Sharing too much? Information exchange in the digital economy

Is an excess of information hurting competition? Although there are some well-established, economically founded principles for assessing the exchange of information between competitors, the general increase in information availability in the digital economy presents new challenges. We revisit the economic principles that can be used to understand the likely effects, both beneficial and malign, of information sharing, and how competition authorities could react to these trends.

The economic effects of information exchange form an important component of Article 101 antitrust cases considered by competition authorities. However, they can vary considerably based on the specifics of each case. Economics can assist in explaining the rationale and effects of such practices, and therefore provide guidance as to the circumstances in which they are likely to be anticompetitive.

Technology—especially the rise of the Internet and digital platforms—has transformed the way information is gathered and shared. This has implications for the assessment of information exchange cases, as well as for wider competition policy. In this article we look again at the economics of information sharing and how it has informed current practice in competition policy. We also consider the extent to which trends in the availability of digital information are likely to challenge the orthodox approach.1

The economics of information sharing

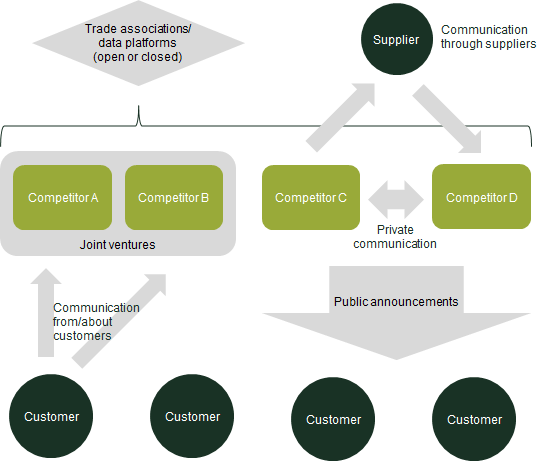

The transfer of information between competitors comes in many forms. It can be exchanged directly between competitors or indirectly through suppliers, customers or a trade association. In the information economy, it can also be exchanged via an open data platform, which may have an effect similar to that of a public announcement. Some of the main modes of exchange are illustrated in Figure 1.

Figure 1 Modes of information exchange

Regulators and consumer groups often see market transparency as a laudable goal, so it may be surprising that firms’ openness with respect to their own information can harm competition. A common theory of harm is that information exchange facilitates coordinated outcomes and reduces the risks inherent in competitive markets, replacing them with certainty and stability. If, for example, a firm knows that a rival is planning to expand in Germany and not in France, that firm may be tempted to expand in France and not in Germany, thus avoiding some of the direct competition that it might otherwise have faced.

However, it is problematic to use a ‘reduction in uncertainty’ as a means of differentiating between information exchanges that are beneficial and those that are harmful. Almost by definition, any exchange of information will reduce uncertainty to some degree—so the key question should be whether that reduction harms competition in terms of overall output and prices. In the above example, it is ambiguous whether consumers would benefit from both firms targeting Germany if this led to capacity shortages in France. As has long been recognised in economic and legal practice, the market context is important.

The European Commission’s Guidelines on Horizontal Agreements highlight a wide range of possible positive and negative effects from information exchange.2 Information exchange can help to make markets work better, for example by allowing firms to benchmark costs and performance against those of other firms, or by reducing market failures that arise from information asymmetries in markets such as insurance. Whether pro- or anticompetitive effects will dominate depends on a number of factors, particularly the market characteristics and the nature of the information being exchanged. As in many areas of competition law, the optimal way of assessing information exchange involves looking at the trade-off between efficient enforcement on the one hand and allowing for case specifics that may alter the competitive effects in question on the other.

The coordination theory of harm, and in particular the risk that the exchange of information may allow firms to tacitly coordinate on prices, appears to have been influential in forming these guidelines.3 In the classic economic framework, to be able to tacitly coordinate on price, firms must interact repeatedly such that the long-term benefits that come from sustained high prices exceed the value of the additional market share that could be gained in the short term by undercutting rivals. This can be achieved only if there is a mechanism to quickly identify and ‘punish’ firms that undercut on prices.

The guidelines on information exchange link closely to this strategic dynamic, and include the following areas of consideration.

