Bail-in or bailout? State aid to banks under the Single Resolution Mechanism

Various European banks and other credit institutions are facing a challenging economic and commercial environment. This has brought the issue of state aid back to the fore. If these institutions do require state support, it is critical that this complies with both the European Bank Recovery and Resolution Directive (BRRD) and EU state aid rules. What exactly are these rules, and how can banks and their respective authorities demonstrate that support is compliant?

According to the International Monetary Fund (IMF), ‘almost a third of the European banking system remains weak’.1 For example, a substantial stock of non-performing loans have led the Italian government to set up the Atlante funds. These two private equity funds, backed by the Italian government, exist so as to fund capital increases of, and buy non-performing loans from, Italian banks in order to avoid the bail-in of junior creditors (many of which are retail investors) under the BRRD and state aid rules.2 Portugal had to modify the terms of the resolution of its (formerly) second-largest bank, Banco Espírito Santo,3 and its successor, Novo Banco,4 and there are rumours that it is considering setting up a fund similar to those set up by the Italian government.5 In Germany, weak earnings and restructuring and litigation costs have recently caused speculation about the stability of Deutsche Bank.6

These cases have brought the issue of state aid back to the surface and could potentially reverse a recent trend, whereby the amount of state aid granted to financial institutions since 2008 has stabilised at just under €5.5trn.7

In the event that state support is required, it is critical that this is structured in a way that is compliant with both the BRRD and state aid rules. If state support were subsequently found by the European Commission to constitute illegal aid, it would have to be repaid by the beneficiary.

This article starts by considering the relevant rules, before outlining what banks and their respective authorities would need to demonstrate in order to show that support is compliant with state aid and BRRD rules. The box below summarises the EU’s state aid rules.

What is state aid? Why are state aid rules needed?

State aid rules are designed to monitor and restrain selective measures involving the state that threaten to distort competition across the EU.

A measure constitutes state aid if it:

- involves the transfer of state resources;

- confers a selective economic advantage to the recipients; and

- has potential distortive effects on competition and trade in the EU market.

Not all state aid is unlawful, however. If the aid contributes positively to the EU economy without having an undue negative impact on competition, under certain conditions it would be lawful (or ‘compatible’).

If, however, measures are found to constitute incompatible aid, the aid quantum would need to be paid back by the beneficiary, including interest, for a limitation period of ten years.

Source: Article 107 of the Treaty on the Functioning of the European Union.

Overview of the state aid and BRRD frameworks

Before the introduction of the first Banking Communication in October 2008, no sector-specific state aid rules were applicable in the financial services sector. Since the onset of the financial crisis that began in 2007/08, the state aid framework in the banking sector has evolved significantly, with state aid policy playing an important role in the coordination of the response to the financial crisis. Over the period 2008 to 2013, the Commission introduced a series of further Communications, which set out the requirements for demonstrating the compatibility of aid.8

The 2013 Banking Communication raised the minimum requirements for burden-sharing at an EU level, and marks a shift to more ex ante analysis, thereby increasing the hurdle for the evidence required to demonstrate the compatibility of aid. Crucially, it represents a move away from taxpayer-funded bailouts to ‘bail-in’, the practice of imposing losses on investors before state funds can be received by banks.9

Following the establishment of the EU banking union programme in 2013 (the Single Resolution Mechanism, SRM, one of the two central pillars of the banking union, came into force on 1 January 2016),10 banks that are ‘failing or likely to fail’ are subject to the processes set out in the BRRD. The BRRD harmonises the different mechanisms previously used by member states to intervene in failing banks, and is implemented through the SRM, which establishes uniform rules and procedures for the resolution of failing banks.11

The Single Resolution Fund (SRF) has also been established at EU level to provide support to banks in resolution after all the options, including bail-in by shareholders and debtors of a failing bank, have been exhausted.12 The SRF has a target of €55bn, to be built up with contributions from the banking sector.13

Under most circumstances, the granting of any aid to preserve or restore the viability, liquidity or solvency of a bank will trigger the resolution provisions set out in the BRRD and SRM. In parallel, the compatibility of the aid (including any use of the SRF) will be assessed by the Commission against the applicable state aid rules. One example of the SRM and state aid frameworks operating in parallel is the case of Banif in Portugal, as described in the box below.

