Autonomous vehicles in transport appraisal

The very real prospect of large proportions of the road fleet being fully autonomous within the next 20 years means we need to capture the implications of this in demand forecasting and appraisals for other modes of transport. This is especially the case for large investment projects, where decision-making needs to take the impact of autonomous scenarios into account.

Oxera discussed this topic at the European Transport Conference in October 2018.

Over the past decade, the automobile and technology industries have made significant investments in the research and development of connected and autonomous vehicles (CAVs).1 These vehicles, and the technology required to run them, are being advanced rapidly, and, according to some predictions, are likely to be rolled out fully in developed economies over the next 20–30 years.2

This will inevitably have implications for demand forecasting and appraisal for rail and other modes of transport—both for future transport scenarios (and therefore the choice of investment and other schemes) and for the way in which major transport schemes are appraised. CAVs will conceivably be ubiquitous in the developed world well before the end of a conventional 60-year transport appraisal period.

Definitions

While there has been significant coverage of connected and autonomous vehicles in the media, the distinction between the two technologies is not often made and can lead to misconceptions.

- Connected vehicles are able to communicate with other vehicles and the world around them. They supply useful information to the driver to help him or her make safer and more informed decisions. This could involve vehicles receiving information about accidents from the network. Crucially, however, it is still the responsibility of the driver to respond appropriately to warnings of potentially dangerous situations.

- A fully autonomous vehicle, on the other hand, ‘does not require a human driver – rather, they are computer driven’.3 Fully autonomous vehicles are able to navigate the road network independently and do not necessarily require connected vehicle technology to operate. However, as they start incorporating information on the road ahead (e.g. rerouting due to road closures), autonomous vehicles will become ‘safer, faster and more efficient’.4

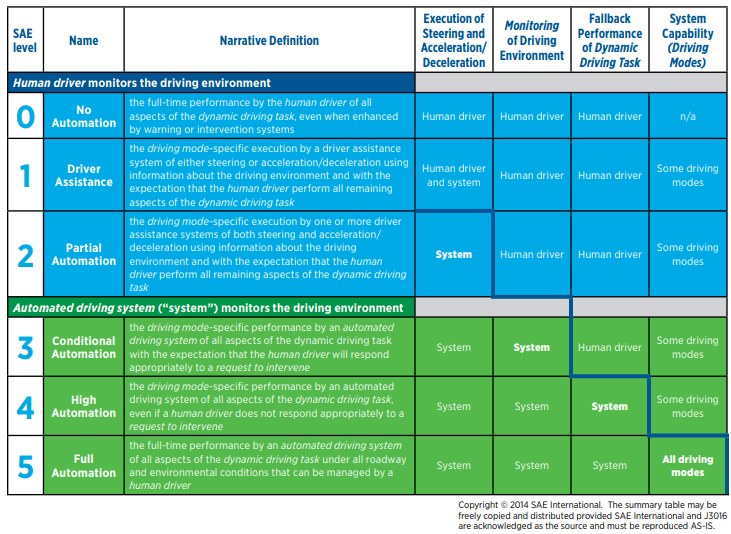

A useful way of defining the different stages of development of CAVs, in terms of the different capabilities and behaviours involved, is set out in SAE International’s different levels of driving automation.5 As shown in the figure below, these comprise six levels (SAE 0–5), ranging from no automation to full automation.

Figure 1 Levels of driving automation

From a purely technological perspective, there have been significant recent advancements, and reaching level 5 (‘Full Automation’) could soon become a reality. However, there are significant barriers that need to be overcome with regard to consumer understanding, legal issues and acceptance of autonomous vehicles.6 This will affect the way in which CAVs are rolled out and the speed of uptake of fully autonomous vehicles.

Roll-out scenarios

In the UK, Highways England has set out its long-term vision, which is for the majority of new vehicles to have connected capabilities within the 2020s and for most of them to be connected to the infrastructure and other vehicles by the 2040s.7 Vehicles with intermediary assistance technology will become prevalent over the coming decade, leading to higher levels of automation during the 2030s and fleets of fully autonomous vehicles by 2050.

In the initial stages of automation (SAE levels 0–2), the driver still needs to monitor the driving environment, but the vehicle’s driver assistance systems increasingly operate the steering and acceleration/deceleration. Most obviously this will affect—and regulate—the flow of vehicles across road networks, which will have an impact on journey speeds, congestion and reliability. Technologies (such as driver assistance) associated with CAVs will allow vehicles to travel more closely spaced and to maintain speed, especially in high-flow and high-speed situations.8 Features such as cruise control and autonomous emergency braking can also considerably reduce motorway bunching, leading to reduced travel times.9

As the level of automation increases, the ‘driver’ will no longer actively need to monitor or perform the driving task, but will only be asked to respond in certain circumstances (Level 3). As full automation (Level 5) is approached, where the automated driving system performs all aspects of the driving task, the ‘driver’ no longer needs to respond. Autonomous vehicle technology therefore has the potential to significantly reduce the number of road casualties by removing the potential for human error from the system.