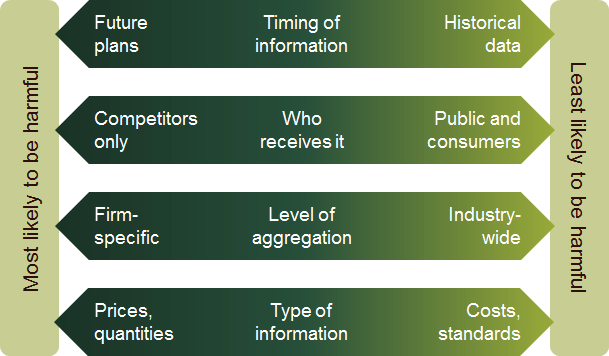

- Timing of information—for price coordination to be successful, firms must have a reasonable degree of confidence that rivals will keep prices high in the future. Sharing information on future prices may allow firms to seek a coordinated outcome on prices, without needing to offer those prices in the market, and risk being undercut. For this reason, sharing historical information is considered less likely to be problematic.

- Who receives the information—direct, private communication between competitors concerning information that cannot be found in the public domain is the form of information exchange that is most likely to raise competition concerns. This is because it limits the extent to which any coordination can be observed and disrupted by customers or new entrants. It also precludes any offsetting efficiencies that may arise from better information being available to all market participants, including suppliers and customers.

- Level of aggregation—the more the information is aggregated across suppliers, the less it reveals about the behaviour of individual suppliers. Detailed, verifiable, firm-specific data may allow any deviation from coordinated pricing to be observed, and a punishment mechanism to be activated. In addition, the more frequently the information is shared and the greater the specificity of the period that it covers (for example, whether it is daily or as an average over a month) will be important considerations, particularly in digital or financial markets where prices can change in seconds or even fractions of a second. Higher-frequency interactions mean that the competitive response can be more quickly perceived, and will allow for more efficient punishment and lower benefits from deviation.

- Type of information—coordination will be most likely where information is exchanged on a factor on which firms may have an incentive to strategically coordinate. Exchanges relating to prices, quantities or other commercially sensitive or strategic information will usually raise more concerns than, for example, those relating to standards or safety records.

These points are summarised in Figure 2.

Figure 2 Spectrum of considerations for information exchange cases

Technology facilitating the availability of information

In many markets, advances in technology have led to:

- easier access to information generally, including competitors’ current prices. This is potentially accessed at a highly disaggregate level—web-scraping tools, price comparison websites, customer discussions on online forums, and market research services all serve to increase the availability of information;

- more frequent competitive interactions and more frequent changes in price;

- a widening of the set of information that is available to firms, by making it possible to search for and locate relevant information quickly and cheaply—for example, through online search;

- an increase in the ease with which firms can communicate with each other, both directly (e.g. through professional social networks) and indirectly (e.g. through posting on their own websites).

These trends have wide-ranging implications for how firms compete in today’s markets, many of which are positive for consumers. These include the use of digital comparison tools reducing the search costs for consumers looking for the cheapest prices, and an improved ability to assess quality through accessing expert reviews and customer discussion forums. However, the availability of detailed information is not without risks and drawbacks. For this reason, competition authorities are showing an increased interest in issues relating to data and digital platforms, including the increased ease with which information can now be shared.4

The effect of the availability of information on different firms’ current prices is ambiguous. In general, price dispersion would be expected to decrease. This is partly because it makes it easier for consumers to find low prices, thus increasing competitive pressure on firms’ pricing. However, it could also result in changes to the competitive process, for example for firms that are engaged in pricing strategies such as ‘cost leadership’. If firm A has an efficiency advantage over firm B for a homogeneous product, firm A will want to ensure that it is also pricing lower than firm B; if it knows for certain that firm B is pricing at €5, it may target a price of €4. On the other hand, if it knows only that firm B is pricing somewhere between €3 and €7, it may target an even lower price—say, €2.5

Because there is no clear ‘unilateral’ direction to the price effect of information availability, consideration of coordinated effects becomes important. The likelihood of such effects will depend on characteristics of the industry in which the exchange is taking place, and on the nature of the information being exchanged. In some markets, particularly those that are focused on e-commerce, the nature of the information is likely to be such that firms have a high degree of visibility of each other’s competitive strategies without recourse to any direct communication. Indeed, there are parallels between the characteristics of the information that online markets make available, and the kinds of information that are identified above as being problematic for firms to share. The risk of tacit coordination may therefore be increased in these markets, relative to a situation in which price and product information is more difficult to access.6

From a competition policy perspective, legal and economics practitioners are likely to react differently to these developments.7 If improvements in a firm’s information technology give rivals access to more information (for example, by enabling a third-party service to ‘web-scrape’ information on prices), the important issue from an economics point of view will be the effect of this exchange. The nature of the information exchanged may mean that the situation is equivalent to one in which the firms in question take active steps to provide this information to each other—by sharing price schedules in a trade association setting, for example. Legal decision-makers would tend to be more concerned about the latter conduct, which follows from active private decisions that the firm has made; yet the economic impact could be the same.