Aid to Banco Internacional do Funchal (Banif)

In January 2013, the Portuguese authorities notified urgent recapitalisation aid amounting to €1.1bn to the Portuguese bank, Banif. The Commission temporarily approved the rescue recapitalisation, conditional on a restructuring plan that would lead to a material overhaul of Banif’s business model.

Although the Portuguese authorities submitted a number of revised restructuring plans to the Commission, in July 2015, the Commission started an in-depth state aid investigation into whether the recapitalisation aid received by Banif was in line with state aid rules. The Commission raised concerns that insufficient measures were introduced to ensure burden-sharing and to limit distortions to competition.

In September 2015, as the difficulties experienced by the bank intensified, the Portuguese authorities considered additional restructuring measures, and proposed to carve out the impaired assets from the bank.

As Banif’s viability could not be restored on a stand-alone basis, in December 2015 the Portuguese authorities placed Banif into resolution. The authorities notified the Commission of approximately €2.25bn of aid for the purposes of the resolution, which involved selling part of the bank’s assets and liabilities to another entity, and transferring its impaired assets to a newly created asset management vehicle owned by the Portuguese Resolution Fund. In December 2015, the resolution aid was approved by the Commission, together with the €1.1bn of aid granted to Banif in January 2013.

Source: European Commission (2015), ‘State aid SA.43977 (2015/N)—Portugal, Resolution of Banif—Banco Internacional do Funchal. S.A.’, 21 December.

Demonstrating compatibility of the aid

To ensure that state support to banks constitutes compatible aid, a number of criteria need to be met, as outlined in the box below. These requirements are more stringent for structural forms of aid (i.e. recapitalisations and impaired asset relief measures) than they are for non-structural forms (i.e. state guarantees and liquidity measures).14

Demonstrating compatibility

- The aid must contribute to financial stability and prevent major negative spill-over effects

- The aid must be limited to the minimum necessary

- The aid must restore the long-term viability of the company in difficulty

- The aid recipient must make a significant contribution of its own, as ‘burden-sharing’

- Any distortions of competition created by the aid must be mitigated through compensatory measures

Source: European Commission Communications.

It is generally accepted that state aid to banks and other credit institutions contributes towards financial stability, as it helps to restore confidence in the financial sector and lending to the real economy.15 In order for recapitalisations and impaired asset relief measures to be compatible with state aid rules, a restructuring plan must be prepared that demonstrates the return to long-term viability, and also sets out the burden-sharing and compensatory measures to limit distortions to competition.

As mentioned above, the 2013 Banking Communication marks a shift to more ex ante analysis, and thereby increases the hurdle for the evidence required to demonstrate the compatibility of aid. Economic and financial analysis is particularly important for the assessments of asset values, long-term viability and compensatory measures.

Long-term viability

The restructuring plan must demonstrate how the aid will help the bank to return to long-term viability. If it is not possible for the bank to return to viability, liquidation plans need to be prepared for the orderly winding-up of the bank.

The difficulties experienced by Banif in obtaining approval from the Commission highlight the importance of developing a robust plan and engaging with DG Competition as early as possible.

The Commission’s assessment of banks’ long-term viability has evolved into an approach requiring specific economic and financial analysis. In particular:

- long-term viability is achieved when a bank ‘is able to cover all its costs including depreciation and financial charges and provide an appropriate return on equity, taking into account the risk profile of the bank’;16

- long-term viability must be demonstrated for each business activity in the base case, and in ‘stress’ scenarios requiring robust forecasts and stress tests.17 This can be a difficult exercise in a period of significant market uncertainty.

The appropriate return on equity of the restructured bank depends on a careful definition of the assets retained in the restructured bank, and the resulting estimate of the bank’s gearing, as well as its geographic and product mix. In addition, the generic parameters of the cost of capital need to be estimated—i.e. the risk-free rate and the equity risk premium, and potentially also the country risk.

Forecasts for the base case and ‘stress’ scenarios need to be robust and credible. Aside from macroeconomic parameters, robust business model assumptions are required, and competitive dynamics, including the impact of compensatory measures on market shares, need to be taken into account.

