Italian water regulation: a changing scene

Regulation of the Italian water sector has undergone profound change over the past decade. Until 2011, it was based on local contracts and lacked a nationwide tariff framework, and the sector outlook appeared disordered and complex—as discussed in a 2016 Agenda article. Since 2012 overall performance has improved. Lorenzo Bardelli, Director of the Water Systems Directorate at ARERA (formerly AEEGSI), and Alberto Biancardi, former Commissioner of ARERA, consider how this has been achieved and ask what is next for the regulator.

See Bardelli, L. (2016), ‘The strange case of water regulation in Italy’, Agenda, April. In December 2017, law n. 205/2017 assigned regulatory and control functions to Autorità per l’energia elettrica il gas ed il sistema idrico (AEEGSI) over the waste cycle. As a result, AEEGSI was renamed Autorità Italiana di Regolazione per Energia Reti e Ambiente (ARERA). This important development is outside the scope of this article.

In December 2011, the Italian Authority for Electricity and Gas was assigned regulatory and control functions over water regulation in Italy.1 Since then, the presence of the regulator has promoted decision-making among stakeholders and contributed to the development of the sector by increasing transparency, facilitating industry aggregation and promoting investments. Specifically, ARERA has put in place a series of measures with the following objectives:

- applying best practice from the Italian energy sector, which has been under ARERA’s oversight since 1995;

- developing a transparent, nationwide set of rules, while preserving local decision-making powers enshrined in primary legislation;

- devising a flexible framework to capture the specifics of the Italian context.

With regard to the first point, the water sector has evolved from an ‘input-based’ regime to an ‘output-based’ one. The introduction of service quality regulation, based on best practice from the Italian electricity and gas sector, has been a key milestone in this development.

The second objective concerns ARERA’s role within the multi-level governance framework, according to which functions and powers attributed at a local level should be consistent with the overall framework designed by the national regulator.

The third objective has been to design a transparent framework with clear rules on the responsibilities of local and central decision-makers:

- while local authorities have kept their power over the planning and investment phase, the national regulator has designed a set of industry-wide tariff rules;

- ‘menu regulation’ (described below), the introduction of a standard business-planning model, and the definition of a common template for concession agreements between operators and municipalities, are all consistent with a multi-level governance framework;

- the recent decision taken by Italian Parliament to ask the regulator to flank local authorities in their planning functions can be considered a further step in the development of comprehensive and responsive multi-level regulation.

Learning from best practice

The regulator applied its experience of 17 years of energy regulation to the water sector. For example:

- new data-gathering procedures, by means of a web-based platform, have facilitated data collection among thousands of operators;

- a clear methodology for the calculation of the regulatory asset base (RAB) has been introduced through simple software, integrated into official documents and legal declarations. This has represented a fundamental step in promoting transparency and accountability in a sector that, historically, was funded mainly by public expenditure;

- ex post recovery of investments has introduced a fundamental shift compared with past methodologies;

- investigation of specific complaints, based on the experience of complaints management in the energy sector, has led to an improvement in consumer satisfaction;

- enforcement activity has been improved through both inspections and sanctioning powers.

More generally, the transposition of the experience of the energy sector has enabled the regulator to build a platform for the collection of relevant financial and technical data and documents from all water operators. Such data has been instrumental in the enforcement of service quality regulation, which was put in place in 2015.2

This new service quality regulation regime introduced a set of common standards and obligations, such as terms for automatic compensation for customers, billing and payment rules, and answers to written requests.

Nationwide rules and tools for capturing sector-specific issues

In 2012, water investment amounted to less than €1bn per year—about one-third of the required level. An increase in investment levels has been a key objective of the water regulator.

In designing the cost-recovery framework, there were three main challenges:

- how to deal with the outcome of a 2011 referendum, which required ARERA to develop an innovative approach to account for infrastructure and fiscal costs, consistent with the legislative framework;3

- the introduction of a methodology for setting operating expenditure (OPEX) and capital expenditure (CAPEX) on the basis of both ex ante and ex post data;

- the objective of full cost recovery in the presence of a gradual reduction of public expenditure, which required the introduction of a specific tariff component (‘FoNI’) to recover maintenance expenditure of existing infrastructure from public funds.