Implications for competition policy

Targeting firm-specific conduct is practical from an enforcement and remedies perspective—information sharing that results from firm policies can be stopped by seeking or imposing commitments from the firms involved. Reversing technological developments, on the other hand, is beyond the powers of even the most active competition regulators. Economically, this does not imply that the right approach to the wider developments is inaction, particularly in an environment where competition authorities have raised concerns about rising corporate profits in Europe and apparent falls in the level of competition.8

First, regulators have the ability to reduce market transparency where it is appropriate to do so, for example through regulation or market investigations. This could be achieved by establishing rules or guidelines that restrict the information that companies can make available through their digital sales channels.

The challenge to competition authorities would be to identify interventions that could be directed at inter-competitor transparency more than consumer–firm transparency, to mitigate the loss of transparency-related benefits to consumers. In some cases, this could be achieved by targeting types of information that would appear to have little information value for consumers, such as prices that are not yet available, or certain information on sales volumes. Personalised pricing, whereby firms show different prices to different users, can keep prices visible to individual consumers while obscuring the firm’s overall pricing strategy to rivals. Such pricing is often unpopular with consumers, and has raised considerations around price discrimination, privacy and fairness.9 However, competition authorities and regulators could allow or even promote such practices where benefits outweigh risks—which would be a technological solution to a technological problem.

Changes in general transparency will also have implications for how more conventional information exchange mechanisms (from private telephone calls to public announcements) should be considered. Technology has the net effect of making information that is already public more easily accessible. As with the assessment of any form of conduct in a competition context, the relevant question when analysing information exchange is how much extra information the conduct makes available relative to the baseline counterfactual (i.e. the situation without the exchange in question).

This means that some types of information exchange that may previously have had an effect on competition may no longer do so where this information is already easily accessible in the public domain. Such cases would need careful consideration of the right counterfactual for assessing the effects of the information exchange. It also means that, where firms are proposing to share additional non-public information with each other, competition authorities will be thorough in examining why such efficiencies cannot be achieved through the array of information that is available in the public domain. The high level of transparency may also increase the likelihood of sustainable coordination in some areas, making previously harmless actions problematic. For example, sharing information about future prices may be more likely to support coordination where it can be verified that the prices have been implemented in the market, and where any deviations can be quickly observed.

Adapting competition tools to the digital economy

With the technology-driven transformation in how information is gathered and shared, the well-established economic framework for assessing information exchange will have new questions asked of it. Careful case-by-case assessments, and well-targeted regulatory investigations, will help authorities to find answers to these questions, and ensure that competition policy with respect to information exchange remains fit for purpose in the information economy.

This topic was discussed at the Oxera Economics Council meeting on 6 June 2018, where guests were the Chief Economists of DG Competition, the German Bundeskartellamt and the French Autorité de la concurrence. The Council is a group of prominent European academics, specialising in microeconomics and industrial organisation, that meets with Oxera twice a year to discuss pressing economic issues facing policymakers. This article does not reflect the views of the Council, its members or guests.

1 See also Oxera (2011), ‘Thanks for sharing: can exchanging information be good for competition?’, Agenda, November. While information exchange is often a necessary component of explicit collusion such as market sharing or bid rigging, in this article we focus on where the exchange of information itself is the main component of the conduct under consideration.

2 European Commission (2011), ‘Guidelines on the applicability of Article 101 of the Treaty on the Functioning of the European Union to horizontal co-operation agreements’, Official Journal of the European Union, 2011/C 11/01, section 2.

3 We use the example of prices here for brevity, but it is important to emphasise that coordination risks are not limited to prices. For example, market-sharing information on volumes to facilitate coordination on the level of output could represent an equivalent level of risk to consumers.

4 For example, see Autorité de la concurrence and Bundeskartellamt (2016), ‘Competition Law and Data’, 10 May.

5 This effect could also work the other way and reduce prices if the firm misperceives the price that rivals are setting. For example, consider a case where a firm, without access to pricing data, perceives that its rivals are pricing at €7. It may then seek to price at €6. If, through additional transparency, the firm now observes rivals pricing at €5, it will seek to undercut that price, to (say) €4.

6 For a discussion of this issue in the case of prices that are set algorithmically, see Oxera (2017), ‘When algorithms set prices: winners and losers’, Agenda, June.

7 See also the discussion in Bennett, M. and Collins, P. (2010), ‘The law and economics of information sharing: The good, the bad and the ugly’, European Competition Journal, 6:2, pp. 311–37.

8 Vestager, M. (2018), ‘Competition in changing times’, speech at FIW Symposium, Innsbruck, 16 February.

9 See Oxera (2015), ‘The Cloud, or a silver lining? Differentiated pricing in online markets’, Agenda, May.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More