Changing tides: how consumers and merchants are redefining the payment experience

Retail payments bring together retailers and consumers, and the two-sided nature of this market means that the design of payment methods must reflect the needs of both sides. Today, the competitive landscape for retail payments in Europe is rapidly transforming due to changing consumer preferences, technological progress, regulatory intervention and, most recently, the COVID-19 pandemic. How are the expectations of consumers and merchants redefining the payment experience?

In many cases you no longer need to hold cash in your pocket, or even a physical payment card, to pay for goods or services. Instead, new service offerings are enabling consumers to transact with retailers through their mobile phones.

In June this year, Agenda explored how payment systems are two-sided markets, bringing together retailers and consumers.1 A payment method is a product that provides services to households and merchants at the same time. This means that the design of a payment method must meet the needs of both users. Households and consumers want convenience and protection, and merchants and retailers want convenience and conversion of sales. As payment providers compete to design products to meet the changing needs of households and merchants, the payment experience is being redefined.

Convenience has become an increasingly important feature—and something that consumers and merchants have come to expect. Consumers increasingly prefer to make payments remotely (e.g. online) or to use contactless technologies when shopping in store, and in response, retailers are looking to ensure a smooth transaction process. These trends have been accelerated by COVID-19. In this article, we explore various ways in which the expectations of consumers and merchants are redefining the payment experience.

Changing tides

The rapid adoption of technologies and innovations in the payments ecosystem, as well as recent changes in regulation, are driving a step change in how we, as consumers, pay for goods and services, as well as how retailers facilitate these payments.

The rise of e-commerce

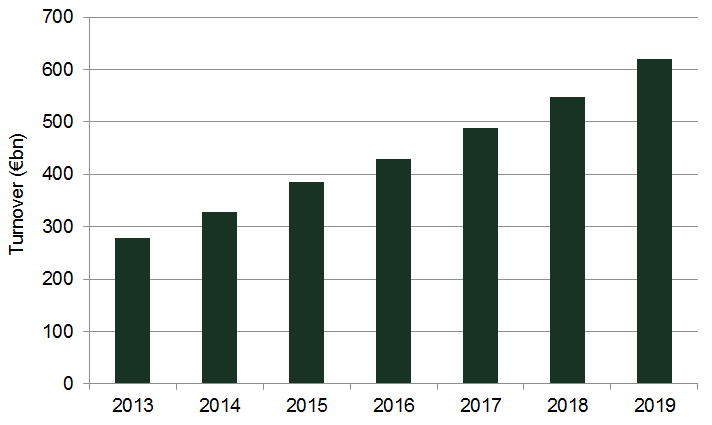

The first big trend has been the rise in e-commerce. Over the last five years, the value of e-commerce has nearly doubled in Europe, from €328.6bn in 2014 to an estimated €621bn in 2019 (as shown in Figure 1 below).2

The rise of e-commerce has gone hand in hand with the demand for, and expectation of, fast and safe payments. Technological advancements, such as biometric authentication and tokenisation, are helping to reduce fraud and improve the customer experience of making remote payments.3

Figure 1 Annual European e-commerce turnover

The growing expectation of a seamless payment experience and the increasing popularity of the digital marketplace are requiring merchants to rethink the traditional payment process. For example, retailers are increasingly automating customer checkout—for instance, by automatically populating customer details—in order to make the payment experience as smooth as possible. A 2019 study found that nearly half of UK consumers (43%) said that ‘speed and ease of payment’ was the most important factor when paying for goods or services online.4 In order to boost sales and retain consumers on their website, retailers therefore want to make the payment process as frictionless as possible.

Retailers are integrating payments into their value proposition, in part to reduce ‘cart abandonment’ and thereby promote sales.5 As fewer clicks leads to a more successful checkout process,6 retailers are incentivised to streamline the payment process. For example, Amazon’s 1-Click ordering tool places the customer’s order automatically and lets them skip the shopping basket.7 This trend highlights the increasing importance of competition along non-price dimensions for retailers.

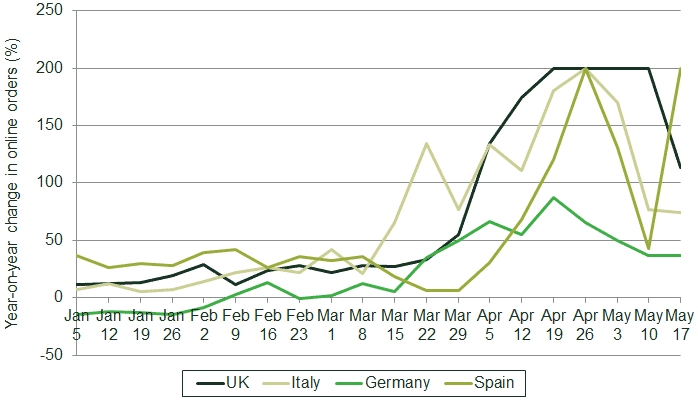

COVID-19-related closures of non-essential stores and restaurants in many countries have supported this trend. For many consumers buying (non-essential) goods and services, shopping online has been the only available option. In some countries, there has been a 200% increase in the number of online transactions taking place compared with the same period in 2019, as shown in Figure 2 below.

