Optimal hesitation? Confirmation bias in consumer choices

Behavioural economics is now part of the toolbox for many competition authorities. As academic research increases our knowledge of this area, this toolbox will grow to include a wider range of behavioural methods. A recent study at the crossroads of economics, neuroscience and machine learning analyses the ‘hesitation’ process of consumers, shedding new light on the limits of their ability to assess information.

This article is based on work by Oxera Analyst, Ambroise Descamps, and PhD advisers at the Queensland University of Technology, Australia: Descamps, A., Massoni, S. and Page, L. (2018), ‘Optimal hesitation, an experiment’, Queensland Behavioural Economics Group, working paper no. 47.

Economic theory about consumer choice is usually divided into two categories. On the one hand, analysis of decision-making ‘under certainty’ describes situations where consumers have well-defined preferences for particular products, and compare prices to make up their mind. For instance, if John prefers apples over pears, as long as the price of apples is reasonable, he will always buy apples rather than pears. There is no risk associated with making a choice, and consumers have perfect knowledge of the characteristics of the options they are comparing. On the other hand, in the economics of choice ‘under uncertainty’, the decision-maker has to choose between alternatives while facing an irreducible uncertainty (i.e. an uncertainty that cannot be acted upon). The consumer has some knowledge of the risk faced, which is ‘rationally’1 accounted for in their decision-making process. This would describe a situation where, for example, Jane is comparing different car insurance plans and assesses their relative costs against the likelihood that she will be involved in an accident, given her driving skills.

In practice, many of our decisions lie in between these two categories. Consumers hesitate between different options, but are able to learn more about these options by accumulating information. When buying a house we do not simply look at a few adverts, read their descriptions, and pick the one that we believe to be the best given our preferences and our budget. We use online research tools to scroll through dozens of adverts, we sometimes seek advisory services from professionals, and we invest a lot of time and energy in viewing houses. This search process is costly, and consumers face an ‘optimal hesitation’ problem where they have to weigh the costs of accumulating further information against its potential (incremental) benefits. We know that the 50th house we look at may not be the best available on the market, but if it’s already great, do we really want to spend another year running around town to find the ‘best’ possible option? While standard economic theory simply describes how the costs and benefits of further searching are compared, recent research at the crossroads of behavioural economics, machine learning and neuroscience attempts to open up the black box of hesitation.

The behavioural economics of information search

Neuroscientists can contribute valuable insights into why we hesitate. They analyse human perceptions, and how information gathered over a few milliseconds is processed by the brain.2 This period of time is too short for us to realise that we are making an active choice, but in fact the brain is making computations ‘in the background’ and trying to figure out which option to choose. The results of these studies are striking. Information-processing is costly for the brain and, as in an economics scenario, the brain solves a mathematical problem3 in which the cost of processing further evidence is weighed up against the potential benefits of that additional evidence. The human brain is not wired to make the best possible decision of all, but rather to make the best decision given the cost of information. As such, imperfection is embedded in our decision-making process.4

Research conducted by Descamps et al. (2018) incorporates these findings into an economics framework in order to study how hesitation affects decision-making.5 The main challenges are twofold. First, contrary to the problems that neuroscientists study, economic choices are conscious and can take place over a long period of time. Second, in an economics setting, products are complex, and it can be difficult to disentangle the effect of their features from actual search behaviour.

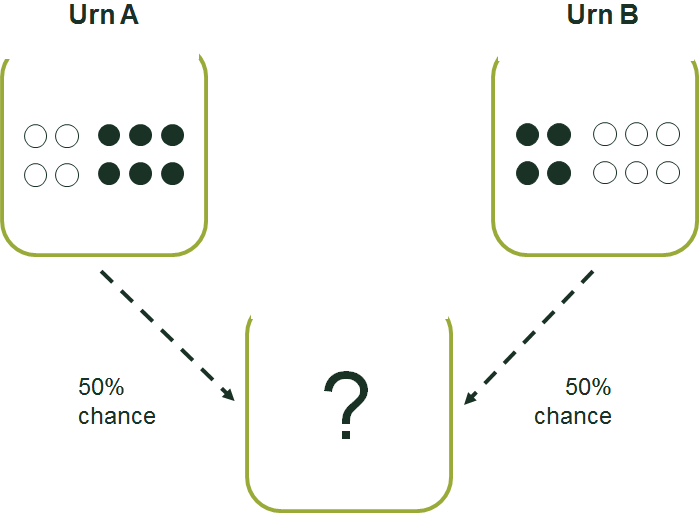

To overcome these challenges, the researchers designed a laboratory experiment. Students from an Australian university were recruited, and paid to play the following video game. Two urns filled with balls were presented on a computer screen, representing two products or financial assets that the participants had to choose from. The two urns were identical, except in their shares of black and white balls: ‘Urn A’ contained six black balls and four white balls, while ‘Urn B’ contained four black balls and six white balls (as shown in Figure 1).

