Green derivatives? Trading for a low-carbon future

Financial markets facilitate economic growth, which contributes to global prosperity and wellbeing. The political recognition that addressing climate change is also integral to these has seen financial markets adapt by providing a way to value the externality of pollution. Markets need reliable and liquid carbon and energy benchmarks to deliver an efficient transition from high- to low-carbon energy generation. Gordon Bennett, Managing Director of Utility Markets at ICE, considers the role of derivatives markets.

Climate change is one of the biggest global challenges of our time and will require significant changes to every aspect of the energy system, from exploration and production to transport, storage and consumption of energy. Fortunately, history shows us that the transition to new energy sources is not unprecedented but has been a continual process, driven by the forces of supply and demand, as well as technological innovation and public policymaking.

Countries across the globe have recognised the potentially catastrophic effects of global warming and are considering how to navigate the complex road to net zero.1 It will require enormous investment, from greater energy efficiency and decarbonisation technologies, to increased use of renewable energy sources.

The complexity of the energy transition lies in the fact that policymakers and market participants do not know from the outset which business models and technologies to invest in and support in order to reap the highest carbon returns.

The main purpose of financial markets is to provide a transparent price signal that allows participants to allocate capital and manage risk efficiently. This function will be critical in helping achieve the net-zero objective. More specifically, the price signals from financial markets have previously proven to be a beacon for policymakers and market participants alike.

The development of liberalised energy markets

The foundation of liquid markets is liberalisation—the process of removing government or other ‘control’ and opening markets up to supply and demand forces.

The UK was the first country in Europe to liberalise its gas and electricity markets, through a series of policy reforms dating back to the 1980s, which privatised and unbundled the state-owned monopolies.

Other European countries followed suit, and the EU introduced three consecutive legislative packages to harmonise and liberalise the internal gas and electricity market during the late 1990s and early 2000s. In addition, the EU introduced an Emissions Trading System (EU ETS) in 2005, as described in the box below.

EU Emissions Trading System (ETS)

The EU ETS operates in all EU countries plus Iceland, Liechtenstein and Norway. It limits emissions from more than 10,000 energy-intensive installations (power stations and industrial plants) and airlines operating across these countries and covering around 40% of the EU’s greenhouse gas emissions.

The EU ETS works on the ‘cap and trade’ principle. A cap is set on the total volume of certain greenhouse gases that can be emitted, which is reduced over time so that total emissions fall.

Trading brings flexibility that ensures that emissions are cut where it costs the least amount to do so. A robust carbon price also promotes investment in clean, low-carbon technologies.

The EU ETS has proven to be an effective tool in driving cost-efficient emissions reductions. Emissions from installations covered by the ETS declined by about 35% between 2005 and 2019.

Notes: 1 See European Commission (2020), ‘Emissions cap and allowances’. 2 See European Commission (2020), ‘Emissions trading: greenhouse gas emissions reduced by 8.7% in 2019’, 4 May.

Source: European Commission, ‘EU Emissions Trading System (EU ETS)’.

Following decades of policy developments and privatisations, the UK and Europe now provide the best examples of wholesale energy and carbon markets where the whole electricity generation value chains are subject to market forces.

Importantly, electricity (output) is a secondary form of energy generated from primary energy sources (input) such as oil, coal, natural gas, nuclear and renewables (e.g. solar and wind). In a liberalised energy market, the price of electricity predominantly results from ranking the available sources of primary energy based on ascending order of price—the ‘merit order’. The cheapest primary energy source sets the price of the marginal megawatt hour (MWh). In the UK and Europe, the price of the marginal MWh of electricity results from the competition between natural gas and coal, while taking into account the cost of greenhouse gas emissions. The theoretical profit margin of generating ‘decarbonised’ electricity from natural gas or coal is referred to respectively as the ‘clean spark spread’ and ‘clean dark spread’.2

The role of market infrastructure providers

Market operators and intermediaries play an integral role in facilitating liquid markets by allowing the interests of buyers and sellers to be matched. Brokers are critical in the early stages of market development: where products are generally not standardised, participants demand flexibility in contract design to meet specific hedging needs and where there are high search costs associated with locating a buyer or seller to trade with.

