Two-sided market definition: some common misunderstandings

The European Commission is consulting on updating its 1997 Market Definition Notice, which provides important guidance on identifying relevant markets in competition cases. One hotly debated topic is defining markets for two-sided platforms. We discuss some common misunderstandings on this topic, including on how to apply the hypothetical monopolist test to digital platform markets.

A longer version of this article is available at Oxera (2020), ‘Two-sided market definition: some common misunderstandings’, September.

Market definition is an important step in competition cases. The Commission’s Market Definition Notice of 1997 sets out the principles for defining relevant markets, including the hypothetical monopolist or ‘SSNIP’ test—where SSNIP stands for small but significant and non-transitory increase in price.1 The SSNIP test captures the idea that if a hypothetical monopolist is able to profitably raise prices for a group of products (or geographic area), then that group (or area) constitutes a relevant market since there is insufficient competitive pressure from outside products (or areas). However, economic thinking on market definition has developed since 1997.2

One topic that is important to cover in the Commission’s update is two-sided market definition. This has received widespread attention due to a proliferation of competition cases involving digital platforms. These are often referred to as two-sided platforms as they bring together two (or more) types of user—for instance, online travel sites connect holidaymakers with hotels, and social media sites bring together users, app developers and advertisers. There are many questions, and misunderstandings, around the application of market definition to two-sided platforms. Here we address some of these.

Can the SSNIP test be applied to two-sided platforms?

The answer is yes: as shown below, one can ask whether a hypothetical two-sided platform monopolist is able to impose a SSNIP, and from this one can draw conclusions about the relevant market. In a number of cases, courts and competition authorities have recognised the two-sided nature of platforms when defining the relevant market: examples include the US Supreme Court ruling in American Express (2018), which involved payment card services; and the Court of Amsterdam ruling on Funda, involving a property search website (2018).3 However, this is not always the case—for example, in their investigations into Booking.com (an online travel platform), the Swedish and Italian competition authorities did not base their market definition on the nature of the platform, but on a comparison of product characteristics.4

When is a platform two-sided for the purposes of market definition?

‘Two-sided platform’ has become a common label for all sorts of digital platform, not just in competition policy but also in the business community. Many digital platforms do indeed bring together different types of user on different sides, but they usually have a number of additional economic characteristics, and it is important to be explicit about these to avoid over-generalisation. The main characteristics can be described as follows (although sometimes different commentators use different terminology).

