Behavioural remedies: the CMA’s approach to the Mastercard–VocaLink merger

11 April 2017 saw the UK Competition and Markets Authority (CMA) clear Mastercard’s acquisition of VocaLink, the formerly bank-owned company that runs a large part of the payment infrastructure in the UK. This was one of the few cases in the UK that has received Phase 1 clearance with non-structural undertakings. This article gives an overview of the CMA decision and some of the lessons from it.

In the last decade, the payment services sector has seen considerable technological change and been subject to much regulatory reform and intervention. The European Payment Services Directive 2 has been adopted and is being implemented. In the UK, a sector regulator for payment systems was established in 2015. Moreover, there have been several mergers and acquisitions, the most recent being Mastercard’s acquisition of VocaLink, which is the focus of this article.1

The payment services sector is complex, with several different functions and providers.2 The providers include:

- payment schemes, which set the rules that apply to the payment system;

- the central infrastructure, which provides central processing services;

- banks and other providers of retail payment services to consumers and corporates, such as PayPal and ApplePay;

- gateway service providers, which provide the communications channel between the payment service provider and the central clearing provider, among others.

The range of parties involved means that mergers between two payment service providers can often raise complex competition issues. For example, there may be a concern that access to some part of the value chain may be impeded as a result of the merger (known as ‘vertical foreclosure’).

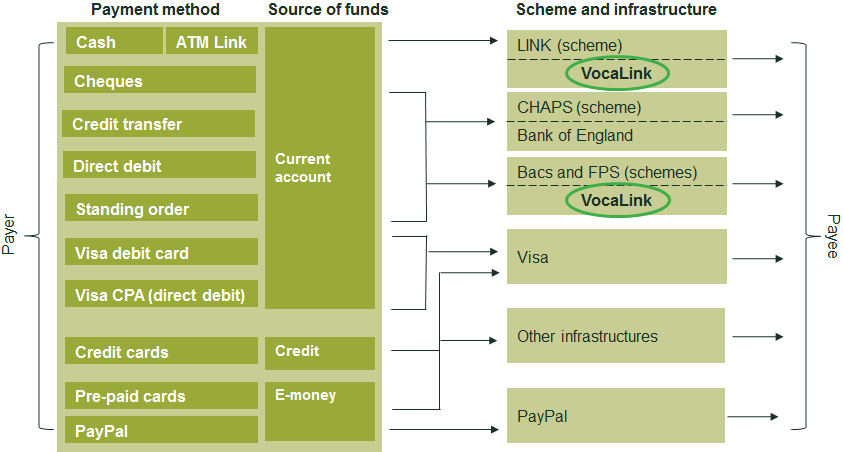

The structure of the current (pre-merger) UK payments sector, including the interbank and card payment systems, is shown in Figure 1.

Figure 1 Payment products, schemes and infrastructures (based on the UK)

As shown in the figure, VocaLink is an important player in the interbank payment processing market as it provides processing services to the Bacs, Faster Payment Service (FPS) and LINK scheme companies in the UK.3 Before the Mastercard acquisition, VocaLink was bank-owned. This prompted the UK Payment Systems Regulator (PSR) to raise concerns that bank ownership of VocaLink might be limiting competition and innovation in payment system processing: a small number of large banks owned and controlled VocaLink and were also members of the Bacs, FPS and LINK schemes that award the contracts for processing services to VocaLink. The PSR considered that this weakened the scheme companies’ incentive to consider alternative payment processors (e.g. as it would put at stake VocaLink’s value) and could affect potential bidders’ perceptions about their likelihood of winning the contract.4

In February 2016, following an in-depth market review, the PSR ruled that the four largest VocaLink bank shareholders had to divest their interest in VocaLink, to stimulate competition.5 At the same time, Mastercard was already negotiating the purchase of VocaLink; the transaction was announced a few months later in July 2016. Given Mastercard’s existing presence in the payment systems sector, the merger required approval by the CMA.6

The CMA’s investigation

As with competition authorities in other countries, the CMA has a duty to examine whether a merger would result in a substantial lessening of competition in a relevant market.7 In this regard, the CMA examined existing levels of competition between VocaLink and Mastercard (as this competition could be lost post merger) for the following ‘product markets’.8

- Supply of processing services to Bacs and FPS, both separately and combined.

- Supply of processing services to LINK (i.e. for ATM withdrawals).

- Competition from emerging payment methods such as Zapp.9

In relation to the first area, the CMA ruled that there is currently no overlap between VocaLink and Mastercard in relation to Bacs and FPS. Furthermore, taking into account the various PSR reforms to stimulate competition, the CMA found that there are a large number of credible international providers that could compete against the parties in future tenders. The second and third areas—payment processing for ATM withdrawals and mobile payment services—came under much more scrutiny. We examine these below.

Supply of ATM processing services to LINK

The CMA examined both horizontal and vertical competition in relation to the supply of processing services to LINK.