As markets mature, exchanges compete to introduce their own standardised, exchange-traded contracts. This brings several benefits to developing energy markets.

First, switching to exchange trading from predominantly ‘over-the-counter’ (OTC) physical markets can reduce barriers to entry for new participants and make trading more accessible. This is because new trading participants do not have to establish bilateral trading, credit and settlement relationships with incumbent participants. Instead, traders can access liquidity through a single point of entry—i.e. the exchange. This also means that a trader can execute against all prices on an exchange, in comparison to broker venues, in which the trader can trade only with counterparties with which it has established a trading and credit agreement. Similarly, new trading participants do not have to invest so heavily in the logistics associated with physically delivering the underlying commodity.

Second, exchange trading rules facilitate non-discretionary, anonymous and multilateral trading. The non-discretionary nature of an exchange order book means that orders are matched automatically on a price-time basis. Therefore, in order to trade, participants must provide competitive quotes (i.e. lower ask prices or higher bid prices). Anonymity of trading can also bring benefits to participants by reducing the risk of information revelation and adverse selection.3

Third, exchange-traded futures are cleared by definition. The promotion of more central counterparty clearing was a key policy objective supported by G20 and central bankers following the 2008 global financial crisis. Central clearing provides critical credit risk mitigation, as well as the efficient allocation of capital by providing offsets for correlated contracts. This is even more pertinent in the energy world due to the plethora of spread relationships that exist through either the conversion of one energy to another or the increasing globalisation of trade.

The breadth and diversity of trading participants that are attracted to the exchange model explains why most liquidity ‘benchmark’ contracts are exchange-traded. These key benchmark contracts provide price discovery and risk-management for several markets, not just the market for the underlying asset—in other words, benchmarks are proxies, as there is a pay-off between liquidity and basis risk.

Role of liquid markets

Price discovery and competition between energy sources

The transition to net zero will involve altering the aforementioned merit order to prioritise primary sources of energy that can be generated with lower or no greenhouse gas emissions.4 This will require changes across multiple sectors, including power generation, industry, mobility and buildings (heating and cooling) across the globe.

Well-functioning, transparent and liquid markets are critical to the energy transition as they provide a price discovery mechanism that fosters competition between energy sources.5 A clear price signal allows market participants to accurately value the energy we generate and consume. Moreover, it allows investors to value their capital at risk with more certainty, and investors and investees to manage risk.

The development of key benchmarks across the fuel inputs of electricity generation in Europe—API2 (coal), NBP and TTF (natural gas), and EUAs or European Emissions Allowances (underpinned by the EU ETS)—meant that the cost of pollution could now be reflected in the price of electricity. The era of carbonomics was born, and the profit margin of electricity from natural gas and coal was now determined through the clean spark spread and clean dark spread.

Reducing financing costs for new technologies

Energy derivatives markets also provide participants in the energy value chain with the ability to hedge risk associated with fluctuating energy prices.

Because primary energy is part of global supply chains, the interplay between primary and secondary energy sources brings about a high degree of complexity and uncertainty, and therefore volatility. Factors such as weather, geopolitics, storage and transport capacity constraints, as well as the availability of market information, all contribute to volatility in energy markets. Renewable fuel sources add an extra layer of complexity to this value chain due to their intermittent nature, which means that cash flows for companies in the energy value chain can be highly uncertain. The ability to hedge lowers funding costs for these companies by reducing the uncertainty of these cash flows.6