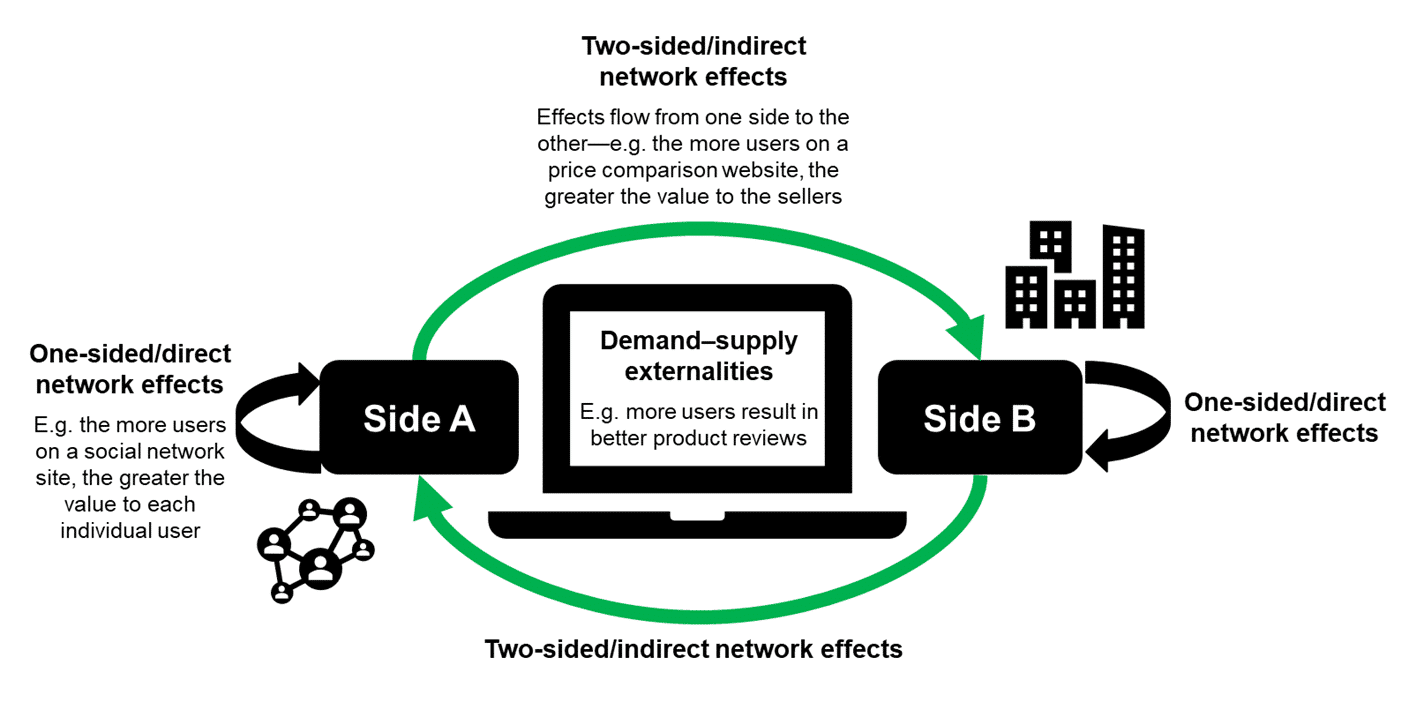

- On the demand side, platforms can combine one-sided, or direct, network externalities, and two-sided, or indirect/cross-group, network externalities, as illustrated in Figure 1 below. One-sided effects are between the same type of user—Facebook becomes more valuable to you the more of your (real or virtual) friends you can connect with. Two-sided effects are between different types of user—Facebook is more valuable to advertisers the more users it has.

- On the supply side, a platform may exhibit economies of scale—where its average costs decrease with size—or economies of scope—where it can efficiently offer multiple services simultaneously. Platforms may also offer complementary services—i.e. services that are more valuable when consumed together, such as a messaging or payment functionality on the platform. Sometimes these are offered on the platform by third-party providers (or ‘complementors’). Complements and two-sided network externalities can have similar effects, but a platform offering complementary services does not make it two-sided as such.

- Digital platforms are particularly effective at combining these demand-side and supply-side characteristics and reinforcing the feedback effects. These could be labelled ‘demand–supply externalities’. More users on a platform mean more and better data, and through data-enabled learning this allows the platform to improve its efficiency and functionality, which in turn attracts more users.5 For example, the more drivers use Waze, the better its traffic predictions become, and the more attractive it becomes to other drivers.

Figure 1 Types of network effect that platforms can exhibit

There are many types of digital platform, and they may combine the above characteristics to different degrees. Before turning to market definition, it is important to identify whether the two- (or multi-)sided nature of the platform in question is of significant importance to the platform operator’s commercial decisions relative to its other characteristics. If it is, it should be factored into the SSNIP test.

Where do you start with the SSNIP test?

It is important to be explicit from the outset about the nature of the hypothetical monopolist. Does it operate on both sides of the platform, or just one? That is, can it alter the attractiveness (price, quality, availability) of the platform to all types of user? This is an important question, as it determines the flexibility of the monopolist to maximise profits and therefore the results of the market definition exercise; but it is not often acknowledged. The most sensible approach is to define the hypothetical monopolist in such a manner that it most closely reflects reality. If the real platforms in the market are two-sided, with indirect network effects between the two sides, then so should be the hypothetical monopolist.

How does the SSNIP test work for two-sided platforms?

In essence, the SSNIP test is about a comparison of prices in two situations: before and after hypothetical monopolisation of candidate products or services. The question is whether the price in the latter situation is more than 5–10% higher than the price in the former. The price after hypothetical monopolisation is simply the result of the monopolist maximising its profits over all the products that it controls—in this case, the two-sided platform(s).

There is an often-overlooked difference between the pure SSNIP test as it functions in theory, and the critical loss analysis used to apply the test in practice. We discuss critical loss analysis below. Here we answer the current question with reference to the theoretical SSNIP test, where the hypothetical monopolist sets profit-maximising prices.6

Just like the real platform operator, the hypothetical platform monopolist sets profit-maximising prices on both sides simultaneously. The monopolist will take into account not only the fact that a price increase on one side results in a sales loss on that side (which depends on the own-price elasticity), but also the fact that this sales loss makes the platform less attractive to the other side (reflecting the externality effect).

Where close substitutes are brought under the control of the monopolist, there is upward pricing pressure, and therefore prices will normally increase after the hypothetical monopolisation. There is no reason why the percentage price increase should be the same on both sides. It is well known that two-sided platforms tend to have a skewed pricing structure across the two sides. Typically, the platform will set a lower (or zero, or even negative) price on the side that exerts a stronger positive externality on the other. The platform will charge more on the side where the externality exerted on the other side is weaker. By the same token, price increases on both sides that result from hypothetical monopolisation may also be asymmetric.

