM Partners and Hoist Finance.9

To manage their risks, banks are required to put money aside (through ‘provisioning’) as a safety net to compensate for the actual and expected losses incurred from NPLs. In the case of impaired assets, the ‘net book value’ on banks’ balance sheets reflects the value of the assets after accounting for expected losses. When investors buy NPL portfolios, they typically do so at a discount to the net book value to reflect, among other aspects, that there are likely to be additional losses that have not been provisioned for by the bank. The estimated market price for the portfolio of NPLs is therefore typically below the net book value of the loans.

As part of the NPL Action Plan, the Commission is encouraging member states to purchase NPLs through the establishment of national AMCs, with the primary goal being removing NPLs from banks’ balance sheets and extracting as much value as possible from them via active workouts and asset recovery.10

What are the key economic considerations?

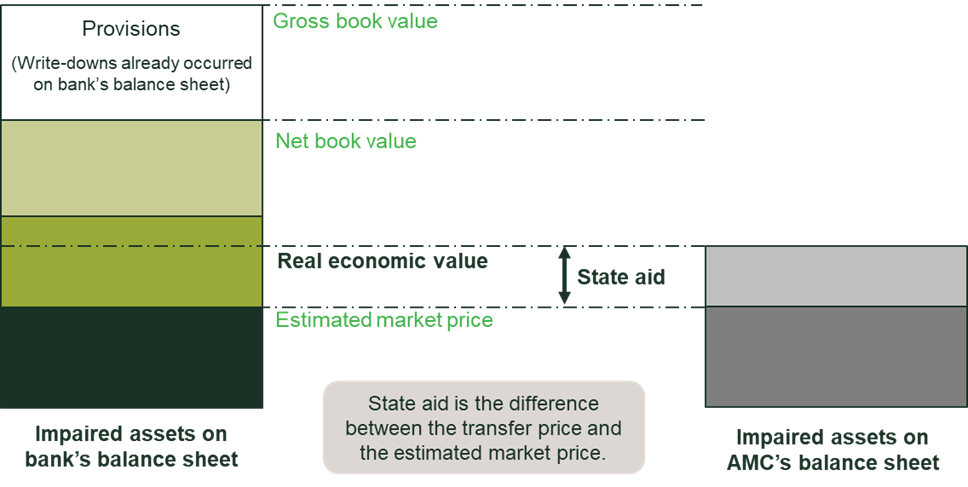

Under state aid rules, any transfer by a bank of impaired assets to state-supported AMCs does not constitute state aid if the transfer is deemed to take place on market terms. However, if a state-supported AMC buys impaired assets above their current market price, this is likely to constitute state aid, as illustrated in Figure 1 below. For the aid to be declared compatible, among other criteria, the impaired assets should be transferred to the state at, or below, their real economic value (REV), which reflects the underlying long-term value of the assets.11

Figure 1 The transfer price and the state aid implications

Source: Oxera.

During crises, the current market price of an NPL portfolio may be below its REV for a number of reasons, including asymmetric information between the seller and the buyer about the quality of the loans, as well as limited liquidity in the market.

In the state aid context, key economic considerations relate to whether the transfer price is in line with an estimated market price or, if not, whether the transfer price is in line with, or below, the REV of the portfolio. If it is in line with the REV, the transfer price might be deemed compatible aid (subject to other criteria also being met).12

How can NPLs be transferred on a no-aid basis?

One way for NPLs to be transferred on a no-aid basis is for the portfolio to be transferred on market terms. This raises a question about how to identify the market price of the NPL portfolio during times of crisis.

One approach would be to consider the price of similar transactions that have recently taken place. However, often the market for impaired assets is illiquid, and a limited number of transactions are available for estimating the market price. This can make estimating the market price based on comparator analysis challenging, and, in some circumstances, potentially misleading.