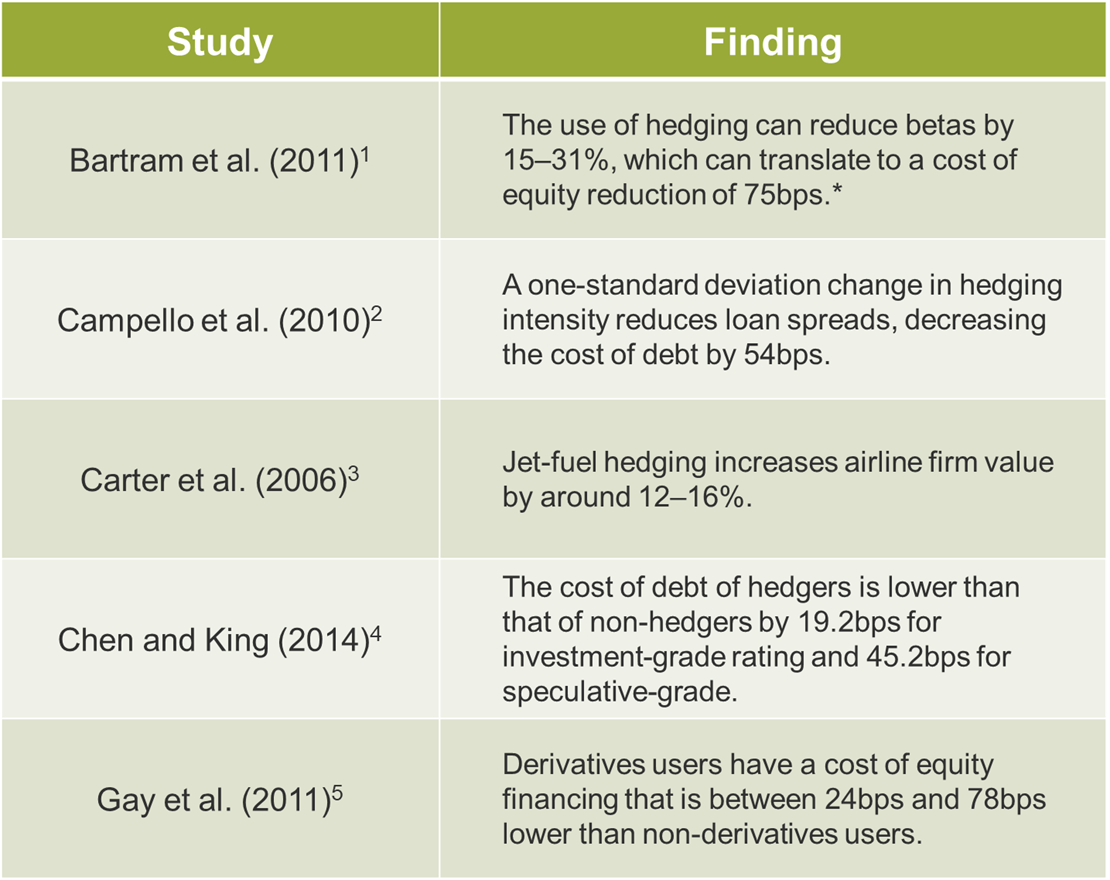

As summarised in Table 1, several academic papers show that, by reducing the volatility of these cash flows, hedging can have a tangible impact on cost of capital. This research indicates that the ability to hedge can reduce the cost of debt by around 19–54bps and the cost of equity by around 24–78bps.

Table 1 Studies estimating the impact of hedging on cost of financing

Source: 1 Bartram, S.M., Brown, G.W. and Conrad, J. (2011), ‘The effects of derivatives on firm risk and value’, The Journal of Financial and Quantitative Analysis, 46:4, pp. 967–99. 2 Campello, M., Lin, C., Ma, Y. and Zou, H. (2010), ‘The real and financial implications of corporate hedging’, NBER Working Paper No. 16622. 3 Carter, D.A., Rogers, D.A. and Simkins, B.J. (2006), ‘Does hedging affect firm value? Evidence from the US airline industry’, Financial Management, 35:1, pp. 53–86. 4 Chen, J. and King, T.D. (2014), ‘Corporate hedging and the cost of debt’, Journal of Corporate Finance, 29, pp. 221–45. 5 Gay, G.D., Lin, C.M. and Smith, S.D. (2011), ‘Corporate derivatives use and the cost of equity’, Journal of Banking & Finance, 35:6, pp. 1491–506.

