Financing investment: can regulation adapt to new challenges?

Water, electricity and transport networks in the UK are facing substantial investment requirements relative to historical levels, reflecting the need to replace ageing infrastructure, and meet environmental obligations and demand for new capacity. While the regulatory regime has to date enabled substantial investment to be delivered, growing pressure on balance sheets as companies issue debt to finance this expenditure raises questions about whether the framework will prove sustainable in the future. This article examines options for change to address this challenge.

The process of regulation entails a constant tension between intervention to protect customers from large companies who control key segments of the economy, and providing incentives and flexibility to enable market dynamics to increase competition. Perhaps nowhere has this tension been more apparent, and more differing points of view been expressed, than in the areas of capital structure and investment.

The regulatory regime—in particular the trend towards increased financial gearing by regulated infrastructure companies—has been under a great deal of scrutiny in recent years in the UK. What have been some of the major concerns expressed by observers of the regulatory system?

Some have worried about whether the financial structure of the system is sustainable, what will happen if conditions deteriorate, and who will be responsible for ensuring that the large-scale investment programme taking place across the regulated utilities does not falter. Others have worried about whether the trend towards highly leveraged models represents a flight of equity, driven by some inappropriate aspect of the regulatory system. However, perhaps most of all, they have worried about the potential impact on customers, who may well have benefited from substantial efficiencies in recent years, but who are also facing the pressure of ongoing price increases due to large-scale investment, particularly in water and now also in other areas.

Given the recent trend towards the use of debt financing in sectors such as water, energy and rail, this article identifies three important questions for regulators:

- is there any cause for concern regarding systemic default risk where companies have adopted highly leveraged capital structures?

- does the regulatory framework need to evolve to encourage investment in the longer term?

- is there a case for increasing price limits to address concerns about the financeability of companies?

Addressing systemic default risk

Around one-third of the UK water sector, including a number of large companies such as Anglian Water and Southern Water, has adopted a highly leveraged structure, and gearing has increased in other regulated sectors both in the UK and in markets as diverse as South America and Asia. Although companies with these models appear to have achieved a low cost of capital, there has been unease about their longer-term implications for systemic risk in the sectors where they have been adopted. Systemic risk refers to the knock-on effects that may be caused by the financial failure of a company. Due to contagion, changes in risk perceptions, and a desire to exit the market before major losses are incurred, such an event may lead to the cost of debt increasing to unsustainable levels for highly leveraged companies.