Burden-sharing

Under both state aid and BRRD requirements, the burden must be shared among banks, shareholders and creditors before turning to state support. The 2013 Banking Communication introduced a new, higher minimum standard for burden-sharing for all banks, their owners, and certain creditors.18

This new emphasis has resulted in the inclusion of an explicit ‘burden-sharing’ commitment, whereby the state commits that the bank will write down in full its shareholders’ equity and outstanding subordinated debt before any state aid is granted. For example, in the case of Banif, the Resolution Authority generated €431m of capital by applying bail-in to holders of all of Banif’s debt instruments that were subordinated to senior debt.19

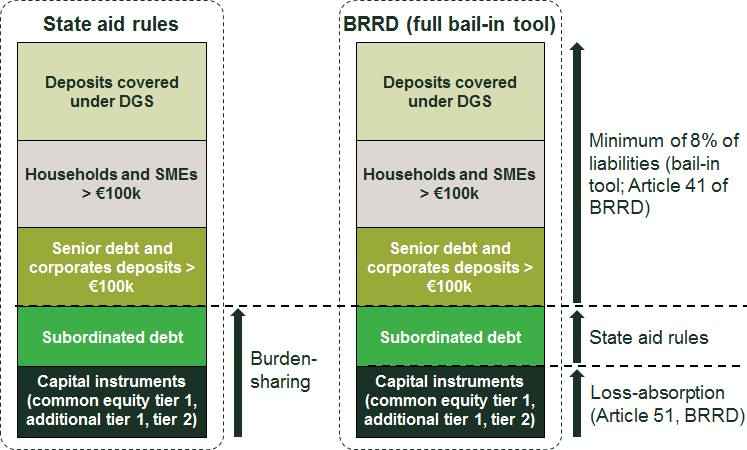

The BRRD rules go beyond the state aid requirements for burden-sharing: the full bail-in rules require not only a bail-in of equity and junior debt, but also a partial bail-in of senior debt if necessary, thereby setting a minimum of 8% of liabilities that need to be bailed in.20 The difference between burden-sharing under state aid rules and the bail-in requirement of the BRRD are illustrated in Figure 1.

Figure 1 Bail-in and burden-sharing: comparison between state aid and BRRD rules

Source: Oxera, based on European Parliament (2015), ‘Banking Union: ECB Stress Test and EU state aid rules’, Briefing, 19 January.

While the 2013 Banking Communication makes it clear that burden-sharing is normal practice in bank state aid cases, it is not mandatory if imposing bail-in would endanger financial stability.

Limiting distortions to competition

It must also be demonstrated that the aid will not result in any long-term damage to the level playing field and competitive markets, and measures must be followed to limit distortions to competition.

Compensatory measures are imposed ex ante and can be categorised into behavioural and (quasi-)structural measures. Behavioural measures include prohibitions on advertising that a bank is receiving state support, price leadership bans, and prohibitions on non-mandatory dividend or coupon payments.21 In most cases, the Commission has imposed a price leadership ban.

(Quasi-)structural measures are designed to incentivise the entry of competitors and cross-border activity, and include divestments, balance sheet reductions and acquisition bans.22 The last of these are imposed on all cases of structural aid, and most restructuring aid approvals include the obligation to divest assets and the requirement to deleverage.

The Commission has emphasised that the measures should be ‘tailor-made’ to address specific circumstances.23 Among other things, the package of measures depends on the amount of aid (in both absolute and relative terms), market characteristics, the potential for return to viability, the remuneration of the aid measure, and the degree of burden-sharing.

The guiding principle for the degree of compensatory measures is that of proportionality. In general, the higher the level of aid and the bank’s risk, the more onerous the compensatory measures. However, there are trade-offs. Higher burden-sharing, for example, could lead to lower levels of remedies.

Although compensatory measures are designed to increase competition, they may be counter-productive and actually reduce competition, as described in the box below.

Unintended consequences of compensatory measures

An example of where compensatory measures had a negative impact on the wider banking market is the price leadership ban imposed on Dutch banks that have received state aid (e.g. ING in 2009 and ABN Amro in 2010). In the Dutch mortgage market, ING and ABN Amro held a significant market share and competed with three providers that had offered the lowest prices. Following complaints, the Netherlands competition authority (NMa, now Autoriteit Consument & Markt) began an investigation into competition in the Dutch mortgage market, and found that the price leadership ban had had a detrimental impact on competition by leading to higher interest rates.1

Note: 1 Kok, J. de (2015), ‘Competition Policy in the Framework and the Application of State Aid in the Banking Sector’, European State Aid Law Quarterly, 14:2, pp. 224–40.

