On schedule: do TV programming clashes matter?

To what extent do scheduling clashes between the BBC (the UK’s main public service broadcaster) and ITV (its main commercial rival) harm ITV’s audience figures? An Oxera study has found that, contrary to conventional wisdom, head-to-head clashes of weekend primetime entertainment shows do not seem to affect ITV’s audience figures. However, clashes between crime dramas do have an impact.

In 2016, the UK Department for Culture, Media & Sport published a report that looked at the market impact of the BBC (British Broadcasting Corporation). The BBC is governed by Royal Charter, and the current Charter expires at the end of 2016. The report, produced by Oliver & Ohlbaum with support from Oxera, formed part of the evidence base for the renewal of this Charter.1 The government published a White Paper in May 2016,2 and its draft Charter was published on 15 September.3

The BBC is the main public service broadcaster in the UK.4 Unlike its rivals, the BBC does not broadcast advertising in its TV programming schedule or charge an opt-in subscription. Instead, anyone wishing to watch TV in the UK must purchase a TV licence, the price of which is set by government at the time when the Charter is renewed. The licence is used to fund the BBC’s TV, radio and online activities, and represents a unique model worldwide. However, concerns have been expressed over the years by commercial operators—in particular, rival broadcasters have complained about the impact of the BBC on their ability to attract a sufficient audience to bring in advertising revenues.5

The BBC has an impact on commercial broadcasters through both the types of TV programme that it broadcasts, and when it broadcasts them. If a particular type of programme is being broadcast on BBC One at the same time as a similar type of programme is being broadcast on ITV, this head-to-head scheduling might be expected to have an impact on ITV’s audience. Oxera undertook an econometric study to determine whether this was indeed the case—in terms of both the extent to which such clashes actually occur, and their impact on ITV. The study was the first of its kind in the UK.6

Clash or no clash?

Oxera analysed the impact of BBC One on ITV viewing figures during primetime slots over the three-year period from 2012 to 2014.7 The impact on ITV audience numbers of drama scheduling clashes with BBC One (and other channels) was explored through econometric ‘panel data’ analysis using Broadcasters Audience Research Board (BARB) data on the scheduling of weekly drama series. Also considered was the impact on ITV of primetime weekend entertainment scheduling clashes.

The main issue examined was the extent to which BBC One’s (and other channels’) scheduling of dramas affects ITV’s drama audience. To explore this, 20 ITV dramas were identified over the period 2012–14 that were classified as series or serials, aired on a weekly basis, non-repeats, and broadcast during the primetime slot (20.00 to 22.00). The panel dataset comprised 222 observations across ITV shows and weeks.8

Given that all the ITV shows identified on this basis were dramas, it was then possible to ascertain when scheduling clashes occurred with dramas on BBC One (and other channels). Both a broad and a narrow definition of scheduling clashes were considered; a broad clash being assumed to occur when ITV and another channel simultaneously aired any drama. There were 102 ‘broad’ clashes out of the 222 ITV drama episodes examined (i.e. 45%).

This may seem a lot. However, it was not immediately obvious that a drama on one channel (e.g. a crime drama) would necessarily be in direct competition with a drama of a different kind on another channel (e.g. a period drama). A previous US study had analysed these issues at the subgenre level,9 so Oxera therefore categorised the ITV dramas into the following subgenres using Internet Movie Database (IMDb) information: crime, medical, comedy, period, history, fantasy, adventure, and life story. This allowed the identification of ‘narrow’ clashes.