Figure 2 Weekly e-commerce trends in Europe during the COVID-19 pandemic, 2020

Source: Statista (2020), ‘Year-on-year growth in weekly online orders in retail industry during the Coronavirus pandemic in selected countries in Europe in 2020’, 20 May.

The use of mobile phones

Another trend that has been emerging is the rise of mobile phone use and the growth in mobile payments. In Europe, the transaction value of mobile payments has more than doubled from €16m in 2017 to €44m in 2020.8 This has been facilitated by developments in contactless technology and improvements in customer authentication.

The increased use of smartphones and apps for various activities has also facilitated the growth of innovative payment methods—such as those offered by digital wallet providers such as PayPal and Amazon Pay—and aggregators, which allow consumers to see all their accounts in one place.

Retailers have responded to this change in consumer behaviour by developing innovative solutions offered via smartphones. Merchants now increasingly attract customers by offering a more automated and frictionless payment experience.

Examples include Uber, where payment for the journey is fully integrated into the service, and Sainsbury’s SmartShop, which allows customers to scan items as they shop. This enables customers to skip the checkout queues, making grocery shopping quicker and more convenient.9

Regulation

Regulation is also playing an important role in redefining the payment experience for consumers and retailers.

In 2018, the introduction of the EU’s second Payment Service Directive (PSD2) opened up competition for payments. This enables the customers of banks to use third-party providers to initiate payments on their behalf. Banks are now required to give third-party providers access to their customer accounts via open application programming interfaces (APIs). With direct access to customer accounts, it is easier for third-party providers to build services on top of a bank’s existing data infrastructure. The overall aim of these measures was to reduce barriers to new entrants and enable greater choice and better prices for consumers. While the number of registered third-party providers continues to increase, the full impact of the regulation is yet to be felt across the payment sector.

Governments across Europe have also recently responded to the increased demand for contactless transactions by making changes to contactless spending limits. For example, in Germany and the Netherlands, the limit has been increased from €25 to €50, and there have been increases from €20 to €50 in Portugal and Spain.10 In the UK, the increase has been from £30 to £45.11

The rise of new payment methods

Recent years have also seen a rise in new and innovative payment methods. As well as domestic and international card schemes, three-party schemes, and bank-transfer-based payment methods, new card schemes are entering the market. For example, China UnionPay is leveraging its European acceptance network to target European issuers by offering ‘one-stop-shop’ payment solutions.

Other examples of new and growing payment methods include Klarna, PayPal, Vipps, Swish, Payconiq, and Apple Pay, which have all entered the payments market by leveraging their existing customer base to their own payment solutions.

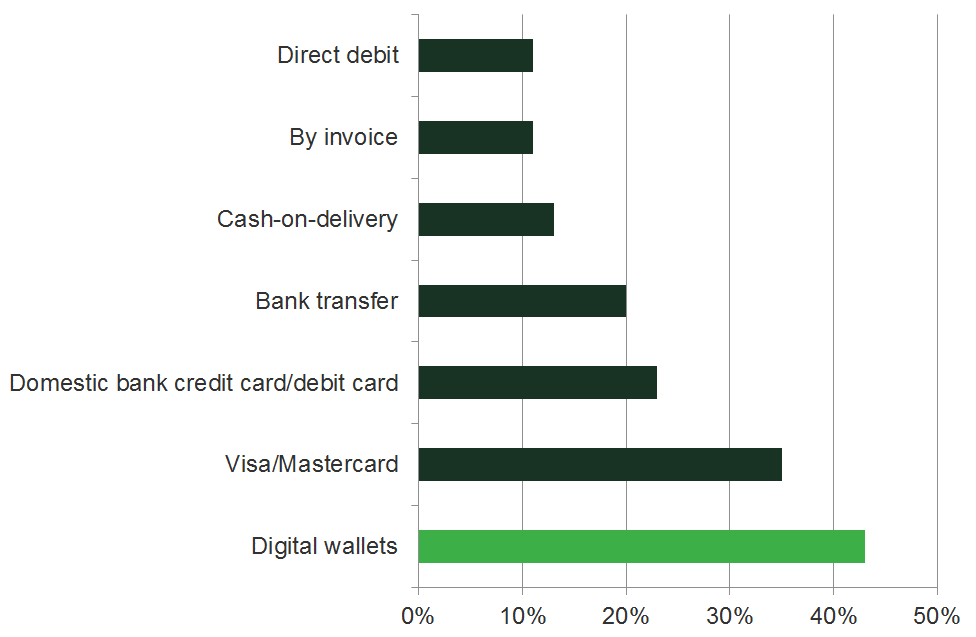

The growth in e-commerce and mobile payments has also supported the development of digital wallets, which have become a prominent payment method in Europe for online payments (see Figure 3 below).