Overall, it is important that the economic impact of compensatory measures is assessed in advance, in order to determine a package that mitigates consequences for the wider banking market and to understand the implications for the restructuring plan. Given that compensatory measures may restrict the commercial freedom of the aid recipient, it is important that this is factored into the restructuring plan.

Valuation of impaired assets

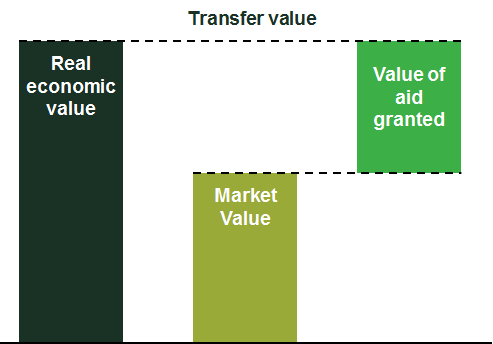

Impaired asset relief measures, such as the asset separation tool under the BRRD, require valuations of the bank’s assets. The value of aid in these cases is calculated as the difference between the transfer value and the market value, as shown in Figure 2.

Figure 2 Impaired asset relief measures

The transfer value should reflect ‘the underlying long-term economic value (the “real economic value”) of the assets, on the basis of underlying cash flows and broader time horizons’.24 The market value reflects the value of the assets under the prevailing market conditions.

The state aid framework requires the bank to provide valuations undertaken by a recognised independent expert and certified by the supervisory authority. The Commission may challenge the valuation, in which case it may appoint its own experts (as occurred in the case of SNS REEAL)25 or resort to its own estimates of ‘safe harbour values’ (as in the Banif case).

Given the time constraints and the potential market upheaval, the valuations will inevitably be uncertain, particularly for non-traded assets. An indication of the size of the uncertainty is provided by a recent study of US Chapter 11 proceedings.26 The difference between the court valuations and the valuations when the companies emerged from Chapter 11 was almost 50% on average.27

The likelihood of large valuation errors raises the possibility of third-party challenge and ex post adjustments via pre-determined mechanisms or through court action.

Conclusions

The BRRD and the state aid framework complement and reinforce each other. The BRRD focuses on preserving financial stability through orderly resolution, and the state aid framework focuses on creating a level playing field and limiting distortions to competition. Both are aimed at addressing the moral hazard of banks that are ‘too big to fail’, and limiting the exposure of taxpayers to ‘bailouts’.

Therefore, although the bail-in requirement of the BRRD meets the burden-sharing condition for aid to be approved as compatible, the Commission also has to be satisfied that the restructuring plan is sufficiently robust and demonstrates a return to long-term viability; that the aid is limited to the minimum necessary; and that distortions to competition have been minimised.

1 International Monetary Fund (2016), ‘Global Financial Stability Report’, October, p. 10.

2 Bail-in refers to the requirement for shareholders and some unsecured creditors to first contribute (up to certain limits) to the absorption of losses and to the recapitalisation before state funds can be received by banks.

3 Banco Espírito Santo was split into a ‘good bank’, Novo Banco, and a ‘bad bank’ during the bail-out in August 2014.

4 Hale, T. (2016), ‘European banks: New rules, old problems?’, Financial Times, 30 March.

5 Louven, S. (2016), ‘Portugal will Banken helfen’, Handelsblatt, 18 October.

6 Shotter, J., Noonan, L. and Arnold, M. (2016), ‘Deutsche Bank: problems of scale’, Financial Times, 28 July.

7 Oxera analysis, based on data from the European Commission’s ‘State Aid Scoreboard 2015’ of aid granted in the context of the financial and economic crisis that began in 2007/08.