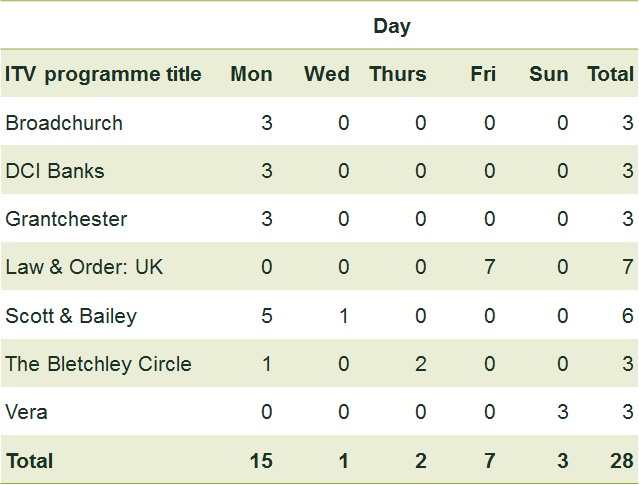

On this basis, the only narrow clashes in the dataset were with crime dramas—in part driven by the prevalence of crime drama episodes in the BBC One and ITV dataset. As Table 1 shows, over the period analysed, there were 28 schedule clashes between BBC One and ITV crime dramas. This was out of a total of 222 ITV drama episodes (or, more specifically, 121 ITV crime drama episodes). In practice, the clashes occurred after the 21.00 watershed—i.e. between 21.00 and 22.00, which is the limited primetime period during which adult drama may be shown. Table 1 also shows that around half of the clashes occurred on a Monday.

Table 1 Crime drama schedule clashes between BBC One and ITV by day

Source: Oxera analysis of BARB data.

As discussed below, the modelling framework allowed the separate impact of the drama subgenre clashes on ITV’s audience to be tested (although a model was also estimated using a broader level of clash).

From the USA to the UK…

The starting point was a US study by Shamsie et al.,10 which was adapted for the UK context and the nature of the dataset. This study identified that the audience for a given show will depend on a number of factors. These include its previous week’s airing (a ‘lagged dependent variable’), the effect leading in from the show in the timeslot immediately preceding it (a ‘flow’ or ‘inheritance effect’), the stability of the time slot, the series tenure, and, as discussed above, competition from other channels offering a series in a similar subgenre at the same time.

Using US micro data (i.e. relating to specific shows), the Shamsie et al. study found that, for a given show, its audience from the previous week and its tenure, as well as the rating of the preceding show, had a positive and statistically significant effect on the show’s audience.11 In contrast, the number of main networks providing content at the same time, and the similarity of these competing shows, were both found to have a negative and statistically significant impact on a show’s ratings. The similarity of the preceding show, and the stability of a show’s time slot per se, were not found to be statistically significant drivers of audience ratings.

An advantage of using micro data, as in the US study and the Oxera approach, is that a number of variables can be included in the analysis (that are reasonably independent), in a way that the impacts of each variable can be meaningfully determined. Aggregated data may not pick up these relationships as readily.

A further advantage of a panel of micro data is that variation within shows over time, and between shows, can be used to fit the model. For example, in the Oxera study, ITV shows that did not experience genre clashes with BBC One can be compared with those that did, while controlling for other factors. For any given ITV show, its audience before and after any clash can be taken into account, again controlling for other factors.

Furthermore, by using observations across shows and over time, panel data analysis can remove the impact of unobservable factors that are specific to each ITV show and do not vary over time—such as the scale of the show and its core loyal audience who rarely switch. The US study used a ‘random effects’ framework to do this.12 While the Oxera study used a random effects model, our main approach was to use a ‘fixed effects’ framework. These generally rely on fewer assumptions than random effects models.13

Given the context, the Oxera study focused on the impact on selected ITV dramas of scheduling clashes with BBC One (and other channels), while controlling for other factors. This differs somewhat from the US study, which examined the impact of scheduling clashes on various network providers. In our analysis, markers or ‘dummy variables’ were included for each channel to indicate when clashes with ITV occurred. When there was a clash, a dummy variable of 1 was assigned, and 0 otherwise. The ‘other factors’ included in our specifications were the audience for the show at its previous airing, flow, tenure, and slot stability.

Audience ratings on other channels, either at the given time slot or for the time slot of the preceding show, were not included as explanatory factors, as this might have led to statistical problems. The US study also did not include these variables, possibly for the same reason. There were also some other modelling-related departures from the US approach.14 In addition, our analysis used a dataset with total (live plus catch-up) audience figures.

What matters in the UK?

