Post-COVID airport regulation: a clear path?

In April 2020, as governments around the world imposed travel restrictions, we asked what the long-term effects would be for the aviation sector, with a focus on the implications for economic regulation.1 One year on, many restrictions remain. In this article, we ask: what has happened since? What are the key challenges for airport regulators and industry stakeholders? And what might the future hold?

One year on from the introduction of lockdown measures across Europe and around the world, COVID-19 remains the biggest issue currently facing the aviation sector. Over the course of the last year, governments worldwide have introduced a variety of travel restrictions, ranging from complete travel bans to bans on entry of non-citizens, quarantining (in hotels or at home), and testing.

While the pace of vaccine development has provided some positive news, it will take many months, and in some cases potentially years, for vaccines to be rolled out to the entire adult population. There is also increasing concern regarding variants of COVID-19, which could reduce, or in the worst case completely undermine, vaccine efficacy.2

Consequently, travel restrictions could remain in place for some time.

Costs and COVID-19

These restrictions can be costly—for example, the PCR tests required as pre-departure tests for entry into most countries cost €69 at Frankfurt Airport3 and £99 at Heathrow Airport.4 There may also be indirect costs in terms of lost work days if people have to quarantine and cannot work from home. Perhaps most importantly, the constantly changing nature of these restrictions, and differences between countries, create uncertainty for travellers, potentially hindering the recovery of demand. These factors, combined with lower output in the economy (GDP) even once travel restrictions are removed, may mean that the path to recovery for the aviation sector is a long one.

While these challenges are occupying much of the sector’s attention at the moment, potentially larger long-term issues loom. Perhaps more than many other sectors of the economy, the aviation industry will have to play its role in tackling climate change and contributing to decarbonisation. Climate-change events are likely to have direct impacts on aviation going forward, such as extreme weather events affecting traffic and rising sea levels affecting coastal airports, and due to shifts in travelling habits because of a greater awareness of the impact of flying.

The focus on such issues has already led to cancelled or delayed investments at airports—such as a third runway at Heathrow and the building of a new terminal at Aéroports de Paris—and the introduction of carbon-pricing policies for airlines. In addition, the support provided to some airlines during the pandemic (e.g. to Air France) has required environmental commitments. At the same time, some government policies aimed at helping the sector recover from the pandemic (for example, potential cuts in domestic Air Passenger Duty in the UK) may conflict with climate commitments.

When taken together, these factors mean there is greater uncertainty around short-, medium- and long-run passenger volumes, investment requirements, and the risks faced by airports. It is therefore important to consider how regulation may need to adapt to address such challenges.

Short-term regulatory challenges

In the aftermath of COVID-19, operators and regulators of airports across Europe are largely facing the same set of issues. The revenue shortfalls arising from the drop-off in traffic have created a relatively unusual challenge of regulating loss-making businesses. It is not obvious that the standard regulatory toolkit—geared towards preventing airports from earning excessive profits—is well suited to helping loss-making businesses return to profitability, particularly when the downstream (airline) market is also under financial pressure and unable to absorb price increases.

The issues are broad and will not be straightforward to address.

- How should regulators treat revenue shortfalls? Should airports bear the full effects, or should they be able to recover some of this ‘lost’ revenue?

- How can regulators reset prices in light of the considerable uncertainty around passenger volumes? How should this uncertainty be dealt with in forecasts?

- How should risks around traffic recovery be allocated between airports and airlines?

- What should happen to capital investment plans?

- Do investors and regulators need to take a fresh view of the degree of financial resilience that should be built into airport capital structures?

- How would price increases impact the airline market and the recovery of passenger traffic?

These questions are largely the same as those that have been discussed since the start of the pandemic, and which were raised in our article a year ago.5 In most instances, regulatory processes have been delayed to allow more time to let the pandemic play out, in anticipation (or hope) that the outlook would become clearer. Consequently, there remains little clarity over how regulators will address these challenges. There have, however, been some developments of note in the last year.

First, discussions have started over whether there should be explicit adjustments to the future value of regulatory asset bases (RABs) to offset the COVID-related revenue losses. Heathrow has positioned such an adjustment in terms of a ‘depreciation holiday’. Its proposal is that given that passenger numbers are well below forecast levels, the RAB should not be reduced by the full amount of forecast regulatory depreciation in 2020 and 2021. The result would be a higher RAB value in 2022 than envisaged under the existing price control. The theoretical basis for this proposition appears to be sound—the airport will not earn sufficient revenues in these years to cover regulatory depreciation, and utilisation of the asset base has been much lower than usual (e.g. terminal buildings are closed and runways and equipment are less frequently used). The question, however, is whether an ex post adjustment of this kind is in the consumer’s (passenger’s) interest.