In terms of OPEX, it is interesting to note that ‘controllable’ and ‘uncontrollable’ OPEX were treated differently. For controllable OPEX ARERA applied a rolling cap mechanism, allowing the firm to partially benefit from any underspend; whereas with uncontrollable OPEX costs are passed through. The distinction proved to be very useful in the starting phase of the new regulatory regime, in that it allowed ARERA to better understand the full scope for efficiency improvements.

A further element was the design of a common framework for the system of concession contracts4 between local authorities and operators, which harmonised the balance of risk between the respective entities.

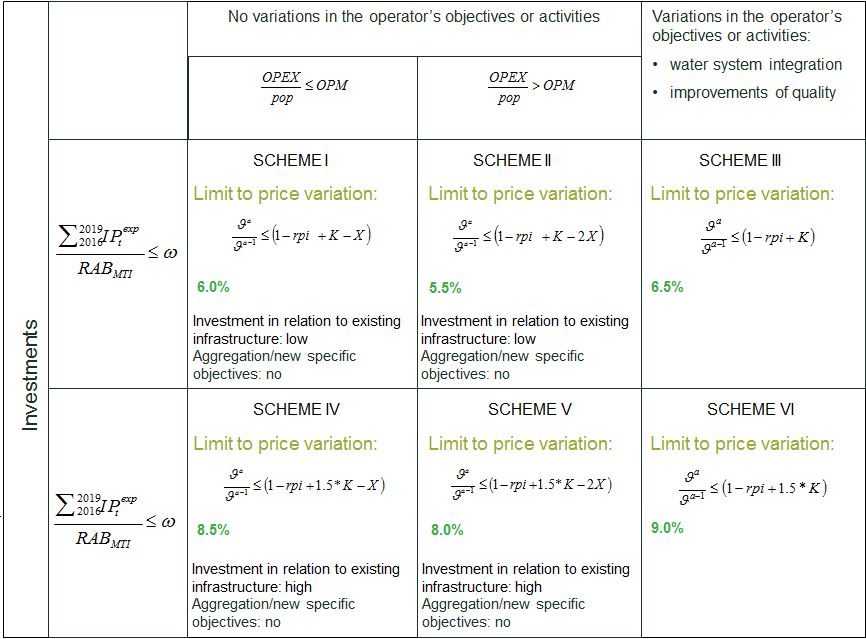

Within the second regulatory period (MTI-2, 2016–19),5 the regulator has the twofold objective of promoting investments and incentivising industry consolidation. It has achieved this through ‘menu regulation’, which has reinforced the incentives on the operators involved in the aggregation process. Menu regulation, which has been in place since the first regulatory period, sets the maximum allowed price increase on the basis of:

- the level of planned investments (net of grants), relative to the RAB;

- the existence of planned variations in quality improvements, or further integration of water activities;

- the level of unit OPEX compared with a benchmark unit cost.

Based on certain predetermined investment thresholds and the objectives considered at the local level, it is possible to select a ‘scheme’ (see Table 1). It is then possible to calculate the total allowed costs level and determine the tariff multiplier, ϑ—that is, the ratio between allowed costs expected in one year and the revenue corresponding to the tariff applied in the base year.6 Under such a regime, aggregation becomes an explicit target.

Table 1 Tariff–setting in the second regulatory period (MTI-2, 2016–19)

Source: AEEGSI (2015), ‘Approvazione del metodo tariffario idrico per il secondo periodo regolatorio MTI-2’, Decision 664/2015/R/IDR.

This approach has brought several benefits:7

- water operators and municipalities are free to choose their preferred level of planned investments, the timeframe, the geographical location, etc.;

- investment decisions have precise and measurable consequences for tariff levels, as well as for the accountability rules to be adopted and other regulatory rules;

- the tariff is cost-reflective, and operators can pass on investment costs only if such costs have actually been borne.