Figure 1 The two urns used in the experiment

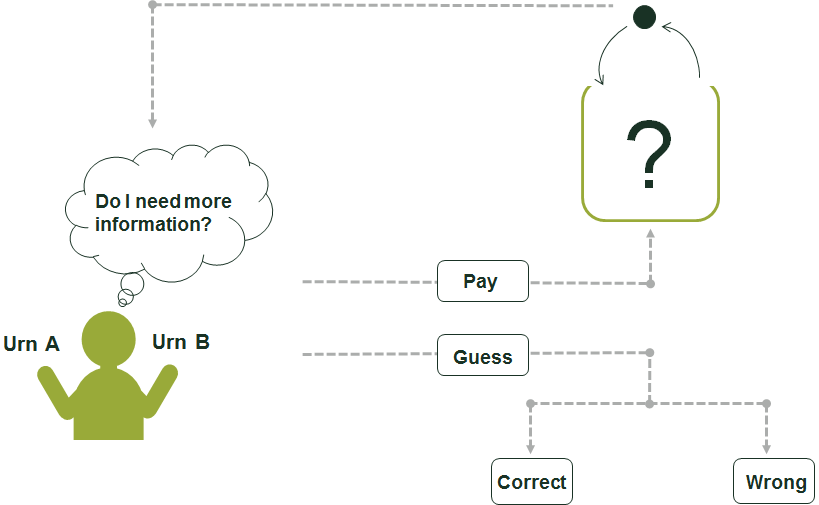

The participants played multiple rounds. At the start of each round one of the urns was selected at random, and the participants were asked to guess which urn they were being presented with. To help them decide, the participants were allowed to draw balls one at a time from the urn. Each ball that was drawn was returned to the urn, which was then reshuffled before the next ball was drawn.6

The participants could choose to guess the identity of the urn at any stage. Making the right guess would yield a payment of $20, while making the wrong guess would leave the participants with nothing. Figure 2 illustrates this process. There was also a catch: to draw balls, the participants had to incur a monetary cost. To go back to the house example, the participants were in a situation similar to someone looking to buy a house and investing time and money in working out whether it was the right one (although with much lower stakes!).

Figure 2 The experiment process

To investigate the tension between information availability and the quality of the decisions taken, the researchers varied the cost of the balls drawn from the urn. In one version of the experiment, the participants paid $0.10 for each ball drawn; in another version, they paid $0.50; and in a third version, they paid $1.

Based on the mathematical models used by neuroscientists, the potential gains from guessing correctly, and the cost of information, the researchers were able to calculate the ‘optimal’ number of balls to draw in each case. In other words, given the high level of control in this setting, it was possible to predict individuals’ most efficient ‘level of hesitation’.

Confirmation bias in decision-making

After testing 180 students, who each took 80 of these decisions, the researchers were puzzled by how their findings compared with their theoretical predictions. On the one hand, the mathematical models offered a good representation of information-processing by the brain. On the other hand, the experiment found that the participants deviated from the ‘optimal’ solution in a systematic way. When the cost of information was low ($0.10 per ball), the participants drew an average of nine balls instead of the predicted 19. When information was costly, however, they drew seven balls instead of four in the $0.50 per ball scenario, and four balls instead of one in the $1 per ball scenario. In other words, when information was cheap, participants gathered too little of it, and when it was expensive, they gathered too much.

Potential explanations were explored, one being that participants exhibited a confirmation bias. Confirmation bias is one of the most frequent biases observed in decision-making. It is the human tendency to perceive as more credible any information that confirms our existing beliefs, and to discount information that contradicts them. The concept is well known in finance:7

A mind is a terrible thing to change. You decide gold is a good bet to hedge against inflation, and suddenly the news seems to be teeming with signs of a falling dollar and rising prices down the road. Or you believe stocks are going to outperform other assets, and all you can hear are warnings of the bloodbath to come in the bond and commodity markets. In short, your own mind acts like a compulsive yes-man who echoes whatever you want to believe. Psychologists call this mental gremlin the ‘confirmation bias’.