In relation to horizontal competition considerations, the CMA examined the closeness of competition between VocaLink and Mastercard. It considered a wide range of evidence, including the experience of past tenders, the technical capability of the different providers, and the costs that LINK users (i.e. banks and ATM providers) might face in switching to an alternative provider. Overall, the CMA found that the merger would lead to a reduction in credible bidders for the supply of processing services to LINK from three to two, and that switching costs would prevent LINK from being able to attract bidders other than VocaLink, Mastercard and Visa.

To address these concerns, the undertakings in lieu (UILs) of a Phase 2 inquiry (discussed below) focused on widening the pool of potential alternative bidders.

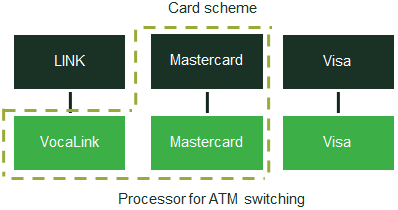

The vertical competition dimension arises because VocaLink provides processing services to the LINK scheme, and both the LINK scheme and the Mastercard scheme provide ATM transaction services (most ATMs in the UK have a LINK and Mastercard symbol). In effect, the merger would give Mastercard control over the LINK scheme’s supplier, VocaLink. This arrangement with the card scheme (rule setting) and processing functions of the value chain is illustrated in Figure 2. The dashed line represents the post-merger scenario and shows the functions undertaken by Mastercard.

Figure 2 Vertical competition considerations

The CMA examined whether the merger would give the merged entity the ability and incentive to weaken (or foreclose) the LINK scheme in order to gain a competitive advantage, by:

- raising costs or providing lower-quality services to LINK or to LINK users;

- preventing innovation within LINK;

- having access to, and strategically using, commercially sensitive data on LINK users.

On close examination, these three theories of harm were dismissed on the grounds that the merged entity would not have the ability and/or the incentive to foreclose the LINK scheme in such a way. Reasons for this conclusion include the following.

- Contractual provisions would prevent VocaLink from raising costs, providing a lower-quality service or accessing commercially sensitive information on LINK users.

- Providing lower-quality services to the LINK scheme and LINK users would cause the merged entity reputational damage (and associated losses) that would outweigh the possible gains.

- Visa rather than Mastercard would be the likely beneficiary of a strategy to lower quality of service, given that nearly all banks have an existing debit card contract with Visa. As a result of lower service quality, the LINK scheme would most likely switch to Visa rather than to Mastercard for the processing of ATM transactions.

Competition from emerging payment methods such as Zapp

Both Mastercard and VocaLink have developed new payment methods—the MasterPass e-wallet (a customer-to-merchant online and point-of-sale-based payment system) and VocaLink’s Zapp payment method (a mobile payment application that allows users to pay merchants online by initiating a credit transfer from the user’s bank account). The CMA examined whether there might, in future, be overlap between the two payment methods, in the merchant or consumer parts of the value chain (i.e. horizontal competition considerations).

First, the CMA identified that MasterPass is only one of an increasing number of competing e-wallets (e.g. GooglePay and ApplePay). It therefore did not consider that there was any realistic prospect of a substantial loss of competition between Zapp and MasterPass. Second, the CMA noted that regulatory developments such as the Payment Services Directive 2 (PSD2) would enable further expansion and proliferation of competitive offerings, some of which use the interbank payment rails for the processing of transactions (e.g. new payment methods such as SEQR) and others the card payment infrastructure (such as ApplePay). As a result, the CMA considered that the merger would not result in a loss of competition in the supply of customer-to-merchant payment services.

Undertakings in lieu

In summary, the only remaining concern was a potential reduction in competition for the supply of processing services to LINK. To overcome this concern, VocaLink and Mastercard offered three remedies that aim to reduce the costs of switching to a new provider and to increase competition for the LINK contract.10

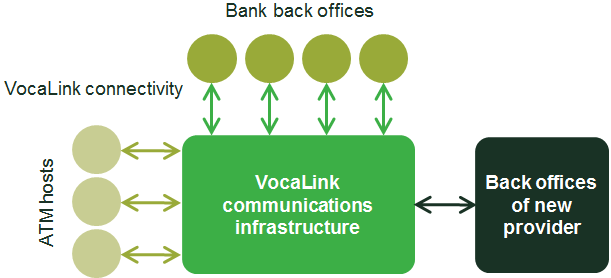

One potential cost of a new provider entering the market and servicing the LINK contract is that the provider would need to establish connectivity with every bank and ATM host that are members of the LINK scheme. While this connectivity would not necessarily be particularly costly, the CMA was concerned that the fact that VocaLink has existing connectivity would reduce the ability of new entrants to compete for the LINK contract.