A digital wallet is an electronic device or online service that allows a user to carry out electronic transactions, providing consumers with access to multiple payment funding options. Digital wallets allow customers to pay by card without carrying a physical card, and to easily switch between multiple payment methods and brands.

Figure 3 Preferred payment methods across Europe for e-commerce, 2017

Source: DPDgroup (2017), ‘E-shopper barometer report 2017’, September.

Another example that demonstrates the rise of new payment methods is the emergence and impact of Alipay and WeChat in the Chinese market.

These important new payment methods were created by two technology giants, Alibaba and Tencent, neither of which started out as a payment service provider—both have entered the payments market by leveraging their existing customer base. After establishing themselves as online payment providers, WeChat and Alipay expanded into the in-store payments market.

Over time, these payment providers have increased the number of ways in which consumers can use their new payment methods, increasing convenience and improving the customer experience. For example, Alipay and WeChat have partnered with the largest ridesharing/taxi apps, retailers, utility companies, and, more recently, public transport companies.12 These partnerships have had a significant impact on consumer payment habits.

This commercial strategy has helped Alipay and WeChat to create ‘super apps’ that provide consumers with a ‘one-stop solution’ for their daily activities—from paying tuition fees, booking medical appointments and tracking physical activities to playing games, shopping and socialising.13 Such integration has enabled Alipay and WeChat to deepen their relationships with customers in a way that traditional payment providers would find difficult to achieve.

The success of Alipay and WeChat demonstrates not only that technology giants that have large existing user bases are well placed to enter a country’s payment landscape, but also that they can become so successful that the payment landscape will change completely. Moreover, with the right strategies, these technology giants are capable of winning significant market shares within a very short period of time.

Although Chinese consumer preferences and the broader regulatory environment in China also played a part in the success of Alipay and WeChat, the competitive forces behind the ultimate shift are already active in Europe. These include network effects in other markets, smartphone penetration driving multi-homing, the take-off of e-commerce, and the increasingly blurred boundaries between online and physical payments.

Looking ahead

Going forward, new technologies, regulation and consumer behaviour will continue to redefine the payment experience. As the benefits of PSD2 start to take effect, and as further technologies are adopted, it is expected that new payment products and business models will enter the market to promote both retailer and consumer usage.

Growth rates of new payment methods suggest that they will acquire a substantial market share—with new entry likely to be further facilitated by PSD2 giving non-bank competitors easy access to interbank systems. Furthermore, the growing desire for a frictionless payment experience will lead to more seamless payment options, such as digital wallets, to intensify the competitive pressure on existing payment options and providers.

While the lasting effects of COVID-19 remain to be seen, in many cases, the pandemic has only accelerated pre-existing trends. It is therefore unlikely that there will be significant changes to the trends described above following the easing of social distancing measures.

1 Oxera (2020), ‘Paying up: the new economics of payment systems’, Agenda in focus, June.

2 Ecommerce news (2020), ‘Ecommerce in Europe: €621 billion in 2019’, 11 June.

3 Tokenisation is the process of replacing a card’s primary account number, the 16-digit number on the plastic card, with a non-sensitive, unique alternative card number—or ‘token’.

4 Finextra (2019), ‘Consumers torn between security and convenience at online checkout’, 26 June.

5 Cart abandonment occurs when a potential customer starts a checkout process for an online order but drops out of the process before completing the purchase. Oliver Wyman (2019), ‘Payments in retail’.

6 PYMNTS (2017), ‘Things To Know: How To Avoid Abandoned eCommerce Carts’, 27 October.

7 Amazon (2020), ‘About 1-Click Ordering’.

8 Patel, M. (2020), ‘Digital Payments in Europe to Surpass $802bn Transaction Value This Year’, The Fintech Times, 25 March. Exchange rate 1 USD = 0.917708 EUR.

9 Sainsbury’s, ‘What is SmartShop and how does it work?’.

10 Finextra (2020), ‘Mastercard enables contactless limit raise across 29 countries’, 25 March.

11 UK Finance (2020), ‘Contactless limit in UK increases to £45 from today’.

12 Xiao, E. (2017), ‘How WeChat Pay become Alipay’s largest rival’, Tech in Asia, 20 April.

13 McKinsey Global Institute (2017), ‘China’s Digital Economy a Leading Global Force’, August, pp. 12–13.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More