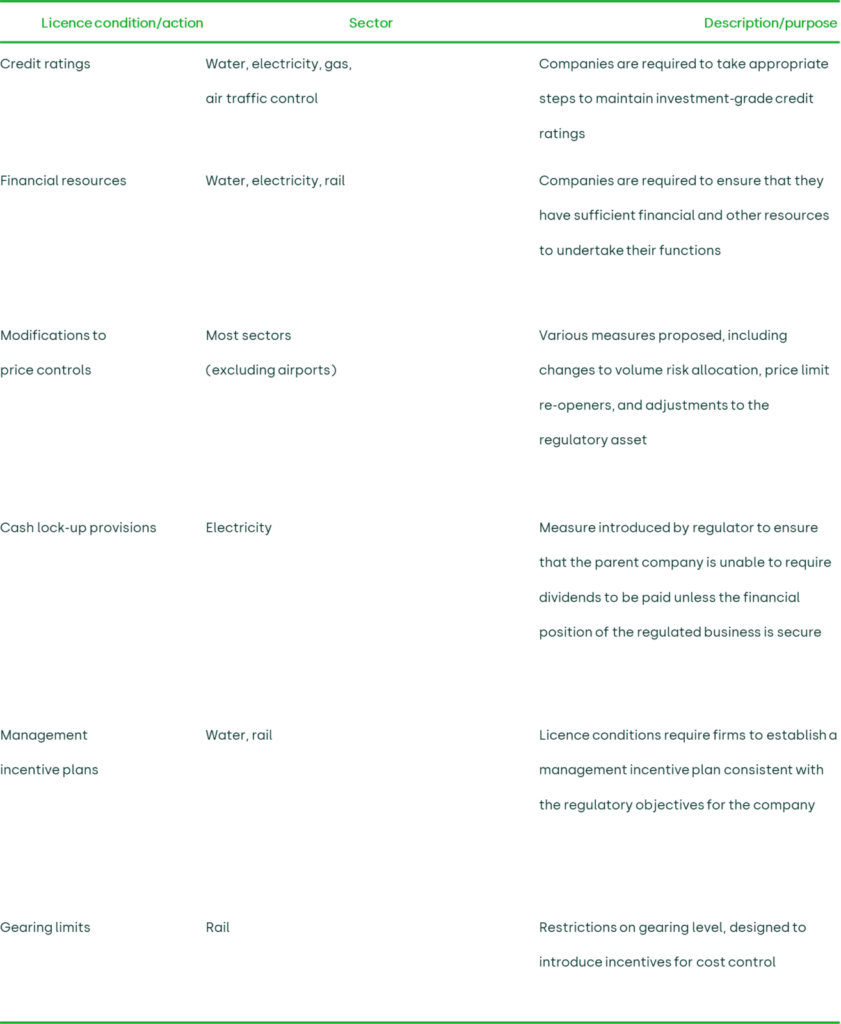

Recognising the need to continue to provide utility services in the case of financial failure of any company, the regulatory framework for utilities in the UK includes a process of special administration to facilitate the transfer of the assets of an appointed business to a new operator or set of operators. In addition, UK regulators have introduced a range of licence conditions to seek to lessen the risk of systemic effects. Table 1 summarises some of the main measures adopted.

Table 1 Examples of measures adopted to reduce default or systemic risk

In addition to these measures, regulators such as Ofwat have been keen to promote the co-existence of both highly leveraged companies and the traditional equity model, and have sought to preserve a balance through policies such as adopting a post-tax allowance for the cost of capital (which reduces the tax advantages to the highly leveraged companies), but otherwise treating both types of company similarly in price reviews.

To date, the measures taken in the UK water sector would appear to be sufficient: companies have so far not encountered financial distress, and the probability of default, as measured by credit spreads across the industry, does not appear to have increased. For the 2004 periodic review, Ofwat assumed the debt spread on the publicly traded debt of water companies to lie between 80 and 140 basis points, well below the range assumed for the 1999 review.1 These figures do not suggest that a wholesale change in the regulatory process is required to deal with highly leveraged models.

If, however, a substantial increase in the proportion of the sector adopting highly leveraged models is observed, and a substantial downward shock (not already addressed within the regulatory regime) is experienced, the possibility of a systemic risk problem could not be discounted. In such a situation, there would be limited capacity within the industry to step in quickly to take over the assets and operations of any failing firm, placing the regulator under pressure to amend the regulatory contract.

While any one of these conditions is possible over the next few years, arguably the confluence of all these events may be perceived as relatively unlikely. If, however, this were to happen, the consequences could be substantial.

- Investment is likely to be curtailed—the common response of firms in financial distress is to cut costs, and discretionary investment is often delayed, as was the case for NATS (the UK air traffic services provider) during its period of financial distress following September 11th.

- Investors, both equity- and debt-holders, would suffer losses—this would lead to an increase in the cost of capital.

- Customers or government are likely to be required to contribute to the resolution of the problem—the regulatory responses to the financial crises that affected NATS and Network Rail included both price adjustments and transfer of risks to customers or government.

Thus, while the probability of a systemic default problem may not be high in the short term, the potential consequences are sufficiently important that a continuation of the trend to highly leveraged models would require a review of the regulatory remedies currently used. A number of responses that could be considered are presented below.

- Proactive measures to retain equity models—measures such as increased returns could be implemented to promote the retention of equity models. In particular, the allowed rate of return could be set at the cost of equity. While more expensive for consumers, the reduced volatility could help restore stability to the industry.

