By object or by effect: revisiting pharmaceutical patent settlements after paroxetine

On 8 March 2018, the CAT handed down its ‘initial’ judgment on an appeal of a decision by the Competition and Markets Authority (CMA) on the patent settlement agreements in the supply of the medicine, paroxetine (the ‘judgment’).1 The judgment is ‘initial’ because, instead of reaching final conclusions, the CAT has referred a number of critical questions to the CJEU for a preliminary ruling.

The case involved GlaxoSmithKline (GSK) as the ‘originator’ of paroxetine (which held the patents relevant for the manufacturing of the drug) and a number of suppliers of generic drugs, which were taking steps to enter the market.2 In particular, the generic suppliers challenged the patents in court and GSK subsequently settled these patent litigations. At a high level, these patent settlement agreements typically involved:

- monetary payments from GSK to the generic suppliers, and certain supply arrangements whereby the generic supplier could supply GSK’s product (the ‘value transfers’);

- a condition under which the generic supplier could not enter the market with its own independent product for a pre-specified period of time (the ‘restrictions’).

The CMA found that the agreements were anticompetitive by object and by effect. The parties appealed both findings. (The CMA also found that GSK abused its dominant position in the relevant market for paroxetine, which was appealed by GSK.)

The CMA’s findings were based on its idea that, in the absence of the value transfers, the generic supplier of paroxetine would have entered the market independently of the originator before the expiry of the patent. This would have occurred either through a successful challenge to the patent or by an alternative settlement agreement whereby the generic supplier and originator agreed a date for the generic supplier to enter the market at some point prior to patent expiry. The box below shows a stylised illustration of competition authorities’ concerns with patent settlement agreements.

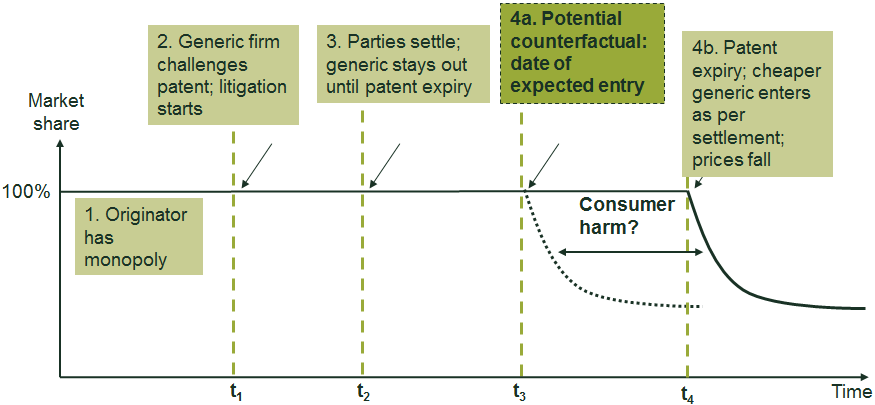

Stylised illustration of the theory of harm in a hypothetical settlement

The figure below summarises the sequence of events that are often involved in a patent settlement agreement. It shows the events in the factual situation, along with (a stylised example of) the counterfactual. In this case, the settlement agreement permits no generic entry until patent expiry, which is different from the factual situation in the paroxetine case where authorised generic entry occurred. Under this stylised example, the hypothesised counterfactual involves generic entry at t3, which is after the settlement agreement at t2 but before the generic entry date under settlement at t4.

The paroxetine case is not dissimilar to the other patent settlement agreements that have been scrutinised by the European Commission in the recent past (including agreements involving Lundbeck and generic suppliers, and a similar case involving Servier and generic suppliers, both of which are under appeal at the CJEU). Each case involved value transfers and a condition preventing independent generic entry for a period of time.

However, there are some important differences between the cases.