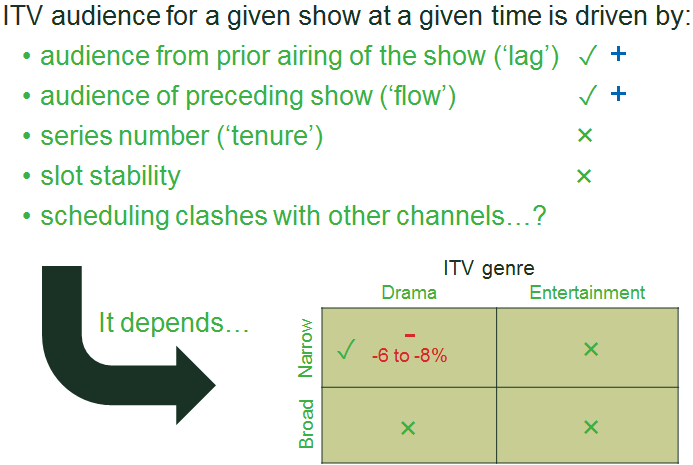

Essentially, broad clashes at the genre level—i.e. ‘entertainment’, ‘drama’—between BBC One and ITV shows do not have an impact on ITV audience numbers. In contrast, narrow subgenre clashes do make a difference—but only in the case of dramas. The main findings are summarised in Figure 1.

Figure 1 What drives ITV audience?

In the case of dramas, for example, there is little impact on ITV’s audience when BBC One schedules a drama at the same time, as long as the subgenres of the two programmes are different. In contrast, the econometric results consistently indicate that when clashes occur between BBC One and ITV drama subgenres, ITV audience figures are 6–8% lower than would otherwise be the case.15 This may also understate the impact, as the audience data used included live, same-day and seven-day catch-up viewing.16 In addition, because it is also found that any given week’s viewing figures for a particular show are highly dependent on those of the preceding week, the effect is likely to persist over a number of weeks.

For instance, assuming that, at the beginning of a month, there is a single clash in week 1, this has an initial impact on the ITV drama audience of around -7%. With an audience week-to-week persistency of 50%,17 the initial clash would translate into a reduction in ITV audience in each of the subsequent weeks of 3% (week 2), 2% (week 3), 1% (week 4), and very small impacts after this. Adding up the impacts over these subsequent weeks, the total impact of the clash is comparable to a 14% reduction in audience concentrated in the first week. While, in this scenario, audience numbers eventually recover, this is not the case if clashes persist week on week. In this alternative scenario there would be around a 13% reduction in ITV drama audience each week over the longer term. However, as shown in Table 1, the extent to which repeat clashes actually occur varies by ITV crime drama.

Over the three-year period the narrow clashes occurred between crime dramas only, for 28 out of 121 ITV crime drama episodes. This is a small but significant number of clashes, which in turn will have commercial implications for ITV. However, in practice clashes emerge as a result of action by both the BBC and ITV. Both parties place a major emphasis on crime drama, and it is not clear that the BBC deliberately schedules its own crime dramas against those of ITV. The 21.00 watershed means that there is a limited time slot for the channels to schedule any given adult drama on a given day, meaning that some scheduling clashes are unavoidable. It may simply be that the abundance of crime drama per se, squeezed into a tight schedule, is driving the clashes. However, it is also notable that half of the crime drama clashes occur on a Monday.

Weaker effects of clashes between BBC One and ITV shows are found with regard to weekend entertainment viewing. At a broad level, scheduling clashes between a BBC One entertainment programme and an ITV entertainment programme mean that ITV’s audience is around 1% lower than would otherwise be the case. However, this effect is not statistically significant (i.e. given the low magnitude, and the amount of uncertainty in the estimate, the number cannot be relied on). At a narrow level, there are 27 clashes (out of 244 ITV episodes), mainly in music/dance entertainment, but also in the quiz/panel/game show subgenre. The magnitude of the effect is again around -1%, and is once again not statistically significant.

Throughout much of the analysis, the scheduling and content decisions of the other channels examined (BBC Two, Channel 4, Channel 5) are also found not to have a statistically significant negative impact on ITV’s audience. And throughout, prior episode audience for the ITV show (often the previous week’s airing) and the audience of the preceding ITV show (‘lead-in’ or ‘flow’) are the main drivers of ITV’s audience for any given show.

Closing credits

Oxera’s analysis sought to explore whether scheduling clashes between the BBC and ITV reduce the latter’s audience numbers. It was found that this can happen, but is not always the case. The results for entertainment are interesting in themselves, as conventional wisdom says that weekend primetime entertainment clashes matter. The Oxera evidence calls this into question.

