Crisis cartels: a COVID-19 side effect?

Over the years, crises have had a global impact on consumers and companies. The COVID-19 pandemic is no exception, with a number of companies being forced to close their doors for a prolonged period. National governments and competition authorities have shown increased willingness to allow companies to collaborate in order to combat the crisis. But what does economic theory suggest about the current COVID-19 crisis and its effect on the number of active cartels?

In the economics literature, the term ‘crisis cartel’ can be used in reference to two very different phenomena. The first is where a government allows or fosters coordination or agreement between firms during an economic downturn. The second is where a cartel emerges during a period of economic downturn without government permission or legal grounds. This latter type of cartel is a classic example of an ‘off-the-radar’ cartel and is the focus of this article.1

During an economic crisis, demand generally falls at the economy-wide level, resulting in overcapacity in the economy. However, the COVID-19 crisis—at least in the early stages—has been a little different. While a number of industries experienced an abrupt significant reduction in demand (for instance, aviation and hospitality), a limited number of industries instead faced capacity constraints. This was pronounced in the case of such COVID-19-related products as hand sanitisers, certain painkillers, and masks; however, some businesses with production facilities primarily located in China or Italy also faced a shortage of supply and longer delivery times. Moving forward, as the COVID-19 crisis runs on, the world might approach a demand shock crisis in which multiple sectors are hit with demand reductions due to overall economic downturn.

Crisis cartels—what does economic theory tell us?

The economic literature has established that cartels can break up as a result of an economic downturn. With decreasing demand, it is harder to maintain a pricing agreement, as it is more difficult to determine whether price decreases are the result of cartel members cheating or due to market circumstances.2 In addition, theoretical economic research shows that it is harder for firms to collude during crises due to the relatively low forgone profits from inducing a price war during an economic downturn.3 The difference between a collusive price and the competitive price might be larger during a crisis than during an economic boom. Although a firm that begins a price war by decreasing its price from the cartel price to the competitive price faces a large price drop, the low demand will ensure that it does not miss out on a lot of money by doing so.4

That said, evidence from prior cases seems to suggest that collusive agreements can arise as a result of decreased demand. For example, the French beef cartel formed as a reaction to falling demand.5 In addition, the cathode ray tubes cartel formed in response to technological developments causing a decline in the industry.6 Theoretically, there are a number of reasons why cartels might form in these situations.

- First, in ordinary circumstances, and without a decrease in demand, firms might have been able to tacitly collude on prices—but during a crisis they can only maintain a higher price level through explicit collusion. Accordingly, there is a greater incentive to form a ‘hard-core’ cartel (though perhaps with more difficulty, as noted above).7

- Second, by granting cartel members a bankruptcy discount, National Competition Authorities (NCAs), somewhat counterintuitively, increase the incentive to continue the cartel. Infringing firms that would not be able to afford high fines due to the risk of insolvency are eligible to request an ‘inability to pay’ discount. This policy is reasonable insofar as it prevents competition enforcement relating to historical activity that could have the perverse effect of reducing the number of active firms in the market in the future. However, in the economics literature, the tipping point for self-reporting is often illustrated by means of a theoretical formula depending on the rate of detection, the expected fine, the cartel profit, the profit from deviating, and the reduction following a successful leniency application.8 By permitting inability to pay requests, the NCAs essentially lower the expected fine, and so the balance is more likely to tip towards continuing the cartel.9 Aside from criminal sanctions, a way to reinstall the deterrence effect after granting bankruptcy discounts is through private enforcement; however, the evidence regarding the impact of a downturn on private enforcement is mixed.10

- Third, depending on the alternatives, forming a cartel may be the best outcome—for instance, if the firm in question would otherwise face exiting the market without colluding.

How have companies reacted to the COVID-19 crisis?