The UK CAA is currently consulting on Heathrow’s proposal and has yet to commit to, or rule out, a RAB adjustment.6 The considerations it has set out are likely to have wider applicability to other airports proposing similar adjustments. In particular:

- balancing the certainty of higher future prices if a RAB adjustment is made against the less certain impact on prices if there is no RAB adjustment but a consequent increase in the cost of capital;

- promoting affordable charges, particularly in supporting recovery of the aviation sector following the pandemic;

- ensuring that equity investors are taking their fair share of the financial burden arising from the pandemic.

Elsewhere, other regulators have initiated interim review processes. For instance, in June 2020, just as the appeals from the last price review were being decided, Ireland’s Commission for Aviation Regulation (CAR) launched a consultation on the regulatory response to COVID-19 for Dublin Airport. CAR noted that ‘the assumptions underpinning the 2019 Determination are not reflective of the current situation, and it does not appear that this will change at least in the short term’.7 It suggested that there were a number of possible responses, including:

- no interim review;

- an interim review to address immediate issues for 2020 and 2021;

- a full interim review addressing all issues;

- both an interim review to address immediate issues and a full review at a later stage.

CAR also noted that:8

To date we have used the building blocks approach to RAB based regulation to arrive at the price cap. This is not the only possible methodology and we are open to representations on innovations to this approach, or alternative methodologies which may be more suitable to the current circumstances.

After consulting with stakeholders, CAR published its Decision in December.9 It determined that an interim review was needed to ‘address immediate unintended consequences for the 2019 Determination that the pandemic has created’.10 It therefore removed all triggers and adjustments relating to the price caps for 2020 and 2021 (e.g. financial penalties relating to service quality performance), as they were based on outdated targets and could provide perverse incentives. CAR also noted that it expects a further interim review of the 2019 Determination to be required as the situation develops over the coming years.

At other airports there have been renegotiations of the terms of concession agreements, as well as the consideration of whether the airports should receive any compensation for the loss of passengers that resulted from government restrictions on international travel. In our article a year ago, we posed the question of whether market-based solutions, such as commercial agreements between airports and airlines, would be preferable to regulator-driven processes. It is notable that Copenhagen Airport, which operates under a commercial negotiations-based regime (with a fall-back regulatory price cap if agreement cannot be reached), has been able to reach agreement with its airlines on a set of prices and incentives through to December 2023.11 This agreement has been approved by the Danish Civil Aviation and Railway Authority.

In all of these cases, regulators are making important trade-offs and trying to balance the financeability of airports on their path back to profitability with the affordability for airlines and passengers that have also been impacted by COVID-19.

Higher risk, higher returns?

A related question that regulators are tackling is whether these issues have affected the cost of capital for airport operators, and, if so, the extent to which this will be a lasting effect.

Current market evidence indicates that investors believe the airports sector is subject to higher levels of risk and uncertainty following the pandemic. The key unknowns are the speed of recovery of traffic given uncertainty around vaccination programmes, travel restrictions, macroeconomic conditions and whether there will be structural changes in demand (e.g. reduced business travel) in future years.

Critically, the range of possible outcomes in terms of traffic is very wide. There is evidence to suggest that this is affecting how both debt and equity investors view the sector. On the debt side, Moody’s has given the European airports sector a negative outlook, stating that this ‘reflects [their] expectation that the path to recovery in passenger traffic remains very uncertain’.12 On the equity side, there has been a marked increase in asset betas of listed airport operators over the last year, indicating that this uncertainty has also affected equity investors’ assessment of the risk profile of airports relative to the market as a whole.

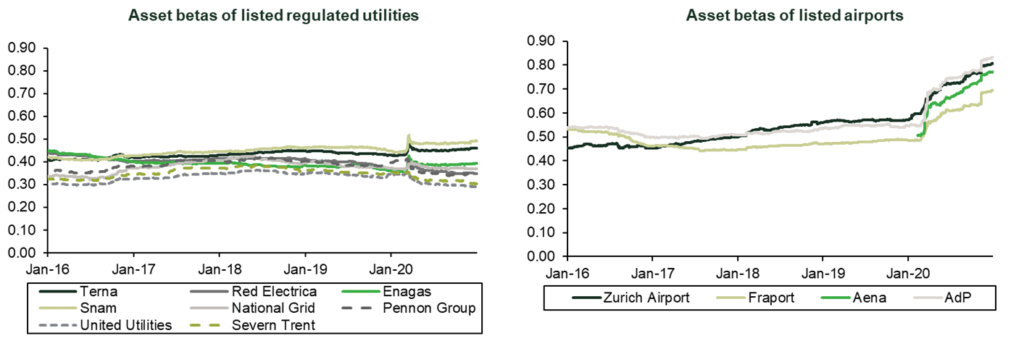

This effect on the equity market can be observed clearly when comparing the betas of listed airports to those of other sectors. Airports have generally been considered higher risk (higher beta) than utilities (given greater elasticity of demand and exposure to volume risk), but the difference has historically been relatively small. In contrast, current market evidence shows a clear divergence between the betas of airports and utilities in light of COVID-19 (see Figure 1).