One such difference is whether the agreements allowed for authorised generic products (i.e. where the generic supplier enters into a supply agreement for an alternative version of the branded product, instead of its own independent product). The paroxetine case, for instance, involved entry of authorised generic suppliers (which captured over 50% of the market in the two years following the settlement agreements),3 while the Servier and Lundbeck cases, for the large part, did not. This is relevant because authorised generic entry may deliver benefits to consumers and health authorities by increasing the supply of cheaper products and by potentially replacing parallel imports of medicines.

There are also other differences on facts such as parties’ expectations about their success in the patent litigation. Nonetheless, the CAT’s assessment—particularly of the ‘by object’ question—is of broad relevance to the treatment of patent settlement agreements under competition rules.

Questions posed by the CAT

The CAT opined on, and ultimately referred to the CJEU, questions relating to the following three themes with regard to the potential infringement of Article 101 TFEU.

Potential competition

First, the CAT considered whether the originator and the generic suppliers are potential competitors when there is ongoing patent litigation and uncertainty regarding its outcome, and in the presence of an interim injunction. While it has referred this question to the CJEU, the CAT’s preliminary opinion, consistent with that of the General Court in Lundbeck, is that, even if the generic firm cannot enter in the short term, it could be regarded as a potential competitor, and the ability of the generic supplier to prepare to launch its product in the future is important for the competitive process.4

Infringement by object

The second set of questions referred by the CAT relate to whether such agreements can be considered an infringement by object. In particular, the CAT asks whether a settlement agreement that involves (a) a restriction on independent generic entry (and restrictions on a challenge on the patent); and (b) a value transfer from the originator that cannot be explained on the basis of avoided litigation costs or payment for any goods or services to the patent holder, can be considered an infringement ‘by object’, in circumstances where the patent strength is uncertain. In other words, this question asks whether one can infer an anticompetitive nature of a settlement agreement from the fact that it includes a large unexplained value transfer and a restriction on entry. This is known as the ‘pay-for-delay inference’.5

The CAT also asks whether the answer to the above is different (i.e. whether the inference holds) if there is entry of authorised generic products (as was the case in the paroxetine market). It sets this out as a separate question because authorised generic entry could yield benefits for consumers.6

While the CAT considered the extensive economic evidence from experts on the theory of the pay-for-delay inference and the specific context of this case, it ultimately does not conclude on this question. The specific context considered by the CAT included detailed analysis of the effect of the authorised generic entry on wholesalers, pharmacists and the NHS.7 In considering this evidence, the CAT noted that:8

[T]he fact that it may not be possible to show on the facts that a particular agreement is likely to have an anticompetitive effect does not preclude it from being a restriction ‘by object’.

Restriction by ‘object’ therefore focusses on determining the potential effect of the agreement, having regard to its nature and its context, rather than on establishing on the facts what are, or were, its likely effects…Of course, that potential must be realistic and not fanciful and it must be clear that the potential effects would materially harm competition. The assessment may, therefore, involve some consideration of potential effect in the overall market context [emphasis added]

Infringement by effect

In opining on whether the agreements in this case were anticompetitive by effect, the CAT considered that it was necessary to assess the counterfactual and whether that would have been more competitive:9

[A] finding that an agreement gives rise to a restriction by effect requires consideration of whether the agreement was in fact likely to have restricted or distorted competition on the relevant market to an appreciable extent. Therefore, fundamental to an ‘effects’ case is the counter-factual: i.e. what would have happened in the absence of the agreement? That includes a potential effect on competition. [emphasis added]

Given the debates around the challenges involved in assessing patent strength, it is noteworthy that the CAT considers that to find that an agreement is an infringement by effect:10

[I]t is necessary to establish it on the balance of probabilities: i.e. that it is more likely than not that the counter-factual would have been more competitive.