In July 2020, Global Competition Review (GCR) investigated whether cooperative agreements are being used in practice to mitigate the effects of the COVID-19 pandemic. Of the lawyers and in-house counsels surveyed, 63% reported to have seen no change in collaboration between competitors, while 37% reported having observed more collaboration during the COVID-19 pandemic.11

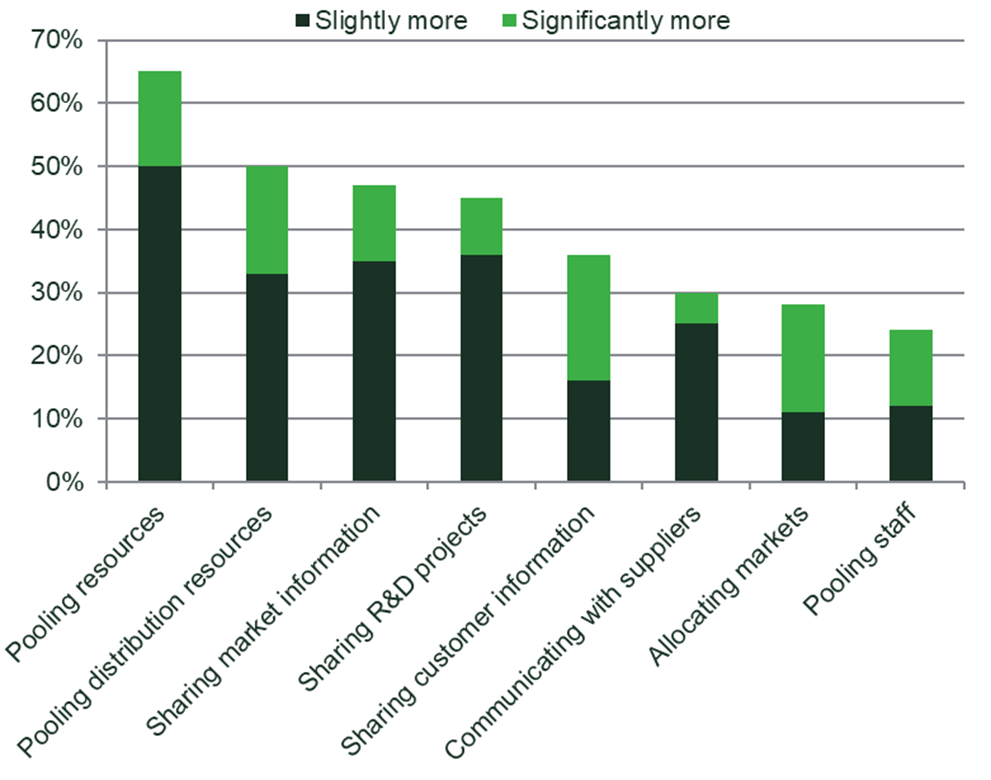

The most cited form of increased collaboration was the pooling of resources, which is somewhat unsurprising given that, for some industries (such as manufacturing), the short-term impact of the pandemic has been constraints on the supply side—where production facilities have been forced to close, for example. Notably, as seen below, the survey evidence suggests that the type of collaboration agreements that are usually associated with a fall in demand—for example, competitors allocating markets by customer, product or territory in order to reduce competitive pressures—have largely seen no change in frequency as a result of the pandemic.12 While some caution is needed in interpreting these results (in particular, law firms and their clients may be less likely to report behaviour such as market sharing that is generally perceived as more likely to be problematic under competition law), they suggest that most cross-firm cooperation during the COVID-19 crisis has been aimed at addressing supply bottlenecks. The outcome of the survey might be different if it were to be repeated at the current (later) stage of the COVID-19 crisis.

Figure 1 Proportion of survey responses to ‘What are the forms and extent of collaborations that have been carried out with competitors during the pandemic?’

How are governments responding to the COVID-19 crisis in terms of cartel enforcement?