The following factors would need to be taken into account when considering whether recent market transactions could be used to approximate the market price of the NPL portfolio in question:

- the comparability of the asset class and the financial characteristics of the observed transactions to the portfolio in question;

- the similarity of market characteristics across the member states in question, particularly as bankruptcy laws can differ between jurisdictions;

- the degree of liquidity (and demand) in the respective markets;

- the development and capacity of the NPL markets in question;

- the extent of information asymmetry between the buyer and the seller of the NPL portfolio.13

The ability to robustly apply comparator analysis to estimate the market price will differ depending on the asset category in question. For example, if the collateral underlying the loan is a tangible asset, such as a building or aircraft, it is likely to be more straightforward to estimate a market price. In contrast, if the underlying asset is more intangible, as in the case of some SME business loans or consumer loans, estimating the market price can be more challenging, as market prices rarely exist.

In some cases, it will not be possible to value assets on the basis of their current market value, particularly when the market for such assets has largely dried up.14 For example, during the early stages of the COVID-19 pandemic, activity in the NPL market in Europe declined significantly, and although it has now partly recovered, deal volumes remain significantly below levels prior to the onset of the pandemic.15 If the available comparators do not represent an appropriate control group for the transaction, adjustments may need to be applied to take account of (for example) country-specific factors (such as the expected timing of court procedures).

However, if there are no observable transactions that represent reliable comparators, the market price could be approximated using discounted cash flow (DCF) analysis. This approach would be in line with other areas of state aid practice, where the Commission has expressed a preference for the use of DCF analysis over comparator analysis.16 The Commission has also accepted the use of DCF analysis to estimate the market price in state aid cases involving the transfer of impaired assets.17

If it cannot be demonstrated that the transfer of the NPL portfolio is on market terms, however, this raises a question about whether the transfer can constitute compatible aid. As discussed below, an important element of this assessment is ensuring that the transfer price does not exceed the REV of the NPL portfolio.

Compatible aid: how can the real economic value be determined?

The REV concept was introduced by the Commission in its 2009 Impaired Assets Communication, and is defined as:18

[the] value reflecting the underlying long-term economic value of the assets, on the basis of underlying cash flows and broader time horizon [emphasis added]

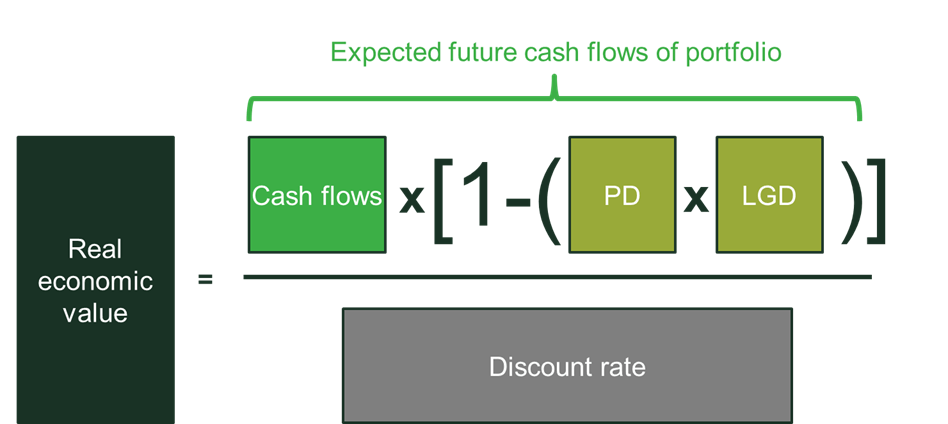

In the case of impaired assets, the REV of a portfolio can be estimated using the DCF approach, as the sum of the discounted cash flows that are expected from holding the portfolio until maturity.19 Put differently, the REV corresponds to the net present value (NPV) of the stream of expected future cash flows, reflecting the losses that could reasonably be expected over the remaining life of the assets.

In order to determine the REV of impaired assets, a number of parameters need to be estimated, as highlighted in Figure 2 and discussed in the first box below. In a portfolio context, the calculation would need to be undertaken for each payment in the portfolio, and cross-correlations would need to be considered.

Figure 2 Calculating the REV

Source: Oxera.