This is somewhat at odds with the Federal Trade Commission’s finding in the Actavis case, where the US Supreme Court suggested that patent strength (or weakness) could be inferred from the magnitude of the value transfer (i.e. the larger the value transfer from the originator, the weaker the patent is likely to be).11

The CAT notes that there was no compelling evidence that the counterfactual world without the specific agreement (which potentially includes continued litigation and an alternative settlement) would have been more competitive.12 However, given the broader relevance of this aspect, the CAT asked the CJEU to decide whether, to find an infringement by effect, ‘a positive chance of entry’ is sufficient, or whether ‘the probability of generic entry need[s] to be above 50%’.13

While the CJEU’s views on these questions will be eagerly awaited by the wider industry, in the short term they put a spotlight on the pay-for-delay inference itself, given its critical role in the question about object infringement. Can one infer the anticompetitive nature of the agreement from the existence of a ‘large’ value transfer and a restriction on entry?

The economic debate on the pay-for-delay inference

In the economic literature, the pay-for-delay inference is based on a specific economic model involving a patent litigation between one originator and one generic company.14 This model considers the trade-off that each party makes when deciding whether to continue the patent litigation or to discontinue and settle the litigation. The trade-off arises from the fact that, if the litigation is continued, both parties face an uncertainty in the outcome of the litigation and incur costs. In contrast, if they settle, they save litigation-related costs and each party receives some benefit as per the specific terms of the settlement agreement. In the model seen in the literature, a settlement agreement has two dimensions—a value transfer, and an agreed date of independent entry by the generic company.

For example, let us assume that an originator is seeking to settle a dispute with a single generic producer over a patent with ten years left before expiry. For simplicity, we assume no litigation costs.

The probability that the patent will be successfully challenged under litigation is 10%. Total profits in the market are €100m and the generic supplier would achieve a 30% market share if it entered. All this information is known to both parties.

Under these assumptions the generic company therefore has a 10% chance of making a profit of €30m. It would therefore agree to stay out of the market until patent expiry in exchange for a payment of €3m. The two parties could also agree to a combination of a value transfer and an agreed date of entry prior to patent expiry, such that the generic supplier agrees to a lower value transfer in exchange for an entry prior to the patent expiry.

This framework makes some simplifying assumptions, including that:

- both parties are risk-neutral (which effectively means that each party cares only about its expected profits, such that receiving €3m with certainty is equivalent to a gamble that has a 10% chance of a €30m payout and a 90% chance of €0);

- both have common (or symmetric) and complete information, in that both know the true strength of the patent and the profits that each will receive under the scenario of generic entry following the conclusion of litigation, and under the scenario of no generic entry;

- the negotiation between parties is efficient.

The model postulates that a settlement agreement can be anticompetitive even if the settlement allows entry before patent expiry.

This is because the originator would, in principle, pay the generic firm only if it expected to receive benefits from the settlement. One such benefit to the originator is the avoidance of litigation-related costs, which is therefore considered a legitimate reason for such a payment. However, in the simple model above, if the payment is above litigation costs and no other goods and services are provided by the generic firm to the originator, it is inferred that the extra payment is for benefits that arise from restrictions on the generic firm, such as a delay to independent market entry. In particular, the argument is that, without payment, an earlier date for independent entry would have been agreed under the same negotiation, and would therefore have been more competitive. Hence, this simple model suggests that a settlement agreement with an ‘unexplained’ value transfer (i.e. that which is not explained by litigation-related costs or other goods or services) is anticompetitive.

Impact of risk-aversion and asymmetry

While this logic holds within the framework above, it critically depends on the assumption of risk-neutrality and symmetry. There is some economic literature that highlights that, if parties have asymmetric information and the originator is risk-averse, this inference does not hold15—i.e. agreements with value transfers above avoided litigation costs cannot be assumed to delay entry beyond what would have happened in the counterfactual.

These two factors are particularly important given the inherent uncertainty in the patent litigation and the broader risks around losing a litigation in this sector. Parties can have—and in many cases, do have—very different views on the patent strength and the probability of their win at trial, and about the future profits that each might expect from supplying the medicine. At the very least, it cannot be assumed that both parties are perfectly aligned about the outcome of the litigation, and that their expectations match the true outcome (which is unknown until after the trial).