Figure 1 Utilities and airports: divergence in asset betas

As regulators come to reset price controls, they will need to decide how much weight to place on the pronounced movement in betas over the last year. At the heart of this lies the question of whether the higher level of risk exposure will continue. If it is considered that it will, the impact on regulatory cost of capital allowances could be marked.

As far as we are aware, there have not yet been any regulatory determinations on the cost of capital for a European airport since the start of the COVID-19 pandemic (i.e. March 2020). However, the early signs are that airports will (unsurprisingly) be requesting material increases on allowed rates of return, and in particular the cost of equity.

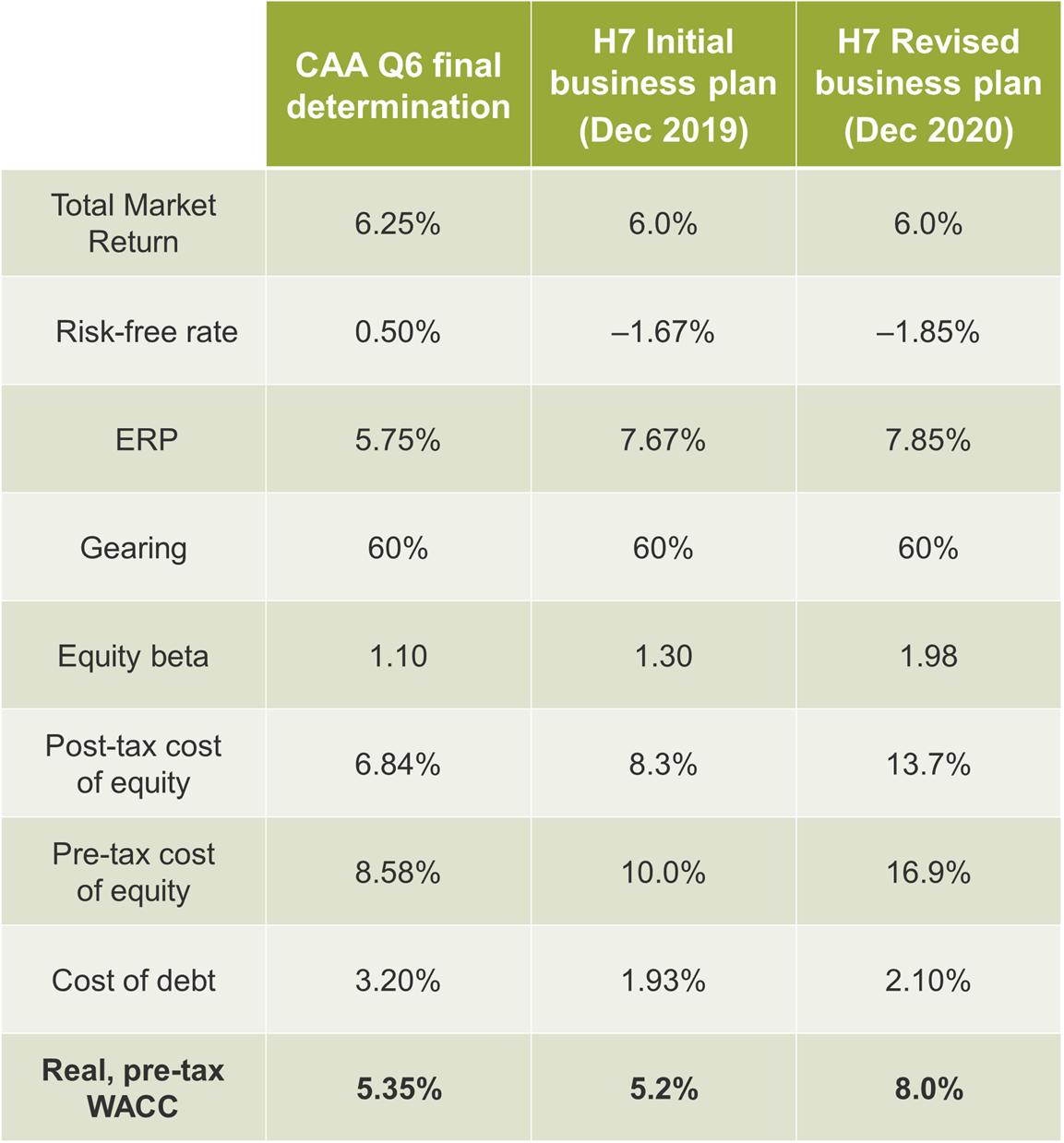

- Heathrow’s latest H7 business plan incorporates an ‘ask’ of 8% for the real, pre-tax weighted average cost of capital (WACC)—with a real cost of equity in excess of 13.5%.13 This is a significant increase on the level requested in its initial plan and the allowance in the previous period (Q6), as shown in Table 1. The main driver of this change is a significant increase in the equity beta assumption.

- Aena, the Spanish airports operator, is proposing a nominal, pre-tax WACC of 7.68% for the second DORA.14 This compares to an allowed rate of return of 6.98% (nominal, pre-tax) for the first DORA.

Table 1 Heathrow Airport’s WACC proposals

It is worth noting that regulatory decisions may themselves affect the cost of capital. In particular, the level of commitment that regulators are willing to give around airports’ ability to recover the capital in the RAB and the approach to allocating volume risk are likely to have a direct impact on the cost of capital. Heathrow has taken this position in its Revised Business Plan—presenting separate WACC proposals depending on whether the CAA makes a RAB adjustment.

A regulatory framework fit for the future?

While the current regulatory framework may need to be adapted in the short term to deal with the impact of COVID-19, there is a risk that this unprecedented shock, and the subsequent focus on the recovery path, leads to inaction in addressing the longer-term challenges facing the sector, and notably the climate crisis.

This is clearly a critical issue for all parts of the aviation value chain, and EU leaders are being encouraged to join an EU Pact for Sustainable Aviation by the end of 2021, with a view to securing a net-zero aviation sector by 2050. Leading industry associations of airports (ACI Europe), airlines (A4E and the European Regions Airline Association), air traffic controllers (CANSO) and aircraft manufacturers (ASD) recently joined forces to set out a pathway to net zero for the entire sector.15

It is clear from the route map that the majority of the required reductions in emissions are expected to come from improvements in engine technology, sustainable fuels, air traffic management and emissions pricing schemes rather than directly from airport operations or infrastructure. However, airports will have to make their own investments in decarbonisation and will play a significant role in facilitating the required transformation of other stakeholders—for example, by providing the supporting infrastructure for hydrogen-powered or electric aircraft.