The analysis does show, however, that crime dramas are a key battleground and, when crime drama scheduling clashes occur, ITV audience numbers are 6–8% lower in the week concerned—compared with what might have been expected if BBC One had scheduled a different type of programme. Over the longer term, the cumulative impact of clashes could be greater.

This type of analysis has the potential to be extended to address other scheduling questions.

1 Oliver & Ohlbaum and Oxera (2016), ‘BBC television, radio and online services: An assessment of market impact and distinctiveness’, prepared for The Department for Culture, Media and Sport, February.

2 Department for Culture, Media & Sport (2016), ‘A BBC for the future: a broadcaster of distinction’, presented to Parliament by the Secretary of State for Culture, Media & Sport, Cm 9242, May.

3 Department for Culture, Media & Sport (2016), ‘Broadcasting: A copy of the Draft Royal Charter for the continuance of the British Broadcasting Corporation’, presented to Parliament by the Secretary of State for Culture, Media and Sport, Cm 9317, 15 September.

4 The commercial public service broadcasters in the UK are ITV, Channel 4 and Channel 5, all of which have public service broadcaster obligations in their broadcast licences issued by the UK communications regulator, Ofcom.

5 Concerns have also been raised about the BBC’s reach into other areas, such as on-demand programming and online news. See Oliver & Ohlbaum and Oxera (2016) for a discussion.

6 See Oliver & Ohlbaum and Oxera (2016), ‘TV scheduling analysis’, section 8, pp. 197–220. The econometric study focuses on the channel formerly known as ITV1 (renamed ITV in 2013), as opposed to the ITV organisation with its full range of channels.

7 For drama, primetime slots are defined as 20.00 to 22.00 Monday to Friday and Sunday. For entertainment, primetime is defined in the vast majority of cases as 19.00 to 22.00 on Saturday (although there are a limited number of instances in which entertainment shows occur before 19.00 on a Saturday, and a limited number of instances in which they occur on a Sunday).

8 For dramas split into two episodes (e.g. in the series finale), only the first episode was included.

9 Shamsie, J., Miller, D. and Greene, W. (2006), ‘A question of timing: strategies for scheduling television shows’, chapter 8, pp. 119–33, in J. Lampel, J. Shamsie and T.K. Lant (eds), The Business of Culture, Strategic Perspectives on Entertainment and Media, Lawrence Erlbaum Associates, reprinted in 2008 by Psychology Press.

10 Shamsie, J., Miller, D. and Greene, W. (2006), ‘A question of timing: strategies for scheduling television shows’, chapter 8, pp. 119–33, in J. Lampel, J. Shamsie and T.K. Lant (eds), The Business of Culture, Strategic Perspectives on Entertainment and Media, Lawrence Erlbaum Associates, reprinted in 2008 by Psychology Press.

11 The impact was statistically significant at the 5% level. This relates to the chance of finding a ‘false positive’—in terms of concluding that a relationship exists, rather than its sign. In this instance it means that the (conditional) probability of wrongly rejecting the hypothesis that there is no impact on the ITV audience (i.e. finding an impact when the coefficient truly is zero) is 5%.

12 Random effects models assume that, for each show, there is a time-invariant jump in the error term included in the regression. Generalised least squares estimation seeks to remove these unobservable effects by taking account of variation in the data for each show over time (‘within group’ variation) and between shows at any given point in time (‘between group’ variation). Random effects models assume that individual specific effects are uncorrelated with the explanatory variables.

13 Fixed effects models assume that, for each show, there is a time-invariant jump in the constant or intercept term included in the regression. Within group estimation seeks to remove these unobservable effects by taking account of variation in the data for each show over time.

14 For example, the framework used in the Oxera study was a fixed effects model, as opposed to a random effects model (although various models were explored). A natural log specification for the dependent variable was also adopted, rather than the linear specification used in the US study.

15 The results of the main effects-based models are statistically significant at the 1% to 5% level.

16 Based on BARB data from the Oliver & Ohlbaum dataset.

17 This takes the coefficient for the lagged dependent variable from the fixed effects model of around 0.5, which is a lower-bound estimate.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More