This can give rise to three types of outcome of the hypothetical monopolisation:

- the price increases on both sides are greater than 5–10%;

- the price increases on both sides are below 5–10%;

- the price increase on one side (A) exceeds 5–10%, but on the other side (B) it is less than 5–10%.

In outcome (i), the candidate group of products/services forms the relevant market. In outcome (ii), the candidate group of products must be expanded to include the nearest substitute. Outcome (iii) is trickier to interpret. It would seem that the monopoly platform operator faces stronger competitive constraints on side A (where it cannot raise prices by more than 5–10%) than on side B (where it can). What does this imply for market definition? There are two possible interpretations.

The first interpretation follows the smallest-market principle established in the purest form of the hypothetical monopolist test. This entails that the two platforms are a relevant market because the platform monopolist imposes a SSNIP—i.e. on side A. A pocket of market power has been identified; bringing the platforms under common ownership allows the monopolist to raise prices on side A. The second interpretation of outcome (iii) is that the test so far does not provide the full picture of competitive constraints on the platform. Side B clearly still faces competition from other substitutes that prevent a SSNIP. These other substitutes must be identified.

There is no single correct interpretation. It depends on the competition concern that the market definition exercise is aiming to shed light on. If the competition concern relates purely to one side (say, side A here), the first interpretation based on the smallest-market principle will be informative. However, if the competition concern is about conduct that affects both sides of the platform—as will often be the case given the close interaction between the two sides—the second interpretation is more appropriate. Delineating the market based on the price increase for side A only would be too narrow an approach. It would overlook the fact that the platform still has to compete hard for users on side B.

Should there be one market for the platform, or one for each side?

This question has generated much confusion, probably because it captures two distinct aspects. One is about the process of applying the SSNIP test, and one is about the outcome. In terms of process, it follows from the above description that it is inherent in the test that after hypothetical monopolisation there will be price changes on both sides of the platform, given that the monopolist controls both sides and takes into account the externalities between them. Thus, one always looks at both sides in the SSNIP test, and one always takes into account the externalities between them. The outcome of the test is then a matter of how the results are interpreted, as discussed above with reference to outcomes (i), (ii) and (iii).

However, as mentioned above, in practice, the SSNIP test is often applied through critical loss analysis, where the 5–10% price increase is imposed exogenously—i.e. by the analyst carrying out the market definition exercise. The question becomes whether this price increase is profitable. If the price increase results in a sales loss above the critical level, it is not profitable, and hence the market should be defined more widely.7

The literature does not identify a single correct approach for performing critical loss analysis in two-sided markets. One could apply the SSNIP test first on one side and then on the other, or on both sides simultaneously. Or one could start from a 5–10% increase on the total platform price or a weighted-average or composite price charged by the platform,8 and make an assumption about how this is translated into price increases on both sides. When applying such critical loss analysis to two-sided platforms, one can obtain the same three types of outcome discussed above. Again, the relevant markets will depend on the interpretation of these outcomes.

Is there a distinction between transaction and non-transaction platforms?

The short answer is no. From a theoretical perspective, the above logic—that the hypothetical monopolist takes into account the externalities between the two sides of the market when setting prices—applies to all two-sided platforms where such externalities are strong.9

In the literature, and in some competition cases, a suggestion has been made that there is a distinction between transaction and non-transaction platforms for market definition purposes. For example, the UK Competition and Markets Authority referred to this distinction in its 2017 decision on the merger between Just Eat and Hungryhouse, two online food ordering platforms bringing together restaurants and consumers:10

We first consider whether separate markets should be defined on each side of the platform. For this purpose, a distinction can be made between two-sided markets which facilitate transactions between customers on each side of the platform (such as auction houses or credit card services) and those two-sided platforms which do not facilitate transactions (eg ‘media-type’ platforms like radio stations and newspapers).

In some two-sided markets, which do not facilitate transactions between each side of the platform, the Parties may face very different competitive constraints on each side of the market. For example, a local radio station may face very different constraints in the market for selling advertising from those it faces in the market for attracting listeners. In those cases, it may be necessary to define two separate markets: one on each side of the platform, with distinct product and geographic scopes and separate sets of competitors and competitive constraints.

In the case of a two-sided platform where the platform is ‘matching’ or facilitating transactions (as is the case for food delivery marketplaces), a single market definition is appropriate, which takes account of the competitive constraints on both sides of the market and assesses the hypothetical monopolist’s ability to increase the price of concluding a transaction, given the number of close substitutes on each side and the impact of any [indirect network effects] on the platform.