Some results and future challenges

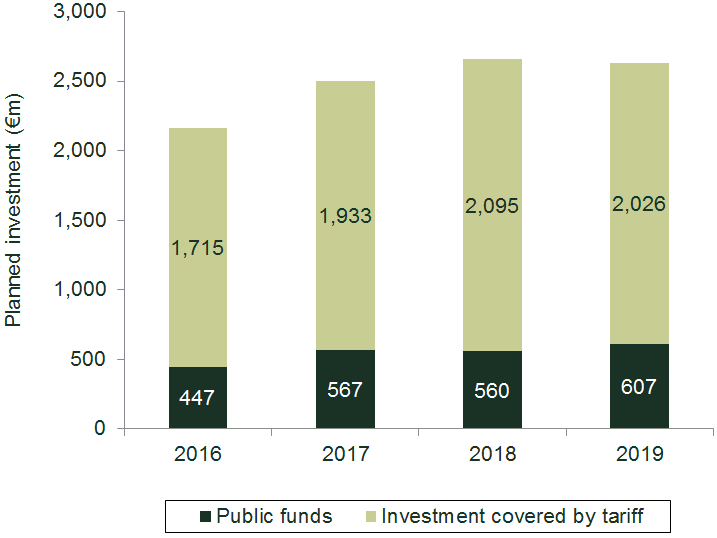

The reaction of operators, investors and consumers to the regulatory reform appears to have been positive. The pace of the investment process has sped up. Investments increased from €1bn in 2012 to around €1.5bn in 2015, with a further year-on-year increase in 2016 to €1.72bn. Data suggests that more than €2bn per year will be invested over the ongoing regulatory period (see Figure 1).

Figure 1 Trend of planned investments for the period 2016–19

A significant reduction in the number of operators in the Italian water industry was observed in 2017 compared with 2012, from around 2,900 (most of which were small) to 2,100.8

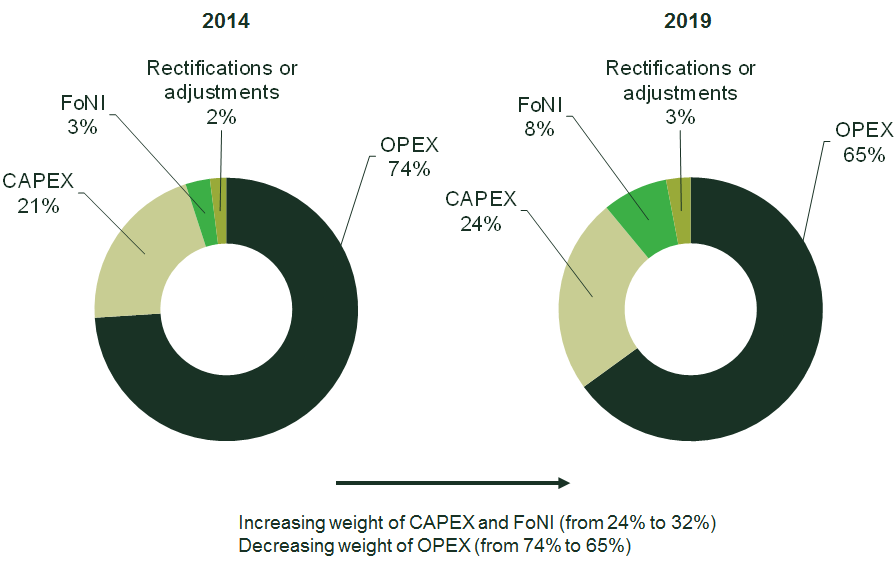

Rising investment levels and aggregation trends have led to an average yearly price increase of slightly above 4%, which appears to have been accepted by consumers. The sharp increase in investment has been eased by a reduction in the share of OPEX. In this regard, it is striking that the overall share of OPEX amounted to 74% in 20149 compared with 30–35% in some other European countries. Since 2014 the gap has shrunk, and the OPEX share is forecast to decrease to 65% by 2019. The reduction has been achieved through both a CAPEX increase and a reduction in OPEX, resulting from increased efficiency in the Italian water system as a whole (see Figure 2).