More efficient use of the road network, and greater attractiveness of road travel, are likely to increase demand for it. They will also increase effective road capacity and reduce demand for other modes, including rail (all else being equal). However, the effect of CAVs is likely to differ between urban and inter-urban networks. For inter-urban travel, a key source of benefits (in addition to ‘drivers’ becoming increasingly productive because they no longer need to drive) will be increased capacity and speed, leading to significant journey time savings. As urban areas are generally subject to much lower speed limits, these benefits are unlikely to be realised here.10 Instead, it seems more likely that CAVs will lead to an increase in traffic and congestion as there will be more vehicles on the road due to higher demand.

In contrast, there are studies that predict scenarios for urban areas where CAVs might actually lead to a reduction in vehicles on the road. If car sharing becomes more prevalent, with increasing provision of Mobility as a Service (MaaS), this could lead to a reduction in both the number of cars needed and the need for parking spaces.11 CAVs could improve the accessibility and appeal of public transit by providing first- and last-mile connectivity to stations, to some extent tempering the expected reduction in demand.12

However, the effects of CAVs will take time to be realised. As long as the stock of cars remains mixed, with conventional vehicles still being widely used, many of the wider system benefits may not be apparent, as they will require a substantial penetration of the fleet.

Impacts

As CAVs become prevalent over the next 30 years, this will affect the context in which transport policy and investment decisions are taken. There will be changes to both the technical properties of the transport system and the choices made by transport users and suppliers. These will need to be reflected in the models and methods used for forecasting and appraisal. Assuming that CAV penetration reaches the tipping point at which the benefits of automation and connectivity begin to be realised,13 the following effects are likely to be observed.

- Demand: cars will be more comfortable, safer and generally more attractive. They may lead to improved mobility for people who are currently unable to drive. Cars will become closer substitutes for rail (and bus), while retaining their flexibility advantages for individual journeys. All else being equal, this will mean increased demand for car travel.14 As a result, demand projections will need to be adjusted down for rail in certain markets, to account for baseline CAV effects.

- Cross-elasticities: if car, bus and rail travel are now regarded as closer substitutes, cross-elasticities of demand may rise. As a result, the negative effects of crowding, fare increases and unreliability of rail travel will need to be given higher weight when revising rail demand models. Similarly, rail projects that increase the attractiveness of rail travel by reducing journey times or increasing comfort and other quality features may lead to larger mode shifts and greater welfare benefits.

- Value of travel time saved: values of travel time saved for car travel are likely to fall as automation enables ‘drivers’ (or at least those who don’t suffer from motion sickness) to undertake other activities during journeys. This is because travel time is deemed unproductive in appraisal calculations, whereas with autonomous vehicles it will increasingly no longer be valid.

- GJT elasticity: if values of time saved for car travel are lower, especially (but not solely) for business travellers, changes in generalised journey times (GJT) will mean smaller changes in overall generalised journey costs (GJC), in which case GJT (but not GJC) elasticities of demand could be lower.

- Congestion and crowding: for urban travel, the alternative to rail may still be heavily congested roads, albeit with a greater degree of driver productivity and comfort. However, for inter-urban travel, significant journey-time savings for road travel using CAVs would contribute to making it a more attractive alternative. The balance of speed and attractiveness effects could be very different in the two cases. This will affect key parameters used in appraisals. The effects of changes in rail crowding costs (reflecting the value that passengers place on travelling in less crowded conditions) may be increased, for example, as passengers become more aware of the comfort advantages of road travel. Likewise, the penalties for fare increases and unreliability may be increased.

- Capacity: a high penetration of CAVs should enable road networks to function more efficiently. As a result, speed-flow curves should shift out, as autonomous vehicles can travel closer together. This means that, for a given speed, a higher flow of vehicles will be possible, providing a material boost to road network capacity. In this context it is important to distinguish between personal demand, which should increase, and vehicle demand, which is what matters for the use of road capacity. If the roll-out of CAVs is accompanied by more vehicle sharing, increased provision of MaaS and reduced car ownership, perhaps encouraged by policy, this will reduce the vehicle numbers required. On the other hand, if shared vehicles circulate more on the roads between trips—for example, on feeder trips to transport hubs—this will use up road capacity. The relationship between personal and vehicle demand is therefore complex, and it will need addressing explicitly.