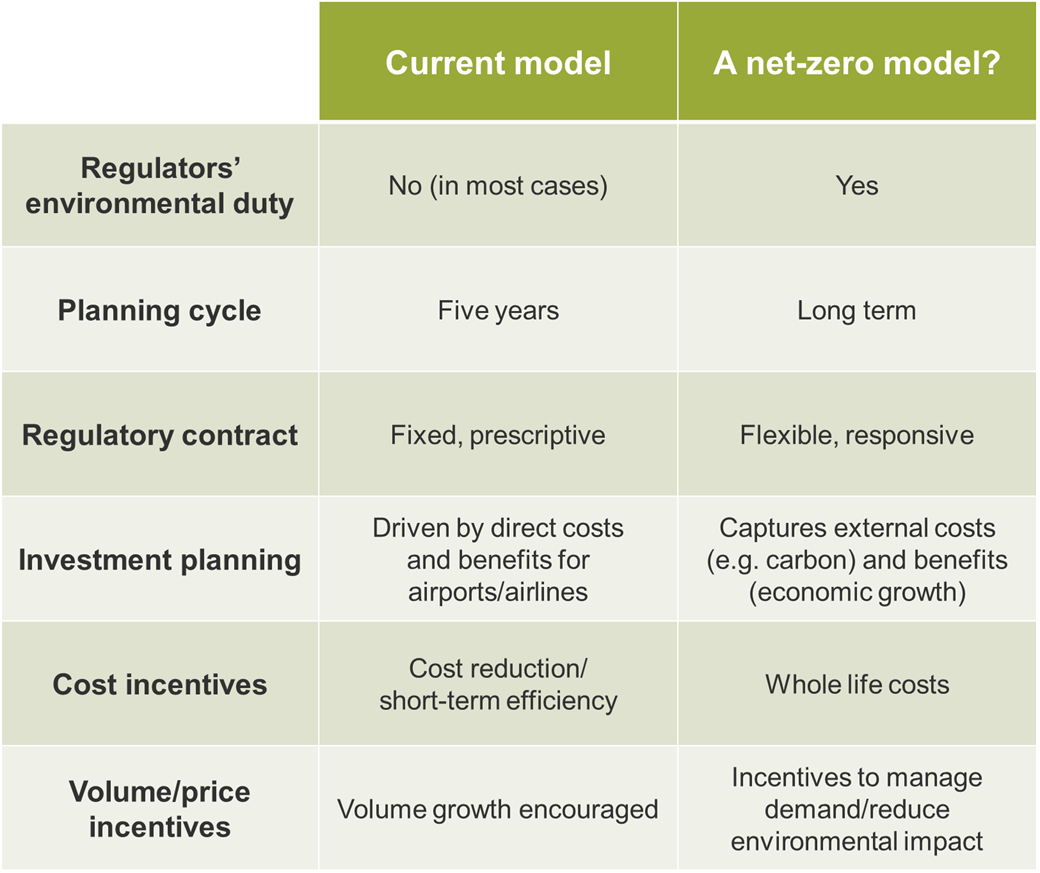

It is therefore relevant to ask whether current economic regulatory frameworks provide the right incentives and appropriately aid the achievement of the net-zero ambition. Will a fixed and prescriptive five-year regulatory settlement provide sufficient flexibility and agility to meet evolving requirements? Will current approaches to appraisal, driven primarily by the commercial imperatives of airports and airlines, lead to the right investments and appropriately capture external costs (such as for carbon)? Are the relationships between airports and other industry players (airlines, aircraft manufacturers, air traffic controllers) sufficiently strong to coordinate and collaborate effectively? And perhaps most fundamentally, is it still appropriate for airports to have high-powered incentives around traffic growth?

In order to ensure that regulatory frameworks are fit for purpose in helping with these challenges, regulators themselves must have environmental issues at the top of their agenda. However, there are very few European airport regulators with duties to consider environmental issues, and where these duties exist, they tend not to be primary ones.16 What is clear is that without any changes, current regulatory frameworks are unlikely to provide the right platform and incentives for the long-term planning, sustainability-driven investment prioritisation, and cross-industry collaboration needed to deliver the sector’s environmental ambitions (see Table 2).

Table 2 How might airport regulatory frameworks evolve?

Where next?

Naturally, much of the airport sector’s current focus is on COVID-19 and the recovery profile. This is unsurprising given the scale of the pandemic’s impact on the sector. Considerations about how the regulatory framework may need to adapt in the short term to deal with these losses are important. But it is essential to have one eye on the long-term strategic challenges that the industry will need to address, and consider how the regulatory framework may need to adapt in the longer term as a result. Addressing the climate emergency is likely to become a central issue in airport regulation over the next few years.