The assumption of risk-neutrality may also be a strong one in the context of this sector. There could be a range of reasons for companies to be risk-averse. Risk-aversion may be greater where there is more at stake. In the context of patent litigation, an originator may be risk-averse when the patented product is responsible for a large share of a company’s profits.16 It could also be due to other indirect costs that the litigation entails (including in other geographic markets). Risk-aversion may also be present at the level of the individual managers and decision-makers in the business.

If the originator is risk-averse, it will place high value on the certainty of a settlement (compared with the uncertainty of ongoing litigation) and may therefore be willing to offer a more favourable settlement term to the generic supplier. This creates the possibility that a settlement could be procompetitive compared with ongoing litigation. However, such a procompetitive settlement may not be achieved if there is informational asymmetry. In particular, if the generic firm’s expectation about its success is unduly high (relative to the originator’s expectation as well as the underlying probability of its success), it may not be willing to accept the terms that the originator offers. In such a situation, it can be impossible to conclude the procompetitive settlement agreement without a value transfer from the originator to the generic supplier.

Hence, the factors of risk-aversion and asymmetry could provide a legitimate explanation for payments, over and above litigation-related costs, and lead to procompetitive settlements. This would depend on how the parties’ own expectations about their success match with the underlying true likelihood of the outcome of the litigation, and the extent of risk-aversion of the originator.

Concluding remarks

Whether, and how, risk-aversion and symmetry are taken into account by the CJEU in its preliminary ruling remains to be seen. Meanwhile, it is interesting to note that, although the CAT did not reach a conclusion on the question of object infringement, it recognised some of the above aspects.17 For example, it notes that the uncertainty in the patent strength could be relevant because, while there is a possibility of generic entry following the counterfactual of litigation, there is also the possibility that the originator would have prevailed in the litigation (which, according to the CAT, is not less competitive because it provides incentives to innovate). The judgment also recognises—somewhat contrary to the majority judgment in Actavis—that it is not possible to infer the patent strength (or weakness) from the size of the payment in light of factors such as risk-aversion and asymmetry.

1 Competition Appeal Tribunal, Generics (UK) Limited, GlaxoSmithKline Plc, (1) Xellia Pharmaceuticals APS (2) Alpharma LLC, Actavis UK Limited and Merck KGAA v Competition and Markets Authority, judgment of 8 March 2018. Paroxetine is a serotonin reuptake inhibitor (SSRI) antidepressant medicine. Oxera advised Merck during the investigation and the appeal, and provided expert evidence during the hearing.

2 The suppliers of generic drugs affected by the settlements included GUK, Merck, IVAX/Teva, Alpharma, Xellia and Actavis.

3 Judgment, para. 291.

4 Judgment, paras 155–158.

5 Judgment, paras 321 and 322.

6 Judgment, paras 292 and 325.

7 Judgment, paras 264–308.

8 Judgment, paras 168 and 170.

9 Judgment, para. 328.

10 Judgment, paras 349 and 330.

11 FTC v Actavis, Inc, 133 S Ct 2223 (2013), 2236-37.

12 Judgment, paras 346 and 348.

13 For example, see judgment, para. 330.

14 Edlin, A., Hemphill, C., Hovenkamp, H. and Shapiro, C. (2013), ‘Activating Actavis’, Antitrust, 28:1, Fall, Appendix.

15 See Harris, B., Murphy, K., Willig, R. and Wright, M. (2014), ‘Activating Actavis: A More Complete Story’, Antitrust, 28:2, Spring.

16 See FTC v Watson Pharmaceuticals 677 F.3d (1298) (11th Cir. 2012) at 1313: ‘A party likely to win might not want to play the odds for the same reason that one likely to survive a game of Russian roulette might not want to take a turn.’

17 Judgment, para. 321 (1)–(3).

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More