Figure 2 Composition of allowed revenues

Despite these promising results, more effort is required and a great deal is yet to be accomplished:

- the objectives of investment growth and aggregation have not yet been fully met. The two targets are linked: it is very unlikely that small operators can put in place significant investment plans;

- the sector lacks significant investment in other areas such as water supply, abstraction and leakage reduction. An increase in investment in these specific areas is required to mitigate climate change risks;

- while in some areas, mainly in Northern and Central Italy, a large increase in investment has been observed, in other areas investment levels have been stable. Often, local authorities have been unable to propose a suitable investment plan.

New regulatory measures

Over the last few months, ARERA’s initiatives have aimed to overcome the sector’s most pressing challenges. For example, it has enforced a new framework for quality of service regulation10 and introduced six performance indicators,11 with a view to obtaining granular data and incentivising investment in certain critical areas through a system of penalties and rewards.

Another significant improvement comes from the 2018 national Budget Law (n. 205/17), which requires ARERA to identify a list of priority investments in the water infrastructure section of the National Water Plan. As part of this, the regulator can support local authorities in drawing up the Plan, and is responsible for monitoring its implementation.12 It is worth noting that:

- the recent decision of the Italian Parliament is fully aligned with the multi-level governance framework, retaining the planning decision at the local level;

- the regulator provides technical support to local authorities only if they fail to provide the necessary information (for example, on the amount of the planned investment, or the investment timeframe).

Final remarks

Since 2012, the Italian water sector has shown an improvement in overall performance. The independent regulator has facilitated decision-making among stakeholders. Investments have almost doubled and the number of operators has been decreasing, with a slight upturn in tariffs.

Nevertheless, the need for specific investments and heterogeneity across geographical areas calls for further regulatory measures. The full impact of the new regulatory measures (such as quality regulation, and support to local authorities in the planning phase) is yet to materialise, although preliminary evidence indicates that regulation can still contribute to the development of the sector.

Lorenzo Bardelli and Alberto Biancardi

1 Law n. 201/2011—the ‘Save Italy’ law.

2 ARERA (2015), ‘Regolazione della qualità contrattuale del servizio idrico integrato ovvero di ciascuno dei singoli servizi che lo compongono – RQSII’, Decision 655/2015/R/IDR.

3 The referendum proposed a repeal of an article in a legislative decree stating that a fair amount must be assured on the invested capital. Following this, a number of formal appeals were made by consumer associations against the regulator. Article 154 (Tariffa del servizio idrico integrato), legislative decree 3 April 2006, n. 152, para. 1.

4 ARERA (2015), ‘Convenzione tipo per la regolazione dei rapporti tra enti affidanti e gestori del servizio idrico integrato – Disposizioni sui contenuti minimi essenziali’, Decision 656/2015/R/IDR.

5 ARERA (2015), ‘Approvazione del metodo tariffario idrico per il secondo periodo regolatorio MTI-2’, Decision 664/2015/R/IDR.

6 Once ϑ is determined, it is multiplied for all existing end-user tariffs in order to calculate (holding scale constant—for example, number of consumers and volumes) a tariff structure that is coherent with the total amount of costs to be recovered.

7 ARERA (2012), ‘Regolazione dei servizi idrici: approvazione del metodo tariffario transitorio – MTT’, Decision 585/2012/R/IDR.

8 By the end of the first regulatory period the number of operators had reduced to around 2,600.

9 Reaching 90% in some circumstances.

10 ARERA (2017), ‘Regolazione della qualità tecnica del servizio idrico integrato ovvero di ciascuno dei singoli servizi che lo compongono (RQTI)’, Decision 917/2017/R/IDR.

11 Water losses, water interruption, water quality, sewerage system adequacy, sludge disposal and wastewater quality.

12 ARERA (2018), ‘Avvio di procedimento relativo agli interventi necessari e urgenti per il settore idrico ai fini della definizione della sezione “acquedotti” del Piano nazionale, di cui all’articolo 1, comma 516, della legge 205/2017’, Decision 25/2018/R/IDR.

Download

Contact

Dr Leonardo Mautino

PartnerGuest authors

Lorenzo Bardelli

Alberto Biancardi

Related

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More