Calculating the REV: the key parameters

In order to calculate the REV, the schedule of likely recoverable cash flows needs to be calculated by adjusting the baseline cash flows for default risks, including the probability of default, the loss given default, the size of the loss, and the duration of the recovery, as described below.

- Calculate the probability of default (PD). Default rates for the asset(s)/portfolio(s) in question need to be projected. These can be estimated directly through econometric analysis, based on historical data (e.g. a logit or hazard model),1 a Black–Scholes–Merton model,2 or credit rating methodologies. However, if the loan has already defaulted, the PD equals 1 by definition.

- Calculate the loss given default (LGD). The next step is to determine the expected losses in the event of default for each payment date. Three factors contribute to the LGD of an asset: the value of the asset, the uncertainty associated with the value of the asset, and the degree of leverage. The LGD can be predicted based on historical data. In the case of lending to businesses, the LGD could be informed by data from the company’s financial accounts, while in the case of consumer credit, home ownership (a proxy for asset value) and lifestyle may constitute indicative proxies of asset risk and leverage. For loans that have already defaulted, survival analysis can be informative in calculating the LGD.3 The advantage of using survival analysis in this context is that we can model the time to default, and not just whether a borrower will default. Historical evidence indicates that time in default and recoveries realised so far are the main drivers of the expected cash flows for defaulted exposures.4

- Adjust cash flows for country-specific bankruptcy regulations. The cash flows are then adjusted for the seniority of claims imposed by country-specific bankruptcy regulations, information asymmetry, and specific contractual terms. As the recovery streams are uncertain and involve risk that cannot be diversified away (e.g. in a downturn or a fire sale situation), the final step is to calculate a discount rate that captures the time value of money, as well as a risk premium reflecting the undiversifiable risk associated with the specific asset class.

Sensitivity analysis should be undertaken to reflect variations in key assumptions, such as the asset class, the default rate, the loss given default, and the discount rate.5

Note: 1 Shumway, T. (2001), ‘Forecasting bankruptcy more accurately: a simple hazard model’, The Journal of Business, 74:1, pp. 101–24. 2 Hillegeist, S., Cram, D., Keating, E. and Lundstedt, K. (2004), ‘Assessing the probability of bankruptcy’, Review of Accounting Studies, 9, pp. 5–24. 3 Survival analysis models the time elapsed until a particular event (e.g. default) occurs, conditional on the specific characteristics of the borrower. See, for example, Fenech, J.P., Yap, Y.K. and Shafik, S. (2016), ‘Modelling the recovery outcomes for defaulted loans: A survival analysis approach’, Economics Letters, 145, pp. 79–82. 4 Dermine, J. and De Carvalho, C.N. (2006), ‘Bank loan losses-given-default: A case study’, Journal of Banking and Finance, 30:4, pp. 1219–43. 5 European Commission (2009), ‘Communication from the Commission on the treatment of impaired assets in the Community banking sector’, Official Journal of the European Union, 26 March, Annex IV.

The Irish Authorities followed a DCF analysis to estimate the REV in a state aid case relating to the establishment of the National Asset Management Agency (NAMA), as set out in the box below.

The NAMA case: estimating the REV

In the NAMA case the Commission accepted the use of DCF analysis to estimate both the market value and the REV of purchases of impaired land, development property and commercial loans from certain financial institutions.

In order to calculate the REV, the approach to valuing the following inputs into the DCF analysis differed from the calculation of the market price:

- the value of the underlying collateral, which reflected its long-term value, rather than the current market price. Econometric analysis was proposed to adjust the observed value of the collateral to reflect its long-term value, with adjustments to take into account the extent to which the price of the assets deviated from their long-term historical average, supply and demand projections, macroeconomic projections, and other aspects;

- the benefit of any ancillary security, such as personal guarantees or other corporate assets, which was taken into account when calculating the REV;

- the discount rate.

Source: European Commission (2010), ‘State aid N725/2009 – Ireland – Establishment of a National Asset Management Agency (NAMA): Asset relief scheme for banks in Ireland’, 26 February.