To address the concern that connectivity would be a barrier to entry for potential competitors for the LINK contract, the main undertaking involved a network access requirement that requires VocaLink to provide any future supplier of processing services to LINK with access to VocaLink’s communications infrastructure and connectivity to banks and ATM hosts. This will mean that VocaLink essentially becomes a subcontractor to the new processor, in providing capacity at a service level equivalent to that it receives from its own external telecoms provider. The undertaking would remain in place for a fixed period, depending on what happens at contract renewal and whether a new provider would want this service.

Figure 3 shows how the undertaking will work in practice.

Figure 3 The subleasing remedy

Other remedies include:

- an LIS5 remedy (LIS5 is the messaging standard used by all users to process ATM withdrawals). This requires VocaLink to transfer the intellectual property of the LIS5 messaging standard to the LINK scheme, which could in turn make this messaging standard available to a new provider;

- a switching fund that requires Mastercard to commit up to £5m towards the costs incurred by LINK users in switching to a new provider.

The CMA accepted these UILs rather than refer the case to a Phase 2 merger inquiry.

Lessons

The Mastercard/VocaLink merger inquiry provides several lessons of relevance to future mergers in the payments sector.

First, this is one of the few merger inquiries where the UK CMA has accepted non-structural UILs (rather than structural UILs such as divestment) in Phase 1.11 It is a useful example of how non-structural remedies can reduce entry barriers and increase the number of potential players in a market.

Second, in relation to vertical competition considerations:

- a supplier’s reputation for reliability and service performance is of crucial importance to bank and other users in the payments sector.[12] Thus, while theories of harm relating to vertical foreclosure through lowering service quality or restricting innovations may look valid at first sight, they are unlikely to present a significant risk given that such behaviour would be detrimental to a provider’s reputation;

- several parties are involved in completing a payment, and it is common to observe a payment processor’s customer or supplier also being a competitor for another product or service. These relationships (and the reputation at stake) serve as a deterrent against full or partial foreclosure strategies (such as reducing service quality or reliability);

- there is good industry practice in terms of managing confidential information (e.g. through contractual provisions). These provisions serve as a deterrent to accessing commercially sensitive data, and strategically using it to target a competitor’s users.

Finally, given the pace of technological development in the payments sector, competition authorities will increasingly need to consider how changes in technology could affect the development of competition. For example, the CMA had to consider how VocaLink’s Zapp payment method might compete against Mastercard’s own payment methods. The results of this inquiry therefore emphasise the importance of understanding the sector, in particular the value chain and the parties involved in completing a payment, and in taking a forward-looking view of competition and how that might change given technological developments.

Oxera advised VocaLink on this merger.

1 Competition and Markets Authority (2017), ‘Anticipated acquisition by Mastercard UK Holdco Limited of VocaLink Holdings Limited. Decision on acceptance of undertakings in lieu of reference’, April.

2 See also Oxera (2014), ‘Money-go-round: insights into the economics and regulation of payment systems’, Agenda, May.

3 The Bacs payment system authorises, clears and settles direct credits and direct debits. It has the capability to authorise and clear both batch and individual payments. FPS is a real-time interbank payments system that processes forward-dated payments, standing orders and single immediate payments. The LINK payment system relates to the authorisation, clearing and settlement of ATM withdrawals.

4 See, for example, Payment Systems Regulator (2016), ‘Market review into the ownership and competitiveness of infrastructure provision: final report’, July, p. 5.

5 Payment Systems Regulator (2016), ‘Market review into the ownership and competitiveness of infrastructure provision: final report’, July, p. 6.

6 Mastercard (2016), ‘MasterCard announces acquisition of VocaLink’, press release, 21 July.

7 See Competition and Markets Authority (2014), ‘CMA mergers guidance’, July.

8 See Competition and Markets Authority (2017), ‘Anticipated acquisition by Mastercard UK Holdco Limited of VocaLink Holdings Limited. Decision on relevant merger situation and substantial lessening of competition’, January.

9 Zapp is a mobile payment application that allows users to pay merchants online by initiating a credit transfer from the user’s bank account.

10 Competition and Markets Authority (2017), ‘Anticipated acquisition by Mastercard UK Holdco Limited of VocaLink Holdings Limited. Decision on acceptance of undertakings in lieu of reference’, April.

11 The other cases include Stagecoach and the Intercity East Coast Franchise, and Muller UK & Ireland Group and Dairy Crest Group. See Competition and Markets Authority (2015), ‘CMA accepts Stagecoach undertakings over InterCity East Coast franchise’, news story, 17 June; and Competition and Markets Authority (2015), ‘CMA accepts remedy in dairy merger’, news story, 19 October.

12 This was also recognised in a proposed merger between suppliers of ATM hardware. See Competition and Markets Authority (2016), ‘Completed acquisition by Diebold Incorporated of Wincor Nixdorf AG’, August.

Download

Related

Economics of the Data Act: part 1

As electronic sensors, processing power and storage have become cheaper, a growing number of connected IoT (internet of things) devices are collecting and processing data in our homes and businesses. The purpose of the EU’s Data Act is to define the rights to access and use data generated by… Read More

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More