This is important when thinking about financing investments in new, cleaner energy technology. Here, carbon pricing plays a key role in dealing with what Bill Gates calls the ‘green premiums’ issue. Green premiums describe the cost difference between a product that involves emitting carbon and an alternative that does not. Understanding this premium is vital to addressing climate change, as it indicates how far down the road to net zero you are in respect of a specific fuel or technology.

The UK and Europe have been applying this concept, through the application of carbon pricing. In particular, the UK has all but removed oil and coal, the most carbon-intensive fuels, from the electricity generation merit order. This has been undertaken through the application of market-based carbon pricing from the EU ETS and unilateral policy interventions—for instance, the introduction of the Carbon Price Support (CPS) via a carbon tax in 2013, which makes it more expensive to generate electricity from oil and coal than from natural gas.

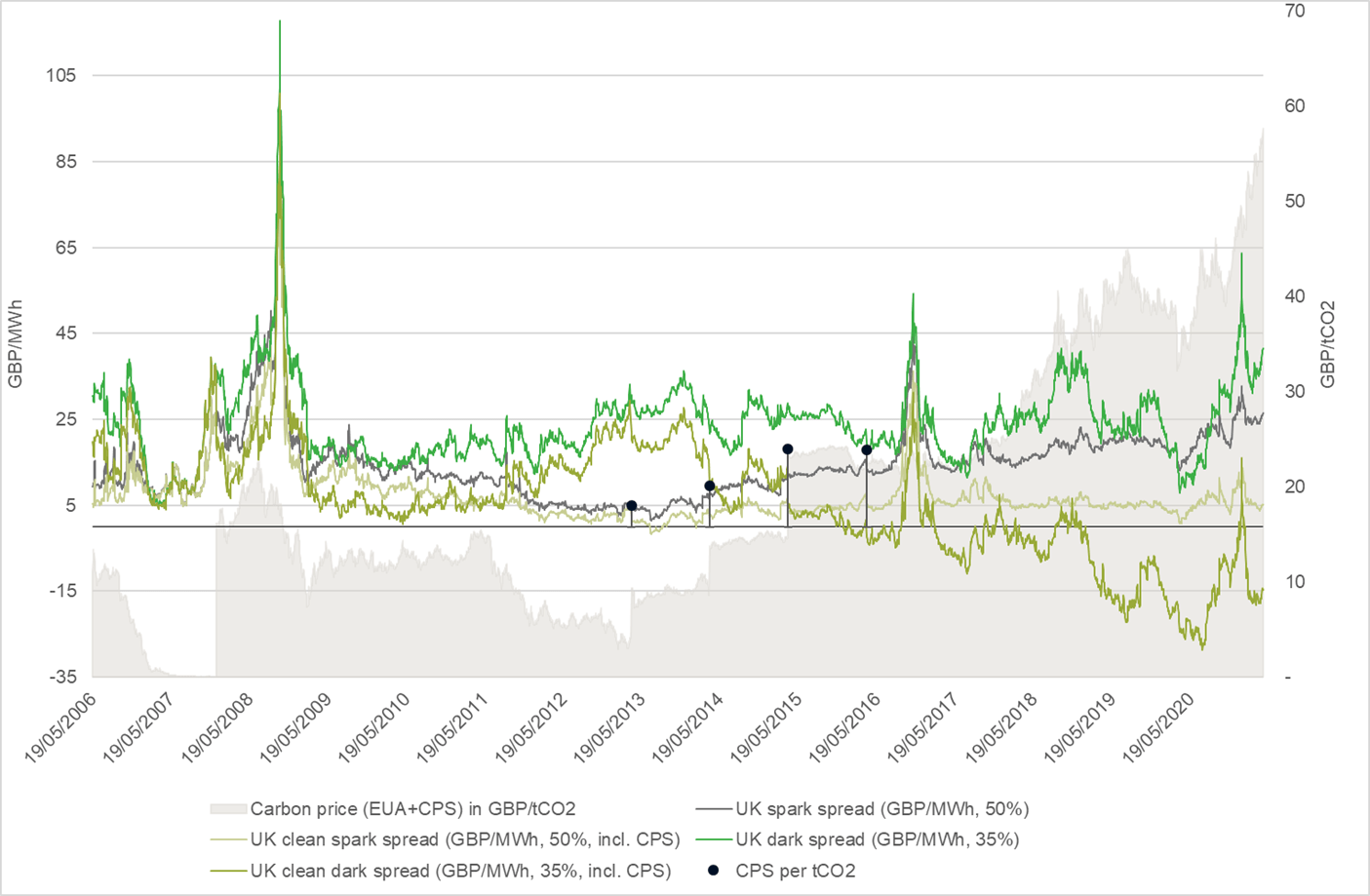

Figure 1 shows the theoretical gross margin of gas- and coal-fired power plants in Great Britain (GB) from selling a unit (MWh) of electricity (i) excluding the cost of GHG emissions—spark and dark spreads respectively—and (ii) including the cost of GHG emissions—clean spark and clean dark spreads respectively. Applying the cost of GHG emissions (measured as the price of EUA futures including the Carbon Price Support) inverts the merit order; coal goes from the most profitable to the least profitable source of fuel in the electricity generation mix, thereby meeting the policy objective of using ‘cap and trade’ programmes to limit emissions.

