Paying up: the new economics of payment systems

Retail payments play an important role in the functioning of modern society. They are currently going through a period of upheaval due to changes in technology, consumer behaviour and regulation, and most recently the global COVID-19 pandemic. What are the underlying economics behind retail payment systems, and what are their implications for competition in the sector?

Nearly all economic transactions rely on a payment system of some kind (either electronic, or a physical ‘system’ such as cash). Payment systems enable funds to be transferred between two or more parties. They involve a number of participants, consist of a set of rules for a transaction (including technical standards), and require infrastructure for processing the transaction.

In March’s issue of Agenda in focus, we analysed the changing competitive landscape for retail payments, and explored the implications for the competitive dynamics and market outcomes in the sector.1 In this follow-up article we focus specifically on the underlying economics of retail payment systems.

Retail payments have long been characterised by the following three economic features:

- two-sided network effects—where the attractiveness of participating in a payment system depends on the level of participation on the other side of the market;

- extensive multi-homing on both sides of the market—whereby firms and consumers both make use of a range of payment systems, such as cash and credit cards;

- economies of scale—which mean that it can be more efficient to operate a platform with a large number of users (although regulatory and technical developments are tending to reduce the importance of this).

Here, we consider how each of these features have been shaping the evolution of retail payment systems in Europe, and how markets are now being disrupted by the COVID-19 pandemic.

Two-sided network effects

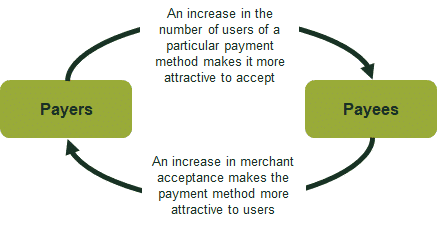

Retail payment systems bring together consumers (‘payers’) who are able to make a payment, and retailers (‘payees’) who adopt the means to accept that payment. As such, retail payments constitute ‘two-sided’ markets, serving two distinct types of user. Payees want to be able to accept payments on a system that payers are able to use; similarly, payers want to have access to systems that payees typically use. This means that the attractiveness of participating in a payment system is a function of the level of participation on the other side of the market—a ‘two-sided network externality’, as shown in Figure 1.

Figure 1 Network effects in payments

There are also ‘usage externalities’ in the decision about which payment system to use—a payer’s choice will result in both costs and benefits to the payee. These externalities may be asymmetric in nature, and can lead to skewed pricing structures (with higher fees on one side of the market than the other). This phenomenon can be seen in other industries—for example, placing adverts in a newspaper is desirable for advertisers, but not necessarily for its readers. For this reason, in order to align incentives, some newspapers are free of charge to readers, and make their revenue from advertisers. This pricing structure has been a topic of debate, and ongoing litigation,2 in the context of payment card interchange fees, but remains a feature of competition in the payments market in general.

The growth of a particular retail payment method does not depend solely on the ‘level’ of any given fee, but also on getting the right balance of fees across both sides of the market. In the case of retail payment schemes, it is the consumers, rather than the merchants, who choose which payment method to use when transacting. Consumers typically have a low willingness to pay, because they have a wide variety of options—including cash—for which they do not pay any direct transaction fees. Merchants value the payments that consumers make and are therefore typically more willing to pay than consumers are.

Card schemes such as Visa and American Express compete among themselves and with other payment methods such as cash. The aim of each platform is to persuade consumers to own and use its payment product. This can be achieved by having a better service offering, or offering lower prices and/or incentives. These demand dynamics mean that providers of retail payment products have an incentive to charge more on the merchant side than on the cardholder (consumer) side, in order to promote scheme growth and compete more effectively with other retail payment methods. This is true of card schemes, and also of other payment methods such as PayPal, which is free to use for consumers but comes at a cost to merchants.3

There may also be negative prices—incentives—on the cardholder side, which can come in the form of rewards or cashback or free services that the consumer values. Klarna, for example, allows shoppers a free online ‘try before you buy’ service at merchants that accept its payment product.4 Card issuers may include ‘contactless’ technology in their card products, typically at no extra cost to the consumer. Unsurprisingly, the attraction and take-up of online and contactless payment methods has been accelerated in response to the COVID-19 pandemic.5