1 See Oxera (2020), ‘Flying through the storm: airport regulation in the wake of COVID-19’, April.

2 World Health Organization (2021), ‘The effects of virus variants on COVID-19 vaccines’, 1 March.

3 See Centogene (2021), ‘COVID-19: test centers: Frankfurt Airport’.

4 See Heathrow (2021), ‘COVID-19 Test for Travel’.

5 Oxera (2020), ‘Flying through the storm: airport regulation in the wake of COVID-19’, April.

6 Civil Aviation Authority (2021), ‘Economic regulation of Heathrow Airport Limited: response to its request for a covid-19 related RAB adjustment’, CAP 2098, February.

7 CAR (2020), ‘CP3/2020 COVID-19 Price Regulation Response Airport Charges – Dublin Airport’, Commission Paper 3/2020, 30 June, p. 2.

8 Ibid.

9 CAR (2020), ‘Decision on an Interim Review of the 2019 Determination in relation to 2020 and 2021’, Commission Paper 12/2020, 22 December.

10 Ibid., p. 2.

11 Copenhagen Airport (2021), ‘CPH and airlines team up to restart traffic’, 18 March, press release.

12 Moody’s (2020), ‘Airports—Europe: 2021 outlook negative on high degree of traffic uncertainty’, 25 November, p. 2.

13 Heathrow (2020), ‘H7 Revised Business Plan’, December.

14 Aena (2021), ‘Disclosure of other relevant information’, 9 March.

15 NLR and SEO Economics (2021), ‘Destination 2050: A route to net zero European aviation’, February.

16 For example, the CAA has a secondary duty to the environment. It states that the CAA needs to ensure that a licence holder (i.e. a regulated airport) ‘is able to take reasonable measures to reduce, control or mitigate the adverse environmental effects of the airport to which the licence relates, facilities used or intended to be used in connection with that airport (“associated facilities”) and aircraft using that airport’.

Download

Contact

Michele Granatstein

PartnerContributor

Guest contributor

Related

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More