However, it is not the lack of a transaction that is driving the potential differences in market dynamics; it is rather that the strength of the network effects in both directions may differ between radio stations and matching marketplaces.

Furthermore, it is not even clear in practice that such a distinction between transaction and non-transaction platforms would be workable. In the real world there is a spectrum of interactions between the different sides of platforms, with transactions simply being at one end of the spectrum, and mere interactions of various sorts being at the other. What matters for market definition is the nature of the externalities between the two sides and how the platform operator takes these into account when setting prices. This is the same for all two-sided platforms with network externalities, regardless of the precise nature of the interaction between the sides.

Take the example of price-comparison websites for specific products, such as private homes, car insurance or flights. A range of business models and charging structures exist for such sites, and not all of them are clearly classifiable as ‘transaction platforms’. Some of these platforms—for example, in real estate—charge the seller primarily for placing an advertisement on the site. Others go a step further and (in addition or instead) charge the seller each time a potential buyer clicks on the advertisement. Yet others may charge the seller each time a potential buyer contacts the seller via the platform and requests a quote, as in the case of price-comparison sites for car insurance products. Finally, some price-comparison websites have turned into platforms where the buyer and seller actually exchange the product, and the platform charges a commission fee (to one or both sides). Which of these websites can be classed as transaction and non-transaction platforms is not clear, but nor should this be a decisive question for market definition. They all set their prices on both sides as a function of the own-price elasticities on each side and the externalities between the sides.

A framework for market definition

Two-sided market definition is far from straightforward. Yet, as we have set out here, the SSNIP test provides a useful framework for market definition that can also be applied to two-sided platforms. It is important to take into account the externality effects between the two sides, for the simple reason that real-world platforms also base their commercial decisions on such externalities. Focusing on only one side risks overlooking an important competitive dynamic, which can lead to an incorrect market definition.

Market definition is meant to be informative for the subsequent analysis of market power (or dominance) and effects on competition. Once the market for the two-sided platform in question has been defined, one must still determine the degree of market power of the platform vis-à-vis competitors in the market. This raises some further challenges, such as measuring market shares (which can differ between the sides), the degree of multi-homing by users of the platform on one or both sides, and the dynamic nature of the market—is the market prone to ‘tipping’ to one dominant platform, and is there potential competition for the market by new platforms?

1 European Commission (1997), ‘Notice on the definition of relevant market for the purposes of Community competition law’, Official Journal of the European Communities, 97/C 372/03, 9 December.

2 European Commission (2020), ‘Commission consults stakeholders on the Market Definition Notice’, press release, 26 June.

3 Ohio v. American Express Co., 585 U.S. 12 (2018); Rechtbank Amsterdam, VBO Makelaar v. Funda en NVM, ECLI:NL:RBAMS:2018:1654, judgment of 21 March 2018. See Niels, G. (2018), ‘Funda-mentals of Article 102: A dominant platform, but no abuse’, Agenda, September.

4 Konkurrensverket, Decision 15/04/2015, Ref. no. 596/2013; Autorità Garante della Concorrenza e del Mercato, Provvedimento n. 25422, I779 – Mercato dei servizi turistici-prenotazioni alberghiere online, Bollettino n. 14, 27 April 2015.

5 See Hagiu, A. and Wright. J. (2020), ‘Data-enabled learning, network effects and competitive advantage’, working paper, June.

6 For a detailed explanation of the difference between the SSNIP test and critical loss analysis, see Niels, G., Jenkins, H. and Kavanagh, J. (2016), Economics for Competition Lawyers, Oxford University Press, second edition, chapter 2.

7 The critical sales loss level can be derived with a simple formula based on the percentage price increase and the profit margin (although for two-sided platforms the formula becomes more complicated).

8 If a platform charges a price along the same dimension for both sides (e.g. a percentage of the value of the transaction between the sides), one can determine a ‘total platform price’, which is the sum of the two percentages. If (more commonly) the platform charges along different dimensions between the sides, or sets multiple charges along different dimensions on the same side (e.g. a membership fee and a usage fee), one still can determine weighted-average or composite ‘total platform price’.

9 See Niels, G. (2019), ‘Transaction versus non-transaction platforms: A false dichotomy in two-sided market definition’, Journal of Competition Law & Economics, 15:2−3, pp. 327–57.

10 Competition and Markets Authority (2017), ‘Just Eat and Hungryhouse’, 16 November, para. 4.11.

Download

Contact

Dr Gunnar Niels

Managing PartnerContributors

Related

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More