- Development of a cross-industry insurance fund—this would be used to cover the costs of special administration and any subsequent measures required to re-establish a viable company, avoiding the need to pass through substantial price increases to affected customers.

- Caps on gearing levels—a direct, and highly interventionist, approach would be to change licence conditions to restrict gearing levels to those considered to be sustainable.

- Allowing companies to fail—it may be in users’ interests to allow companies to fail; however, this would call into question the appropriate interpretation of the duties to enable companies to finance their activities within wider duties to customers.

These measures may need to be reviewed if the trend towards highly leveraged models, and hence the concerns identified above, continue unabated.

Regulation and investment incentives

The amount of required investment in regulated sectors is forecast to remain at high levels for the foreseeable future, reflecting the need to replace ageing infrastructure, increase security of supply, improve quality in line with European Directives, and address substantial environmental challenges.

Is there any reason to consider that a highly leveraged company may be less able or willing to finance investment? Debt-providers may wish to focus on conserving cash, rather than spending it, even if returns are reasonable. Given a choice of projects, they would prefer the less risky projects. This may imply a focus on areas such as replacement of the core network, rather than enhancements to provide improved service or that might facilitate an increase in demand. Therefore, even if substantial amounts of investment are feasible within the debt-based model, there may be a concern that the type of investment undertaken may not be consistent with wider policy objectives.

A more direct concern is likely to be the response of debt-based models to periods of financial distress. Tight covenants might prevent the use of cash for discretionary spending during periods of distress. Even if a company seeks to avoid breaches of licence obligations, it may respond to pressure to reduce investment programmes relating to new capacity, meeting long-term policy objectives, or asset replacement.

If incentives for additional equity are required in future, what options might be open to regulators? The simplest approach would be to increase the return on investment. However, the returns would need to be related to outturn levels of investment; otherwise, the higher returns would simply be seen as a fixed amount of revenue, with marginal investment incentives potentially remaining at a low level.

By linking the regulatory asset base (RAB) to actual investment (albeit with a lag to preserve unit cost efficiency incentives), an increased rate of return could be effective in encouraging investment. A further advantage would be that this approach would lead to an increase in market values, making it easier to undertake rights issues. It would also arguably be fair across companies, since all would benefit from an equivalent rate of return. However, given that consumers would bear these costs directly, regulators would wish to avoid providing excessive returns.

An alternative approach, known as the split rate of return, would lead to different rates of return being applied to various types of investment. In principle, the different returns could be based on the nature of the underlying investments (risky investments should receive higher returns), or on the method of financing used by the company (equity financing should receive higher returns than debt). One frequently cited example is for returns to be linked to the regulatory process itself, with a lower return for the ‘low-risk’ RAB, which could largely be financed by cheap debt, and a higher return for new investment, which could be funded with equity to cover delivery, demand and cost risk associated with the investment programme.

For such an approach to work, the regulator would need to assess carefully the required return for the new investment. In particular, there is a danger that, by assuming that the investment can then be passed into the cheaply financed RAB at the end of each period, the companies will be undercompensated for the actual risks of the new capital projects. This could be overcome, but only if care is taken to avoid clawing back good performance by capping returns, while forcing the company to bear the full consequences of failed projects.

The general ‘split return’ approach has a number of properties.

- Differing returns for different companies, broadly in proportion to the amount of new investment relative to their existing capital base—it might be argued that this would reflect actual risk differentials, to the extent that investment intensity is a key driver of operational gearing.

- Higher marginal incentives to invest—although, this would only be the case if the higher returns were linked to actual, rather than planned, investment.

- Overall financing costs—this approach could arguably avoid an overall increase in financing costs, and may therefore be more aligned with customers’ interests than would be the case with the alternatives.

Since investment decisions are made on the basis of the trade-off between expected risk and return,2 reducing the existing risk profile faced by companies may also act to encourage providers of capital into regulated sectors. However, this may simply lead to more debt being used. A further concern with this approach would be how it may affect the incentives for efficiency and the value for money of projects undertaken.