I. Measures to avoid a shortage (or ensure security) of supply

Many enforcement agencies have published temporary measures outlining where collaboration may or may not be permitted.13 Given that some sectors have faced supply-side shortages (for instance, of hand sanitiser), it is unsurprising that many enforcement agencies’ measures to date have been focused on addressing short-term undercapacity. For example, a statement released by the European Competition Network noted that companies may cooperate in order to ‘ensure supply and fair distribution of scarce products to all consumers’.14 In such cases, it is considered that temporary measures ‘are unlikely to constitute a restriction of competition or, if they do, they are likely to generate efficiency gains apt to outweigh their potential harm’.15

These measures tend to be focused on critical sectors with scarce supply—for example, the pharmaceutical sector, in which the European Commission has allowed coordination to ‘rebalance and adapt capacity utilisation, production and supply’ of essential medicine for the treatment of COVID-19.16 Another critical sector that has been singled out is the grocery sector where, in the UK for example, competitors have been permitted to coordinate on limiting purchases by consumers of particular groceries, the range of groceries to be supplied, and the sharing of information on their stock position and logistics.17

II. Measures to ensure the continuation of essential services

Other measures have been introduced with the aim of sustaining essential services. A block exemption for airlines and other transport companies in Norway was created with the aim of ensuring that citizens have access to the necessary goods and services. This exemption allows coordination agreements between all transport providers as long as cooperation ensures the maintenance of ‘socially critical functions’.18 A similar stance has been taken by the UK government, which suspended competition law to allow competitors that run ferry services to the Isle of Wight to coordinate on timetables and staffing to ensure the continuation of essential ferry services.19

III. Measures to reduce the impact of demand-side shocks (overcapacity)

Crisis cartels have in the past not been treated any differently to other cartels under EU competition law. The European Commission has maintained that even in times of long-term structural overcapacity—for instance, stemming from a recession—the criteria for cartel exemptions under Article 101(3) TFEU will rarely be met, and that overcapacity should be rectified by market forces.20 This suggests that, in Europe, for the most part, businesses with products that are experiencing little or no demand as a result of the pandemic will remain bound by competition law in their ability to coordinate their practices.

Outside the EU, the Administrative Council for Economic Defense (CADE) in Brazil has authorised the collaboration of competitors in the food and beverages industry in order to minimise the effects of the pandemic, and in particular to prevent the market exit of small food retailers.21 Most notably, these measures allow large food suppliers to coordinate on special conditions, such as discounts for purchases that are required to be passed on to consumers (to stimulate demand), and longer payment terms and loans for businesses. With guidance from the OECD, these measures do not permit the coordination of commercial initiatives or the exchange of sensitive information, but are a novelty in that they are aimed at dampening demand shocks to these businesses.22

The future of crisis cartels

The COVID-19 crisis differs from past economic crises in that it was—in some sectors—initially characterised by a mix of capacity constraints resulting from the closure of production facilities, the increased demand for certain hygiene, health and medical products, and severe demand shocks in other sectors such as aviation and tourism. Economic theory suggests that, in some circumstances, it is harder for firms to sustain stable collusion during times of falling demand; however, there are some circumstances in which falling demand can act as a stimulus to collusion (for example, where capacity is constrained or there is a risk of a firm exit). Certainly, past cases have proven that crisis cartels can form in periods of economic downturn.

Enforcement agencies have maintained a firm stance on crisis cartels, but have also introduced supply-side measures aimed at remedying issues in specific sectors. At the same time, governments have provided greater amounts of funding to companies affected by the crisis to offset the reductions in demand. Such measures may limit the extent of cartelisation as a result of this crisis, since the provision of such funding has the effect of keeping people employed. The need for firms to collude is lower than it would be without this financial support.

On balance, it might be the case that the COVID-19 crisis, like other crises before it, leads to a few new illegal cartels that find a successful stabilisation mechanism in the volatile economic environment. However, the policy response to the COVID-19 crisis, consisting of significant stimulus packages to offset demand falls, targeted and time-limited allowances for coordination between suppliers, and continued vigilance with respect to firms that overstep these allowances, is likely to act as a dampener on such activity. Like so many aspects of the economic outlook following the crisis, the extent of cartel activity across the economy is likely to change substantially; however, the unique nature of the crisis means that it is not yet possible to forecast the direction of this change.

1 OECD Directorate for Financial and Enterprise Affairs, Competition Committee, Global Forum on Competition (2011), ‘Crisis Cartels: Background Note: Session III; Vitzilaiou, L. (2011), ‘Crisis Cartels: For Better or for Worse?’, Competition Policy International Antitrust Chronicle, 2, March.