- Reliability and safety: greater connectedness and automation are likely to reduce journey time variability, and although reliability effects are not currently included in benefit–cost ratios in appraisal in the UK, it is expected that they will be quantified and valued. As most crashes on the road network are attributable to driver error, CAVs have the potential to significantly reduce road traffic accidents. However, the number of vehicle crashes may not decline during the early stages of automation, as drivers in semi-autonomous vehicles may lack the situational awareness required when asked to re-engage and take control.15 Adjustment of the relationship between safety effects and road traffic, speeds and congestion will need to take these factors into account.

- Other factors: it seems likely that polluting emissions and noise from CAVs will be lower, as CAVs will adopt technology that improves driving efficiency—such as reducing stop/start driving conditions.16 This will reduce the current environmental and health benefits of switching from road to rail travel. However, if long-distance road travel becomes more congenial, it may lead to increased demand for road travel, which could result in increased traffic and a reduction in air quality, depending on future emissions technologies.17

What effect will CAVs have on rail?

It seem likely that the roll-out of CAVs over the next 20–30 years will have considerable implications for both road travel and the rail sector. Rail demand models will need to be adjusted to reflect the evolving situation, and demand forecasting will need to reflect key factors:

- reduced base demand for rail;

- greater substitutability between rail and road transport;

- greater sensitivity to crowding, journey time and in-vehicle conditions.

The modelling changes required may well differ between urban and inter-urban services.

In terms of appraisal, it is likely that increasing CAV penetration will reduce the benefits of investment in rail schemes, except perhaps in the case of schemes designed to raise the quality (for example, a more personalised environment) and speed of rail travel. The implications for demand are likely to mean that less rail capacity is needed than would otherwise be the case, except to the extent that it is necessary to improve journey conditions (especially crowding reduction to ensure high on-board productivity). Given the important interactions between the road and rail networks, it is important that steps are taken now to take into account these requirements and reflect them in rail forecasts and appraisals.

Coming to a road near you

Connected and autonomous cars are now on the horizon for the near future, and are likely to have practical advantages for both users and the efficiency of the road and other networks. Governments and other stakeholders will be watching closely to monitor their effects on transport networks such as rail.

1 Fagnant, D.J. and Kockelman, K. (2015), ‘Preparing a nation for autonomous vehicles: opportunities, barriers and policy recommendations’, Transportation Research Part A, 77, pp. 167–181.

2 The Engineer (2017), ‘Highways England outlines vision for high-tech motorways’, 14 December, accessed 26 September 2018.

3 Atkins (2015), ‘Connected & Autonomous Vehicles: Introducing the Future of Mobility’, accessed 30 November 2018.

4 Atkins (2015), ‘Connected & Autonomous Vehicles: Introducing the Future of Mobility’, accessed 30 November 2018.

5 SAE International (the Society of Automotive Engineers) has developed a classification system that has been adopted by the US Department of Transportation and the United Nations. See SAE International, ‘Levels of Automation’, accessed 30 November 2018.

6 DirectLine Group (2018), ‘The Future of Cars: Public opinion lags behind the technology’, 20 November, accessed 30 November 2018.

7 Highways England (2017), ‘Connecting the Country – Planning for the long term’, December, accessed 4 October 2018.

8 Atkins (2016), ‘Research on the Impacts of Connected and Autonomous Vehicles (CAVs) on Traffic Flow’, Summary Report, Department for Transport, May, accessed 4 October 2018.

9 KPMG (2015), ‘Connected and Autonomous Vehicles – The UK Economic Opportunity’, March, accessed 27 September 2018.

10 Atkins (2016), ‘Research on the Impacts of Connected and Autonomous Vehicles (CAVs) on Traffic Flow’, Summary Report, Department for Transport, May, accessed 4 October 2018.

11 A model of Lisbon where all car and bus trips were replaced by self-driving fleets of vehicles (that can be shared simultaneously by different passengers) found that nearly the same mobility could be delivered with only 10% of the cars. Source: International Transport Forum (2015), ‘Urban Mobility System Upgrade: How shared self-driving cars could change city traffic’, OECD, accessed 4 October 2018.

12 Gruel, W. and Stanford, J.M. (2016), ‘Assessing the Long-Term Effects of Autonomous Vehicles: a speculative approach’, Transportation Research Procedia, 13, pp. 18–29.

13 Atkins (2016), op. cit., suggests that 50–75% of the fleet needs to be autonomous before major benefits are seen.

14 For example, see Macquarie (2016), ‘The impact of technological change on the infrastructure sector’, August, section 3, accessed 27 September 2018.

15 McKinsey (2017), ‘Self-driving car technology: When will the robots hit the road?’, May, accessed 27 September 2018.

16 Atkins (2015), ‘Connected & Autonomous Vehicles: Introducing the Future of Mobility’, accessed 30 November 2018.

17 Atkins (2015), ‘Connected & Autonomous Vehicles: Introducing the Future of Mobility’, accessed 30 November 2018.

Download

Contact

Andrew Meaney

PartnerContributors

Related

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More