Figure 1 GB clean dark and spark spreads

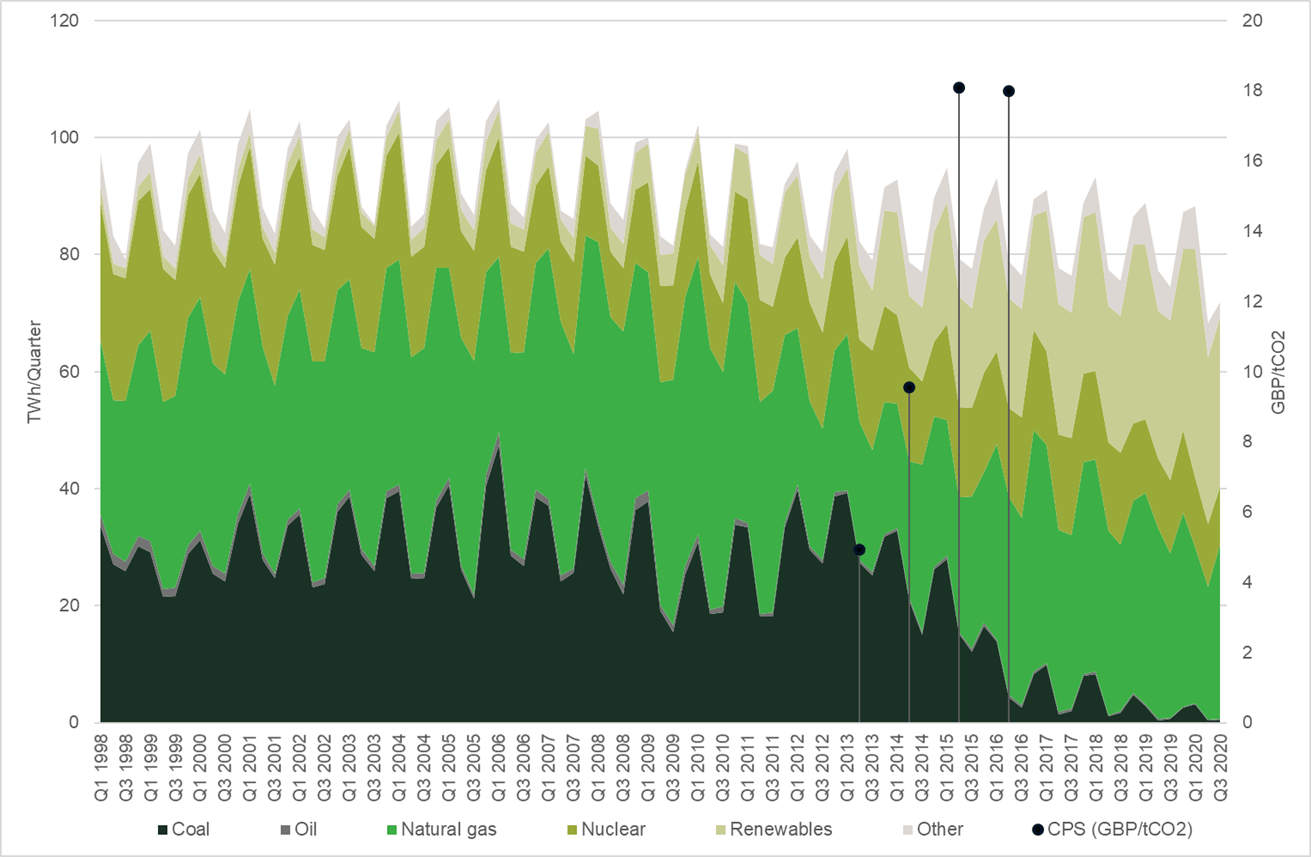

Figure 2 shows how coal has all but been removed as a source of fuel from the electricity generation mix in GB and how this reduction correlates with the introduction of the CPS in 2013 and increases in respectively 2014 and 2015 which has contributed to the corresponding deterioration in the clean dark spread vs. the clean spark spread in GB.

Figure 2 GB electricity generation mix by fuel source

The EU achieved the same objective via the Market Stability Reserve in 2019. The decline in electricity generation from coal in Europe is expected to play out as it did in the UK.

Despite the success of carbon cap and trade in abating emissions in Europe, awareness of carbon pricing’s impact does not seem to be widespread. This is because carbon cap and trade programmes only cover approximately 40% of emissions in Europe and have their greatest impact in the electricity generation sector. Unlike other sectors, the electricity generation sector does not receive free allocation and must buy an allowance for every tonne emitted. Due to this exposure to carbon pricing, Europe’s electricity generation sector has arguably witnessed the birth of carbonomics via the establishment of the clean dark spread and clean spark spread.

Yet this era is ending. Companies across the globe will likely need to adopt carbon pricing in their business models in order to accurately reflect the value of assets and liabilities in this new, sustainable finance world. At a higher level, this will allow governments to meet the goals of the Paris Agreement, and contribute to global prosperity.

Gordon Bennett