2 Ivaldi, M., Jullien, B., Rey, P., Seabright, P. and Tirole, J. (2003), ‘The Economics of Tacit Collusion: Final Report for DG Competition’, March; and Haltiwanger, J. and Harrington, J. E. (1991), ‘The Impact of Cyclical Demand Movements on Collusive Behavior, RAND Journal of Economics, 22:1, pp, 89–106.

3 Haltiwanger, J. and Harrington, J. E. (1991), ‘The Impact of Cyclical Demand Movements on Collusive Behavior’, RAND Journal of Economics, 22:1, pp, 89–106.

4 More recent theoretical work has also taken the capacity of firms (and specifically, capacity constraints) into consideration. See Fabra, N. (2006), ‘Collusion with capacity constraints over the business cycle’, International Journal of Industrial Organization, 24:1, pp. 69–81. When capacity constraints are tight enough, it is easier for firms to collude during a recession. If there is no spare capacity, there is less reason for individual cartel members to deviate from the agreement, as there is less to win.

5 Coop de France Betail et Viande (formerly Federation Nationale de la Cooperation Betail et Viande (FNCBV)) v. Commission of the European Communities (C-101/07 P) [2008] E.C.R. I-10193 (ECJ (third Chamber)).

6 European Commission (2012), Case 39437 TV and computer monitor tubes.

7 Stephan, A. (2012), ‘Price Fixing in Crisis: Implications of an Economic Downturn for Cartels and Enforcement. World Competition’, 35:3, pp. 511–28.

8 For the full formula, read from p. 159 of Motta, M. (2004) Competition Policy: Theory and Practice, Cambridge University Press.

9 See, for example, Stigler, G. J. (1964), ‘A Theory of Oligopoly’, Journal of Political Economy, 72:1, pp. 44–61; Kinghorn, J. R. (1966), ‘Kartells and Cartel Theory: Evidence from Early 20th Century German Coal, Iron and Steel Industries’, Cliometric Society; and Levenstein, M. and Suslow, V. Y. (2010), ‘Constant Vigilance: Maintaining Cartel Deterrence During the Great Recession, Competition Policy International, 6:2, Autumn, pp. 145–62.

10 Stephan, A. (2012), ‘Price Fixing in Crisis: Implications of an Economic Downturn for Cartels and Enforcement’, World Competition, 35:3, pp. 511–28.

11 Global Competition Review (2020), ‘Collaboration between competitors in a crisis’, 31 July, p. 3.

12 Ibid., p. 5.

13 European Commission (2020), ‘Temporary Framework for assessing antitrust issues related to business cooperation in response to situations of urgency stemming from the current COVID-19 outbreak’, 8 April; FTC (2020), ‘Joint FTC-DOJ Antitrust Statement Regarding COVID-19’, 24 March.

14 European Competition Network (2020), ‘Antitrust: Joint statement by the European Competition Network (ECN) on application of competition law during the Corona crisis’, 23 March.

15 OECD (2020), ‘Co-operation between competitors in the time of COVID-19’, p. 3.

16 European Commission (2020), ‘Comfort letter: coordination in the pharmaceutical industry to increase production and to improve supply of urgently needed critical hospital medicines to treat COVID-19 patients’, 8 April.

17 UK Government (2020), Public Policy Exclusion Order 2020 No. 369.

18 Regjeringen.no (2020), ‘Merknader til de enkelte bestemmelser i midlertidig forskrift om unntak fra konkurranseloven §10 for samarbeid i transportsektoren’.

19 Gov.uk (2020), ‘Press release: Government to suspend competition law to support Isle of Wight ferry routes’, 27 March.

20 European Commission (2011), ‘Global Forum on Competition: Crisis Cartels’, 27 January, para. 58.

21 CADE Administrative Council for Economic Defense (2020), ‘Cade authorizes collaboration among Ambev, BRF, Coca-Cola, Mondelez, Nestlé and Pepsico due to the new coronavirus crisis’, 5 June.

22 Latham & Watkins LLP (2020), ‘Impact of COVID-19: New exemptions under antitrust law’, 5 October.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More