These dynamics are driving increased use of digital payment systems in place of cash. However, it remains unclear which payment providers stand to benefit from this shift. Industries with network effects are often characterised as tending towards high levels of concentration, as large firms can benefit from increasing returns to scale. However, payments, like many network industries, has widespread multi-homing (i.e. users having access to more than one network), which allows for sustained competition between networks.6

Multi-homing

A user who joins only one network is said to ‘single-home’, whereas someone who joins more than one network is said to ‘multi-home’. Widescale multi-homing can increase competition between platforms by ensuring that the network effects enjoyed by one platform do not preclude other platforms benefiting from the same network effects. As such, multi-homing is an important determinant of competition in two-sided networks.7

In general, platforms compete more intensely for the side of the market that has more single-homing. This is because acquiring a user who single-homes means that the user is exclusive to that platform, and thus more valuable. By way of an example, consider the premium paid by video platforms to be able to host content exclusively. By attracting users on the single-homing side of the market, the platform gains market power on the other side of the market because it becomes the only ‘channel’ through which the single-homers can be accessed. As the single-homing side of the market is the side on which platforms compete most closely, it is also the one that is likely to result in lower platform fees to its users.

Multi-homing on both sides of the market can increase the competitive pressure on platforms, as it means that users participate in, and thus have easy access to, competing platforms. Any attempt to increase prices, for example, on either side of the market would be met with users switching their business to rival platforms. Growth in accessing one network is possible without being at the expense of access to another network, thereby breaking the winner-takes-all dynamic that can apply in markets where single-homing is prevalent on one or both sides of the platform.

In retail payments, multi-homing on both sides of the market enables providers to compete with each other. Notwithstanding some adjustments that have been made during the COVID-19 pandemic, physical stores generally continue to accept cash as well as a range of electronic payment methods (such as cards and digital wallets on mobile phones); meanwhile, a typical consumer has access to both cash and a card, and increasingly has access to other electronic payment methods (including digital wallets) as well. Online, the range of options for electronic payment extends beyond cards to include methods such as PayPal, Klarna, Trustly or other services that make use of bank transfers. The use of smartphones has made multi-homing extremely easy for consumers—the only thing required is for them to download the relevant app and sign up.

The range of payment systems that the typical consumer has access to online is likely to further increase due to regulatory developments under the EU’s second payment services Directive (PSD2)—this is also referred to as ‘Open Banking’. This Directive makes it possible for new entrants to set up their own payment method using the interbank infrastructure for transaction processing at relatively low cost. In such a setting, a typical consumer with a current account would have access to at least one card (debit cards are usually issued with a current account) and the ability to make payments using an interbank scheme through a payment initiation service provider (PISP) or a card scheme.8

In future, the advent of initiatives such as the EPI (European Payments Initiative), the digital payment system Libra, and central bank digital currencies means that there will be more players with whom individuals can multi-home. These initiatives will allow for the development of rival payment systems. Where one payment method offers substantial mutual advantages to merchants and customers relative to rival payment methods, this widespread multi-homing can be expected to facilitate rapid switching to that payment method. This is particularly true in an environment where consumers are being prompted to try new services in response to the COVID-19 pandemic.

Economies of scale and scope

Another important issue concerns the unit costs of participating in the retail payments industry. For any given payment system there will be at least some economies of scale. Economies of scale can occur because fixed costs do not vary with the number of units produced. Thus, as the number of units—and, in the case of payments, the number of transactions—increases, the average cost per unit decreases. Historically, having more transactions led to increased efficiency, which in turn led to greater competitive strength. This acted as a barrier to entry for smaller providers and may have led to a more concentrated market.

However, in the retail payments industry, regulatory and technical developments are tending to reduce the importance of economies of scale, thus promoting competition. For example, new entrants such as PayPal and Klarna have been successful in building their own systems, and PSD2 makes it possible for new entrants to set up their own payment method using interbank infrastructure at relatively low cost.