8 European Commission (2008), ‘Communication from the Commission—the application of State aid rules to measures taken in relation to financial institutions in the context of the current global financial crisis’, 25 October. European Commission (2009), ‘Communication from the Commission—the recapitalisation of financial institutions in the current financial crisis: limitation of aid to the minimum necessary and safeguards against undue distortions of competition’, 15 January. European Commission (2009), ‘Communication from the Commission on the treatment of impaired assets in the Community banking sector’, 26 March. European Commission (2009), ‘Commission communication on the return to viability and the assessment of restructuring measures in the financial sector in the current crisis under the State aid rules’, 19 August. European Commission (2010), ‘Communication from the Commission on the application, from 1 January 2011, of State aid rules to support measures in favour of banks in the context of the financial crisis’, 7 December. European Commission (2011), ‘Communication from the Commission on the application, from 1 January 2012, of State aid rules to support measures in favour of banks in the context of the financial crisis’, 6 December. European Commission (2013), ‘Communication from the Commission on the application, from 1 August 2013, of State aid rules to support measures in favour of banks in the context of the financial crisis’, 30 July (the ‘2013 Banking Communication’).

9 The bail-in requirements of the 2013 Banking Communication were upheld in July 2016 by the General Court. For further details, see Judgment of the Court, Tadej Kotnik and Others v Državni zbor Republike Slovenije, Case C‑526/14, 19 July 2016.

10 European Commission (2015), ‘Commission welcomes the successful ratification of the Intergovernmental Agreement on the Single Resolution Mechanism by Greece and calls on Luxembourg to follow suit’, 7 December.

11 European Commission (2014), ‘Directive 2014/59/EU of the European Parliament and of the Council of 15 May 2014 establishing a framework for the recovery and resolution of credit institutions and investment firms’. European Commission (2014), ‘Regulation (EU) No 806/2014 of the European Parliament and of the Council of 15 July 2014 establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Resolution Fund and amending Regulation (EU) No 1093/2010’.

12 ‘Resolution’ refers to the restructuring of a bank to ensure the continuity of its critical functions, preservation of financial stability, and restoration of the viability of all or part of the bank. It is an alternative to normal insolvency proceedings.

13 European Commission, ‘Presentation in Lisbon (25 January 2016): Banking Union and Competition “From Bail out to bail in: laying foundations for a restructured banking sector in Europe”’, speech.

14 Recapitalisations and impaired asset relief measures constitute structural forms of aid, since they address deficiencies in the recipient’s balance sheet. In contrast, state guarantees and liquidity measures grant the beneficiary improved access to funding only on a temporary basis, and are therefore non-structural. For non-structural aid, the minimum requirements are market-price remuneration for the aid, a restructuring plan, and safeguards against distortions of competition. See 2013 Banking Communication, para. 59.

15 2013 Banking Communication, para. 7.

16 European Commission (2009), ‘Commission communication on the return to viability and the assessment of restructuring measures in the financial sector in the current crisis under the State aid rules’, 19 August, para. 13.

17 Long-term viability refers to the ability of the bank to cover all its costs, to provide an adequate return on equity given the bank’s risk profile, and to the aid being redeemed and remunerated based on market rates.

18 2013 Banking Communication, paras 40–46.

19 European Commission (2015), ‘State aid SA.43977 (2015/N)—Portugal, Resolution of Banif—Banco Internacional do Funchal. S.A.’, 21 December, paras 140–4. Senior debt takes priority over more ‘junior debt’ owed by the issuer.

20 BRRD Article 34(1); SRM Regulation, Article 15(1).

21 2013 Banking Communication, para. 47.

22 2013 Banking Communication, para. 47.

23 European Commission (2009), ‘Commission Communication on the return to viability and the assessment of restructuring measures in the financial sector in the current crisis under State aid rules’, 19 August, para. 30.

24 European Commission (2009), ‘Communication from the Commission on the treatment of impaired assets in the Community banking sector’, 26 March, para. 40.

25 European Commission (2013), ‘State aid SA.36598 (2013/N)—The Netherlands—Restructuring Plan SNS REAAL 2013’, 19 December.

26 Chapter 11 sets out the conditions under which temporary protection is given to US companies in financial difficulty, in order to enable reorganisation under US bankruptcy law.

27 Demiroglu, C., Franks, J.R. and Lewis, R. (2016), ‘Do Market Prices Improve the Accuracy of Court Valuations in Chapter 11?’, 22 September, working paper.

Download

Related

Economics of the Data Act: part 1

As electronic sensors, processing power and storage have become cheaper, a growing number of connected IoT (internet of things) devices are collecting and processing data in our homes and businesses. The purpose of the EU’s Data Act is to define the rights to access and use data generated by… Read More

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More