Financeability uplifts

Revenue amounting to around £430m in net present value terms over the period 2005–10 was provided by Ofwat to ‘ensure that cash-flow indicators remain robust and stable so that efficient companies can finance their functions and retain stable credit quality going forward’.3 This reflects the ongoing net cash requirements of the business, itself driven by ongoing investment needs as well as the fact that financing costs are primarily nominal, while regulatory returns are set out in real terms.4

Such payments might be justified if any of the following conditions hold:

- the base allowed return is insufficient to attract discretionary funds;

- markets are inefficient, so regulators need to enable companies to maintain reasonable cash-flow positions even if the underlying long-term fundamentals are sound; or

- the differential investment patterns of different companies lead to different risks being incurred.

While none of these arguments has been used explicitly by Ofwat, it is interesting to note that the implication of the third is very similar to the split rate of return. In each case, the differential in average rates of return across the firms as a whole depends on the ratio of investment to the RAB. There are some subtle differences: split returns will depend on gross levels of investment, while financeability will be linked to net new investment (after depreciation is allowed for). However, within a given sector, it is unlikely that the distinction between these two areas across companies will be significant.

If net investment intensity is an important factor in determining risk, it could be argued that the split rate approach may be a more transparent way of considering how to address the investment incentives issue than has been achieved to date.

Conclusions

This article has examined whether the regulatory framework is consistent with the growing need for investment, and whether the trend towards highly leveraged models as observed in water and other regulated sectors may have longer-term implications. The main conclusions are as follows.

- In the England and Wales water sector, despite a substantial trend towards adoption of highly leveraged models, so far there has been no evidence of systemic default risk, perhaps due to the various regulatory and structural measures adopted, such as enhanced ring-fencing, credit enhancement and risk sharing. In single-company sectors where the use of structured finance has been adopted (eg, NATS), some indication of the potential frailty of the model has been demonstrated. Systemic problems are only likely to occur in water if many more firms adopt highly leveraged structures and if substantial shocks to the system arise, such as new unfunded requirements or cost shocks. Medium-term measures may need to be considered if the highly leveraged company trend continues, such as higher equity incentives, risk insurance or gearing limits.

- While a high level of investment has been delivered against a backdrop of increased gearing, balance sheet capacity constraints may lead to greater need for equity investment in future. In principle, if strong regulatory commitment is provided, and risks are transferred to customers, debt markets could continue to be the source of most new investment funds. This may not be in customers’ interests if it leads to further risk transfer. Such a trend may also lead to hesitation to invest in socially worthwhile but riskier projects, and delays due to financial restrictions.

- There are a number of mechanisms that may be useful for regulators to consider, were the encouragement of greater equity investment to become a priority. These include changing the level or structure of allowed returns, or reducing risks by building regulatory commitment. Regulators are likely to be concerned about increasing average returns due to the impact on customers, but may see some benefit in increasing marginal incentives for investment.

- Finally, there has been much discussion recently about financeability payments. Although such payments may lack theoretical underpinnings, if the allowed cost of capital is judged to be appropriate, they lead to rate of return differentials largely based on investment intensity. If this is deemed to be an actual driver of risk to investors, the case for uplifts may be justifiable, even if alternative formulations, such as the split return, may be more transparent ways of achieving a similar outcome.

1 Ofwat (2004), ‘Future Water and Sewerage Charges 2005–10: Final Determinations’, December. However, Ofwat also observed that the current, very low debt spreads are unlikely to be sustained throughout the next five-year period and there is a much greater risk that spreads will rise over the period rather than remain unchanged or fall.

2 An exception may be investments necessary to provide services in accordance with licence obligations.

3 Ofwat (2003), ‘Setting Water and Sewerage Price Limits for 2005–10: Framework and Approach’, March.

4 This point is noted in Bucks, P. (2005), ‘The Financeability Gap’, The Utilities Journal, March, 16–17.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More