There are also important interactions with economies of scope, which arise in instances where it is cheaper to produce a range of products from a common cost base.9 In a digital economy, economies of scope can extend beyond the provision of multiple payment methods, and can include other services of value to the customer. Consider the growth of peer-to-peer (P2P) payment networks, where the technical infrastructure and user data of a social network uses—and benefits from—the provision of an associated payment method. For example, Alipay and WeChat have become ‘super apps’ that not only act as payment methods, but also provide consumers with a one-stop solution for their daily activities—from booking medical appointments, tracking physical activity, and paying tuition fees to playing games, shopping, and socialising.10 Such integration enabled Alipay and WeChat to deepen their relationships with customers in a way that traditional payment providers would find difficult to achieve.

Technology also helps merchants that would not historically have achieved economies of scope by offering a payment method to do just that, meaning that they are able to cross-sell the payment product to a loyal user base and potentially benefit from the data generated by those users. As the popularity and importance of digital payment platforms continues to grow, again accelerated in places following the COVID-19 pandemic, the above examples suggest that e-commerce, mobile and social media platforms that integrate a payment system into their consumer offering are set to become increasingly important players in this market.

How will payments work in future?

Understanding the economics of retail payments provides a lens through which trends in payments, and the more recent impacts of COVID-19, can be viewed.

Network effects are a central feature of any electronic payment product, and understanding these effects is crucial to understanding competitive dynamics in payments.

Success for both existing providers and new entrants comes from building traction in the customer base on both sides of a transaction. While in the past industries with network effects were characterised as tending towards high levels of concentration, changes in technology, regulation and consumer behaviour (such as multi-homing) now mean that the retail payment industry can sustain multiple providers. The changing landscape will enable these dynamics to play out as new entrants and products come to market.

As discussed, the COVID-19 pandemic is accelerating existing trends in the payments industry. The perception that cash could spread the virus is changing payment behaviour by users and also by firms, which have increased spending limits on contactless transactions.11 It may also fast-track regulatory changes, although what exactly this regulation will look like remains to be seen. This makes it even harder to predict which providers are going to be leaders over the next decade or so, and things that once seemed distant, such as central bank digital currencies, may more quickly come to the fore.

1 Oxera (2020), ‘Retail payments: a changing European landscape’, Agenda in focus, March.

2 This is being considered by the UK Supreme Court at the time of writing in the case of Walter Hugh Merricks CBE v Mastercard Incorporated and Others.

3 A four-party card scheme involves four parties: the cardholder, the merchant, the issuer (the cardholder’s payment service provider, PSP), and the acquirer (the merchant’s PSP). The scheme rules set out the terms of dealing between the issuer and the acquirer.

4 Dooley, J. (2019), ‘Shopify Style Series: Try Before You Buy is the Hottest Item You Can Offer this Year’, Klarna, 20 February.

5 Guerin, A. (2020), ‘The role of research and insight in COVID-19 times’, Ipsos, 29 April.

6 Armstrong, M. (2006), ‘Competition in Two-Sided Markets’, The Rand Journal of Economics, 37:3, Autumn, pp. 668–691.

7 See also Oxera (2020), ‘Home advantage? Who wins in multi-sided platform competition?’, Agenda in focus, February.

8 Under PSD2, a PISP lets a customer pay companies directly from their bank account.

9 Niels, G., Jenkins, H. and Kavanagh, J. (2016), Economics for Competition Lawyers, 2nd edition, Oxford University Press, section 3.51.

10 McKinsey Global Institute (2017), ‘China’s Digital Economy a Leading Global Force’, August, pp. 12–13.

11 Auer, R., Cornelli, G. and Frost, J. (2020), ‘Covid-19, cash, and the future of payments’, BIS Bulletin No 3, 3 April. Finextra (2020), ‘Mastercard enables contactless limit raise across 29 countries’, March.

Download

Contact

Joseph Bell

PartnerContributors

Related

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More