1 ‘Net zero’ refers to achieving a balance between the volume of greenhouse gases produced and the volume removed from the atmosphere. There are two different routes to achieving net zero, which work in tandem: reducing existing emissions, and actively removing greenhouse gases. A gross-zero target would mean reducing all emissions to zero.

2 Clean dark spreads are defined as the average difference between the price of coal and carbon emission, and the equivalent price of electricity. If the level of dark spreads is above 0, coal power plant operators are competitive in the observed period. Clean spark spreads are defined as the average difference between the cost of gas and emissions, and the equivalent price of electricity. If the level of spark spreads is above 0, gas power plant operators are competitive in the observed period.

3 Knowing the identity of the participant may provide information with respect to the direction (buying or selling) of the trade, and the pricing available may therefore be framed differently.

4 The merit order defines the sequence in which various energy sources are preferred for a given use (e.g. for heating, transportation or electricity generation, or as a feedstock in manufacturing).

5 ‘Price discovery’ refers to the process by which information is incorporated into prices.

6 In a frictionless market, individual investors can hedge themselves. If the assumptions of a perfect capital market are violated (e.g. if investors do not have perfect information or access to the same hedging instruments), firm-level hedging can increase shareholder value.

Download

Contact

Jostein Kristensen

PartnerGuest authors

Gordon Bennett

Managing Director of Utility Markets at ICE

Related

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More