In this case, confirmation bias implies that, after initially seeing (for example) a black ball, the participants placed too much weight on the next piece of information they received if that was a black ball as well. When information was cheap, it meant that participants reached a conclusion very quickly, and regarded the information provided by a subsequent ball as not being worth the extra cost of drawing it (relative to an unbiased decision-maker). On the other hand, when additional information was costly, the value of the confirming draw was exaggerated by the participants (with a ‘confirmation premium’), thereby leading to an increased incentive to draw it.

Implications

The impact of confirmation bias on economic and financial decisions is important.

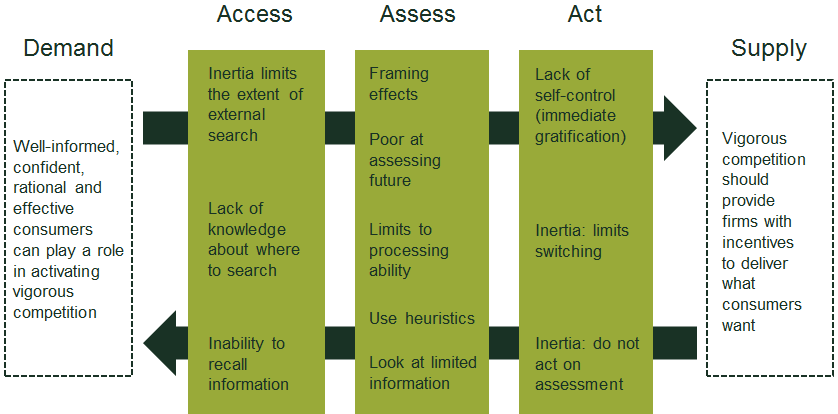

In economics, competition authorities have incorporated into their toolbox elements relating to consumers’ ability to assess information. The taxonomy of biases typically used by UK competition authorities, for example, is made up of three categories, depending on whether they affect consumers’ ability to access, assess or act upon received information.8 The results of the experiment discussed above highlight a failure in consumers’ ability to assess information, which in turn affects how they decide to access information over time. This decision-making process is illustrated in Figure 3.

Figure 3 The ‘access, assess and act’ classification of behavioural biases

When implementing behavioural remedies, regulators often seek to lower the cost of information to consumers. For example, in the extended warranties market study, the UK Office of Fair Trading accepted undertakings that aimed at reducing consumers’ searching costs, and promoting the alternative options available.9 Also, in the short-term loan markets investigation by the UK Competition and Markets Authority, lenders were prohibited from supplying payday loans if they did not provide details of their products on a price comparison website.10 One interpretation of the research by Descamps et al. (2018) is that, in the presence of confirmation bias, lowering search costs might not be as effective as it is usually assumed to be.

This research into confirmation bias highlights the importance of testing the way in which consumers respond to information. Further research is needed to understand what kind of information should be provided so that consumers act on it in the most appropriate way. Merely providing information may not be as efficient as previously supposed, if it is not used appropriately by consumers.

1 ‘Rational’ processing of information often refers to how new pieces of evidence are incorporated into decision-making using the mathematical formula known as Bayes’s rule.

2 In a typical experiment of this kind, participants see dots moving for less than a second, and are then asked to state which way they were going. For a review, see Bogacz, R., Brown, E., Moehlis, J., Holmes, P. and Cohen, J.D. (2006), ‘The Physics of Optimal Decision Making: A Formal Analysis of Models of Performance in Two-Alternative Forced-Choice Tasks’, Psychological Review, 113:4, pp. 700–765.

3 Known as ‘sequential sampling’, ‘drift diffusion’ or ‘optimal stopping’.

4 This links to the ‘random utility model’ in economics, which describes consumers’ choices while acknowledging it will never perfectly predict choice. The theories described in this article give a neuroeconomic foundation to this well-known model. For instance, see Fehr, E. and Rangel, A. (2011), ‘Neuroeconomic Foundations of Economic Choice—Recent Advances’, Journal of Economic Perspectives, 25:4, pp. 3–30.

5 Descamps, A., Massoni, S. and Page, L. (2018), ‘Optimal hesitation, an experiment’, Queensland Behavioural Economics Group, working paper no. 47.

6 This method is called ‘sampling with replacement’.

7 Zweig, J. (2009), ‘How to Ignore the Yes-Man in Your Head’, Wall Street Journal, 19 November.

8 For a full discussion, see Oxera (2014), ‘Review of literature on product disclosure’, prepared for Financial Conduct Authority.

9 See Oxera (2012), ‘Behavioural problem, behavioural solution: the case of extended warranties’, Agenda, October.

10 See Competition and Markets Authority (2015), ‘Payday lending market investigation’.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More