Recently, the Commission has announced that it is considering whether a simplified approach could be adopted to determine the REV.20 One option would be to use parameters estimated empirically from other data sources and studies (e.g. estimating the liquidity component based on past transactions). In order to estimate PDs and LGDs, rather than conducting primary analysis, a simplified approach would be to use the range of parameters estimated by European banks in their internal models for the purposes of regulatory capital requirements. All of these parameters would need to vary by asset type.

Looking ahead

Some forward-looking indicators, including ratings actions, indicate that corporate defaults are likely to increase in the coming years, particularly as the package of government support that was introduced to tackle the impact of the pandemic unwinds.21 In line with projections from the ECB, NPLs could increase sharply over the next few years.22

It is plausible that the state aid issues discussed in this article will gain further prominence in the next few years, as a greater number of banks seek to transfer NPLs off their balance sheets. Ensuring the appropriate valuation of the impaired assets will be important, alongside other measures, in order to prevent undue distortions to competition.

1 European Central Bank, ‘Economic Bulletin’.

2 See, for example, Haynes, J., Hope, P. and Talbot, H. (2021), ‘Non-performing loans – new risks and policies? NPL resolution after COVID-19: main differences to previous crises’, European Parliament study requested by the ECON committee, section 2.1, and European Central Bank (2020), ‘ECB Banking Supervision provides further flexibility to banks in reaction to coronavirus’, press release, 20 March.

3 European Banking Authority (2020), ‘Risk Dashboard, Data as of Q4 2020’, p. 39.

4 European Banking Authority (2020), op. cit., p. 39.

5 European Central Bank, ‘Non-performing loans’.

6 The strategy is often referred to as the NPL Action Plan.

7 European Commission (2020), ‘Communication from the Commission to the European Parliament, the Council and the European Central Bank, Tackling non-performing loans in the aftermath of the COVID-19 pandemic’, COM(2020) 822 final, 16 December.

8 See European Central Bank (2017), ‘Guidance to banks on non-performing loans’, March.

9 Debtwire (2020), ‘European NPLs – 1H20: An overview of the non-core and non-performing loan market’.

10 European Commission (2020), op. cit., p. 11.

11 See the Commission’s 2009 Impaired Assets Communication for the other criteria that would need to be met for the aid to be declared compatible. European Commission (2009), ‘Communication from the Commission on the treatment of impaired assets in the Community banking sector’, Official Journal of the European Union, 26 March.

12 European Commission (2009), op. cit.

13 Laprévote, F.-C., Gray, J. and de Cecco, F. (2017), Research Handbook on State Aid in the Banking Sector, Research Handbooks in Financial Law, Edward Elgar, p. 61.

14 Laprévote, F.-C., Gray, J. and de Cecco, F. (2017), op. cit., p. 149.

15 See, for example, Debtwire (2020), op. cit., p. 6.

16 For example, in the aviation sector, the Commission has expressed a preference for the use of profitability analysis, rather than comparator analysis, to assess whether agreements signed by state-owned airports with airlines are on market terms. See European Commission (2014), ‘Communication from the Commission, Guidelines on State aid to airports and airlines’, Official Journal of the European Union, 4 April, C 99/18 paras 59 and 61.

17 European Commission (2010), ‘State aid N725/2009 – Ireland – Establishment of a National Asset Management Agency (NAMA): Asset relief scheme for banks in Ireland’, 26 February.

18 European Commission (2009), op. cit., para. 40.

19 The DCF approach is a common methodology; however, depending on the context, more complex models, such as option pricing methodologies, might be needed. These are particularly relevant when valuing complex loan structures that might involve structured products or derivative components as part of the collateral.

20 European Commission (2020), op. cit., p. 17.

21 European Parliament (2021), ‘Non-performing Loans – new risks and policies, NPL resolution after COVID-19: main differences to previous crises’, March.

22 European Central Bank, ‘Non-performing loans’.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More